Glucose Syrup Market

Global Glucose Syrup Market Size, Share & Trends Analysis Report by Application (Food & Beverage, Pharmaceuticals, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global glucose syrup market is projected to grow at a moderate CAGR during the forecast period. The primary factor that drives the growth of the market includes the increased demand for glucose syrup in the food & beverage and pharmaceutical sector. The food sector including bakery and confectionery, ice cream, chocolates, and many canned foods requires a huge amount of glucose syrup, which in turn drives the growth of the global market during the forecast period. Besides, glucose syrup also provides longer shelf life to the food and other items due to which it is widely accepted across the industries.

Additionally, it offers an alternative to the normal sugar, which has its various harmful factors; and it is also used as a thickening agent which further drives the growth of the market during the forecast period. It also prevents crystallization, which is an essential requirement across the industries. Thus, owing to such extraordinary benefits and features; the glucose syrup has actively paved strong growth opportunities across various verticals in the market.

Segmental Outlook

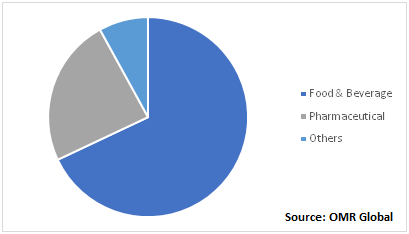

The global glucose syrup market is segmented on the basis of application into food & beverage, pharmaceuticals, and others. Food & beverage segment is likely to hold considerable share owing to the high demand for sweeteners in the confectionery grades coupled with the growth of the bakery industry as well as increasing demand for glucose syrup in the manufacturing of fruit drinks and soft drinks.

Global Glucose Syrup Market by Application, 2019 (%)

Food Industry to Drive the Global Glucose Syrup Market

Amongst the application segment of the market, the food industry is likely to contribute a significant share. The segmental growth is attributed to the various properties possessed by glucose syrup, such as it acts as a better alternative to sugar in various food items, gives longer shelf life, and it provides an extra flavor and texture to the food item. Due to this, glucose syrup is widely accepted especially in the food industry, which in turn, will drive the growth of the market during the forecast period.

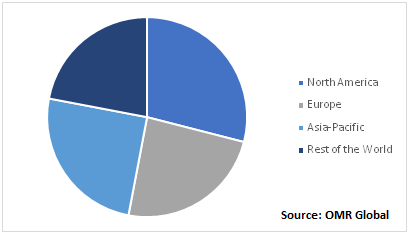

Regional Outlook

The global glucose syrup market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific region is estimated to grow significantly during the forecast period. The growth of the market is primarily being driven by China and India’s fast-paced economies and significant growth in the food & beverage and pharmaceutical sector. Additionally, consumers opting for natural and healthier alternatives in comparison with conventional sugar to prevent diseases such as diabetes and obesity. This is also likely to drive the growth of the market during the forecast period. Besides, the North American region is also projected to register significant market growth over the forecast period. In June 2018, the US FDA reconsidered a plan necessitating extra sugar, including glucose syrup, be included on all pure maple syrup and honey labels, which, in turn, flourished the growth of the market in the region.

Global Glucose Syrup Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global glucose syrup market include AGRANA Beteiligungs-AG, Cargill Inc., Ingredion Inc., Roquette Freres, Tate & Lyle PLC, The Archer Daniels Midland Co., and others. These players are adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global glucose syrup market.

For instance, in October 2017, Ingredion Inc. introduced in the US and Canada a new line of low-sugar glucose syrups. VERSASWEET low-sugar glucose syrups enable manufacturers of confectionery, dairy, ice cream and baked good products to achieve reduced grams of sugar on the Nutrition Facts panel by formulating with low-sugar corn- or tapioca-based glucose syrups that, compared to standard glucose syrups, have a lower percentage of mono- and disaccharides, also called DP1 + DP2.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global glucose syrup market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Glucose Syrup Market by Application

5.1.1. Food& Beverages

5.1.2. Pharmaceuticals

5.1.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACH Food Companies, Inc.

7.2. AGRANA Beteiligungs-AG

7.3. Avebe UA

7.4. Cargill Inc.

7.5. Conagra Foodservice, Inc.

7.6. Danone S.A.

7.7. Dr. Oetker

7.8. Grain Processing Corp.

7.9. Ingredion Inc.

7.10. Roquette Freres

7.11. Sonoma Syrup Co.

7.12. Tate & Lyle PLC

7.13. Tereos

7.14. The Archer Daniels Midland Co.

7.15. The Kraft Heinz Co.

1. GLOBAL GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL GLUCOSE SYRUP FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GLUCOSE SYRUP FOR PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GLUCOSE SYRUP FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

6. NORTH AMERICAN GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. EUROPEAN GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. EUROPEAN GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. ASIA-PACIFIC GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

12. REST OF THE WORLD GLUCOSE SYRUP MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL GLUCOSE SYRUP MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL GLUCOSE SYRUP MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

5. UK GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD GLUCOSE SYRUP MARKET SIZE, 2019-2026 ($ MILLION)