Healthcare Contract Development and Manufacturing Organization (CDMO) Market

Global Healthcare Contract Development and Manufacturing Organization (CDMO) Market Size, Share & Trends Analysis Report by Services (Contract Development and Contract Manufacturing) and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for healthcare CDMO is projected to have considerable CAGR of around 7.6% during the forecast period. The growth of the healthcare CDMO market is attributed to the various factors including growing outsourcing by the pharmaceutical and medical device companies, growing investment in the R&D activities across the globe. In the recent years the demand of drugs and medicines have been increased significantly as well as many pharmaceutical companies conducting the process of drug development and deliver the drug into the market in substantial quantity. In pharmaceutical industry, the several large pharmaceutical companies are forming the collaboration and partnerships with the many contract manufacturing organizations. Moreover, the aspect of increasing the pharmaceutical contract development services is to identify the growth in biotechnology as well as most of the companies develops the drug compounds relating to the therapeutic areas that further contribute in the growth of the market.

Segmental Outlook

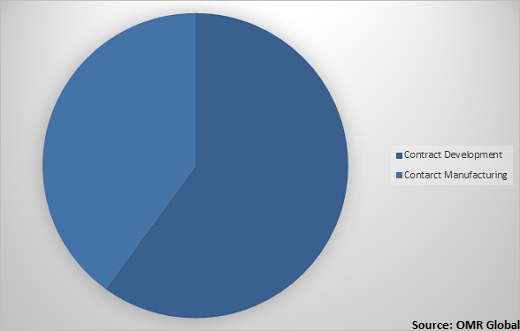

The global healthcare CDMO market is segmented based on services including the contract development and contract manufacturing. The contract development services include clinical, pre-clinical and laboratory services. Contract development services enables internal safety, medical, and regulatory team to emphasis on core competencies. Contract development services is beneficial for mid-sized companies too as having an outsourcing partner is important in ensuring compliance, quality, and controlling costs.

Global healthcare CDMO Market Share by Services, 2019(%)

Global healthcare CDMO market to be driven by contract manufacturing services

Among services, the contract manufacturing segment held a considerable share in the market. The segmental dominance is mainly due to significant adoption of outsourcing services by pharmaceutical companies. In the highly competitive world, the contract manufacturing industry is on the rise with the developing pharmaceutical and biotechnology companies, which are primarily targeting their resources towards marketing, in place of production and drug discovery. The pharmaceutical companies have faced a need to sign contract with the manufacturers for the development of their products for various reasons. The main factor associated with the contract manufacturing of biotechnology and pharmaceutical products include the less expertise and facilities in the start-up firms for producing the type and quantity of biologics or drugs that are necessary for pre-clinical and clinical studies of new drugs. The contract manufacturing enables the pharmaceutical companies to enhance process efficiency and priorities the outsourcing of products according to their own internal capacity therefore growing adoption of contract manufacturing services.

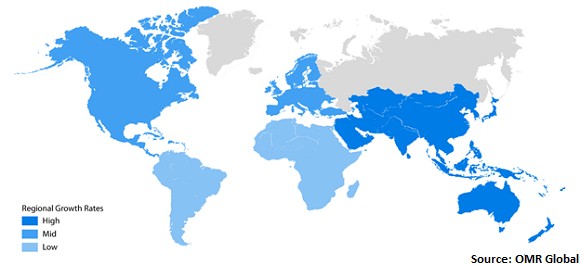

Regional Outlook

Geographically, the global healthcare CDMO market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is projected to grow at a considerable CAGR in the healthcare CDMO market during the forecast period. The increasing healthcare cost in emerging economies such as India and China, healthcare organizations are adopting outsourcing services for increasing productivity and reducing overall cost of the products. Additionally, the pharmaceutical contract manufacturing firms are also focusing on expanding its business operations in the region. For instance, Fujifilm Holdings plans to widen its biopharmaceutical contract manufacturing business in Japan. This enables the company to offer moreo efficient manufacturing services to the pharmaceutical industry in the region.

Global healthcare CDMO Market Growth, by Region 2020-2026

North America to hold a considerable share in the global healthcare CDMO market

Geographically, North America is projected to hold a significant share in the global healthcare CDMO market during the forecast period. The healthcare CDMO industry in North America is fueled by the increase in adoption of outsourcing services by biotechnology companies. These companies are dedicated for developing drug compounds for specific therapeutic area. However, these companies lack infrastructure in the areas of formulation, clinical and regulatory agency submission. With the biotechnology and pharmaceutical industries striving for cost minimization and profit maximization, outsourcing production has become an ever-increasing trend as they are striving for cost minimization and profit maximization. These companies are not left with any option other than selling to a big pharma or biotechnology company. However, partnership with a pharmaceutical contract manufacturer can provide the biotechnology companies with an alternate viable option that further encourages the demand of healthcare CDMO in the region.

Market Players Outlook

The key players in the healthcare CDMO market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Catalent, Inc., Lonza Group Ltd., Boehringer Ingelheim International GmbH, Pfizer Inc., Thermo Fisher Scientific Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For Instance, In May 2019, Catalent, Inc., completed the acquisition of Paragon Bioservices, Inc., a contract research and manufacturing organization, for $1.2 billion. With this acquisition, paragon brought its unique development and manufacturing capabilities, which is anticipated to improve catalent’s biologics business.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare CDMO market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Catalent, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Lonza Group Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boehringer Ingelheim International GmbH

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pfizer Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Thermo Fisher Scientific Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Healthcare CDMO Market by Services

5.1.1. Contract Development

5.1.1.1. Clinical

5.1.1.2. Preclinical

5.1.1.3. Laboratory Services

5.1.2. Contract Manufacturing

5.1.2.1. Active Pharmaceutical Ingredients( API)

5.1.2.2. Finish Dosage Formulations

5.1.2.3. Medical Devices

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie Inc.

7.2. Almac Group Ltd.

7.3. Baxter International, Inc.

7.4. B. Braun Melsungen AG

7.5. Boehringer Ingelheim International GmbH

7.6. Catalent Inc.

7.7. Covance Inc.

7.8. Cambrex Corp.

7.9. Hisun Pharmaceuticals Inc.

7.10. Jabil Inc.

7.11. Jubilant Life Sciences Ltd.

7.12. Lonza Group Ltd.

7.13. Mikart LLC

7.14. Pfizer Inc.

7.15. Probiogen AG

7.16. Recipharm AB

7.17. Siegfried Holding AG

7.18. Sanmina Corp.

7.19. Stason Pharmaceuticals, Inc.

7.20. Thermo Fisher Scientific Inc.

1. GLOBAL HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY SERVICES, 2019-2026 ($ MILLION)

2. GLOBAL CONTRACT DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

5. NORTH AMERICAN HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

6. NORTH AMERICAN HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY SERVICES, 2019-2026 ($ MILLION)

7. EUROPEAN HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. EUROPEAN HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY SERVICES, 2019-2026 ($ MILLION)

9. ASIA-PACIFIC HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. ASIA-PACIFIC HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY SERVICES, 2019-2026 ($ MILLION)

11. REST OF THE WORLD HEALTHCARE CDMO MARKET RESEARCH AND ANALYSIS BY SERVICES, 2019-2026 ($ MILLION)

1. GLOBAL HEALTHCARE CDMO MARKET SHARE BY SERVICES, 2019 VS 2026 (%)

2. GLOBAL HEALTHCARE CDMO MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

5. UK HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD HEALTHCARE CDMO MARKET SIZE, 2019-2026 ($ MILLION)