Geothermal Heat Pump (GHP) Market

Geothermal Heat Pump (GHP) Market Size, Share & Trends Analysis Report, By Type (Closed-Loop Systems, Open-Loop Systems, and Hybrid Systems), By Application (Residential, Commercial, and Industrial) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Geothermal heat pump (GHP) market is estimated to grow at a CAGR of 3.5% during the forecast period. Increasing demand for renewable energy technologies, rising industrialization across the globe, and increasing focus on energy efficiency protocols are the major factors leading to the demand for GHP systems. The GHP is a highly efficient renewable energy technology that is gaining significance in both commercial and residential buildings. These pumps are used for space cooling and heating, as well as water heating. The advantages of GHPs are they concentrate naturally available heat, instead of producing heat through fossil fuel combustion.

As per the National Renewable Energy Laboratory (NREL), the US government invests nearly $8 billion annually in its energy requirement. To minimize the use of energy in Federal buildings, in June 1999, President Bill Clinton issued Executive Order 13123, which aims for the reduction of 35% in Federal energy use from 1985 levels by 2010. As a result, the demand for GHPs has significantly increased in federal buildings to accomplish the energy savings goal of up to 40%. Nearly a dozen federal agencies including the Bureau of Indian Affairs, the Veteran’s Administration, the Department of Defense (DOD), the US Postal Service, Housing and Urban Development, and the Environmental Protection Agency (EPA), have installed GHP systems in some of their buildings.

In the US, distributed GHP systems are being primarily used in commercial buildings, (including large residential buildings with multiple dwelling units, offices, hotels, and schools). Through a distributed GHP system, every region of the building is conditioned with an individual water-to-air heat pump (WAHP), and the multiple WAHPs are connected to a common water loop. GHPs have demonstrated the capability to reduce CO2 emissions, energy use, and peak electricity demand in buildings by satisfying the demands for space cooling, space heating, and domestic water heating. Therefore, GHP technologies are among the highly extensive green technologies for cooling and heating buildings.

Segmental Outlook

The global GHP market is segmented based on type and application. Based on type, the market is segmented into closed-loop systems, open-loop systems, and hybrid systems. Based on application, the market is classified into residential, commercial, and industrial.

Closed-loop systems have significant applications in residential and commercial installations

Rising demand for closed-loop GHP systems in residential and commercial spaces is contributing to the large adoption of these systems. These systems include horizontal, vertical, and pond/lake systems. Vertical systems are often used in schools and large commercial buildings as the required land area for horizontal loops would be restrictive. In addition, it is used where the soil is highly shallow for trenching, and they reduce the disturbance to current landscaping. Horizontal GHP systems are normally cost-effective for residential applications, especially in new construction where adequate land is available. A closed-loop GHP system is highly reliable and needs less maintenance in the long term.

Regional Outlook

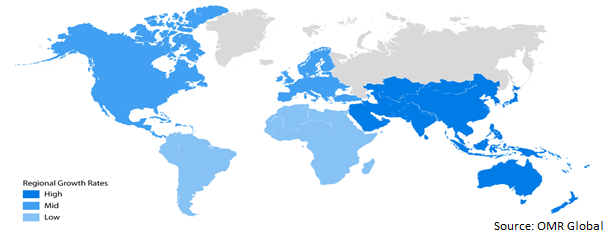

The global GHP market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America has been witnessing potential growth in the market owing to the rising demand for energy-efficient systems and increasing installations of GHP systems in residential and commercial buildings. With its RE-Powering America’s Land Initiative launched in 2008, the US Environmental Protection Agency (EPA) promotes the development of renewable energy on landfills, current and formerly contaminated lands, and mine sites while associated with the community’s vision for the site.

This Initiative increased screening to over 80,000 state-tracked and EPA- sites, involving more than 43 million acres. Using screening criteria developed in partnership with the NREL, each site was screened for the development of geothermal, solar, wind, and biomass facilities at multiple scales. This initiative tracks the installation of renewable energy projects installed on mine sites, contaminated lands, and landfills, which in turn, is driving the adoption of geothermal heat pumps in the country.

Global GHP Market Growth, by Region 2023-2030

Asia-Pacific is Estimated to Witness Considerable Growth During the Forecast Period

Asia-Pacific is expected to show potential growth during the forecast period owing to the rising industrialization and Significant focus on the expansion of geothermal capacity in the region. For instance, in August 2019, Sinopec, a Chinese oil giant, plans to triple its geothermal heating capacity from 50 million square meters to 150 million Sq. meters by 2023, which will be adequate to offer geothermal heating to nearly 2.1 million residents. With this initiative, Sinopec would replace coal with geothermal energy in 20 cities. To accommodate a shift to geothermal energy, it has already retrofitted the facilities in 10 Chinese cities. Asian Development Bank (ADB) is encouraging the geothermal efforts of Sinopec with $250 million in funding. Sinopec has also allied with Arctic Green Energy in Iceland to track geothermal research and project work. This, in turn, will drive the demand for geothermal heat pumps for heating and cooling applications.

Market Players Outlook

The major players in the global GHP market include Carrier Corp., Robert Bosch LLC, NIBE Industrier AB, Baker Hughes Co., (a GE Company), and Danfoss A/S. Product launches and mergers and acquisitions are considered some key strategies adopted by the market players to increase market share and gain a competitive advantage. For instance, in March 2020, NIBE acquired WATERKOTTE GmbH, a German heat pump manufacturer. With this acquisition, WATERKOTTE will provide NIBE access to expertise to handle large projects and heat pumps with higher capacity. With this acquisition, NIBE would further reinforce its market position in the European heat pump market, primarily in Germany. In Europe, the heat pump market has witnessed optimal growth coupled with the recent legislative changes intended to accelerate the use of highly sustainable air conditioning solutions. As a result, the company has initiated to take benefit of this law and increase its sales generation from Europe.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global GHP market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Carrier Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Robert Bosch LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NIBE Industrier AB

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Baker Hughes Co. (a GE Company)

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Danfoss A/S

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

4. Market Segmentation

4.1. Global GHP Market by Type

4.1.1. Closed Loop Systems

4.1.1.1. Horizontal

4.1.1.2. Vertical

4.1.1.3. Pond/Lake

4.1.2. Open Loop Systems

4.1.3. Hybrid Systems

4.2. Global GHP Market by Application

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aztech Geothermal, LLC

6.2. Baker Hughes Co. (a GE Company)

6.3. Bard Manufacturing Co., Inc.

6.4. Bryant Heating & Cooling Systems

6.5. Carrier Corp.

6.6. ClimateMaster, Inc.

6.7. Daikin Industries, Ltd.

6.8. Dandelion Energy, Inc.

6.9. Danfoss A/S

6.10. Enertech Global, LLC

6.11. Hydro-Temp Corp.

6.12. Mammoth Inc.

6.13. Maritime Geothermal Ltd.

6.14. Mississippi Power (a Southern Company)

6.15. NIBE Industrier AB

6.16. Renugen Ltd.

6.17. Robert Bosch LLC

6.18. Spectrum Manufacturing Inc.

6.19. Trane Technologies plc

6.20. Viessmann Werke GmbH & Co. KG

6.21. WaterFurnace International, Inc.

1. GLOBAL GHP MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL CLOSED-LOOP GHP SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL OPEN-LOOP GHPSYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HYBRID GHP SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL GHP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL GHP IN RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL GHP IN COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL GHP IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL GHP MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN GHP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

11. NORTH AMERICAN GHP MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

12. NORTH AMERICAN GHP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

13. EUROPEAN GHP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

14. EUROPEAN GHP MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

15. EUROPEAN GHP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC GHP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC GHP MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC GHP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

19. REST OF THE WORLD GHP MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

20. REST OF THE WORLD GHP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBALGHP MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL GHP MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

3. GLOBAL GHP MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL CLOSED-LOOP GHP SYSTEMS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL OPEN-LOOP GHPSYSTEMS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL HYBRID GHP SYSTEMS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL GHP IN RESIDENTIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL GHP IN COMMERCIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL GHP IN INDUSTRIAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. US GHP MARKET SIZE, 2022-2030 ($ MILLION)

11. CANADA GHP MARKET SIZE, 2022-2030 ($ MILLION)

12. UK GHP MARKET SIZE, 2022-2030 ($ MILLION)

13. FRANCE GHP MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY GHPMARKET SIZE, 2022-2030 ($ MILLION)

15. ITALY GHP MARKET SIZE, 2022-2030 ($ MILLION)

16. SPAIN GHP MARKET SIZE, 2022-2030 ($ MILLION)

17. ROE GHP MARKET SIZE, 2022-2030 ($ MILLION)

18. INDIA GHP MARKET SIZE, 2022-2030 ($ MILLION)

19. CHINA GHP MARKET SIZE, 2022-2030 ($ MILLION)

20. JAPAN GHP MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC GHP MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD GHP MARKET SIZE, 2022-2030 ($ MILLION)