Gluten-Free Foods and Beverages Market

Global Gluten-Free Foods and Beverages Market Size, Share & Trends Analysis Report, By Product (Bakery Products, Pizza and Pasta, Cereals, Savory and Snacks, Baby Food, Meat and Meat Substitute Products, Desserts and Ice Creams, Beverages, and Others), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Online Retail Stores, Drug Stores and Pharmacies, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global gluten-free foods and beverages market is estimated to grow at a CAGR of nearly 8.4% during the forecast period. The major factors contributing to the growth of the market include a significant prevalence of celiac diseases and rising athletes shift towards gluten-free products. As per the University of Chicago Medicine, celiac disease affects at least 3 million Americans, which is nearly 1 in 133 people in the US. Additionally, in UK, the coeliac disease affects 1 in 100 people, which has increased from 24% in 2011 to 30% in 2015. The incidences are also rising significantly in Asia-Pacific countries, including India and China.

People suffering from celiac disease, inflammation occurs in the small intestinal mucosa while exposed to gluten in the diet. Gluten can cause the immune system of patients with celiac disease to attack gut lining which resulting in reduced nutrient absorption and intestinal permeability. Gluten-based foods are critical for the treatment of celiac disease and therefore, it is required to avoid such foods in their diets. Eliminating gluten from the patient’s diet enables to improve symptoms and heal damage to the small intestine as well as prevent further damage over time.

The patient can eat gluten-free types of pasta, bread, and other foods which are easily available in restaurants, stores, and special food companies. They can also eat rice, potato, rice, quinoa, soy, amaranth, bean flour, or buckwheat rather than wheat flour. The avoidance of gluten can make the person healthier and support weight loss. However, it is not always a healthy diet. A gluten-free diet may not deliver sufficient minerals, nutrients, and vitamins, the body needs, including calcium, fiber, and iron. Foods labelled gluten-free can be costly more than the same foods containing gluten, which is acting as a restraining factor for the growth of the market. The market has significant opportunity owing to the increasing preference of adults towards gluten-free products and innovations in terms of ingredients and packaging of gluten-free products.

Market Segmentation

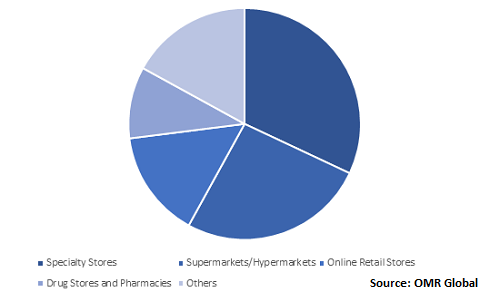

The global gluten-free foods and beverages market is segmented based on product and distribution channel. Based on the product, the market is classified into food and beverages. Food products are further classified into bakery products, pizza and pasta, cereals, savory and snacks, baby food, meat and meat substitute products, desserts and ice creams, and others. Beverages are further classified into alcoholic beverages, juices, carbonated soft drinks, functional beverages, and others. Based on the distribution channel, the market is classified into specialty stores, supermarkets/hypermarkets, online retail stores, drug stores and pharmacies, and others.

Online retail stores are anticipated to witness potential growth during the forecast period

Online retail stores are expected to have significantly used distribution channel for gluten-free foods and beverages during the forecast period. The rising e-commerce industry has made the lives easier for internet users to shop online. Owing to the benefits such as 24/7 accessibility, with no downtime for public holidays, bad weather conditions, and closing times, e-commerce platforms have been gaining foremost importance among the digital population. Ecommerce allows buying products quickly and easily without the hassle of awkward social interactions, crowds, and traffic. Improved infrastructure, lower selling price and reduced costs associated with marketing and outreach of products over a digital platform contribute to promoting online sales across the globe. Therefore, the manufacturers of gluten-free foods and beverages have been focusing on increasing its sell of products through online stores, which in turn, can increase their revenue generation.

Global Gluten-Free Foods and Beverages Market Share by Distribution Channel, 2019 (%)

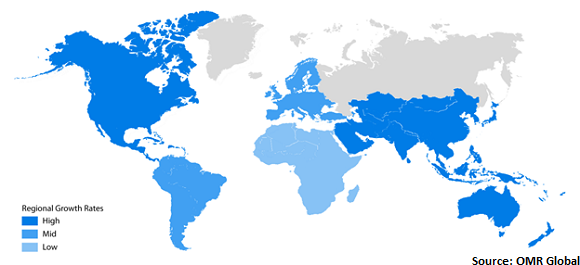

Regional Outlook

Geographically, the market is classified into North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, North America gluten-free foods and beverages market are significantly driven by the increasing awareness regarding gluten-free products. In addition, nearly 18 million Americans have a gluten sensitivity or non-celiac gluten sensitivity (NCGS), which is six times the number of Americans with celiac disease. NCGS symptoms including diarrhea, bloating, and abdominal pain, which can improve while removing gluten-based foodstuffs from the diet. This, in turn, is expected to contribute to the adoption of gluten-free products as it often contains high fiber, no preservatives, low sugar, and no added flavors and colors.

Global Gluten-Free Foods and Beverages Market Growth, by Region 2020-2026

Market Players Outlook

The major players operating in the market include the Kraft Heinz Co., the Hain Celestial Group, Inc., General Mills, Inc., Conagra Brands, Inc., and Kellogg Co. The market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in January 2019, the Kraft Heinz Co. acquired Primal Nutrition, LLC, makers of Primal Kitchen branded products. Primal Kitchen is primarily focused on Condiments, Sauces and Dressings such as Avocado Oil, Mayonnaise, and Salad Dressings, with increasing product lines in healthy snacks and other groups.

Primal Kitchen is engaged in creating delicious products that are free of soy, gluten, dairy and grains focus on beneficial fats and high-quality proteins. With this acquisition, Kraft Heinz joined Primal Kitchen under Springboard, which is the dynamic platform of Kraft Heinz aimed to collaborate with brands and founders that will disrupt the food industry. Primal Kitchen will remain in Oxnard, California and will operate as an autonomous company. It will support to leverage assets and infrastructure of Kraft Heinz.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global gluten-free food and beverages market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. The Kraft Heinz Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. The Hain Celestial Group, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. General Mills Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Conagra Brands, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Kellogg Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Gluten-Free Foods and Beverages Market by Product

5.1.1. Food

5.1.1.1. Bakery Products

5.1.1.2. Pizza and Pasta

5.1.1.3. Cereals

5.1.1.4. Savory and Snacks

5.1.1.5. Baby Food

5.1.1.6. Meat and Meat Substitute Products

5.1.1.7. Desserts and Ice Creams

5.1.1.8. Others

5.1.2. Beverages

5.1.2.1. Alcoholic Beverages

5.1.2.2. Juices

5.1.2.3. Carbonated Soft Drinks

5.1.2.4. Functional Beverages

5.1.2.5. Others

5.2. Global Gluten-Free Foods and Beverages Market by Distribution Channel

5.2.1. Specialty Stores

5.2.2. Supermarkets/Hypermarkets

5.2.3. Online Retail Stores

5.2.4. Drug Stores and Pharmacies

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Alara Wholefoods Ltd.

7.3. Barilla G. E R. Fratelli SpA

7.4. Bob's Red Mill Natural Foods, Inc.

7.5. Conagra Brands, Inc.

7.6. Domino's Pizza, Inc.

7.7. Dr. Schär AG / SPA

7.8. Farmo S.p.A.

7.9. Freedom Nutritional Products Ltd.

7.10. Frontier Soups

7.11. General Mills Inc.

7.12. Genius Foods Ltd.

7.13. Golden West Specialty Foods, Inc.

7.14. Hero Group

7.15. Kellogg Co.

7.16. Mondel?z International, Inc.

7.17. Norside Foods Ltd.

7.18. Quinoa Corp.

7.19. Raisio Plc

7.20. Silly Yak Foods Pty Ltd.

7.21. The Hain Celestial Group, Inc.

7.22. The Kraft Heinz Co.

1. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL GLUTEN-FREE FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL GLUTEN-FREE BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GLUTEN-FREE FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

5. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES IN SPECIALTY STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES IN SUPERMARKETS/HYPERMARKETS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

7. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES IN ONLINE RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES IN DRUG STORES AND PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES IN OTHER DISTRIBUTION CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

13. NORTH AMERICAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

14. EUROPEAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

16. EUROPEAN GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

20. REST OF THE WORLD GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

21. REST OF THE WORLD GLUTEN-FREE FOODS AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL GLUTEN-FREE FOODS AND BEVERAGES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

6. UK GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD GLUTEN-FREE FOODS AND BEVERAGES MARKET SIZE, 2019-2026 ($ MILLION)