Green Ammonia Market

Global Green ammonia Market Size, Share & Trends Analysis Report by Technology (Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), Solid Oxide Electrolysis (SOE)), By Application (Transportation Fuel, Power Generation and Energy Storage, Fertilizer, Other (Textile & Pharmaceuticals, Explosives, Refrigeration & Heat Transfer Application)), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global green ammonia market is anticipated to grow at a significant CAGR of 7.8% during the forecast period (2021-2027). With the growing potential of green ammonia as energy source and an energy carrier, a high adoption of green ammonia to curb greenhouse gases emission has been noticed. The high adoption of green ammonia as a replacement of GHG causing material and cohesive government policies to promote production of green ammonia are key factors to drive the growth of this market globally. With the gaining momentum of its adoption in different application different players operating in the market are likely to invest in its production plants to meet the growing global demand.

For instance, in November 2020, Mitsubishi Heavy Industries (MHI) announced to make a capital investment in H2U Investments, the holding entity of the H2U Group. The Group includes The Hydrogen Utility (H2U), an Australia-based developer of green hydrogen and green ammonia projects using power from renewable energy. By this investment MHI intends to promote H2U's projects and business development initiatives for H2U's Eyre Peninsula GatewayTM project in South Australia. However, higher initial capital investment in setup of green ammonia plant infrastructure, and unwilling of manufacturer to move on green ammonia technology leaving traditional ammonia technology to avoid production cost are the key factors that are likely to hinder the market growth during the forecast period.

The COVID-19 pandemic outbreak is less likely to impact the growth of the green ammonia market. Increased certainty regarding the phasing and completion timelines can be one of the potential impact of this pandemic outbreak. As due to the COVID-19 pandemic outbreak, projects that are at initial phase of development may face startup delays. Production sites that are under construction may face labor and raw material shortages. For instance, the pre-commissioning activities at Ramagundam Fertilizers and chemicals got impacted due to lockdown led by COVID-19 pandemic outbreak.

Segmental Outlook

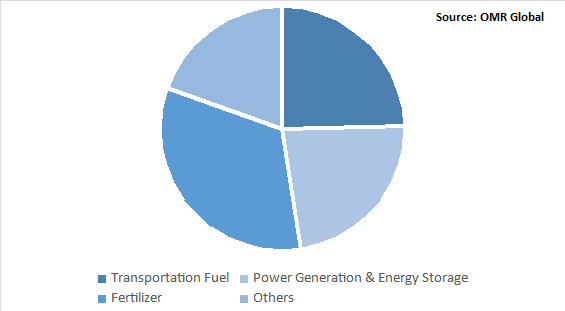

The global green ammonia market is segmented based on technology and application. Based on technology, the market is segmented into Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), and Solid Oxide Electrolysis (SOE). SOECs have possible application in fuel production, carbon dioxide recycling, and chemicals synthesis. Unlike traditional AWE or PEM-based low-temperature electrolysis, SOE offers high electrical efficiency, and uniquely allows co-electrolysis of steam and CO2, and the opportunity of thermal integration with industrial processes. Therefore, SOE is expected to exhibit considerable growth during the forecast period. Based on application, the market is segmented into transportation fuel, power generation and energy storage, fertilizer, and others.

Global Green Ammonia Market Share by Application, 2020 (%)

Power Generation & Energy Storage to Exhibit Considerable Growth based on Application

The environment friendly properties of green ammonia make it a suitable fuel for power generation. The rising demand for power across the globe along with rising inclination towards power generation through renewable sources is a key factor contributing towards the growth of this market segment. Therefore, based on application, the power generation & energy storage application is anticipated to hold considerable growth during the forecast period.

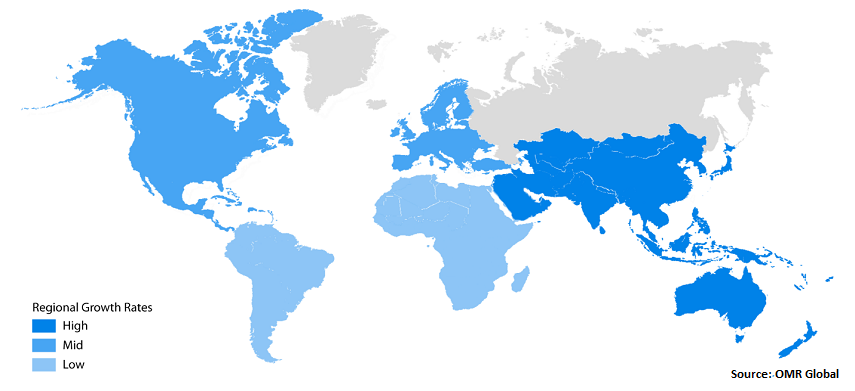

Regional Outlooks

The global green ammonia market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Europe holds a prominent position in the global green ammonia market, followed by North America. Significant increase in green hydrogen projects across Germany and The Netherlands is a key factor contributing towards the high share of the regional market. Further, the presence of key market players across the region and their contribution in establishment of new production plants across the region is another major contributor towards the high share of the regional market.

Global Green Ammonia Market Growth, by Region 2021-2027

Asia-Pacific is projected to have considerable share in the global green ammonia market

Asia-Pacific is anticipated to hold a considerable market share in the global green ammonia market during the forecast period. Cohesive government support in emerging economies such as India is anticipated to fuel the growth of green ammonia market across the region. For instance, in December 2020, the Indian government announced its plans to invite bids for setting up green ammonia projects within six months to reduce import dependence and to fulfill the demand for green ammonia across the country.

Market Players Outlook

The major players operating in the market include Haldor Topsøe A/S, Yara International ASA, Yara International ASA, and CF Industries Holdings, Inc. among others. These market players adopt various strategies such as product launch, partnerships, and collaborations, and mergers and acquisitions to sustain a strong position in the market.

Recent Development

- In December 2020, the Norwegian fertilizer giant Yara International ASA, announced to change the source of hydrogen for its ammonia plant in Porsgrunn, Norway, from hydrocarbons to water electrolysis powered by renewable energy. The conversion of the plant, which has 500,000 metric tons (t) per year of NH3 capacity, would reduce carbon dioxide emissions by 800,000 t annually, the same amount as emitted by roughly 300,000 passenger vehicles.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global green ammonia market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Green Ammonia Market, By Technology

5.1.1. Alkaline Water Electrolysis (AWE)

5.1.2. Proton Exchange Membrane (PEM)

5.1.3. Solid Oxide Electrolysis (SOE)

5.2. Global Green Ammonia Market, By Application

5.2.1. Transportation Fuel

5.2.2. Power Generation and Energy Storage

5.2.3. Fertilizer

5.2.4. Other (Textile & Pharmaceuticals, Explosives, Refrigeration & Heat Transfer Application)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Enapter GmbH

7.2. Green Hydrogen Systems

7.3. Haldor Topsøe A/S

7.4. Hiringa Energy Ltd.

7.5. Hydrogenics (Cummins Inc.)

7.6. ITM Power Plc

7.7. Man Energy Solutions SE

7.8. MCPHY Energy SAS

7.9. Nel Hydrogen AS

7.10. Queensland Nitrates Pty Ltd.

7.11. Siemens AG

7.12. Thyssenkrupp Industrial Solutions AG

7.13. Uniper SE

7.14. Yara International ASA

7.15. Proton Ventures BV

7.16. Grieg Edge AS

7.17. CF Industries Holdings, Inc.

1. GLOBAL GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL ALKALINE WATER ELECTROLYSIS (AWE) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL PROTON EXCHANGE MEMBRANE (PEM) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SOLID OXIDE ELECTROLYSIS (SOE) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

6. GLOBAL TRANSPORTATION FUEL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL POWER GENERATION AND ENERGY STORAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL FERTILIZER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHER (TEXTILE & PHARMACEUTICALS, EXPLOSIVES, REFRIGERATION & HEAT TRANSFER APPLICATION) MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. NORTH AMERICAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

13. EUROPEAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. EUROPEAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

15. EUROPEAN GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

16. ASIA-PACIFIC GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

19. REST OF THE WORLD GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. REST OF THE WORLD GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD GREEN AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. GLOBAL GREEN AMMONIA MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

2. GLOBAL GREEN AMMONIA MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

3. GLOBAL GREEN AMMONIA MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

4. GLOBAL ALKALINE WATER ELECTROLYSIS (AWE) MARKET SHARE BY REGION, 2020 VS 2027 (%)

5. GLOBAL PROTON EXCHANGE MEMBRANE (PEM) MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL SOLID OXIDE ELECTROLYSIS (SOE) MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL GREEN AMMONIA FOR TRANSPORTATION FUEL MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL GREEN AMMONIA FOR POWER GENERATION AND ENERGY STORAGE MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL GREEN AMMONIA FOR FERTILIZER MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL GREEN AMMONIA FOR OTHER (TEXTILE & PHARMACEUTICALS, EXPLOSIVES, REFRIGERATION & HEAT TRANSFER APPLICATION) IMAGING MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. US GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

12. CANADA GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

13. UK GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

14. FRANCE GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

15. GERMANY GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

16. ITALY GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

17. SPAIN GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

18. REST OF EUROPE GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

19. INDIA GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

20. CHINA GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

21. JAPAN GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

22. SOUTH KOREA GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF ASIA-PACIFIC GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF THE WORLD GREEN AMMONIA MARKET SIZE, 2020-2027 ($ MILLION)