Healthcare Distribution Market

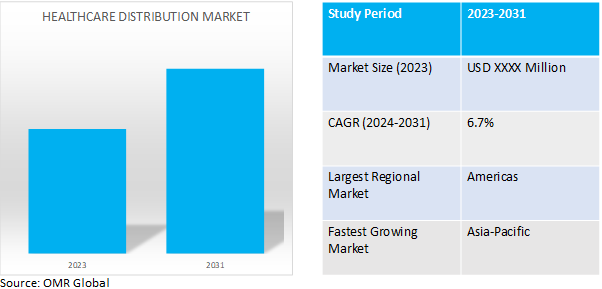

Healthcare Distribution Market Size, Share & Trends Analysis Report by Type (Pharmaceutical Product Distribution Services, Biopharmaceutical Product Distribution Services, and Medical Device Distribution Services), and by End-User (Retail Pharmacies, Hospital Pharmacies, and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Healthcare distribution market is anticipated to grow at a CAGR of 6.7% during the forecast period (2024-2031). Post the COVID-19 pandemic, globally was an increase in demand for effective public health distribution systems. This is primarily due to the supply chain disruption.

Market Dynamics

Increase in launches of new drugs

The rise in the development and launch of new drugs across the globe is the key factor contributing to the market growth. For instance, in February 2024, Zydus Life Sciences announced to launch of its first new drug in the US by early 2026. The company has already received a fast-track designation from the US FDA for its Saroglitazaar drug, used to treat Primary Biliary Cholangitis (PBC), a chronic inflammatory liver disease, in 2020. Furthermore, in February 2024, Roche Pharma launched Ocrevus, a disease-modifying therapy (DMT) drug for treating multiple sclerosis in India.

Increasing prevalence of cancer & infectious diseases in low & middle-income economies

Globally, there is a considerable increase in the prevalence of various infectious and chronic diseases. In low-income countries In LMICs, people predominantly die of infectious diseases such as lower respiratory infections, HIV/AIDS, diarrhea, malaria, and tuberculosis (TB) for all ages, and diarrhea, measles, malaria, and acute respiratory infection (ARI) for children under the age of 5 years. According to the World Health Organization (WHO), the incidence of tuberculosis (TB) in South Sudan to be at 79 per 100 000 for new sputum smear positive TB and 140 per 100 000 for all forms of TB cases.

Market Segmentation

Our in-depth analysis of the global healthcare distribution market includes the following segments by type and end-user:

- Based on type, the market is sub-segmented into pharmaceutical product distribution services, biopharmaceutical product distribution services, and medical device distribution services.

- Pharmaceutical product distribution services include OTC drugs/ vitamins, generic drugs, and brand names/ innovator drugs.

- Biopharmaceutical product distribution services include monoclonal antibodies, vaccines, recombinant proteins, blood & blood products, and others (cellular & gene therapy, stem cells, tissues & tissue products).

- Based on end-users, the market is sub-segmented into retail pharmacies, hospital pharmacies, and others (clinical laboratories, physician offices, home care settings, online pharmacies).

Retail Pharmacies is Projected to Emerge as the Largest Segment

New agreements among the players operating in the market for the distribution of healthcare products and devices is the major factor propelling the segmental growth. For instance, in September 2022, McKesson Corp. partnered with CVS Health to distribute pharmaceutical drugs to retail and other pharmacies globally. The partnership is done based on an agreement valid till 2027. Additionally, in June 2022, Beckton, Dickson, and Co. signed an agreement with Frazier Healthcare Partners to acquire Parata Systems, which provides a pharmacy automation solution for hospitals, residential use, and all types of pharmacies including retail.

Pharmaceutical Product Distribution Services to Hold a Significant Share

Rapidly rising production of pharmaceutical formulations along with growing outsourcing of pharmaceuticals to Asian countries are some of the major factors supporting the segment’s share. Asian countries such as India and others offers a significant cost advantage for pharmaceutical manufacturing. For example, the overall costs of drug manufacturing in India, are up to 50.0% lesser compared to the western industrialized nations. According to the Indian Trade Portal, as of FY21-22, the US, the UK, and Russia are among the largest importers of pharmaceutical products from India, at a share of 29.0%, 3.0%, and 2.4%, respectively.

Regional Outlook

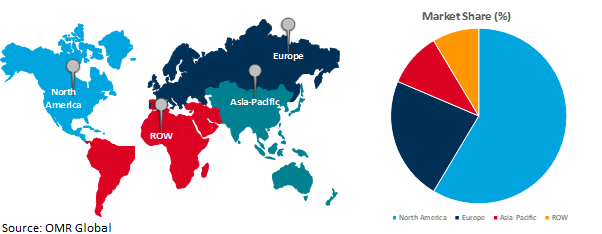

The global healthcare distribution market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Specialty Drugs and Generics Across North America

Specialty drugs are often biologics, normally "drugs derived from living cells" that are injectable or infused. Countries such as the US witnessed a huge demand for specialty drugs and, hence hold a large number of specialty pharmacies. According to the definitive Healthcare Organization, the country has nearly 3,200 specialty pharmacies which have been tracked by around 440 different pharmacy and health system networks.

Global Healthcare Distribution Market Growth by Region 2024-2031

Asia-Pacific Region is Expected to Grow at the Highest CAGR

The growing regulatory requirements in the healthcare sector across several economies of the region are the primary factor contributing to the market growth. Regulatory requirements for providing good manufacturing and distribution practices in the respective countries such as Japan, and others. According to the International Trade Administration report published in 2020, Japan is continuously focusing on improving the regulatory environment and expediting the review process of medical devices. For which, the country has also introduced the Pharmaceutical and Medical Devices Law (PMD Law) which includes the establishment of a device-specific regulatory framework, including a 3-step execution process.

Additionally, countries including India, China, Korea, and Japan, among others are witnessing a considerable increase in the establishment of various biotechnology organizations. For instance, in May 2022, Jiangsu Hengrui Pharmaceuticals announced the launch of Luzsana Biotechnology catering to the global market. Jiangsu Hengrui Pharmaceuticals is one of the largest pharma organizations established from more the 50 years in China. Through the introduction of the subsidiary, the company aims to reduce the overall distribution cost of the medicines.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global healthcare distribution market include McKesson Corp., Cardinal Health, Smith Drug Co., AmerisourceBergen Corp. (Cencora, Inc.), and Henry Schein, Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

- In February 2024, Cosmos Health Inc. successfully acquired the distribution network owned by Pharmatrade S.A., an established pharmaceutical wholesale company operating in Greece. The acquisition is compalted through its subsidiary CosmoFarm Pharmaceuticals S.A. which includes itssales and distribution network of pharmacies for pharmaceutical and para-pharmaceutical products.

- In November 2023, UPS completed the acquisition of MNX Global Logistics to expand its services for healthcare customers through enhanced radio-pharma, temperature-controlled logistics, net-flight-out, and expedited ground services.

- In November 2023, MedAlliance was acquired by Cordis for $1.1 billion. Cordis aims to take over the marketing, distribution, and global accessibility business of MedAlliance. MedAlliance has a manufacturing facility in the US and research and development centers in Switzerland and Singapore.

- In September 2023, Performance Health acquired Sissel France to expand its product offering across France. With a legacy of around 30 years, Sissel is a premier distributor of consumer and professional products.

- In September 2021, Bunzl signed an agreement to acquire the US-based safety business and medical supplies distributor operating in Australia and Singapore. Bunzl plc is one the giant international distribution and services groups.

- In June 2021, AmerisourceBergen Corp. acquired the majority of Walgreens Boots Alliance’s Alliance Healthcare businesses for $6.275 billion. Through this acquisition, the company aims to expand its reach and solutions in pharmaceutical distribution services.

- In June 2021, Ryan Specialty completed the acquisition of certain assets of Point6 Healthcare, LLC, a distributor of medical stop-loss insurance, pharmacy solutions, and complex claims management on behalf of retail brokers and third-party administrators.

- In March 2021, Platinum Equity announced the acquisition of NDC, one of the major healthcare supply chain organizations and distributor of consumable healthcare supplies from an affiliate of Court Square Capital Partners.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare distribution market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cardinal Health, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. McKesson Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Smith Drug Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Healthcare Distribution Market by Type

4.1.1. Pharmaceutical Product Distribution Services

4.1.1.1. OTC Drugs/ Vitamins

4.1.1.2. Generic Drugs

4.1.1.3. Brand Name/ Innovator Drugs

4.1.2. Biopharmaceutical Product Distribution Services

4.1.2.1. Monoclonal Antibodies

4.1.2.2. Vaccines

4.1.2.3. Recombinant Proteins

4.1.2.4. Blood & Blood Products

4.1.2.5. Others (Cellular & Gene Therapy, Stem Cells, Tissues & Tissue Products)

4.1.3. Medical Devices Distribution Services

4.2. Global Healthcare Distribution Market by End-User

4.2.1. Retail Pharmacies

4.2.2. Hospital Pharmacies

4.2.3. Others (Clinical Laboratories, Physician Offices, Home Care Settings, Online Pharmacies)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AmerisourceBergen Corp. (Cencora, Inc.)

6.2. Owens & Minor

6.3. Morris & Dickson Co. LLC

6.4. KeySource Acquisitions, LLC. d.b.a. KeySource USA

6.5. Henry Schein, Inc.

6.6. FFF Enterprises, Inc.

6.7. Patterson Companies, Inc.

6.8. Mutual Drug

6.9. Shanghai Pharma Biotherapeutics USA Inc.

6.10. Medline International B.V.

6.11. CuraScriptSD (Healthcare Distribution, Inc.)

1. GLOBAL HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PHARMACEUTICAL PRODUCT DISTRIBUTION SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BIOPHARMACEUTICAL PRODUCT DISTRIBUTION SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MEDICAL DEVICES DISTRIBUTION SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

6. GLOBAL HEALTHCARE DISTRIBUTION TO RETAIL PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HEALTHCARE DISTRIBUTION TO HOSPITAL PHARMACIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HEALTHCARE DISTRIBUTION TO OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

12. NORTH AMERICAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. EUROPEAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. REST OF THE WORLD HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD HEALTHCARE DISTRIBUTION MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL HEALTHCARE DISTRIBUTION MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL PHARMACEUTICAL PRODUCT DISTRIBUTION SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BIOPHARMACEUTICAL PRODUCT DISTRIBUTION SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MEDICAL DEVICE DISTRIBUTION SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL HEALTHCARE DISTRIBUTION MARKET SHARE BY END-USER, 2023 VS 2031 (%)

6. GLOBAL HEALTHCARE DISTRIBUTION TO RETAIL PHARMACIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HEALTHCARE DISTRIBUTION TO HOSPITAL PHARMACIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HEALTHCARE DISTRIBUTION TO OTHER END-USERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL HEALTHCARE DISTRIBUTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

12. UK HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)

24. THE MIDDLE EAST AND AFRICA HEALTHCARE DISTRIBUTION MARKET SIZE, 2023-2031 ($ MILLION)