Gigabit Ethernet Test Equipment Market

Global Gigabit Ethernet Test Equipment Market Size, Share & Trends Analysis Report by Type(1 GBE, 10 GBE, 40 GBE and Above), By Industry (Automotive, Manufacturing, Transportation and Logistics, Telecom, and Others) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for gigabit ethernet test equipment is projected to have considerable CAGR during the forecast period. The market is mainly driven due to various factors such as increasing demand of for ethernet network in various industries such as manufacturing, automotive and others. The rapid increase of mobile data growth and the use of smartphones are creating unprecedented challenges for wireless service providers to overcome a global bandwidth shortage that further raises the demand for ethernet technology and equipment in industrial operations. The introduction of high speed internet technology further propels the demand of millimeter wave technology. Unprecedented take-up of data and digital services which has been fueled by social media proliferation as well as the widespread availability of connected devices and smartphone has made wireless communication unavoidable. Therefore growing need of higher bandwidth further encourages the demand of ethernet test equipment market that further propels the market growth

Segmental Outlook

The global gigabit ethernet test equipment market is segmented based on type and industry. Based on the deployment, the market is further classified into 1 GBE, 10 GBE, 40 GBE and Above. The 10 GBE segment is projected to have considerable growth owing to the growing demand of 10 GBE gigabit ethernet test equipment solutions due to cost-effectiveness and easy of operation across various industries. On the basis of industry the market is further segregated into automotive, manufacturing, transportation &logistics, telecom and others.

Global Gigabit Ethernet Test Equipment Market Share by Industry, 2019(%)

Global gigabit ethernet test equipment market to be driven by Telecom Industry

Among Industry, the telecom industry segment held a considerable share in the market. The market mainly driven owing to growing digitalization in the industry. There is a significant need for reliable, versatile tactical networks for data, voice, and video communications, that further encourage the demand of ethernet transformers in the telecom industry. Moreover, technological development in telecom sector such as introduction 5G technology further propels the market growth. The introduction of 5G technology has marked a new development in the connection of devices, which is projected to positively impact the communication sector. It is regarded as the cellular communication technology of the next generation that is expected to bring revolutionary and evolutionary services to the telecommunication sector. 5G technology has the ability to unleash advanced economic opportunities and several benefits to society, providing it to be as a potential element in transforming the telecommunication industry.

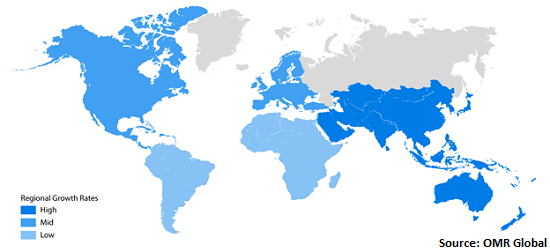

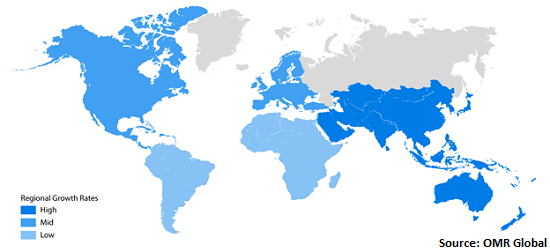

Regional Outlook

Geographically, the global gigabit ethernet test equipment market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth is attributed to the significant adoption of gigabit ethernet test equipment in economies such as China, Japan, India, South Korea, Thailand, and Australia. Further, growth in the industry vertical in these countries and increasing adoption digital solution in SMEs is also driving the market growth.

Global gigabit ethernet test equipment Market Growth, by Region 2020-2026

North America to hold a considerable share in the global gigabit ethernet test equipment market

Geographically, North America is projected to hold a significant market share in the global gigabit ethernet test equipment market. Major economies which are anticipated to contribute to the North America gigabit ethernet test equipment market are the US and Canada. North America gigabit ethernet test equipment market is growing owing to wide adoption of gigabit ethernet test equipment solutions, significant presence of gigabit ethernet test equipment vendors and growing internet penetration. Additionally, the surging demand for gigabit ethernet test equipment solutions by various industry verticals such as automotive, manufacturing, telecom, which are growing significantly in the region, is further driving the market growth. In addition, the high penetration of smartphone, developed ICT industry and adoption of the advanced communication technologies such as 5G, rising demand for connected cars and others in these countries, are some other factors augmenting the market growth.

Market Players Outlook

The key players in the gigabit ethernet test equipment market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Anritsu Corp., EXFO Inc., Fluke Corp., Keysight Technologies, Inc., Spirent Communications plc, VIAVI Solutions Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gigabit ethernet test equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Gigabit Ethernet Test Equipment Market by Type

5.1.1. 1 GBE

5.1.2. 10 GBE

5.1.3. 40 GBE and Above

5.2. Global Gigabit Ethernet Test Equipment Market by Industry

5.2.1. Automotive

5.2.2. Manufacturing

5.2.3. Transportation and Logistics

5.2.4. Telecom

5.2.5. Others(Energy, Chemical)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Anritsu Corp.

7.2. ALBEDO Telecom

7.3. EXFO Inc.

7.4. Fluke Corp.

7.5. GAO Tek Inc.

7.6. Ideal Industries, Inc.

7.7. Keysight Technologies, Inc.

7.8. Marvell Semic onductor, Inc.

7.9. Spirent Communications plc

7.10. TE Connectivity Corp.

7.11. Tektronix, Inc.

7.12. LeCroy Corp.

7.13. VIAVI Solutions Inc.

7.14. Xena Networks Inc.

7.15. Xinertel Technology Co., Ltd.

7.16. Yokogawa Electric Corp.

1. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL 1 GBE GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL 10 GBE GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL 40 GBE AND ABOVE GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

6. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT IN TRANSPORTATION AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT IN TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

15. EUROPEAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

21. REST OF THE WORLD GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

22. REST OF THE WORLD GIGABIT ETHERNET TEST EQUIPMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2019-2026 ($ MILLION)

1. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET SHARE BY INDUSTRY, 2019 VS 2026 (%)

3. GLOBAL GIGABIT ETHERNET TEST EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

6. UK GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD GIGABIT ETHERNET TEST EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)