Kidney and Pancreas Transplant Market

Kidney and Pancreas Transplant Market Size, Share & Trends Analysis Report by Source (Living Donors, and Deceased Donors), by Treatment (Analgesic, Immunosuppressant, and Others), and by End-User (Hospitals, Transplant Centers, and Others) Forecast Period (2024-2031)

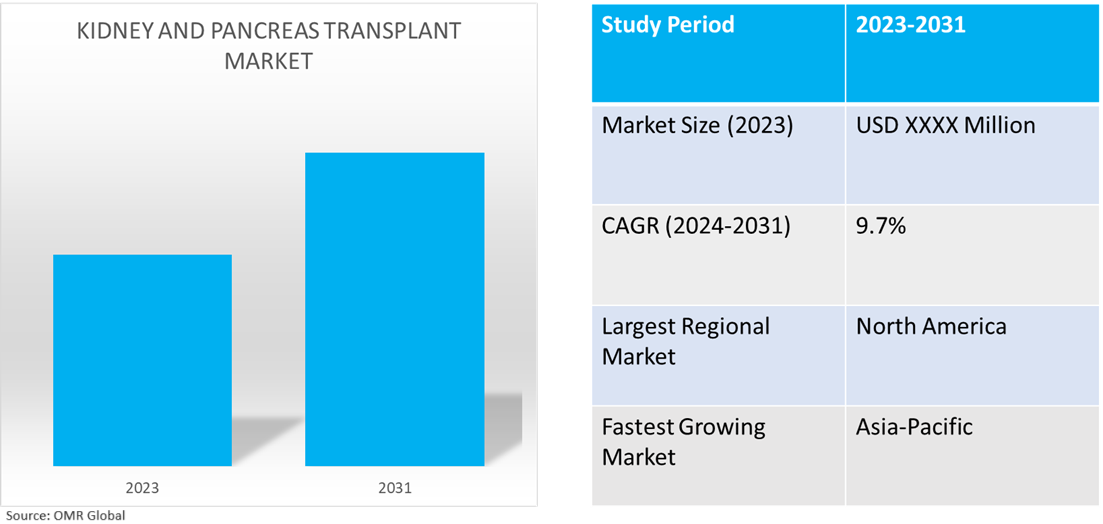

Kidney and pancreas transplant market is anticipated to grow at a CAGR of 9.7% during the forecast period (2024-2031). The kidney and pancreas transplant encompasses the surgical procedures of transferring healthy kidneys and/or pancreas from donors to patients with end-stage renal disease (ESRD) or severe diabetes. The market growth is driven by the rising prevalence of ESRD and diabetes, advancements in surgical procedures and technology, growing support from government and non-government organizations (NGOs) for financial aid and organ donation assistance, and an increasing number of organ donations globally.

Market Dynamics

Rising Prevalence of End-Stage Renal Disease (ESRD) and Diabetes

The growing population of ESRD and diabetes patients has consistently fueled the expansion of the kidney and pancreas transplant markets in recent years. The market is witnessing a rise in the incidence of kidney failure among patients with ESRD or diabetes owing to the serious complications of these diseases, the temporary nature of treatment options like dialysis, and the increased likelihood of kidney failure, especially in ESRD patients. According to the National Institute of Health (NIH), between 2000 and 2019, the number of patients with newly registered ESRD increased from 94,466 to 134,862, representing a 42.8% increase. In 2020, there were 130,522 individuals with newly registered ESRD, which is a 3.2% decrease from 2019. In 2020, 109,107 patients started in-center hemodialysis (HD), accounting for 83.9% of individuals with incident ESRD, a decrease from the peak of 91.4% in 2008. Additionally, as per the IDF Atlas Report 2023, in the adult population, diabetes continued to be a primary factor in kidney failure, or end-stage kidney disease (ESKD). It is estimated that only 27.0% to 53.0% of the global population with ESKD has the opportunity to undergo renal replacement therapy, with limited availability and access, especially in low- and lower-middle-income nations. Conclusively, the number of individuals suffering from kidney failure is projected to grow as the population of those with severe kidney diseases rises, presenting a significant challenge for the market to meet this high demand.

Increasing Number of Organ Donation

In the last two decades, there has been a consistent growth in the number of donors for kidney and pancreas transplants. This increase can be attributed to the collaborative efforts of governments and NGOs in raising awareness and promoting acceptance of organ donation among diverse populations. As a result, there has been a rise in the number of transplant procedures globally, and the trend is anticipated to have a favorable impact on the market in the future. According to the US Department of Human Health and Services in 2021, there was a notable increase in the number of deceased donors from whom at least one kidney was procured, particularly among donors aged 30 years and older. Furthermore, the count of hepatitis C virus (HCV-positive) deceased donors from whom kidneys were retrieved also went up in 2021, albeit with a slightly lower proportion compared to 2020 at 10.2%.

Segmental Outlook

- Based on the source, the market is segmented into living donors and deceased donors.

- Based on treatment, the market is segmented into analgesics, immunosuppressants, and others.

- Based on end-users, the market is segmented into hospitals, transplant centers, and others (clinics outpatient facilities, and academic medical institutions).

Deceased Donors are the Prominent Source

Deceased donors have been the primary source for kidney and pancreas transplants owing to rising awareness of post-death organ donation, streamlining of the organ donation process, advancements in transplant technology, and increasing success rates of deceased donor organ transplants. For instance, as per the National Institute of Health, in 2021, 25,549 kidney transplants were performed, of which 19,569 were from deceased donors and 5,979 were from living donors, suggesting a comparatively higher rate of deceased donors.

Hospitals are the Biggest End-User Segment

Hospitals are the primary end-users of kidney and pancreas transplant equipment, medications, and systems owing to the larger population of kidney and pancreas patients diagnosed in hospitals, a greater preference towards hospitals for serious disease treatment, and the presence of specialized personnel and operational resources.

Regional Outlook

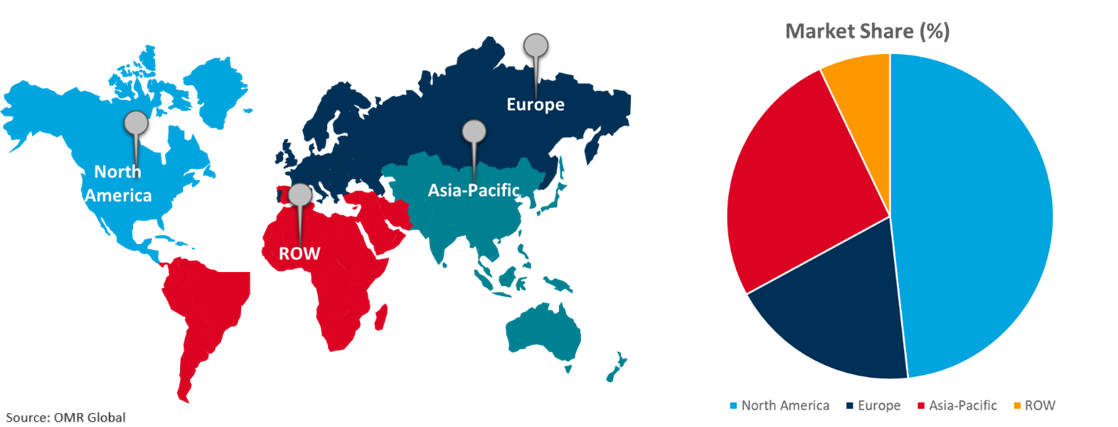

The global kidney and pancreas transplant market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Dominates the Global Kidney and Pancreas Transplant Market

The substantial investment by state-run organizations in kidney and pancreas transplant infrastructure, and the prominent position of the region in medical resource availability are key factors aiding the high share of the regional market. The presence of major transplant equipment and medication manufacturers such as Abbott and Baxter, among others, with the growing number of waiting organ recipients in the region, and the rising exposure of the regional population to the prevalence of ESRD and diabetes are further aiding the regional market share. For instance, in May 2024, the U. Department of Health and Human Services (HHS), working alongside the Centers for Medicare and Medicaid Services (CMS), unveiled the Increasing Organ Transplant Access (IOTA) Model. This new model, to be executed by the CMS Innovation Center, seeks to expand access to kidney transplants for all individuals with end-stage renal disease (ESRD), enhance the quality of care for those seeking kidney transplants, reduce disparities among individuals undergoing the transplant process, and improve the efficiency and capacity of transplant hospitals selected to participate.

Global Kidney and Pancreas Transplant Market Growth by Region 2024-2031

Asia-Pacific is Estimated to be the Fastest Growing in Global Kidney and Pancreas Transplant Market

- Asia-Pacific is the largest kidney failure or kidney-related disease reporting region globally. For instance, as per the National Institute of Health, five of the eight reporting countries or regions with the highest incidence of treated ESRD were in Asia, led by Taiwan at 522 persons per million (PMP).

- The Asia-Pacific region is also one of the largest manufacturing markets for healthcare equipment and medication, making the region a potential location for fulfilling the future demand for medical resources.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global kidney and pancreas transplant market include Baxter Healthcare Corp., Fresenius Medical Care AG & CO. KGaA, and Medtronic PLC among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in September 2021, Sanofi and Kadmon Holdings, Inc. finalized a merger agreement. This acquisition aligns with Sanofi's goal to expand its General Medicines core assets and will immediately introduce Rezurock (belumosudil) to its transplant portfolio. Rezurock is an FDA-approved treatment for chronic graft-versus-host disease (cGVHD) in adult and pediatric patients 12 years and older who have not responded to at least two prior lines of systemic therapy.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global kidney and pancreas transplant market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baxter International Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Fresenius Medical Care AG & Co. KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Medtronic PLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Kidney and Pancreas Transplant Market by Source

4.1.1. Living Donors

4.1.2. Deceased Donors

4.2. Global Kidney and Pancreas Transplant Market by Treatment

4.2.1. Analgesic

4.2.2. Immunosuppressant

4.2.3. Others (Diuretics, Antihypertensive)

4.3. Global Kidney and Pancreas Transplant Market by End-User

4.3.1. Hospitals

4.3.2. Transplant Centers

4.3.3. Others (Clinics, Outpatient Facilities, and Academic Medical Institutions)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. B. Braun Medical Inc.

6.2. Bio-Rad Laboratories, Inc.

6.3. Bristol-Myers Squibb Co.

6.4. CareDx Inc.

6.5. GE HealthCare

6.6. Johnson & Johnson Services, Inc.

6.7. LifeScan IP Holdings, LLC

6.8. Nipro Corp.

6.9. Organ Recovery Systems Inc.

6.10. Sanofi US

6.11. Siemens Healthcare Pvt. Ltd.

6.12. Veloxis Pharmaceuticals Inc.

6.13. XVIVO Perfusion AB

1. Global Kidney and Pancreas Transplant Market Research and Analysis by Source, 2023-2031 ($ Million)

2. Global Living Donor Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Deceased Donor Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Kidney and Pancreas Transplant Market Research and Analysis by Treatment, 2023-2031 ($ Million)

5. Global Analgesic Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Immunosuppressant Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Other Treatments for Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global Kidney and Pancreas Transplant Market Research and Analysis by End-User, 2023-2031 ($ Million)

9. Global Kidney and Pancreas Transplant for Hospitals Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Kidney and Pancreas Transplant for Transplant Centers Market Research and Analysis By Region, 2023-2031 ($ Million)

11. Global Kidney and Pancreas Transplant for Other End-Users Market Research and Analysis By Region, 2023-2031 ($ Million)

12. Global Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

13. North American Kidney and Pancreas Transplant Market Research and Analysis by Country, 2023-2031 ($ Million)

14. North American Kidney and Pancreas Transplant Market Research and Analysis by Source, 2023-2031 ($ Million)

15. North American Kidney and Pancreas Transplant Market Research and Analysis by Treatment, 2023-2031 ($ Million)

16. North American Kidney and Pancreas Transplant Market Research and Analysis by End-User, 2023-2031 ($ Million)

17. European Kidney and Pancreas Transplant Market Research and Analysis by Country, 2023-2031 ($ Million)

18. European Kidney and Pancreas Transplant Market Research and Analysis by Source, 2023-2031 ($ Million)

19. European Kidney and Pancreas Transplant Market Research and Analysis by Treatment, 2023-2031 ($ Million)

20. European Kidney and Pancreas Transplant Market Research and Analysis by End-User, 2023-2031 ($ Million)

21. Asia-Pacific Kidney and Pancreas Transplant Market Research and Analysis by Country, 2023-2031 ($ Million)

22. Asia-Pacific Kidney and Pancreas Transplant Market Research and Analysis by Source, 2023-2031 ($ Million)

23. Asia-Pacific Kidney and Pancreas Transplant Market Research and Analysis by Treatment, 2023-2031 ($ Million)

24. Asia-Pacific Kidney and Pancreas Transplant Market Research and Analysis by End-User, 2023-2031 ($ Million)

25. Rest of The World Kidney and Pancreas Transplant Market Research and Analysis by Region, 2023-2031 ($ Million)

26. Rest of The World Kidney and Pancreas Transplant Market Research and Analysis by Source, 2023-2031 ($ Million)

27. Rest of The World Kidney and Pancreas Transplant Market Research and Analysis by Treatment, 2023-2031 ($ Million)

28. Rest of The World Kidney and Pancreas Transplant Market Research and Analysis by End-User, 2023-2031 ($ Million)

1. Global Kidney and Pancreas Transplant Market Share by Source, 2023 Vs 2031 (%)

2. Global Living Donor Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

3. Global Deceased Donor Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

4. Global Kidney and Pancreas Transplant Market Share by Treatment, 2023 Vs 2031 (%)

5. Global Analgesic Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

6. Global Immunosuppressant Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

7. Global Other Treatments for Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

8. Global Kidney and Pancreas Transplant Market Share by End-User, 2023 Vs 2031 (%)

9. Global Kidney and Pancreas Transplant for Hospitals Market Share by Region, 2023 Vs 2031 (%)

10. Global Kidney and Pancreas Transplant for Transplant Centers Market Share by Region, 2023 Vs 2031 (%)

11. Global Kidney and Pancreas Transplant for Other End-Users Market Share by Region, 2023 Vs 2031 (%)

12. Global Kidney and Pancreas Transplant Market Share by Region, 2023 Vs 2031 (%)

13. US Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

14. Canada Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

15. UK Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

16. France Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

17. Germany Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

18. Italy Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

19. Spain Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

20. Rest of Europe Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

21. India Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

22. China Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

23. Japan Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

24. South Korea Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

25. Rest of Asia-Pacific Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

26. Latin America Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)

27. Middle East And Africa Kidney and Pancreas Transplant Market Size, 2023-2031 ($ Million)