Green Hydrogen Market

Global Green Hydrogen Market Size, Share & Trends Analysis Report by Technology (Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), Solid Oxide Electrolysis (SOE)), By Application (Transportation Fuel, Power Generation, Other), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global green hydrogen market is anticipated to grow at a significant CAGR of 10.8% during the forecast period (2021-2027). The increasing adoption of green hydrogen as a replacement of GHG causing material in transportation and power generation fuel along with cohesive government policies to promote production of green hydrogen is a key factor driving the growth of the global green hydrogen market. With the gaining momentum of its adoption in different application different players operating in the market are likely to invest in its production plants to meet the growing global demand. For instance, in August 2021, Engie Latam SA proposed to set up an array of electrolysers totalling around 26 MW and a hydrogen compression and storage station with initial investment of $47 million. Engie expect to commission its plant in June 2025. The green hydrogen market is currently at its growing phase. The higher initial capital investment in setup of green hydrogen plant infrastructure, and unwillingness of manufacturer to move on green hydrogen technology leaving traditional hydrogen technology to avoid production cost are the key factors that are likely to hinder the market growth during the forecast period.

The COVID-19 pandemic outbreak is less likely to impact the growth of the green hydrogen market. Increased certainty regarding the phasing and completion timelines can be one of the potential impact of this pandemic outbreak. As due to the COVID-19 pandemic outbreak, projects that are at initial phase of development may face startup delays. Production sites that are under construction may face labor and raw material shortages. For instance, the pre-commissioning activities at Ramagundam Fertilizers and chemicals got impacted due to lockdown led by COVID-19 pandemic outbreak.

Segmental Outlook

The global green hydrogen market is segmented based on technology and application. Based on technology, the market is segmented into Alkaline Water Electrolysis (AWE), Proton Exchange Membrane (PEM), and Solid Oxide Electrolysis (SOE). SOECs have possible application in fuel production, carbon dioxide recycling, and chemicals synthesis. Unlike traditional AWE or PEM-based low-temperature electrolysis, SOE offers high electrical efficiency, and uniquely allows co-electrolysis of steam and CO2, and the opportunity of thermal integration with industrial processes. Therefore, SOE is expected to exhibit considerable growth during the forecast period. Based on application, the market is segmented into transportation fuel, power generation, and others.

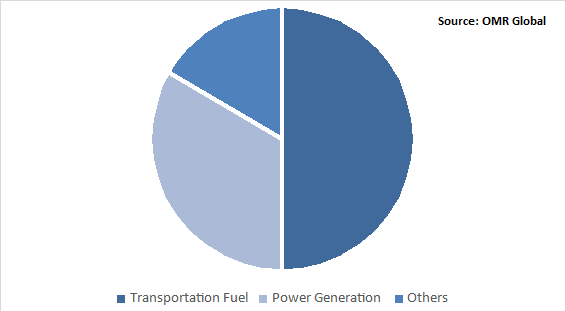

Global Green Hydrogen Market Share by Application, 2020 (%)

Power Generation Segment to Exhibit Considerable Growth based on Application

The environment friendly properties of green ammonia make it a suitable fuel for power generation. The rising demand for power across the globe along with rising inclination towards power generation through renewable sources is a key factor contributing towards the growth of this market segment. Therefore, based on application, the power generation application is anticipated to hold considerable growth during the forecast period.

Regional Outlooks

The global green hydrogen market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. Europe held a major position in the global green hydrogen market, followed by North America. Significant increase in green hydrogen projects across Germany and the Netherlands is a key factor contributing towards the high share of the regional market. Further, the presence of key market players across the region and their contribution in establishment of new production plants across the region is another major contributor towards the high share of the regional market.

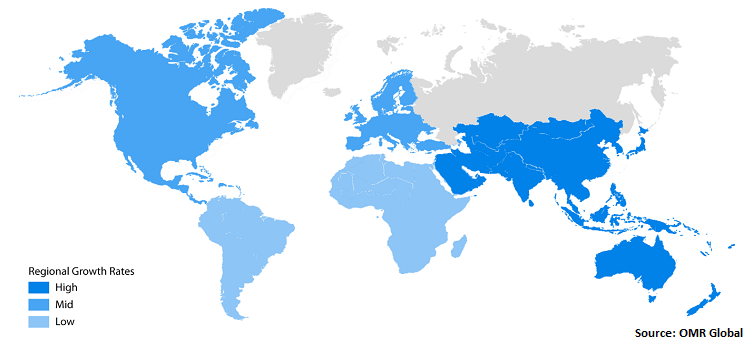

Global Green Hydrogen Market Growth, by Region 2021-2027

Asia-Pacific is projected to have considerable share in the global green hydrogen market

Asia-Pacific is anticipated to hold a considerable market share in the global green hydrogen market during the forecast period. Cohesive government support in emerging economies such as India and China to promote adoption of renewable sources of energy is driving the growth of the regional market. For instance, the government of India is currently working on the development of green hydrogen projects by launching policy initiatives. In July 2021, the Indian governments’ Ministry of New and Renewable Energy (“MNRE”) has reportedly issued 3 policy documents for development of green hydrogen industry; recently, all these policies are currently undergoing inter-ministerial consultation. The approval of these policies is expected to unfold huge scope for the growth of the green hydrogen market across Asia-Pacific.

Market Players Outlook

The major players operating in the market include Haldor Topsøe A/S, Ballard Power Systems Inc., CF Industries Holdings, Inc., Man Energy Solutions SE, and so on. These companies are making continuous investments in R&D to make progress in producing technologically advanced green hydrogen. Mergers & acquisitions, geographical expansion, production capacity expansion, partnerships, and collaborations are some of the key strategies adopted by the market players to remain competitive in the market place.

Recent Development

- In August 2021, Ohmium International, a US-based renewable energy start-up had launched green hydrogen electrolyzer gigafactory at Bengaluru, India. The gigafactory will manufacture India-made Proton Exchange Membrane (PEM) hydrogen electrolyzers with an initial manufacturing capacity of about 500 MW per year and will scale it up to 2 GW per year. The PEM hydrogen electrolyzer is the main equipment for the production of green hydrogen as it uses power generated from renewable resources to break water into hydrogen and oxygen. Thus, launch of this factory is expected to make major contribution to the market growth.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global green ammonia market. Based on the availability of data, information related to new project launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Green Hydrogen Industry

• Recovery Scenario of Global Green Hydrogen Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Impact of COVID on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Green Hydrogen Market by Technology

5.1.1. Alkaline Water Electrolysis (AWE)

5.1.2. Proton Exchange Membrane (PEM)

5.1.3. Solid Oxide Electrolysis (SOE)

5.2. Global Green Hydrogen Market by Application

5.2.1. Transportation Fuel

5.2.2. Power Generation

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Air Products and Chemicals, Inc.

7.2. Ballard Power Systems Inc.

7.3. CF Industries Holdings, Inc.

7.4. Engie SA

7.5. ERGOSUP (Electrolyseur Sous Pression)

7.6. Green Hydrogen Systems A/S

7.7. Haldor Topsoe A/S

7.8. Hiringa Energy Ltd.

7.9. Hydrogenics (Cummins Inc.)

7.10. ITM Power Group

7.11. Linde plc

7.12. Loop Energy Inc.

7.13. Man Energy Solutions SE

7.14. MCPHY Energy SAS

7.15. NEL Hydrogen AS

7.16. Plug Power Inc.

7.17. Siemens AG

7.18. Solena Group Inc. (Global Plasma Systems)

7.19. Toshiba Energy Systems & Solutions Corp.

7.20. Uniper SE

1. GLOBAL GREEN HYDROGEN MARKET BY TECHNOLOGY, 2020-2027 ($ MILLION)

2. GLOBAL ALKALINE WATER ELECTROLYSIS (AWE) BASED GREEN HYDROGEN MARKET BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL PROTON EXCHANGE MEMBRANE (PEM) BASED GREEN HYDROGEN MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL SOLID OXIDE ELECTROLYSIS (SOE) BASED GREEN HYDROGEN MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL GREEN HYDROGEN MARKET APPLICATION, 2020-2027 ($ MILLION)

6. GLOBAL GREEN HYDROGEN FOR TRANSPORTATION FUEL MARKET BY REGION,2020-2027 ($ MILLION)

7. GLOBAL GREEN HYDROGEN FOR POWER GENERATION MARKET BY REGION,2020-2027 ($ MILLION)

8. GLOBAL GREEN HYDROGEN FOR OTHER APPLICATION MARKET BY REGION,2020-2027 ($ MILLION)

9. GLOBAL GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS APPLICATION, 2020-2027 ($ MILLION)

12. NORTH AMERICAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. EUROPEAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

14. EUROPEAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS APPLICATION, 2020-2027 ($ MILLION)

15. EUROPEAN GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. ASIA-PACIFIC GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS APPLICATION, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. REST OF THE WORLD GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2020-2027 ($ MILLION)

20. REST OF THE WORLD GREEN HYDROGEN MARKET RESEARCH AND ANALYSIS APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL GREEN HYDROGEN MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL GREEN HYDROGEN MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL GREEN HYDROGEN MARKET, 2021-2027 (%)

4. GLOBAL GREEN HYDROGEN MARKET SHARE BY TECHNOLOGY, 2020 VS 2027 (%)

5. GLOBAL GREEN HYDROGEN MARKET SHARE APPLICATION, 2020 VS 2027 (%)

6. GLOBAL GREEN HYDROGEN MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (%)

7. GLOBAL ALKALINE WATER ELECTROLYSIS (AWE) BASED GREEN HYDROGEN MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL PROTON EXCHANGE MEMBRANE (PEM) BASED GREEN HYDROGEN MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL SOLID OXIDE ELECTROLYSIS (SOE) BASED GREEN HYDROGEN MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL GREEN HYDROGEN FOR TRANSPORTATION FUEL MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL GREEN HYDROGEN FOR POWER GENERATION MARKET BY REGION, 2020 VS 2027 (%)

12. GLOBAL GREEN HYDROGEN FOR OTHER APPLICATION MARKET BY REGION, 2020 VS 2027 (%)

13. US GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

14. CANADA MARKET GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

15. UK GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

16. GERMANY GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

17. SPAIN GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

19. ITALY GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

20. REST OF EUROPE GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

21. INDIA GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

22. CHINA GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

23. JAPAN GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OFASIA-PACIFIC GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)

25. REST OF WORLD GREEN HYDROGEN MARKET SIZE, 2020-2027 ($ MILLION)