Graphics Double Data Rate Market

Graphics Double Data Rate Market Size, Share & Trends Analysis Report by Product Type (GDDR3, GDDR4, GDDR5, GDDR6, GDDR6), and by Application (Autonomous Vehicles, Gaming, Graphic Design, Professional Workstations, Others) Forecast Period (2025-2035)

Industry Overview

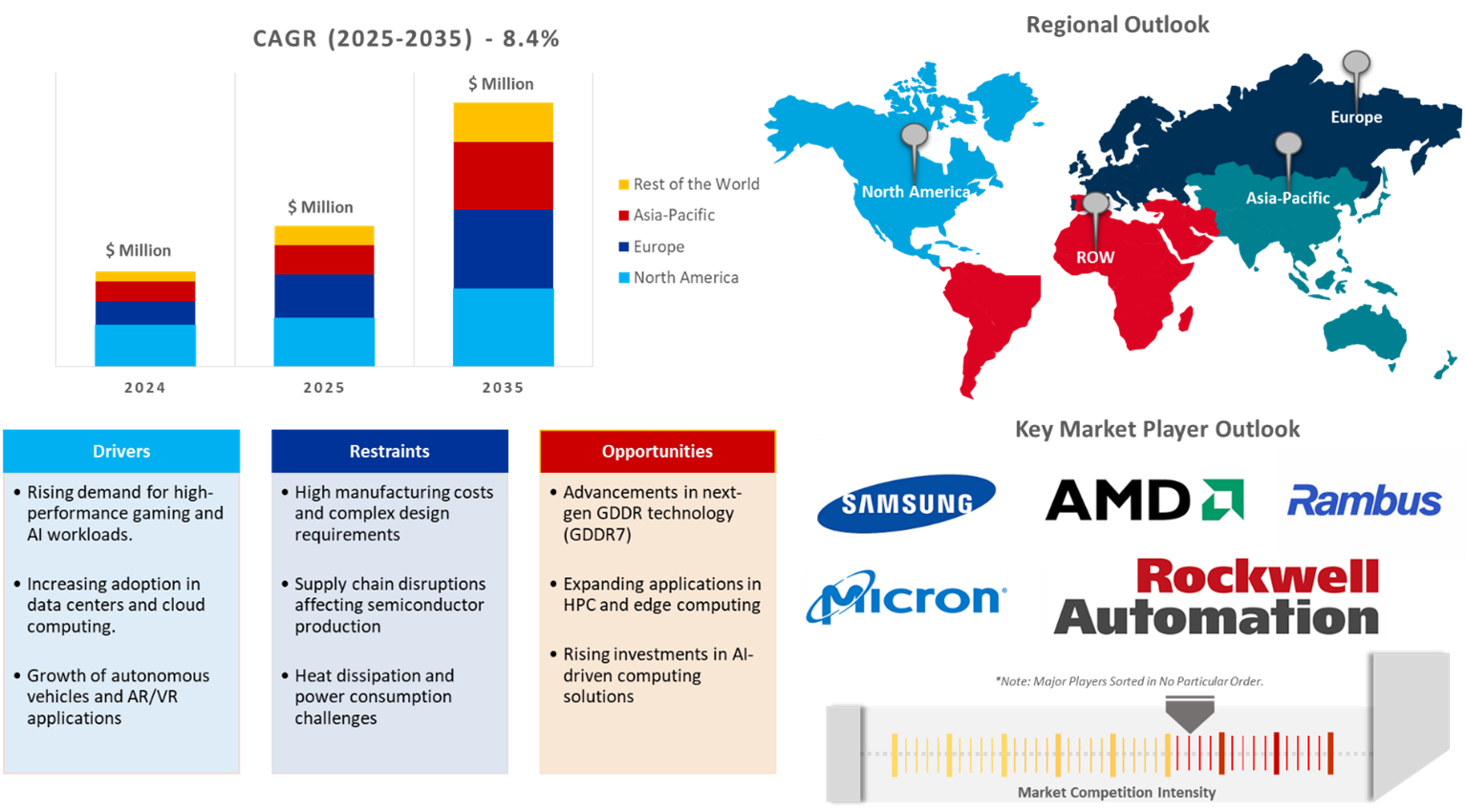

The graphics double data rate (GDDR) market was valued at $6,528 million in 2024 and is projected to reach $15,788 million in 2035, growing at a CAGR of 8.4% during the forecast period (2025-2035). GDDR is a performance memory commonly used in graphics cards. Unlike standard double data rate (DDR) memory, GDDR is optimized for the parallel processing demands of graphics rendering. It's designed to deliver high bandwidth, making it ideal for handling the vast amount of data required by modern graphics-intensive applications. Growth in the gaming business, advancement in graphic technologies, adoption in data centers, are some of the major drivers for the graphics double data rate market growth. It is well suited for tasks such as gaming, video editing, and 3D rendering.

Market Dynamics

Expanding Online Gaming Industry

The gaming industry dominates the global economy. Video games including gaming consoles, games for those consoles, and games for other devices such as personal computers are areas of operation in this market. India's online gaming industry is growing rapidly and has been composed to contribute significantly to the nation's economic development. The online gaming industry consists of two major creative sectors Media & Entertainment (M&E) and Animation, Visual Effects, Gaming, and Comics (AVGC). Various initiatives are being taken by the Government of India and the State Governments to promote the Media and Entertainment sector, such as the Cinematograph (Amendment) Bill (2023), the Information Technology (Intermediary Guidelines, Digital Media Ethics Code) Rules (2021), enhanced FDI limits in cable and DTH sectors and others. According to Invest India, transaction-based game revenues increased by 21% in 2022 from 2021. Additionally, Indian gaming raised $2.8 billion from domestic/global investors in the last 5 years. GDDR memory plays a pivotal role in handling large amounts of graphical data in the gaming area. It enables fast data transfer between the GPU and memory, for running graphics-intensive applications.

Rising demand for AI and ML applications

AI and ML have matured into breakthrough technologies, which have wide applications from natural language processing to the automobile sector. Corporations globally have started to invest in AI-enabled solutions. This investment surge will intensify market growth over the next few years. In September 2024, Microsoft made an investment worth $1.3 billion in Mexico in cloud and AI infrastructure. These infrastructures need a large amount of computing power and memory. High-speed memory is critical for AI and ML activities, and GDDR6 memory has a significant role to play in this industry, where the need for high-speed computing power is predominant.

Market Segmentation

- Based on the type, the market is segmented into articulated, GDDR3, GDDR4, GDDR5, GDDR6, and GDDR7.

- Based on the Application, the market is segmented into autonomous vehicles, gaming, graphic design, professional workstations, and others.

The GDDR7 Segment is projected to Hold the Largest Market Share

GDDR7 is the next generation of graphics memory for GPUs. It will be used in a variety of products over the coming years, providing a generational upgrade over the existing GDDR6 and GDDR6X solutions, which then boosts performance in gaming and other types of workloads. GDDR7 will initially start at speeds of 32 GT/s, 60% higher than the fastest GDDR6 memory, and 33% higher than the fastest GDDR6X memory (though no products ever used 24 GT/s speeds). Companies such as Samsung Electronics developed the 24-gigabit (Gb) GDDR71 DRAM. In addition to the industry’s highest capacity, the GDDR7 features the fastest speed, positioning itself as the optimum solution for next-generation applications. The 24Gb GDDR7 will be widely utilized in various fields that require high-performance memory solutions, such as data centers and AI workstations, extending beyond the traditional applications of DRAM in graphics cards, gaming consoles, and autonomous driving.

Graphic Design Segment to Hold a Considerable Market Share

The graphic design segment is expected to hold a considerable share of the global GDDR market, owing to the growing demand for advanced visual content creation across various platforms. Industries such as entertainment, media, and advertising continue their evolution, and powerful hardware must be managed by graphic designers to render high-resolution images, animations, and 3D models. GDDR memory is well suited for such requirements, especially the high-end GDDR6 offering high bandwidth along with the fast data transfer capability essential for graphic-intensive tasks. The adoption of high-performance GPUs in professional workstations along with rising complexity in digital media projects also leads to a prime driver for this market.

Regional Outlook

The global graphics double data rate market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Graphics Double Data Rate Market

Among all regions, the Asia-Pacific region is anticipated to grow, owing to its robust electronics manufacturing sector and increasing adoption of GDDR in smartphones, advanced robotics, gaming consoles, and other digital devices. According to the International Trade Administration, Japan has the leading manufacturers and robotics companies. In 2022, 45% of all industrial robots globally were initially produced or designed by companies in Japan. Orders for industrial robots from Japanese manufacturers hit a record $7.35 billion in 2022, up 1.6% from 2021. The shift toward adopting automation for packaging and transport has been growing in fields such as logistics, food, and pharmaceuticals. Japan had 631 robots working in the manufacturing sector for every 10,000 humans in 2021. By comparison, the US had 274 robots for every 10,000 humans.

Market Players Outlook

The major companies serving the graphics double data rate market include Samsung Electronics, Micron Technology, Inc., Advanced Micro Devices, Inc. Rockwell Automation Inc., Rambus NVIDIA Corp., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In June 2024, Micron Technology, Inc. announced the sampling of its next-generation GDDR7 graphics memory with the industry’s highest bit density.1 Leveraging Micron’s 1? (1-beta) DRAM technology and innovative architecture, Micron GDDR7 delivers 32 Gb/s high-performance memory in a power-optimized design.

- In June 2024, Samsung Electronics and SK Hynix, along with Micron, planned to commence mass production of the next-generation Graphics Double Data Rate (GDDR) 7, expanding the battleground in the high bandwidth memory (HBM) market. GDDR is predominantly utilized in graphic cards for devices such as laptops and gaming consoles.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global graphics double data rate market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Graphics Double Data Rate Market Sales Analysis – Type| Application ($ Million)

• Graphics Double Data Rate Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Graphics Double Data Rate Industry Trends

2.2.2. Market Recommendations

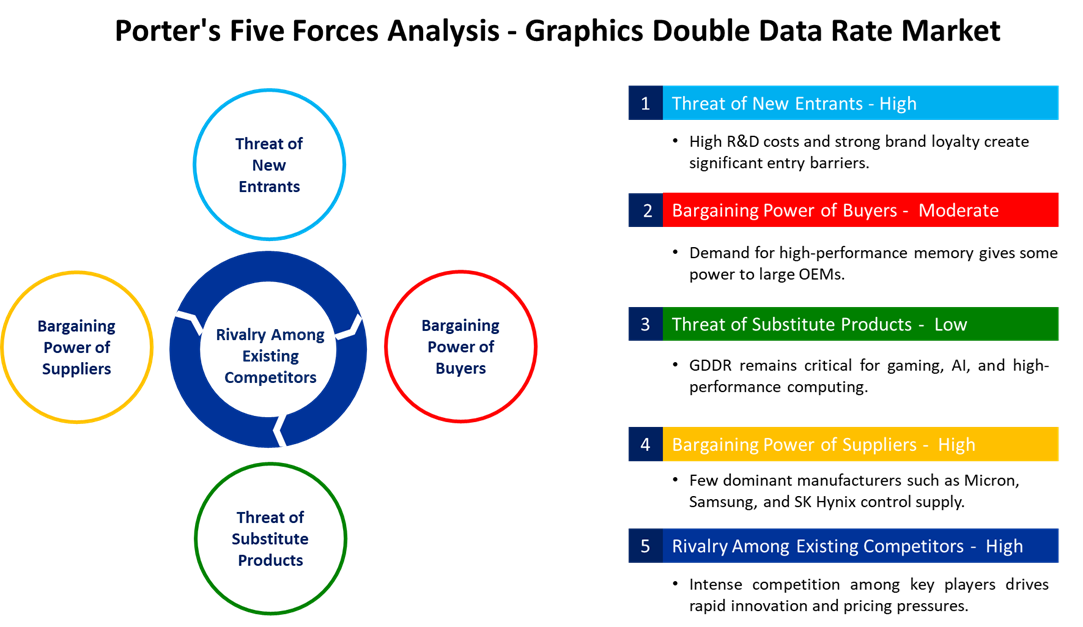

2.3. Porter's Five Forces Analysis for the Graphics Double Data Rate Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Graphics Double Data Rate Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Graphics Double Data Rate Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Graphics Double Data Rate Market Revenue and Share by Manufacturers

• Graphics Double Data Rate Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Advanced Micro Devices, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Micron Technology, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Samsung Electronics Co., Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Rambus

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Market Segmentation

5.1. Global Graphics Double Data Rate Market by Type

5.1.1. GDDR3

5.1.2. GDDR4

5.1.3. GDDR5

5.1.4. GDDR6

5.1.5. GDDR7

5.2. Global Graphics Double Data Rate Market by Application

5.2.1. Autonomous Vehicles

5.2.2. Gaming

5.2.3. Graphic Design

5.2.4. Professional Workstations

5.2.5. Others

6. Regional Analysis

6.1. North American Graphics Double Data Rate Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for North America

6.1.1. United States

6.1.2. Canada

6.2. European Graphics Double Data Rate Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for North America

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific Graphics Double Data Rate Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. South Korea

6.3.4. India

6.3.5. Australia & New Zealand

6.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

6.3.7. Rest of Asia-Pacific

6.4. Rest of the World Graphics Double Data Rate Market Sales Analysis – Type| Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

6.4.1. Latin America

6.4.2. Middle East and Africa

7. Company Profiles

7.1. Advanced Micro Devices, Inc.

7.1.1. Quick Facts

7.1.2. Company Overview

7.1.3. Product Portfolio

7.1.4. Business Strategies

7.2. ASUSTeK Computer Inc.

7.2.1. Quick Facts

7.2.2. Company Overview

7.2.3. Product Portfolio

7.2.4. Business Strategies

7.3. C&T Solution Inc.

7.3.1. Quick Facts

7.3.2. Company Overview

7.3.3. Product Portfolio

7.3.4. Business Strategies

7.4. Cadence Design Systems, Inc.

7.4.1. Quick Facts

7.4.2. Company Overview

7.4.3. Product Portfolio

7.4.4. Business Strategies

7.5. Dell Inc.

7.5.1. Quick Facts

7.5.2. Company Overview

7.5.3. Product Portfolio

7.5.4. Business Strategies

7.6. Galaxy Microsystems Ltd.

7.6.1. Quick Facts

7.6.2. Company Overview

7.6.3. Product Portfolio

7.6.4. Business Strategies

7.7. GIGA-BYTE Technology Co., Ltd.

7.7.1. Quick Facts

7.7.2. Company Overview

7.7.3. Product Portfolio

7.7.4. Business Strategies

7.8. Infineon Technologies AG

7.8.1. Quick Facts

7.8.2. Company Overview

7.8.3. Product Portfolio

7.8.4. Business Strategies

7.9. Intel Corp.

7.9.1. Quick Facts

7.9.2. Company Overview

7.9.3. Product Portfolio

7.9.4. Business Strategies

7.10. Mercury Systems, Inc.

7.10.1. Quick Facts

7.10.2. Company Overview

7.10.3. Product Portfolio

7.10.4. Business Strategies

7.11. Micron Technology, Inc.

7.11.1. Quick Facts

7.11.2. Company Overview

7.11.3. Product Portfolio

7.11.4. Business Strategies

7.12. Micro-Star INT'L CO., LTD.

7.12.1. Quick Facts

7.12.2. Company Overview

7.12.3. Product Portfolio

7.12.4. Business Strategies

7.13. Nanya Technology Corp.

7.13.1. Quick Facts

7.13.2. Company Overview

7.13.3. Product Portfolio

7.13.4. Business Strategies

7.14. NVIDIA Corp.

7.14.1. Quick Facts

7.14.2. Company Overview

7.14.3. Product Portfolio

7.14.4. Business Strategies

7.15. Rambus

7.15.1. Quick Facts

7.15.2. Company Overview

7.15.3. Product Portfolio

7.15.4. Business Strategies

7.16. Rockwell Automation Inc.

7.16.1. Quick Facts

7.16.2. Company Overview

7.16.3. Product Portfolio

7.16.4. Business Strategies

7.17. Samsung Electronics Co., Ltd.

7.17.1. Quick Facts

7.17.2. Company Overview

7.17.3. Product Portfolio

7.17.4. Business Strategies

7.18. SAPPHIRE Technology Ltd.

7.18.1. Quick Facts

7.18.2. Company Overview

7.18.3. Product Portfolio

7.18.4. Business Strategies

7.19. SK Hynix

7.19.1. Quick Facts

7.19.2. Company Overview

7.19.3. Product Portfolio

7.19.4. Business Strategies

7.20. WINBOND ELECTRONICS CORP.

7.20.1. Quick Facts

7.20.2. Company Overview

7.20.3. Product Portfolio

7.20.4. Business Strategies

7.21. ZOTAC Technology Ltd.

7.21.1. Quick Facts

7.21.2. Company Overview

7.21.3. Product Portfolio

7.21.4. Business Strategies

1. Global Graphics Double Data Rate Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global GDDR3 Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global GDDR4 Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global GDDR5 Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global GDDR6 Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global GDDR7 Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Graphics Double Data Rate Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Graphics Double Data Rate For Autonomous Vehicles Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Graphics Double Data Rate For Gaming Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Graphics Double Data Rate For Graphic Design Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Graphics Double Data Rate For Professional Workstations Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Graphics Double Data Rate For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Graphics Double Data Rate Market Research And Analysis By Region, 2024-2035 ($ Million)

14. North American Graphics Double Data Rate Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Graphics Double Data Rate Market Research And Analysis By Type, 2024-2035 ($ Million)

16. North American Graphics Double Data Rate Market Research And Analysis By Application, 2024-2035 ($ Million)

17. European Graphics Double Data Rate Market Research And Analysis By Country, 2024-2035 ($ Million)

18. European Graphics Double Data Rate Market Research And Analysis By Type, 2024-2035 ($ Million)

19. European Graphics Double Data Rate Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Asia-Pacific Graphics Double Data Rate Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Asia-Pacific Graphics Double Data Rate Market Research And Analysis By Type, 2024-2035 ($ Million)

22. Asia-Pacific Graphics Double Data Rate Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Rest Of The World Graphics Double Data Rate Market Research And Analysis By Region, 2024-2035 ($ Million)

24. Rest Of The World Graphics Double Data Rate Market Research And Analysis By Type, 2024-2035 ($ Million)

25. Rest Of The World Graphics Double Data Rate Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Graphics Double Data Rate Market Share By Type, 2024 Vs 2035 (%)

2. Global GDDR3 Market Share By Region, 2024 Vs 2035 (%)

3. Global GDDR4 Market Share By Region, 2024 Vs 2035 (%)

4. Global GDDR5 Market Share By Region, 2024 Vs 2035 (%)

5. Global GDDR6 Market Share By Region, 2024 Vs 2035 (%)

6. Global GDDR7 Market Share By Region, 2024 Vs 2035 (%)

7. Global Graphics Double Data Rate Market Share By Application, 2024 Vs 2035 (%)

8. Global Graphics Double Data Rate For Autonomous Vehicles Market Share By Region, 2024 Vs 2035 (%)

9. Global Graphics Double Data Rate For Gaming Market Share By Region, 2024 Vs 2035 (%)

10. Global Graphics Double Data Rate For Graphic Design Market Share By Region, 2024 Vs 2035 (%)

11. Global Graphics Double Data Rate For Professional Workstations Market Share By Region, 2024 Vs 2035 (%)

12. Global Graphics Double Data Rate For Others Market Share By Region, 2024 Vs 2035 (%)

13. Global Graphics Double Data Rate Market Share By Region, 2024 Vs 2035 (%)

14. US Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

15. Canada Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

16. UK Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

17. France Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

18. Germany Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

19. Italy Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

20. Spain Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

21. Russia Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

22. Rest Of Europe Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

23. India Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

24. China Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

25. Japan Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

26. South Korea Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

27. Australia and New Zealand Graphics Double Data Market Size, 2024-2035 ($ Million)

28. ASEAN Economies Graphics Double Data Market Size, 2024-2035 ($ Million)

29. Rest Of Asia-Pacific Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

30. Latin America Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

31. Middle East And Africa Graphics Double Data Rate Market Size, 2024-2035 ($ Million)

FAQS

The size of the Graphics Double Data Rate market in 2024 is estimated to be around $6,528 million.

Asia-Pacific holds the largest share in the Graphics Double Data Rate market.

Leading players in the Graphics Double Data Rate market include Samsung Electronics, Micron Technology, Inc., Advanced Micro Devices, Inc. Rockwell Automation Inc., Rambus NVIDIA Corp.

Graphics Double Data Rate market is expected to grow at a CAGR of 8.4% from 2025 to 2035.

The Graphics Double Data Rate (GDDR) Market is growing due to rising demand for high-performance computing, AI, gaming, and cloud data centers. Advancements in AR/VR, autonomous vehicles, edge computing, and the shift to GDDR6/GDDR7 further drive market e