Hard Tea Market

Hard Tea Market Size, Share & Trends Analysis Report by ABV% (2%-5%, more than 5.1% ), by Flavor (Lemon, Raspberry, Peach, Orange), and by Distribution Channel (Online, Offline) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Hard tea market is anticipated to grow at a significant CAGR of 23.2% during the forecast period. The growing awareness towards low content alcoholic beverages among people is driving the demand for hard teas across the globe during the forecast period. A Hard Tea is a, tea-based water with any flavour of choice with low alcohol content and no-to-low sugar with very less calories. High alcohol content beverages has harmful effect on health such various disease and death also. Nonalcoholic beer, nonalcoholic wine or even spirits and other types of nonalcoholic drinks like shrubs or kombucha are gaining pull. Due to this the consumers mind is shifting towards other low content alcoholic beverages which is boosting the demand for hard tea. For instance in January 2019, Heineken International B.V. launched “Heineken 0.0”, an alcohol-free malt beverage brewed with a unique recipe for a distinct, balanced taste with only 69 calories per bottle. Heineken's master brewers created the new zero-alcohol option using only natural ingredients, resulting in a brew for beer lovers, by beer lovers. Further, In March 2021, Heineken launched Pure Piraña hard seltzer in Europe, following a successful trial in Mexico and New Zealand launched in three flavors lemon lime, red berries, and grapefruit. The hard seltzer, crafted with carbonated purified water and a splash of natural flavourings, together with 4.5% alcohol by volume. Due to these product launches consumers are getting awared about low alcohol content beverages like hard teas for consumption which is propelling the market during the forecast period.

Segmental Outlook

The global hard tea market is segmented based on ABV%, flavor, and distribution channel. Based on abv%, the market is segmented into 2%-5%, and more than 5.1%. Based on flavor, the market is sub-segmented into lemon, raspberry, peach, orange. Based on distribution channel the market is segmented into online and offline. The above mentioned segments can be customized as per the requirements. Based on flavor the lemon flavor is anticipated to grow at the fastest rate during the forecast period, owing to the importance of immunity-rich food and drinks is driving the demand for lemon-flavored hard teas. Lemon is abundant in vitamin-C to boost immunity, folate to improve reproductive health and potassium which regulates the electrolyte balance in the body. Lemon is packed with astringent properties, which work to remove dead skin cells and rejuvenate face. Moreover, it also possesses anti-inflammatory traits, which effectively combat acne, pimples and eczema, promoting overall skin health and also lemon has a tangy flavor which many peoples likes. In addition, citrus-flavored compliment alcoholic beverages as they help in creating a refreshing beverage that is favored by a large consumer base. Further it gives a tangy taste which boost the demand for lemon flavor head teas across the globe. For instance, in March 2022 Twelve5 Beverage Co. expanded their product portfolio through a line extension into a convenient 19.2 oz., single can size. They launched product in three flavors named, Twelve5's Rebel original hard tea sweet, real black tea flavor with a splash of zesty lemon, Twelve5's rebel half & half hard tea blended perfectly with a tangy and refreshing lemonade, Twelve5's rebel peach hard tea with a burst of juicy peach. Twelve5's rebel hard tea 19.2 oz. line-up will be available in C-stores, grocery stores, liquor stores and other retail locations that sell single serve alcoholic beverages in march.

Regional Outlooks

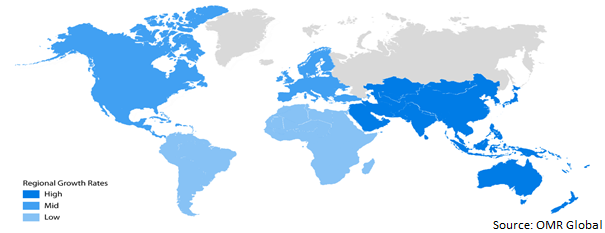

The global hard tea market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The North America is anticipated to grow at the fastest rate during the forecast period. Owing to the presence of various key players such as Boston Beer Company, Inc., Pabst Brewing Company, LLC and others which are boosting the demand for hard teas by using different strategies such as lauchng new products, flavors, low alcoholic content beverages, mergers and acquisition and others. For instance, in August 2021 Boston Beer Company, Inc. partnered with PepsiCo for US launch of new "HARD MTN DEW" alcoholic beverage with alcohol by volume (ABV) of 5%. This new flavored malt beverage (FMB) will be marketed to adults of legal age and merchandized consistently with other alcohol beverages. These factors such as lauching new products are boosting the demand for hard teas in the North America.

Global Hard Tea Market Growth, by Region 2022-2028

The Europe Region is Expected to Hold the Considerable Share in the Global Hard Tea Market during the Forecast Period.

The Europe region is expected to hold the considerable share in the global hard tea market during the forecast period. Owing to the growing awareness among consumers, for beverages with, low sugar beverages, low alcohol content due to health concerns ,the beverages such as hard teas is boosting the market during the forecast period. The infusion of alcohol with tea is one of the major innovations in the sector. Hard teas are increasingly gaining traction of people in Europe as it offers delightful taste along with several health benefits. As the consumers are becoming aware, their demand is also changing they demand beverages with low ABV %, low sugar and low calories beverages. For instance, in August 2021, Akras Flavours Gmbh launched new beverage concept Hard Tea with low alcohol content. The hard tea beverage is inspired by the megastar of the alcoholic beverage segment, the hard seltzers.

Market Players Outlook

The major companies serving the global hard tea market include Anheuser-Busch, LLC., Blue Point Brewing, Boston Beer Company, Inc., Pabst Brewing Company, LLC, Two Chicks Drinks, LLC and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2021, Boston Beer Company, Inc. launched New "Bevy Long Drink” a new, refreshing beverage inspired by the national cocktail of Finland, the "Long Drink." in two flavors named sparkling citrus refresher and sparkling berry refresher. Long Drink is a traditional Finnish cocktail that traditionally consists of gin, grapefruit soda, and tonic.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hard tea market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Anheuser-Busch, LLC.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Blue Point Brewing

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Boston Beer Company, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Pabst Brewing Company, LLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Two Chicks Drinks, LLC

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.6. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hard Tea Market by ABV %

4.1.1. 2%-5%

4.1.2. More Than 5.1%

4.2. Global Hard Tea Market by Flavor

4.2.1. Lemon

4.2.2. Raspberry

4.2.3. Peach

4.2.4. Orange

4.3. Global Hard Tea Market by Distribution Channel

4.3.1. Online

4.3.2. Offline

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ?Mark Anthony Brands, Inc.

6.2. 100 Thieves, Inc.

6.3. Bold Rock Hard Cider

6.4. Crook & Marker LLC

6.5. Loverboy Inc.

6.6. Molson Coors Beverage Co.

6.7. Nude Beverage

6.8. Venture Tea (Pvt) Ltd.

1. GLOBAL HARD TEA MARKET RESEARCH AND ANALYSIS BY ABV %, 2021-2028 ($ MILLION)

2. GLOBAL HARD TEA BY 2%-5% MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL HARD TEA BY MORE THAN 5.1% MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HARD TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR , 2021-2028 ($ MILLION)

5. GLOBAL LEMON HARD TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL RASPBERRY HARD TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL PEACH HARD TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ORANGE HARD TEA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL HARD TEA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL , 2021-2028 ($ MILLION)

10. GLOBAL HARD TEA BY ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL HARD TEA BY OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL HARD TEA MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN HARD TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN HARD TEA MARKET RESEARCH AND ANALYSIS BY ABV%, 2021-2028 ($ MILLION)

15. NORTH AMERICAN HARD TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2021-2028 ($ MILLION)

16. NORTH AMERICAN HARD TEA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL , 2021-2028 ($ MILLION)

17. EUROPEAN HARD TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN HARD TEA MARKET RESEARCH AND ANALYSIS BY ABV%, 2021-2028 ($ MILLION)

19. EUROPEAN HARD TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2021-2028 ($ MILLION)

20. EUROPEAN HARD TEA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC HARD TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC HARD TEA MARKET RESEARCH AND ANALYSIS BY ABV%, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC HARD TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC HARD TEA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

25. REST OF THE WORLD HARD TEA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD HARD TEA MARKET RESEARCH AND ANALYSIS BY ABV%, 2021-2028 ($ MILLION)

27. REST OF THE WORLD HARD TEA MARKET RESEARCH AND ANALYSIS BY FLAVOR, 2021-2028 ($ MILLION)

28. REST OF THE WORLD HARD TEA MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CAHNNEL, 2021-2028 ($ MILLION)

1. GLOBAL HARD TEA MARKET SHARE BY ABV%, 2021 VS 2028 (%)

2. GLOBAL HARD TEA BY 2%-5% MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL HARD TEA MORE THAN 5.1% MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL HARD TEA MARKET SHARE BY FLAVOR, 2021 VS 2028 (%)

5. GLOBAL LEMON HARD TEA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL RASPBERRY HARD TEA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL PEACH HARD TEA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL ORANGE HARD TEA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL HARD TEA MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

10. GLOBAL HARD TEA BY ONLINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL HARD TEA BY OFFLINE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL HARD TEA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

15. UK HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD HARD TEA MARKET SIZE, 2021-2028 ($ MILLION)