Biomarker Market

Global Biomarker Market Size, Share & Trends Analysis Report by Type (Genomic Biomarker, and Protein Biomarker) By Application (Drug Discovery & Development, Diagnostic, Prognostic, Predictive, and Others ) By Disease (Cancer, Cardiac, Renal, Central Nervous System Disease, and Others) By End-User (Hospitals, Diagnostic Centre, and Research Institute) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global market for a biomarker is projected to have a CAGR of 14.6% during the forecast period. A biomarker is an objective measure that captures what is happening in a cell or an organism at a given moment. Biomarkers can serve as early warning systems for health. Biomarkers can have molecular, histologic, radiographic, or physiological characteristics. The use of biomarkers in basic and clinical research as well as in clinical practice has become so commonplace that their presence as primary endpoints in clinical trials is now accepted almost without question. The key factors contributing to the growth of the global biomarker market include the high prevalence of chronic diseases, rising adoption of the biomarker for diagnostic applications, high government funding for cancer research and clinical trials, increasing application in drug discovery and development. According to the National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) report, 6 in 10 adults in America live with at least one chronic disease, and 4 in 10 adults are with two or more. It is estimated that by 2060, the U.S. population aged 65 years and older will more than double, from 46 million today to 98 million. The high prevalence of chronic disease led to the demand for an effective biomarker which, in turn, further drive the market growth. The increase in the number of Contract Research Organizations (CROs) and the low cost of clinical trials in emerging economies are anticipated to further boost the growth of the market.

However, the high investments cost and low-cost benefit ratio and technical issues such as sample collection and storage are restraining the growth of the biomarker market. The increasing government initiatives for R&D, the introduction of new technologies such as digital biomarker and rising adoption in personalized medicine are expected to create lucrative opportunities for the market.

Segmental Outlook

The global biomarker market is segmented based on type, application, disease, and end-user. On the basis of type, the market is bifurcated into genomic and protein biomarker. The application segment is classified into drug discovery & development, diagnostic, prognostic, predictive and others (risk assessment). Among these, the biomarkers in drug discovery and development are anticipated to grow at significant CAGR during the forecast period. Biomarkers can predict the drug efficacy more quickly than conventional clinical endpoints, also they have the potential to accelerate product development in certain disease areas such as cancer, and cardiac disease. The disease segment is segregated into cancer, cardiac, renal, central nervous system disease and others (NASH). The end-user segment is categorized into hospitals, diagnostic centre and research institute.

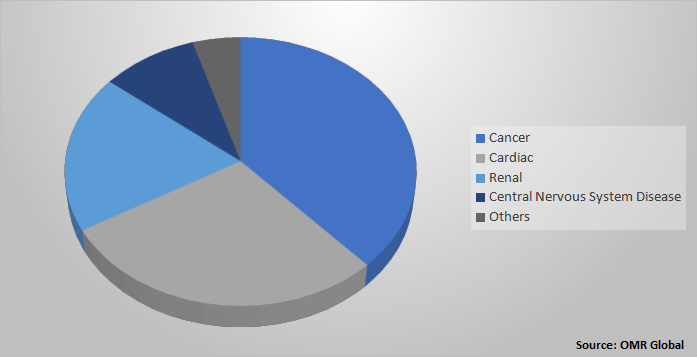

Global Biomarker Market Share by Disease, 2020 (%)

The Cancer disease segment holds the Major Market Share in the global Biomarker Market

Among disease, the biomarker in cancer dominated the market in 2020, and it is anticipated to maintain its dominance during the forecast period. Due to rise in prevalence of cancer cases across the globe, the demand for cancer biomarker has increased significantly in recent years, that has positively impacted the market growth. According to estimates from the International Agency for Research on Cancer (IARC), in 2018 there were 17.0 million new cancer cases and 9.5 million cancer deaths worldwide. By 2040, the global burden is expected to grow to 27.5 million new cancer cases and 16.3 million cancer deaths simply due to the growth and ageing of the population. According to the WHO data for cancer 2020, cancer is the main cause of death across the globe. There were 10 million deaths accounted for due to various types of cancer such as lung (1.80 million), colon and rectum (935 000), liver (8,30,000), stomach (769 000), and breast (685 000 deaths). In cancer research and drug discovery, biomarkers are used in three ways such as diagnostic (support to diagnose the condition in early-stage), prognostic (to forecast how aggressive a condition is), and predictive (to predict the response after treatment). The rising prevalence of cancer disease will increase the use of biomarkers in research-related activities which will further expected to drive the market growth.

Regional Outlook

Geographically, the global Biomarker market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Among these, Asia-Pacific is the fastest-growing region during the forecast period. The factors contributing to the regional growth include the strong population base, high prevalence of chronic diseases such as cancer and CVDs in countries such as China, Japan, and India. Apart from this, improving biopharmaceutical research centres and rising clinical research in the region.

Global Biomarker Market Growth, by Region 2021-2027

North America is projected to Dominate the Biomarker Market

Geographically, North America held the major market share in 2020, and it is anticipated to dominate the market during the forecast period. Major economies which contribute to the market are the US and Canada. Factors that are contributing significantly to the market growth include the presence of well-developed healthcare infrastructure, increasing healthcare R&D investments, high healthcare expenditure and others. The rising number of cancer patients is considered to be one of the major factors that are driving the growth of the market in the North American region. The healthcare expenditure rate of the US is more than that of Canada, as the US government invests more in R&D. Furthermore, socioeconomic factors such as health, income, population base creates more business opportunity in the US as compared to Canada.

Market Players Outlook

The key players in the biomarker market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Abbott Laboratories, Bio-Rad Laboratories Inc, Enzo Biochem Inc., EKF Diagnostics Holdings plc, PerkinElmer Inc, QIAGEN GmbH, Cisbio Bioassays, Johnson & Johnson Services, Inc., among others. To survive in the market, these market players adopt different marketing strategies such as mergers & acquisitions, R&D, product launches, and geographical expansions so on. For instance, in December 2020, Personalis, Inc. announced the launch of proprietary Neoantigen Presentation Score (NEOPS). It is a neoantigen-based composite biomarker for cancer immunotherapy response. NEOPS combines the tumor genomic and immune-related analytics of the Personalis, Next Platform in order to create a composite biomarker through which immunotherapy response can be predicted more effectively.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biomarker market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Biomarker Industry

• Recovery Scenario of Global Biomarker Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Biomarker Market, By Type

5.1.1. Genomic Biomarker

5.1.2. Protein Biomarker

5.2. Global Biomarker Market, By Application

5.2.1. Drug Discovery and Development

5.2.2. Diagnostic

5.2.3. Prognostic

5.2.4. Predictive

5.2.5. Others (Risk Assessment)

5.3. Global Biomarker Market, By Disease

5.3.1. Cancer

5.3.2. Cardiac

5.3.3. Renal

5.3.4. Central Nervous System Disease

5.3.5. Others (Nash)

5.4. Global Biomarker Market, By End User

5.4.1. Hospitals

5.4.2. Diagnostic Centre

5.4.3. Research Institute

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East Africa

7. Company Profiles

7.1. Abbott Laboratories

7.2. ACS Biomarker B.V.

7.3. Agilent technologies inc.

7.4. Abcodia Ltd.

7.5. Adx Neurosciences

7.6. Avacta Life Sciences Ltd.

7.7. Agendia Inc.

7.8. Astellas Pharma Inc.

7.9. Angle plc

7.10. Almac Group

7.11. Alcediag

7.12. Banyan Biomarkers Inc.

7.13. BCAL Diagnostics

7.14. Bioclinica

7.15. Biodesix Inc.

7.16. Bio-Rad Laboratories Inc.

7.17. BiomarkerBay B. V.

7.18. Biomark Diagnostics Inc.

7.19. BioagilytixLabs LLC

7.20. BiogazelleNV

7.21. BiofluidicaInc.

7.22. Biosims technologies SAS

7.23. Cellomatics Biosciences Ltd.

7.24. Celerion

7.25. Covance Inc.

7.26. CrossbetaBioscience B.V.

7.27. Cambridge Biomedical Inc.

7.28. Charles River Laboratories, Inc.,

7.29. Danahar Corp.

7.30. Denovo Biopharma LLC

7.31. Drumetix Laboratories, LLC

7.32. Enzo Biochem Inc.

7.33. ExternauticsSPA

7.34. EKF Diagnostics Holdings, Inc.

7.35. F. Hoffmann-La Roche Ltd.

7.36. Frontage Laboratories, Inc.

7.37. Future Diagnostics Solutions B.V.

7.38. GenenewsLtd.

7.39. GlycotechnicaLtd.

7.40. Healthspan Diagnostics LLC

7.41. Hologic inc.

7.42. Human Longevity, Inc.

7.43. HvivoServices Ltd.

7.44. Insight Genetics Inc.

7.45. Illumina, inc.

7.46. Icon PLC

7.47. Johnson & Johnson Services, Inc.

7.48. Llckcas– Bioanalytical & Biomarker Services

7.49. Luminex Corp.

7.50. Lipotype GmbH

7.51. Md Biosciences Inc.

7.52. MdnaLife Sciences Inc.

7.53. Mdxhealth Group

7.54. Merck KGaA

7.55. Meso Scale Diagnostics, LLC

7.56. Metabolon Inc.

7.57. Metanomics Health GmbH

7.58. Myriad Genetics Inc.

7.59. Neogenomics, Inc.

7.60. Nanosomix Inc.

7.61. Nanostring Technologies, Inc.

7.62. Nordic Bioscience A/S

7.63. Pfizer Inc.

7.64. PerkinelmerInc.

7.65. PamgeneInternational B.V.

7.66. Pacific Biomarkers Inc.

7.67. PersonalisInc.

7.68. Precision Medicine Group, Inc.

7.69. Precision Biomarker Resources Inc.

7.70. Qiagen GmbH

7.71. Quanterix Corp.

7.72. Q2 Solutions

7.73. Randox Laboratories Ltd.

7.74. Response Biomedical Corp.

7.75. Siemens Healthcare GmbH

7.76. SignosisInc.

7.77. SGS SA

7.78. Synexa Life Sciences BV

7.79. Stemina Biomarker Discovery, Inc.

7.80. Thermo Fisher Scientific Inc.

7.81. Twan Biotech Co., Ltd.

7.82. Tamirna GmbH

1. GLOBAL BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

2. GLOBAL GENOMIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

3. GLOBAL PROTEIN BIOMARKER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

4. GLOBAL BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION 2020-2027($ MILLION)

5. GLOBAL BIOMARKER FOR DRUG DISCOVERY AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

6. GLOBAL BIOMARKER FOR DIAGNOSTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

7. GLOBAL BIOMARKER FOR PROGNOSTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

8. GLOBAL BIOMARKER FOR PREDICTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

9. GLOBAL BIOMARKER FOR OTHERS (RISK ASSESSMENT)MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

10. GLOBAL BIOMARKER MARKET RESEARCH AND ANALYSIS BY DISEASE 2020-2027($ MILLION)

11. GLOBAL BIOMARKER IN CANCER DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

12. GLOBAL BIOMARKER IN CARDIAC DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

13. GLOBAL BIOMARKER IN RENAL DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

14. GLOBAL BIOMARKER IN CENTRAL NERVOUS SYSTEM DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

15. GLOBAL BIOMARKER IN OTHERS(NASH) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

16. GLOBAL BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER 2020-2027($ MILLION)

17. GLOBAL BIOMARKER IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

18. GLOBAL BIOMARKER IN DIAGNOSTIC CENTRE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

19. GLOBAL BIOMARKER IN RESEARCH INSTITUTE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLION)

20. GLOBAL BIOMARKER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027($ MILLION)

21. NORTH AMERICAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

22. NORTH AMERICAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

23. NORTH AMERICAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION,2020-2027($ MILLION)

24. NORTH AMERICAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY DISEASE 2020-2027($ MILLION)

25. NORTH AMERICAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER 2020-2027($ MILLION)

26. EUROPEAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

27. EUROPEAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

28. EUROPEAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027($ MILLION)

29. EUROPEAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY DISEASE, 2020-2027($ MILLION)

30. EUROPEAN BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027($ MILLION)

31. ASIA-PACIFIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

32. ASIA-PACIFIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

33. ASIA-PACIFIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION 2020-2027($ MILLION)

34. ASIA-PACIFIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY DISEASE, 2020-2027($ MILLION)

35. ASIA-PACIFIC BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027($ MILLION)

36. REST OF THE WORLD BIOMARKER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027($ MILLION)

37. REST OF THE WORLD BIOMARKER MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027($ MILLION)

38. REST OF THE WORLD BIOMARKER MARKET RESEARCH AND ANALYSIS BY APPLICATION 2020-2027($ MILLION)

39. REST OF THE WORLD BIOMARKER MARKET RESEARCH AND ANALYSIS BY DISEASE, 2020-2027($ MILLION)

40. REST OF THE WORLD BIOMARKER MARKET RESEARCH AND ANALYSIS BY END-USER , 2020-2027($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BIOMARKER MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BIOMARKER MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BIOMARKER MARKET, 2021-2027 (%)

4. GLOBAL BIOMARKER MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL BIOMARKER MARKET SHARE BY APPLICATION 2020 VS 2027 (%)

6. GLOBAL BIOMARKER MARKET SHARE BY DISEASE, 2020 VS 2027 (%)

7. GLOBAL BIOMARKER MARKET SHARE BY END-USER, 2020 VS 2027 (%)

8. GLOBAL BIOMARKER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL GENOMIC BIOMARKER MARKET SHARE BY REGION, 2020-2027 (%)

10. GLOBAL PROTEIN BIOMARKER MARKET SHARE BY REGION, 2020-2027 (%)

11. GLOBAL BIOMARKER FOR DRUG DISCOVERY AND DEVELOPMENT MARKET SHARE BY REGION, 2020-2027 (%)

12. GLOBAL BIOMARKER FOR DIAGNOSTIC MARKET SHARE BY REGION, 2020-2027 (%)

13. GLOBAL BIOMARKER FOR PROGNOSTIC MARKET SHARE BY REGION, 2020-2027 (%)

14. GLOBAL BIOMARKER FOR PREDICTIVE MARKET SHARE BY REGION, 2020-2027 (%)

15. GLOBAL BIOMARKER FOR OTHERS (RISK ASSESSMENT) MARKET SHARE BY REGION, 2020-2027 (%)

16. GLOBAL BIOMARKER IN CANCER DISEASE MARKET SHARE BY REGION, 2020-2027 (%)

17. GLOBAL BIOMARKER IN CARDIAC DISEASE MARKET SHARE BY REGION, 2020-2027 (%)

18. GLOBAL BIOMARKER IN RENAL DISEASE MARKET SHARE BY REGION, 2020-2027 (%)

19. GLOBAL BIOMARKER IN CENTRAL NERVOUS SYSTEM DISEASE MARKET SHARE BY REGION, 2020-2027 (%)

20. GLOBAL BIOMARKER IN OTHERS(NASH) DISEASE MARKET SHARE BY REGION, 2020-2027 (%)

21. GLOBAL BIOMARKER IN HOSPITALS MARKET SHARE BY REGION, 2020-2027 (%)

22. GLOBAL BIOMARKER IN DIAGNOSTIC CENTRE MARKET SHARE BY REGION, 2020-2027 (%)

23. GLOBAL BIOMARKER IN RESEARCH INSTITUTE MARKET SHARE BY REGION, 2020-2027 (%)

24. US BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

25. CANADA BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

26. UK BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

27. FRANCE BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

28. GERMANY BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

29. ITALY BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

30. SPAIN BIOMARKER MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF EUROPE BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

32. INDIA BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

33. CHINA BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

34. JAPAN BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

35. SOUTH KOREA BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

36. ASEAN BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

37. REST OF ASIA-PACIFIC BIOMARKER MARKET SIZE, 2020-2027($ MILLION)

38. REST OF THE WORLD BIOMARKER MARKET SIZE, 2021-2027($ MILLION