Grinding Machine Market

Global Grinding Machine Market Size, Share & Trends Analysis Report By Type (Conventional and CNC (Cylindrical, Surface, Gear, and Others)) By End-User Industry (Automotive, Maritime Industry, Aerospace & Defense, Construction, Industrial Manufacturing, Electrical & Electronics, and Others) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global grinding machine market is anticipated to grow at a CAGR of 8.5% during the forecast period (2021-2027). A grinding machine is a tool used in cleanliness or grinding workpieces in the manufacturing sector. The machine uses an abrasive wheel as a cutting tool that provides high surface quality and low surface roughness. The machine comes in different types such as belt grinder, bench grinder, cylindrical grinder, surface grinder, gear grinder, and others. The adoption of these grinders in end-user verticals such as automotive, aerospace, constructions, electrical & electronics is the major factor for the market growth. Moreover, the current mega-trends – such as resource efficiency, individualization, ergonomics, and Industry 4.0 – are changing the appearance of grinding machines, which is also affected by the availability of new technologies, especially sensors, actuators, and the control or machine intelligence. Industry 4.0 trends in major economies result in the emerging trends towards automation and IoT in the manufacturing sector. Manufacturers are now focusing on the adoption of automated solutions such as CNC grinding machines in order to increase their output along with lower labor costs has increased the product demand.

Besides, government support in form of investment, FDI, and subsidies to boost manufacturing industries will eventually boost demand for grinding machines. For instance, according to the Department for Promotion of Industry and Internal Trade (DPIIT), cumulative FDI inflows in the manufacturing subsectors amounted to $100.4 billion between April 2000 and June 2021. Moreover, the UK government provided $10.6 million in funding to small and medium-sized enterprises (SMEs) to help them modernize and go digital by adopting advanced technology and automated system. Such fundings and support from the government will boost the manufacturing sector, which in turn, will create the scope for market growth.

Impact of COVID-19 on Global Grinding Machine Market

The grinding machine market has registered a decline in growth due to the COVID-19 pandemic. The lockdown imposed by the government and restriction on mobility affected the raw material supply chain across the globe. In addition, government regulations to shut down all the manufacturing operations in all industries across the major economies resulted to lower demand for grinding machines. Post pandemic, the market is anticipated to regain its momentum with a further increase in demand for grinding machines from manufacturing sectors.

Segmental Outlook

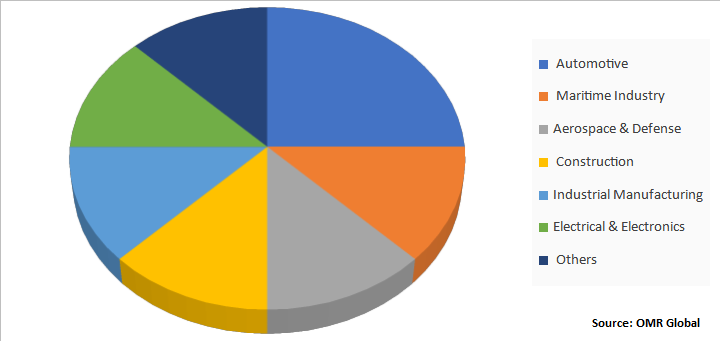

The global grinding machine market is segmented based on type and end-user industry. Based on type, the market is sub-segmented into conventional and CNC. Further, the CNC segment is analyzed into cylindrical, surface, gear, and others. Among these, the CNC segment is estimated to hold a lucrative share in the market during the forecast period. The segment growth is attributed to the increasing adoption of CNC grinding machines in end-user verticals. On the basis of end-user industry, the market is sub-segmented into automotive, maritime industry, aerospace & defense, construction, industrial manufacturing, electrical & electronics, and others.

Global Grinding Machine Market Share by End-User Industry, 2020 (%)

Automotive Emerge as a Fastest Growing Segment in Global Grinding Machines Market

Based on applications, the automotive segment is projected to hold a lucrative share in the global grinding machine market during the forecast period. Inthe automotive sector, milling and machining are replaced with peel and creep-feed grinding. In addition, grinding machines are also used in the automotive sector for the cleanliness of the automotive spare parts in the vehicle. Cleaner car parts enable drivers to go longer between oil changes and have reduced maintenance in general. Cleaner parts have also led to reduced warranty claims, even during increased warranty periods.With the increasing demand for electric vehicles in major economies, the automotive sector is surging at a rapid rate along with the high adoption of automated CNC grinding machines, which is fueling the market growth.

Regional Outlook

Geographically, the global grinding machine market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is projected to dominate the market by accounting highest revenue share in the market during the forecast period. The growth in the construction sector owing to the rapid industrialization and increased demand for polished floors in the residential sector are the prominent factors driving the demand for grinding machines. Whereas, Europe is projected to hold the second-largest position in the global market over the forecast period due to growth in the manufacturing industry and heavy industrialization across the region.

Global Grinding Machine Market Growth, By Region 2021-2027

Asia-Pacific Emerges as Fastest Growing region in Global Grinding Machine Market

Geographically, the Asia-Pacific region is projected to grow at the highest CAGR during the forecast period. China, India, and Japan are the major economies contributing significantly to the market growth. The regional growth is attributed to the rising demand for grinding machines from end-user verticals, increasing adoption of automated systems in all industries to enhance productivity and to reduce labor costs, and rising urbanization. For instance, Industry 4.0 is already influencing sectors like manufacturing, supply chain management, construction, shipping, and more in major economies of Asia-Pacific due to which the adoption of automated systems such as CNC grinding machines has surged. Moreover, economies such as China, India, are looking towards automation and control to replace expensive manpower and attain lower cost of conversion thus regaining their share in the manufacturing economy from emerging economies, resulting in creating huge scope for automated machines like grinding machines. Furthermore, the rising government initiatives in the region such as “Make in India” are some of the factors expected to boost the growth of the market in the forecast period.

Market Players Outlook

The key players in the Grinding machine market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Amada Co, Ltd., ANCA Pty. Ltd., Danobat Group, Fives Group, and JTEKT Corp. among others. These market players are adopting several market strategies including product launch and approvals, mergers & acquisitions, partnership collaboration, business, and capacity expansion, and others.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global grinding machine market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Grinding Machines Industry

• Recovery Scenario of Global Grinding Machines Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Grinding Machines Market, By Type

5.1.1. Conventional

5.1.2. CNC

5.1.2.1. Cylindrical

5.1.2.2. Surface

5.1.2.3. Gear

5.1.2.4. Other

5.2. Global Grinding Machines Market, By End-User Industry

5.2.1. Automotive

5.2.2. Maritime

5.2.3. Aerospace & Defense

5.2.4. Construction

5.2.5. Industrial Manufacturing

5.2.6. Electrical & Electronics

5.2.7. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. 3M Company

7.2. Amada Co, Ltd.

7.3. ANCA Pty. Ltd.

7.4. Chevalier Machinery, Inc.

7.5. Danobat Group

7.6. ELB-SCHLIFF Werkzeugmaschinen GmbH

7.7. EMAG GmbH & Co. KG

7.8. Falcon Machine Tools Co., Ltd.

7.9. Fives Group

7.10. Glebar Co.

7.11. Hardinge, Inc.

7.12. Heinz Berger Maschinenfabrik GmbH & Co. KG

7.13. JTEKT Corp.

7.14. Kent Industrial Co., Ltd.

7.15. Komatsu Ltd.

7.16. Koyo Machinery USA, Inc.

7.17. Kunshan Huachen Heavy Machinery Co., Ltd.

7.18. Mitsubishi Heavy In.dustries Machine Tool Co., Ltd.

7.19. Okamoto Corp.

7.20. Pietro Carnaghi S.p.A

7.21. Shanghai Machine Tool Works Ltd.

7.22. Shigiya (USA) Ltd.

7.23. Sumitomo Heavy Industries Ltd.

7.24. Toshiba Machine Co., Ltd.

7.25. United Grinding Group Management AG

1. GLOBAL GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL CONVENTIONAL GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CNC GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

5. GLOBAL GRINDING MACHINES FOR AUTOMOTIVE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL GRINDING MACHINES FOR MARITIME INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL GRINDING MACHINES FOR AEROSPACE & DEFENSE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL GRINDING MACHINES FOR CONSTRUCTION INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL GRINDING MACHINES FOR INDUSTRIAL MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL GRINDING MACHINES FOR ELECTRICAL & ELECTRONICS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL GRINDING MACHINES FOR OTHER END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. NORTH AMERICAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE,2020-2027 ($ MILLION)

14. NORTH AMERICAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

15. EUROPEAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

17. EUROPEAN GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

23. REST OF THE WORLD GRINDING MACHINES MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL GRINDING MACHINES MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL GRINDING MACHINES MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL GRINDING MACHINES MARKET, 2020-2027 (%)

4. GLOBAL GRINDING MACHINES MARKET SHARE BY TYPE,2020 VS 2027 (%)

5. GLOBAL GRINDING MACHINES MARKET SHARE BY END-USER INDUSTRY, 2020 VS 2027 (%)

6. GLOBAL GRINDING MACHINES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL CONVENTIONAL GRINDING MACHINES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL CNC GRINDING MACHINES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL GRINDING MACHINES FOR AUTOMOTIVE INDUSTRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL GRINDING MACHINES FOR MARITIME INDUSTRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL GRINDING MACHINES FOR AEROSPACE & DEFENSE INDUSTRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL GRINDING MACHINES FOR CONSTRUCTION INDUSTRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL GRINDING MACHINES FOR INDUSTRIAL MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL GRINDING MACHINES FOR ELECTRICAL & ELECTRONICS INDUSTRY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL GRINDING MACHINES FOR OTHER END-USER INDUSTRYS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. US GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

17. CANADA GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

18. UK GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

19. FRANCE GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

20. GERMANY GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

21. ITALY GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

22. SPAIN GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF EUROPE GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

24. INDIA GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

25. CHINA GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

26. JAPAN GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC GRINDING MACHINES MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD GRINDING MACHINES MARKET SIZE, 2021-2027($ MILLION