Hand Tools Market

Global Hand Tools Market Size, Share & Trends Analysis Report by Tool Type (General Purpose Tools, Cutting Tools, Layout and Measuring Tools, and Taps and Dies) and by End-User (Commercial, Industrial, and Residential) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The global hand tools market is expected to expand at a compounded annual growth rate (CAGR) of 2.8% during the forecast period. Hand tools are handheld tools that are powered by manual force rather than battery or electricity like in the case of power tools. Being the most conventional form of tools, they are used for striking, cutting, measuring, fastening, and other general purposes. They are utilized for industrial, commercial, and residential activities; the most commonly used hand tools among end-users include wrenches, drivers, pliers, and hammers.

They are extensively sold by large distributors whereas the DIY retail chains, and e-retailing are gaining momentum in recent years. The growth in Li-ion battery tools is estimated to be a major threat to the hand tools market as they provide enhanced convenience and ergonomics. However, the development of precision hand tools, the demand-supply gap for power tools in the heavy-duty segment, and low-cost labor in the growing economies of Asia-Pacific and Latin America are driving the momentum for hand tools.

Further, due to the onset of the COVID-19 pandemic, the hand tools market suffered a hefty downfall. The imposition of lockdown in nearly all of the countries resulted in a decline in the demand for hand tools, as most of the commercial and industrial activities stopped. However, in the last quarter of 2020, most of the countries have eased up on lockdown guidelines and the commercial and industrial activities have resumed, which will result in the hand tools industry gaining gradual momentum.

Segmental Outlook

The hand tools market is segmented based on tool type and end-user. Based on tool type, the hand tools market is segmented into general-purpose tools (hammers, clamps and vises, pliers, ratchets and sockets, riveters, screwdrivers and nut drivers, wrecking bars, and wrenches), cutting tools (chisel and files, cable and wire cutting tools, knives and blades, and saws), layout and measuring tools (plumb bob and try square), and taps and dies. Based on end-user, the market is classified into commercial, industrial, and residential.

Residential Segment to Gain Momentum as Rise in Home Improvement and DIY Activities Noted

In recent times, residential activities have surged immensely, mostly in developed countries. For instance, in some developed economies including the US and European countries, most adults indulge in creative and purposeful leisure activities. Some consumers also invest in home improvement and maintenance activities, based on their interests. In countries such as France, Germany, Italy, and the UK, consumers consider DIY activities as a major hobby.

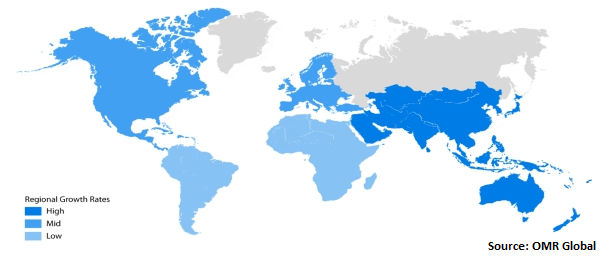

Regional Outlook

The global hand tools market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. In some developed economies of the US and Europe, most adults indulge in creative and purposeful leisure activities. Some consumers also invest in home improvement and maintenance activities, based on their interests. In countries such as France, Germany, Italy, and the UK, consumers consider DIY (Do it yourself) activities as a major hobby. Further, the concept is also gaining momentum in developing economies of Asia-Pacific and Latin America. The DIY tool kits are gaining popularity in countries like India and China owing to the limited availability of skilled labor, which can be seen more in urban areas. This has driven the growth in the utilization of hand tools like chisels, hammers, and screwdrivers for domestic household activities, home improvement, repairs, woodwork, and gardening work.

Global Hand Tools Market Growth, by Region 2020-2026

Market Players Outlook

The global hand tools market is highly competitive with a significant number of global and regional vendors. Vendors are thus introducing innovative features such as insulated coatings, adjustable options, patented blade technologies, and expansion options in their products to differentiate themselves. Looking for more precision and productivity, professional contractors rely on advanced tools and accessories irrespective of price and warranty, where the surges in construction and retrofit activities are expected to fuel the demand for hand tools during the next five years. Akar Tools Limited, Snap-On Incorporated., Stanley Black and Decker, Inc., Techtronic Industries Co. Ltd., Wera Werkzeuge GmbH, Apex Tool Group, Klein Tools Inc., Channellock, Inc., JCBL India, and Emerson Electric Co. are some of the major players operating in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hand tools market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Apex Tool Group, LLC

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Emerson Electric Co.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Snap-On,Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Stanley Black & Decker, Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. JCBL Group

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Hand Tools Market by Tool Type

5.1.1. General Purpose Tools

5.1.1.1. Hammers

5.1.1.2. Clamps and Vises

5.1.1.3. Pliers

5.1.1.4. Ratchets and Sockets

5.1.1.5. Riveters

5.1.1.6. Screwdrivers and Nut Drivers

5.1.1.7. Wrecking Bars

5.1.1.8. Wrenches

5.1.2. Cutting Tools

5.1.2.1. Chisel and Files

5.1.2.2. Cable and Wire Cutting Tools

5.1.2.3. Knives and Blades

5.1.2.4. Saws

5.1.3. Layout and Measuring Tools

5.1.3.1. Plumb Bob

5.1.3.2. Try Square

5.1.4. Taps and Dies

5.2. Global Hand Tools Market by End-User

5.2.1. Commercial

5.2.2. Industrial

5.2.3. Residential

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Apex Tool Group, LLC

7.2. Channellock, Inc.

7.3. Emerson Electric Co.

7.4. Estwing Manufacturing Co., Inc.

7.5. Gray Tools Canada, Inc.

7.6. Ideal Industries, Inc.

7.7. JCBL Group

7.8. JK Files (India),Ltd.

7.9. Kennametal, Inc.

7.10. Klein Tools, Inc.

7.11. KNIPEX

7.12. Leatherman Tool Group, Inc.

7.13. Phoenix Contact USA

7.14. Robert Bosch GmbH

7.15. Snap-on,Inc.

7.16. Stanley Black & Decker, Inc.

7.17. Techtronic Industries Co. Ltd.

7.18. The Würth Group

7.19. WeraWerkzeuge GmbH

7.20. Wiha Tools USA

1. GLOBAL HAND TOOLS MARKET RESEARCH AND ANALYSIS BY TOOL TYPE, 2019-2026 ($ MILLION)

2. GLOBAL GENERAL PURPOSE TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CUTTING TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL LAYOUT AND MEASURING TOOLS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL TAPS AND DIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL HAND TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

7. GLOBAL COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. NORTH AMERICAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY TOOL TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

13. EUROPEAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY TOOL TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN HAND TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC HAND TOOLS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC HAND TOOLS MARKET RESEARCH AND ANALYSIS BY TOOL TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC HAND TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. REST OF THE WORLD HAND TOOLS MARKET RESEARCH AND ANALYSIS BY TOOL TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD HAND TOOLS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL HAND TOOLS MARKET SHARE BY TOOL TYPE, 2019 VS 2026 (%)

2. GLOBAL HAND TOOLS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL HAND TOOLS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

15. SOUTH KOREA HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD HAND TOOLS MARKET SIZE, 2019-2026 ($ MILLION)