Healthcare Analytical Testing Services Market

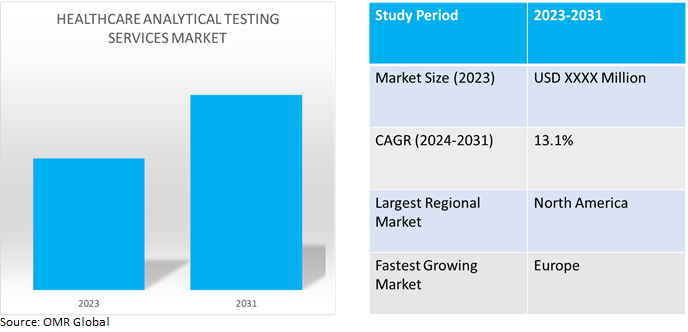

Healthcare Analytical Testing Services Market Size, Share & Trends Analysis Report by Type (Bioanalytical Testing Services, Physical Characterization Services, Method Development & Validation Services, Raw Material Testing Services, Batch- Release Testing Services, and Others (Stability Testing Services, Genomics Testing Services).and by End-Users (Pharmaceuticals, Hospitals and Clinics and Forensic Lab). Forecast Period (2024-2031).

Healthcare analytical testing services market is anticipated to grow at a considerable CAGR of 13.1% during the forecast period (2024-2031).The growth of the healthcare analytical testing services market is attributed to increasing demand for electronic health records (EHRs), personal health records (PHRs), electronic prescription services (E-prescribing), patient portals, master patient indexes (MPI), with digital data collection globally driving the growth of the market. Analytical testing services for healthcare are essential for performing a range of tests, such as bioanalytical, pharmacokinetic, and biomarker testing.

Market Dynamics

Increasing Adoption of Precision Medicine Testing

An increasing demand for personalized treatments, such as genetic testing, biomarker analysis, and companion diagnostics. Biomarkers offer vital information about a person's unique biological traits and the course of a disease, they play a significant role in accurately determining a patient's status in personalized medicine. Precision medicine testing ongoing technological advancements, such as the integration of high-throughput screening methods, automation, and advanced analytical techniques, to improve the accuracy and speed of bioanalytical testing. Precision medicines reflect about half of all new therapeutic approvals this strategy has enormous potential for improving patient outcomes in the future, in addition to its immediate positive effects on patient lives.

Integration of Digital Health Technologies

Digital health technologies (DHTs) have brought several significant improvements to clinical trials, enabling real-world data collection outside of the traditional clinical context and more patient-centered approaches. DHTs, such as wearables, allow the collection of unique personal data at home over a long period. Digital health solutions transforming diagnostic labs ‘operations and paving the path for improved patient care. With technological advancements, integrating digital tools and innovations has unlocked many opportunities for diagnostic labs to enhance their efficiency, accuracy, and overall performance. By embracing innovative technologies, labs can overcome the limitations of traditional approaches and adopt a more efficient, collaborative, and secure future.

Market Segmentation

Our in-depth analysis of the global healthcare analytical testing services market includes the following segments by type and end-users.

- Based on type, the market is sub-segmented into bioanalytical testing services, physical characterization services, method development & validation services, raw material testing services, batch-release testing services, and others (stability testing services, genomics testing services).

- Based on end-users, the market is sub-segmented into pharmaceuticals, hospitals and clinics, and forensic labs.

Bioanalytical Testing Services is Projected to Emerge as the Largest Segment

Based on the type, the global healthcare analytical testing services market is sub-segmented intobioanalytical testing services, physical characterization services, method development & validation services, raw material testing services, batch-release testing services, and others (stability testing services, genomics testing services).Among these bioanalytical testing services, the sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the growing investment in the R&D of new drugs by the pharmaceutical and biotechnology industries. Pharmaceutical and biotechnology companies continue to outsource bioanalytical testing services to specialized firms to enhance efficiency and focus on core competencies. For instance, in May 2021, Labcorp expanded bioanalytical services with an integrated laboratory in Singapore. The expansion of its drug development offering in the Asia-Pacific region with the addition of bioanalytical services in Singapore. The new bioanalytical laboratory in Singapore will support the development of both small and large molecular entities while providing a complete range of regulated and non-regulated bioanalytical services.

Pharmaceutical Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global healthcare analytical testing services market is sub-segmented into pharmaceuticals, hospitals and clinics, and forensic labs. Among these, the pharmaceuticals sub-segment is expected to hold a considerable share of the market. The increasing demand for healthcare analytical testing services in the pharmaceuticals to ensure safety, efficacy, and regulatory compliance. Healthcare analytical testing services play a pivotal role in conducting various tests, including bioanalytical, pharmacokinetic, and biomarker testing, among others. For instance, in January 2021, Almac Group announced additional expansion of its biologics testing laboratory with significant investment in mass spectrometry equipment. With this additional service, clients will benefit from an extended range of mass spectrometry services including the quantitation of genotoxic impurities, structure elucidation, isotopic purity determinations, and high-resolution mass spectrometry of both large and small molecules.

Regional Outlook

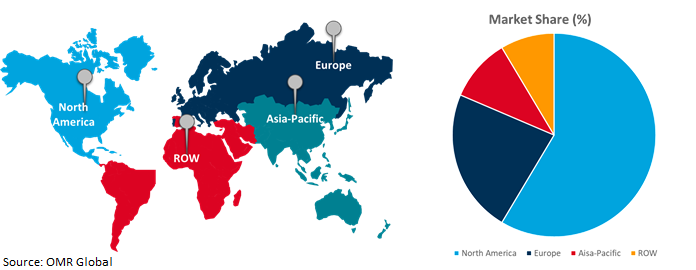

The global healthcare analytical testing services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Healthcare Analytical Testing Services Adoption in Europe

- Growing adoption of electronic health records (EHRs) and other digital healthcare systems, increasing need for efficient healthcare data management and analysis and rising demand for real-time and predictive analytics in healthcare decision-making are the growth drivers in the region.

- Increasing investments by companies from developed economies in enhancing regional analytical services, amendments made by regulatory bodies for changing evaluation standards to align with the global standards, and establishment of new facilities & alliances to increase the reach of their offerings to various locations in the region.

Global Healthcare Analytical Testing Services Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and healthcare analytical testing services providers. The growth is attributed to the growing number of clinical trials, fueled by advancements in medical research and the quest for novel treatments, which directly translates to a higher demand for healthcare analytical testing services. For instance, in August 2023, Pace® Analytical Services expanded laboratory service capabilities across the country. Pace® Analytical Services, the preferred provider of regulatory testing and analytical laboratory services, recently added new capabilities including advanced hydrocarbon analytical support and expanded sediment and tissue testing with the acquisition of Alpha Analytical. According to the World Health Organization (WHO), in February 2023, The US had the highest total number of trials registered during 1999-2022 (168,520), followed by China (94,193) and Japan (63,499).

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global healthcare analytical testing services market include Catalent, Inc., Charles River Laboratories International, Inc., Eurofins Scientific SE, Medpace, Inc., and Merck KGaA, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2022, SGS acquired Silver State Analytical Laboratories, Inc. and its sister company Excelchem Laboratories, Inc. to provide quality analytical and microbiological testing (certified and independent) and support services for clients in the environmental, water, utility, engineering, construction, food processing, chemical, mining, healthcare, resort and hospitality industries.

Recent Development

- In February 2024, WuXi AppTec, announced that the US FDA approved its Philadelphia site to begin the analytical testing and manufacturing of AMTAGVI for Iovance, which received FDA accelerated approval of its Biologics License Application (BLA). With this announcement, WuXi ATU’s Philadelphia site becomes the first US external manufacturing site and the first third-party contract testing, development, and manufacturing organization (CTDMO).

- In February 2021, Charles River Laboratories International, Inc. announced that it had signed a definitive agreement to acquire Cognate BioServices, Inc. to seamlessly conduct analytical testing, process development, and manufacturing for advanced modalities. With the same scientific partner, enabling them to achieve their goal of driving greater efficiency.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare analytical testing services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Catalent, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Eurofins Scientific SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Merck KGaA

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Healthcare Analytical Testing Services Market by Type

4.1.1. Bioanalytical Testing Services

4.1.2. Physical Characterization Services

4.1.3. Method Development & Validation Services

4.1.4. Raw Material Testing Services

4.1.5. Batch- Release Testing Services

4.1.6. Others (Stability Testing Services, Genomics Testing Services)

4.2. Global Healthcare Analytical Testing Services Market by End-Users

4.2.1. Pharmaceutical

4.2.2. Hospitals and Clinics

4.2.3. Forensic Lab

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Almac Group

6.2. Charles River Laboratories International, Inc.

6.3. Curia Global, Inc.

6.4. Frontage Labs.

6.5. ICON plc

6.6. Intertek Group plc

6.7. Labcorp

6.8. LGC Ltd.

6.9. Medpace, Inc.

6.10. North American Science Associates, LLC

6.11. Pace Analytical

6.12. PerkinElmer Inc.

6.13. Q2 Solutions

6.14. SGS SA

6.15. STERIS

6.16. Thermo Fisher Scientific Inc.

6.17. WuXi AppTec Co., Ltd.

1. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BIOANALYTICAL HEALTHCARE TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PHYSICAL CHARACTERIZATION HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL METHOD DEVELOPMENT & VALIDATION HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RAW MATERIAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BATCH- RELEASE HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL OTHER HEALTHCARE ANALYTICAL TESTING SERVICES TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

9. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR FORENSIC LAB MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

16. EUROPEAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

22. REST OF THE WORLD HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD HEALTHCARE ANALYTICAL TESTING SERVICES MARKET RESEARCH AND ANALYSIS BY END-USERS, 2023-2031 ($ MILLION)

1. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL BIOANALYTICAL HEALTHCARE TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PHYSICAL CHARACTERIZATION HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL METHOD DEVELOPMENT & VALIDATION HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL RAW MATERIAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BATCH- RELEASE HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL OTHER HEALTHCARE ANALYTICAL TESTING SERVICES TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

9. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR PHARMACEUTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL HEALTHCARE ANALYTICAL TESTING SERVICES FOR FORENSIC LAB MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

14. UK HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA HEALTHCARE ANALYTICAL TESTING SERVICES MARKET SIZE, 2023-2031 ($ MILLION)