Glycinates Market

Glycinates Market Size, Share & Trends Analysis Report, By Type (Magnesium Glycinate, Calcium Glycinate, Zinc Glycinate, Iron Glycinate, Copper Glycinate, Manganese Glycinate, and Sodium Glycinate), By Application (Animal Feed, Pharmaceutical/Nutraceutical, Food & Beverage, Cosmetics & Personal Care), By Form (Dry and Liquid) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Glycinates market is expected to grow at a CAGR of 6.5% during the forecast period. Glycinates, are byproducts, derived from any salts or esters of glycine, which are widely used in the food and beverage, healthcare, and animal feed industry, glycinates are a good source of magnesium, copper, iron, zinc, and essential amino acids. The rising demand for quality milk products and the rising concern in the animal feed industry are some key factors contributing to the growth of the market. Glycinates are used in animal feed as an additive to improve the quality and yield. According to the World Economic Forum (WEF), around 50 billion chickens and 1.5 billion pigs are slaughtered every year across the globe. This shows the increasing consumption of meat, which increases the demand for glycinates during the forecast period.

Segmental Outlook

The global glycinates market is segmented based on type, application, and form. Based on the type, the market is segmented into magnesium glycinate, calcium glycinate, zinc glycinate, iron glycinate, copper glycinate, manganese glycinate, and sodium glycinate. Based on the application, the market is segmented into animal feed, pharmaceutical/nutraceutical, food & beverage, and cosmetics & personal care. Based on form the market is segmented into dry and liquid. The above-mentioned segments can be customized as per the requirements. Based on type, the calcium glycinates segment is anticipated to hold a significant share in the global glycinates market during the forecast period, as calcium supports maintaining and building strong skeletal structure and it also plays an important role in cell-signalling as a messenger in the whole body. The deficiency of calcium can cause many problems in the body such as blood coagulation, hormone secretion, muscle weakness, fatigue, and others. Calcium strengthens bones and teeth which enhances the overall health of the body. Therefore, it is used for the treatment and prevention of bone diseases, such as osteoporosis, which is a very common disease among elder people. According to National Osteoporosis Foundation, more than 10 million people have osteoporosis and another 45 million have a low bone density which keeps them at increased risk for osteoporosis. Around 54 million people in the US have very weak bones. Also, it is anticipated that by 2025, osteoporosis will be responsible for 3 million fractures resulting in $25.3 billion in costs. This, in turn, is resulting an increasing share of the calcium glycinate segment.

Regional Outlooks

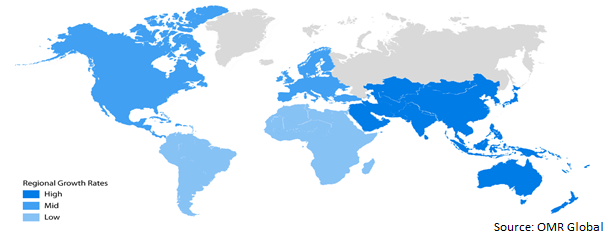

The global glycinates market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Asia-Pacific is anticipated to hold a considerable share in the global glycinates market during the forecast period, owing to the increasing urbanization and aging population owing to the rising demand for packaged foods which in turn increases the demand for glycinates during the forecast period.

Global Glycinates Market Growth, by Region 2022-2028

Glycinates Finds Significant Adoption in North American Region

North America is one of the potential regions for glycinates. Rising poultry production owing to the rising poultry meat consumption for high protein intake is driving the demand for glycinates for poultry feed in the region. Owing to the presence of various food chains and fast service restaurants led to an increase in the consumption of meat and meat products. Thus, the increasing demand for high-quality meat products is simultaneously increasing the demand for glycinates in the North American region. According to Sentient Media Organisation, the US has the world’s second-highest consumption of beef and buffalo after Argentina. In 2020 Americans ate 96.4 pounds of broiler chickens per capita also according to data by the USDA and Economic Research Service, people in the US are anticipated to eat around 101.1 pounds of broiler chickens per capita by 2030. These factors simultaneously increase the demand for glycinates in the region.

Market Players Outlook

The major companies serving the global glycinates market include Ajinomoto Co., Inc., Clariant International Ltd., Solvay SA, BASF SE, and Novotech Nutraceuticals, Inc. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in July 2020 Avitech Nutrition Pvt. Ltd. launched Performins which is an organic trace mineral glycinates. It will be used in the animal feed industry, which will support improving the overall health of the animal while augmenting the yield and output.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global glycinates market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Glycinates Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Ajinomoto Co., Inc.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Clariant International Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Solvay SA

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. BASF SE

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Novotech Nutraceuticals, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Glycinates Market by Type

4.1.1. Magnesium Glycinate

4.1.2. Calcium Glycinate

4.1.3. Zinc Glycinate

4.1.4. Iron Glycinate

4.1.5. Copper Glycinate

4.1.6. Manganese Glycinate

4.1.7. Sodium Glycinate

4.2. Global Glycinates Market by Application

4.2.1. Animal Feed

4.2.2. Pharmaceutical/Nutraceutical

4.2.3. Food & Beverage

4.2.4. Cosmetics & Personal Care

4.3. Global Glycinates Market by Form

4.3.1. Dry

4.3.2. Liquid

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aditya Chemicals Pvt Ltd.

6.2. Albion Laboratories Ltd.

6.3. Aliphos Belgium SA

6.4. Dunstan Nutrition Ltd.

6.5. Galaxy Surfactants Ltd.

6.6. Innospec Inc.

6.7. Pancosma SA

6.8. Schaumann GmbH & Co. KG.

6.9. Shijiazhuang Donghua Jinlong Chemical Co Ltd.

1. GLOBAL GLYCINATES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL MAGNESIUM GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CALCIUM GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ZINC GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL IRON GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL COPPER GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL MANGANESE GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL SODIUM GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL GLYCINATES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

10. GLOBAL GLYCINATES FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL GLYCINATES FOR PHARMACEUTICAL/NUTRACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL GLYCINATES FOR FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL GLYCINATES FOR COSMETICS & PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL GLYCINATES MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

15. GLOBAL DRY GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL LIQUID GLYCINATES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL GLYCINATES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. NORTH AMERICAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

22. EUROPEAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. EUROPEAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. EUROPEAN GLYCINATES MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC GLYCINATES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC GLYCINATES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC GLYCINATES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC GLYCINATES MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

30. REST OF THE WORLD GLYCINATES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. REST OF THE WORLD GLYCINATES MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

32. REST OF THE WORLD GLYCINATES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

33. REST OF THE WORLD GLYCINATES MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

1. GLOBAL GLYCINATES MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL MAGNESIUM GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL CALCIUM GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL ZINC GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL IRON GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL COPPER GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MANGANESE GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL SODIUM GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL GLYCINATES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL GLYCINATES FOR ANIMAL FEED MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL GLYCINATES FOR PHARMACEUTICAL/NUTRACEUTICAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL GLYCINATES FOR FOOD & BEVERAGE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL GLYCINATES FOR COSMETICS & PERSONAL CARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL GLYCINATES MARKET SHARE BY FORM, 2021 VS 2028 (%)

15. GLOBAL DRY GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL LIQUID GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL GLYCINATES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. US GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

20. UK GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD GLYCINATES MARKET SIZE, 2021-2028 ($ MILLION)