Grid-Scale Battery Market

Grid-Scale Battery Market Size, Share, Trends and Growth, Industry Analysis Report by Type (Zinc-Hybrid Batteries, Redox-Flow Batteries, Lithium-Ion Batteries, and Other Batteries), By Application (Peak Shift, Ancillary Services, Back-Up Power, and Renewable Integration), Market Research and Forecasts, 2019–2025 Update Available - Forecast 2025-2035

The grid-scale battery market is growing significantly at a CAGR of 20% during the forecast period owing to the growing demand for renewable energy resources. Electricity consumption is on the rise globally and it is becoming a challenge for the power companies to maintain the consistent flow of electricity to their consumer. Grid-scale battery is one of the best solutions for this and various companies are adopting this technology rapidly. Major factors which are augmenting grid-scale battery market is its wide range application in various application such as peak shaving, load shifting, renewable resource integration and so on. further, the market is also growing at a fast pace owing to technological advancements due to which, battery cost is declining significantly.

The grid-scale battery market is at their initial stage and is expected it will grow exponentially during the forecast period. Rising generation for renewable energy and favorable government regulation will certainly boost the grid-scale battery industry. As an instance, in 2010 the solar energy target set by the government of India for 2022 was 22 GW which has been increased to 100 GW in 2015. Grid-scale batteries are necessary for negating fluctuation in power grids when the electricity is getting generated by renewable resources. The grid-scale battery makes the electricity grid more reliable and flexible.

Segmental Overview

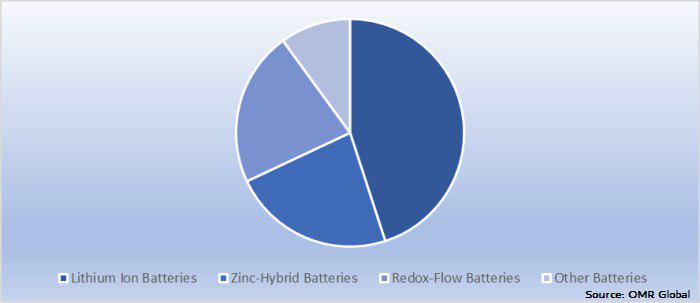

The grid-scale battery market is segmented on the basis of type, and application. On the basis of type, the market is segmented into lithium-ion battery, zinc-hybrid batteries, redox flow batteries, and, others including lead-acid battery and sodium-based battery. By application, the market is segmented into peak shift, ancillary services, back-up power, and renewable integration. It is expected that renewable integration will show a lucrative growth rate during the forecasted period due to the high adoption of renewable energy globally.

Global Grid-Scale Battery Market by Type, 2018 (%)

lithium-ion battery expected to hold significant market size in 2018

Li-ion batteries are expected to have a significant share in the grid-scale battery market. These batteries have high power density and high energy result of which they are lightweight as compare to nickel-metal-hybrid & nickel-cadmium batteries and have a high life expectancy of 5–15 years. Moreover, they have fewer standby losses and efficiency of up to 98%. A number of grid-scale battery plants have been set-up globally with lithium-ion batteries. As an instance, the largest lithium-ion battery storage plant in North America was started on February 2017 in Escondido, the US. The plant is capable of storing up to 120 megawatt-hours of energy from any renewable source.

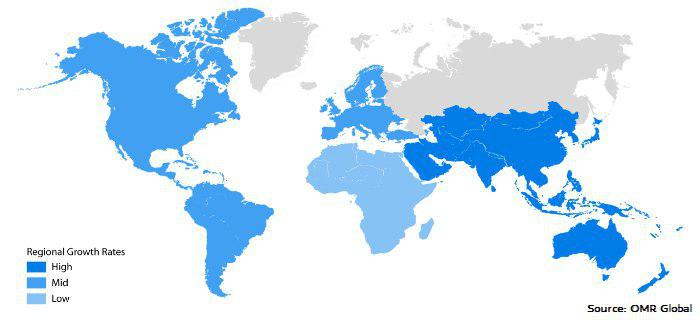

Regional Overview

Based on geography, the grid-scale battery market is segmented on the basis of regions including North America, Asia-Pacific, Europe and Rest of the World (RoW). North America is expected to be one of the major regions in the market. The US is expected to be the largest player in the market. It is due to a large number of projects of grid-scale battery. Europe is expected to have a significant market as a significant focus is given to renewable energy in the region. In February 2019, AES Corp. has announced that it will provide 100 MW 4-hour duration battery-based energy storage system in order to provide grid stability to Arizona Public Service (APS), the US. It is a 20-year contract and the operation of the project is expected to begin from June 2021.

Countries of Asia-Pacific such as India and China are expected to be one of the fastest-growing markets as they are significantly adopting grid-scale battery energy storage system. India, one of the fastest-growing economy has started its first grid-scale battery-based energy storage system in February 2019. AES Corp. and Mitsubishi Corp. owns 10 MW system in New Delhi and operated by Tata Powers-DDL. It is installed for better grid stabilization and peak-load management in the city.

Global Grid-Scale Battery Market Growth by Region, 2019-2025

s

s

Major players in the market include ABB Ltd, AES Corp., Tesla Inc., Samsung SDI Co. Ltd., SAFT Groupe, LG Chem Ltd., and GS Yuasa International Ltd. and so on are significantly contributing to the market growth. These companies are adopting various strategies such as product launch, merger & acquisitions, and various others to stay competitive in the grid-scale battery market. As an instance, on July 2017, Siemens AG and AES Corporation went into an agreement to form a new energy storage technology and services company, Fluence. In 2017, both the companies combinedly had 8 projects totaling 463 MW of battery-based energy storage across 13 countries.

The Report Covers

• Market value data analysis of 2018 and forecast to 2025.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global grid-scale battery market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. LG Chem, Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. SAFT Groupe

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Samsung SDI Co. Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Tesla, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Panasonic Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Grid Scale Battery Market by Type

5.1.1. Lithium-Ion Batteries

5.1.2. Zinc-Hybrid Batteries

5.1.3. Redox-Flow Batteries

5.1.4. Other

5.2. Global Grid Scale Battery Market by Application

5.2.1. Peak Shift

5.2.2. Ancillary Services

5.2.3. Back-Up Power

5.2.4. Renewable Integration

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AES Corp.

7.2. ABB, Ltd.

7.3. Anesco, Ltd.

7.4. BYD Company, Ltd.

7.5. Exide Industries, Ltd.

7.6. General Electric Co.

7.7. GS Yuasa International, Ltd.

7.8. Johnson Control, Inc.

7.9. LG Chem, Ltd.

7.10. Mitsubishi Heavy Industries, Ltd.

7.11. NEC Energy Solutions, Inc.

7.12. NGK Insulators, Ltd.

7.13. Panasonic Corp.

7.14. Robert Bosch GmbH

7.15. SAFT Groupe

7.16. SEC Battery

7.17. Samsung SDI Co. Ltd.

7.18. Tesla, Inc.

7.19. Toshiba Corp.

7.20. Vionx Energy

1. GLOBAL GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL ZINC-HYBRID BATTERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ZINC-HYBRID BATTERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL LITHIUM-ION BATTERIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

7. GLOBAL PEAK SHIFT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ANCILLARY SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL BACK-UP POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL RENEWABLE INTEGRATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. NORTH AMERICAN GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

14. NORTH AMERICAN GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. EUROPE GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPE GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. EUROPE GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

21. REST OF THE WORLD GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

22. REST OF THE WORLD GRID SCALE BATTERY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL GRID SCALE BATTERY MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL GRID SCALE BATTERY MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL GRID SCALE BATTERY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD GRID SCALE BATTERY MARKET SIZE, 2018-2025 ($ MILLION)