Healthcare Cloud Computing Market

Healthcare Cloud Computing Market Size, Share & Trends Analysis Report by Deployment (Private Cloud, Hybrid Cloud, and Public Cloud), Service Model (Software-as-a-service, Platform-as-a-service, and Infrastructure-as-a-service), Application (Clinical Information Systems (CIS), and Non-clinical Information Systems (NCIS)) and End-User (Healthcare Providers, Insurance Companies, Pharmaceutical Companies, and Research Institutes) Forecast Period (2025-2035)

Industry Overview

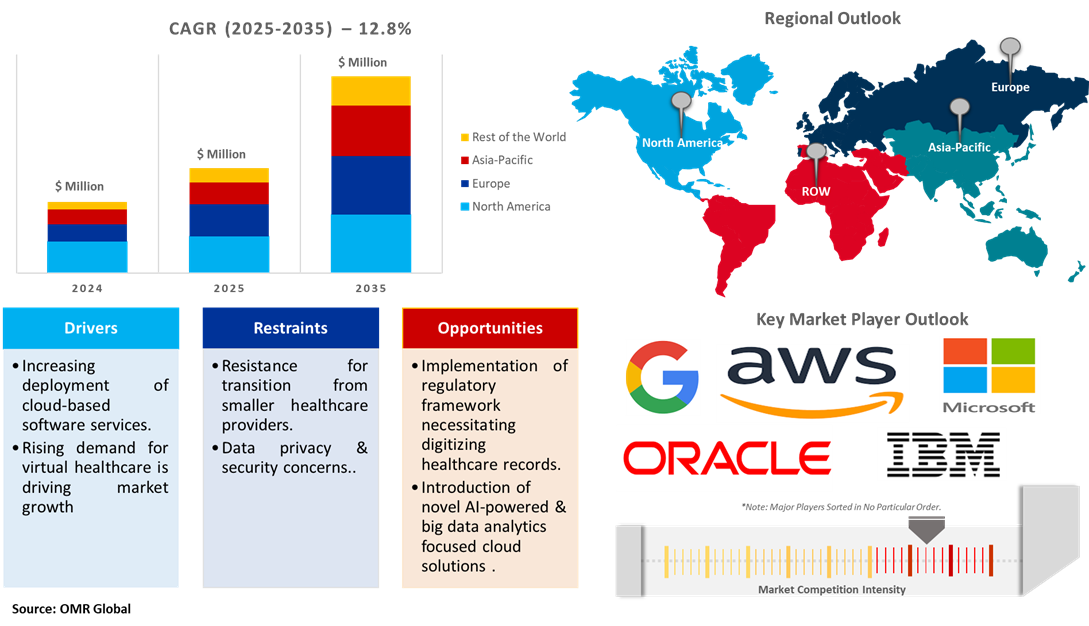

Healthcare cloud computing market valued at $51.3 billion in 2024, is forecasted to grow at a 12.8% CAGR, reaching $190.4 billion in 2035. Healthcare cloud computing solutions are gaining widespread traction across the healthcare sector based on a growing region-level focus on developing digitized healthcare ecosystems, increasing deployment of cloud-based software by end-user organizations, and regulatory frameworks promoting digital record management and data transparency, among others. Further, the rising utilization of healthcare cloud solutions by virtual healthcare providers is projected to be a key contributor to healthcare cloud computing market expansion.

Market Dynamics

Increasing Deployment of Cloud-Based Software Solutions

The wide-scale deployment of cloud-based software solutions by healthcare organizations across the healthcare workflow is projected to drive market growth. This widespread deployment is majorly aided by the growing inclination of healthcare professionals and organizations to digitize workflow, rising focus on optimizing labor resources by organizations, and industry-level focus on developing data-focused patient management capabilities. Further, the industry-level emphasis on developing & incorporating capabilities such as automation tools for patient management and AI-powered medical imaging diagnostics tools is necessitating the use of cloud-based solutions for seamless operations. For instance, in June 2024, AGFA HealthCare secured a major contract with Alliance Medical to implement a cloud-based solution at 120 UK sites, on the AGFA HealthCare Enterprise Imaging Platform. This will underpin the Future Unified Diagnostic Information System for Alliance Medical and smooth the patient pathway.

Rising Demand for Virtual Healthcare is Driving Market Growth

The global virtual healthcare market has seen exponential growth within the last couple of years owing to increasing telemedicine services, developments of remote patient monitoring tools, and rising inclination from patients towards virtual consultation for basic health requirements. The industry-level shift has advocated the requirement for maintenance of robust infrastructure for data storage & accessibility needs, which can be economically achieved through the use of healthcare cloud computing solutions such as cloud-based EHR tools and telemedicine platforms, among others. Further, the market dynamics for the expansion of healthcare organization business footprint and rising consumer propensity to access more convenient healthcare solutions are expected to boost the healthcare cloud computing market. For instance, in April 2024, WELL Health Technologies Corp. partnered with Microsoft under a five-year agreement to drive further digital transformation in healthcare across North America and beyond. The partnership will see WELL bring Microsoft Cloud and AI capabilities into its platform for a more agile delivery of healthcare, the company added.

Market Segmentation

- Based on the deployment, the market is segmented into private cloud, hybrid cloud, and public cloud.

- Based on the service model, the market is segmented into software-as-a-service, platform-as-a-service, and infrastructure-as-a-service

- Based on the application, the market is segmented into clinical information systems (CIS), and non-clinical information systems (NCIS).

- Based on the end-user, the market is segmented into healthcare providers, insurance companies, pharmaceutical companies, and research institutes.

Public Cloud Segment to Lead the Market with the Largest Share

Under the deployment segment, public clouds dominate the market owing to the low cost of public cloud-based offerings, a wider level of scalability & flexibility options for end-user organizations, and accessibility to the latest & advanced industry tools at an economic cost. For instance, in July 2024, GE HealthCare entered into a partnership with Amazon Web Services (AWS) to jointly develop foundational models and generative AI applications. It will use AWS as the strategic cloud provider to enhance the diagnosis of diseases and provide better care for patients by strengthening future AI-enabled solutions.

Software-As-a-Service: A Key Segment in Market Growth

The software-as-a-service segment is projected to remain an important service model across the healthcare cloud computing market due to its low deployment costs for end-user organizations, increasing relevance of SaaS tools including EHRs and telemedicine platforms, lesser infrastructure requirements for incorporating SaaS services, and rising inclination by smaller health cloud computing startups to provide SaaS solutions for market entry & expansion. For instance, Evergreen AI launched a SaaS cloud version of TeraRecon's AI-enabled solutions, blending Intuition Advanced Visualization, Eureka Clinical AI, and CARAai in one platform.

Regional Outlook

The global healthcare cloud computing market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America)

North America Dominates the Global Healthcare Cloud Computing Market

North America comprises the largest share of the global healthcare cloud computing market due to the presence of many major players, including Google, IBM, AWS, and Oracle, the stringent policies enacted such as the Health Insurance Portability and Accountability Act (HIPAA) that enforce the safe digital storage of healthcare records and the growing virtual healthcare market. Further, the regional markets have registered multiple partnerships from the industry players to develop next-gen product offerings that leverage healthcare cloud computing. For example, Servier and Google Cloud have extended their five-year partnership till January 2025 to unlock the power of AI and generative AI across the company's R&D, production, and distribution. It bolsters Servier's ramp to digital transformation while building up its cloud and data strategy toward innovations in therapy development solutions.

Asia-Pacific Region is the Fastest Growing Market

Asia-Pacific is projected to exhibit the fastest growth trajectory in the forecast period owing to the expanding healthcare sector, state-owned efforts to digitize healthcare ecosystems, growing investments in the cloud & data center industry, and the increasing presence of healthcare cloud computing solution providers in the region. For instance, Synapxe, Singapore's national health tech agency, developed a cloud-based analytics platform for the public healthcare sector, HEALIX. This will bring together data, thereby enabling collaborative AI model development that is better at taking care of patients and analytics done faster with tremendous cost savings.

Market Players Outlook

The major companies operating in the global healthcare cloud computing market include Amazon Web Services, Inc., IBM Corp., Google LLC, Microsoft Corp., and Oracle Corp., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, Google Cloud unveiled Vertex AI Search for Healthcare and new features for Healthcare Data Engine, now generally available to global allowlist customers. Vertex AI Search will let developers build assistive technologies to alleviate the healthcare workforce's burden from administrative activities. Healthcare Data Engine lets organizations create interoperable data platforms.

- In September 2024, Consensus Cloud Solutions, trading as CCSI, teamed up with Olah Healthcare Technology to migrate the latter's healthcare customers from faxing from an on-premises location to the cloud-based platform eFax corporate.

- In March 2023, the company Fujitsu launched a cloud-based application that collects and securely aggregates health data, which also converts medical records into the HL7 FHIR standard. Patients can store health data and use it for research purposes to support personalized medicine development and approval.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare cloud computing market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Healthcare Cloud Computing Market Sales Analysis – Deployment | Service Model| Application | End-User ($ Million)

• Healthcare Cloud Computing Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Healthcare Cloud Computing Industry Trends

2.2.2. Market Recommendations

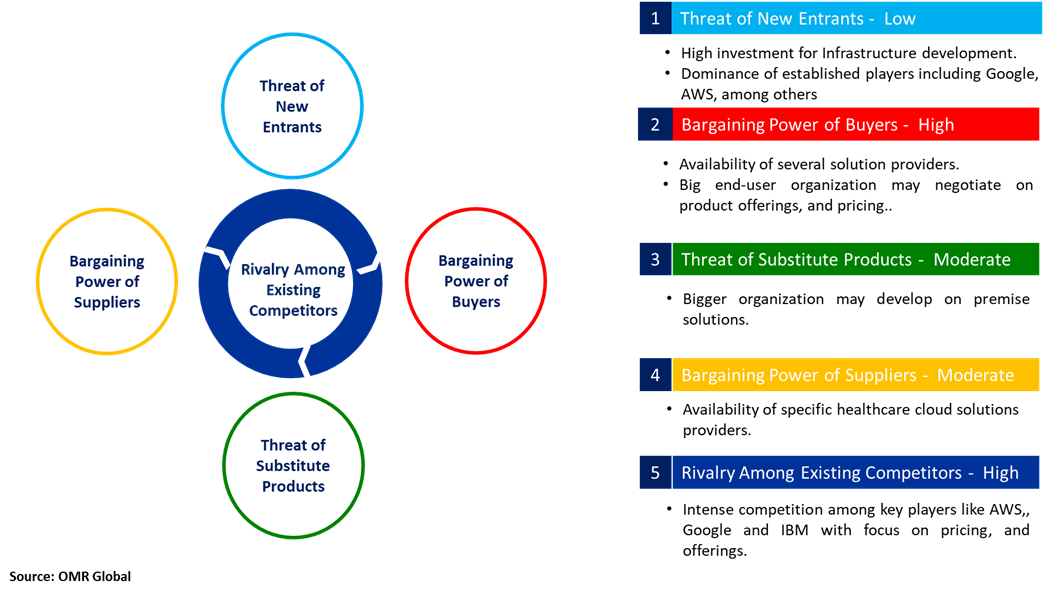

2.3. Porter's Five Forces Analysis for the Healthcare Cloud Computing Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Healthcare Cloud Computing Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Healthcare Cloud Computing Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Healthcare Cloud Computing Market Revenue and Share by Manufacturers

• Healthcare Cloud Computing Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Amazon Web Services, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. IBM Corp.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Google LLC

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Microsoft Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Oracle Corp.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Healthcare Cloud Computing Market Sales Analysis by Deployment ($ Million)

5.1. Private Cloud

5.2. Hybrid Cloud

5.3. Public Cloud

6. Global Healthcare Cloud Computing Market Sales Analysis by Service Model ($ Million)

6.1. Software-as-a-service

6.2. Platform-as-a-service

6.3. Infrastructure-as-a-service

7. Global Healthcare Cloud Computing Market Sales Analysis by Application ($ Million)

7.1. Clinical Information Systems (CIS)

7.2. Non-Clinical Information Systems (NCIS)

8. Global Healthcare Cloud Computing Market Sales Analysis by End-User ($ Million)

8.1. Healthcare Providers

8.2. Insurance Companies

8.3. Pharmaceutical Companies

8.4. Research Institutes

9. Regional Analysis

9.1. North American Healthcare Cloud Computing Market Sales Analysis – Deployment | Service Model| Application | End-User | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Healthcare Cloud Computing Market Sales Analysis – Deployment | Service Model| Application | End-User | Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Healthcare Cloud Computing Market Sales Analysis – Deployment | Service Model| Application | End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Healthcare Cloud Computing Market Sales Analysis – Deployment | Service Model | Application | End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Accenture PLC

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Adobe Inc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Akamai Technologies, Inc.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Akkodis Group AG

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Amazon Web Services, Inc.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Alibaba Cloud International

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. AT&T, Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. CareCloud, Inc.

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Carestream Health, Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Cisco Systems, Inc.

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Cloud Software Group, Inc.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Dell, Inc.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. eClinicalWorks, LLC

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Google LLC

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Hewlett Packard Enterprise Development LP

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. IBM Corp.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Intel Corp.

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Medsphere Systems Corp.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Microsoft Corp.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. NXGN Management, LLC.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. Oracle Corp.

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. OSP Labs

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Rackspace Technology

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. Salesforce, Inc.

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

10.25. Verizon Enterprise Solutions

10.25.1. Quick Facts

10.25.2. Company Overview

10.25.3. Product Portfolio

10.25.4. Business Strategies

1. Global Healthcare Cloud Computing Market Research And Analysis By Deployment, 2024-2035 ($ Million)

2. Global Private Cloud Computing Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Hybrid Cloud Computing Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Public Cloud Computing Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Healthcare Cloud Computing Market Research And Analysis By Service Model, 2024-2035 ($ Million)

6. Global Healthcare Cloud Software-As-A-Service Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Healthcare Cloud Platform-As-A-Service Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Healthcare Cloud Infrastructure-As-A-Service Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Healthcare Cloud Computing Market Research And Analysis By Application, 2024-2035 ($ Million)

10. Global Healthcare Cloud Computing in Clinical Information Systems (CIS) Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Healthcare Cloud Computing in Non-clinical Information Systems (NCIS)) Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Healthcare Cloud Computing Market Research And Analysis By End-User, 2024-2035 ($ Million)

13. Global Healthcare Cloud Computing For Healthcare Providers Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global Healthcare Cloud Computing For Insurance Companies Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Healthcare Cloud Computing For Pharmaceutical Companies Market Research And Analysis By Region, 2024-2035 ($ Million)

16. Global Healthcare Cloud Computing For Research Institutes Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Healthcare Cloud Computing Market Research And Analysis By Region, 2024-2035 ($ Million)

18. North American Healthcare Cloud Computing Market Research And Analysis By Country, 2024-2035 ($ Million)

19. North American Healthcare Cloud Computing Market Research And Analysis By Deployment, 2024-2035 ($ Million)

20. North American Healthcare Cloud Computing Market Research And Analysis By Service Model, 2024-2035 ($ Million)

21. North American Healthcare Cloud Computing Market Research And Analysis By Application, 2024-2035 ($ Million)

22. North American Healthcare Cloud Computing Market Research And Analysis By End-User, 2024-2035 ($ Million)

23. European Healthcare Cloud Computing Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European Healthcare Cloud Computing Market Research And Analysis By Deployment, 2024-2035 ($ Million)

25. European Healthcare Cloud Computing Market Research And Analysis By Service Model, 2024-2035 ($ Million)

26. European Healthcare Cloud Computing Market Research And Analysis By Application, 2024-2035 ($ Million)

27. European Healthcare Cloud Computing Market Research And Analysis By End-User, 2024-2035 ($ Million)

28. Asia-Pacific Healthcare Cloud Computing Market Research And Analysis By Country, 2024-2035 ($ Million)

29. Asia-Pacific Healthcare Cloud Computing Market Research And Analysis By Deployment, 2024-2035 ($ Million)

30. Asia-Pacific Healthcare Cloud Computing Market Research And Analysis By Service Model, 2024-2035 ($ Million)

31. Asia-Pacific Healthcare Cloud Computing Market Research And Analysis By Application, 2024-2035 ($ Million)

32. Asia-Pacific Healthcare Cloud Computing Market Research And Analysis By End-User, 2024-2035 ($ Million)

33. Rest Of The World Healthcare Cloud Computing Market Research And Analysis By Region, 2024-2035 ($ Million)

34. Rest Of The World Healthcare Cloud Computing Market Research And Analysis By Deployment, 2024-2035 ($ Million)

35. Rest Of The World Healthcare Cloud Computing Market Research And Analysis By Service Model, 2024-2035 ($ Million)

36. Rest Of The World Healthcare Cloud Computing Market Research And Analysis By Application, 2024-2035 ($ Million)

37. Rest Of The World Healthcare Cloud Computing Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global Healthcare Cloud Computing Market Share By Deployment, 2024 Vs 2035 (%)

2. Global Private Cloud Computing Market Share By Region, 2024 Vs 2035 (%)

3. Global Hybrid Cloud Computing Market Share By Region, 2024 Vs 2035 (%)

4. Global Public Cloud Computing Market Share By Region, 2024 Vs 2035 (%)

5. Global Healthcare Cloud Computing Market Share By Service Model, 2024 Vs 2035 (%)

6. Global Healthcare Cloud Computing Software-As-A-Service Market Share By Region, 2024 Vs 2035 (%)

7. Global Healthcare Cloud Computing Platform-As-A-Service Market Share By Region, 2024 Vs 2035 (%)

8. Global Healthcare Cloud Computing Infrastructure-As-A-Service Market Share By Region, 2024 Vs 2035 (%)

9. Global Healthcare Cloud Computing Market Share By Application, 2024 Vs 2035 (%)

10. Global Healthcare Cloud Computing Market in Clinical Information Systems (CIS) Share By Region, 2024 Vs 2035 (%)

11. Global Healthcare Cloud Computing in Non-clinical Information Systems (NCIS) Market Share By Region, 2024 Vs 2035 (%)

12. Global Healthcare Cloud Computing Market Share By End-User, 2024 Vs 2035 (%)

13. Global Healthcare Cloud Computing For Healthcare Providers Market Share By Region, 2024 Vs 2035 (%)

14. Global Healthcare Cloud Computing For Insurance Companies Market Share By Region, 2024 Vs 2035 (%)

15. Global Healthcare Cloud Computing For Pharmaceutical Companies Market Share By Region, 2024 Vs 2035 (%)

16. Global Healthcare Cloud Computing For Research Institutes Market Share By Region, 2024 Vs 2035 (%)

17. Global Healthcare Cloud Computing Market Share By Region, 2024 Vs 2035 (%)

18. US Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

19. Canada Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

20. UK Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

21. France Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

22. Germany Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

23. Italy Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

24. Spain Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

25. Russia Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

26. Rest Of Europe Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

27. India Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

28. China Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

29. Japan Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

30. South Korea Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

31. Australia & New Zealand Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

32. ASEAN Economies Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

33. Rest Of Asia-Pacific Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

34. Latin America Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)

35. Middle East And Africa Healthcare Cloud Computing Market Size, 2024-2035 ($ Million)