Healthcare Fabrics Market

Healthcare Fabrics Market Size, Share & Trends Analysis Report, By Material (Polyester, Polypropylene, Cotton, Polyethylene and Others), By Fabric Type (Woven, Non-Woven, and Knitted), By Application (Hygiene Products, Clothing Products, Privacy Curtains, Dressing Products, Blanket & Bedding, and Others), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global healthcare fabrics market is estimated to grow at a CAGR of 6.2% during the forecast period. The major factors contributing to the growth of the market include the rising focus on infection prevention and control techniques among healthcare facilities coupled with the significant demand for non-woven fabrics in the healthcare industry. The prevalence of healthcare-acquired infections is a major problem across the globe. For instance, according to the European Center for Disease Prevention and Control (ECDC) in 2018, nearly 4 million patients acquire a healthcare-associated infection each year in all EU member states.

The European government has taken initiatives to prevent healthcare-acquired infections to improve patients’ safety and decrease the risk of spread of infection in healthcare settings. For instance, the Antimicrobial Resistance and Healthcare-Associated Infections (ARHAI) program is intended to focus on four areas of public health. These areas comprise training and communication, response and scientific advice, and surveillance. This program enables to address the antimicrobial resistance threats and HAI. Medical fabrics with in-built antimicrobial properties are one of the best protections against the spread of infections that continually protect the fabric surface, whether on curtain fabrics, mattress fabrics, or pillow fabrics.

Segment Outlook

The global healthcare fabrics market is classified based on material, fabric type and application. Based on material, the market is segmented into polyester, polypropylene, cotton, polyethylene and others.Based on fabric type, the market is segmented into woven, non-woven and knitted.Based on application, the market is classified into hygiene products, wall coverings, medical devices, privacy curtains, dressing products, blanket & bedding and others.

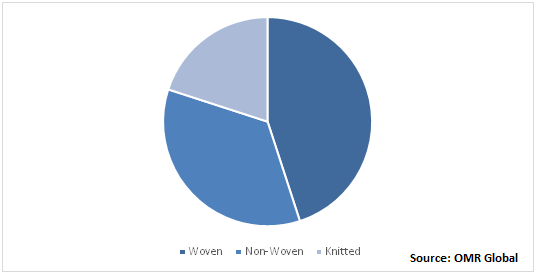

Global Healthcare Fabrics Market: By Fabric Type

Non woven fabrics have become essentially important in medicine and surgery, as these are proved to be superior to woven products regarding disposability, effectiveness, adaptability, and cost. Nosocomial infections and ubiquitous cross-contamination were significantly reported in hospitals. Reuse of gowns and masks are considered as the major cause for these infections in hospitals. Non-woven materials offer potential barriers against bacteria and are considered as effective than linens for the reduction in airborne contamination. Non-woven fabrics can support to mitigate the risk involved in healthcare environments due to drug-resistant bacteria, worsening viral threats, rise in the number of blood-borne diseases, highly-polluted indoor/outdoor air, among others.

Non-woven fabrics can fulfill the rising need for more eco-friendly disposable products. Hence, it has a wide range of applications in healthcare products, including dressings, surgical masks/gowns, orthopedic & tissue structures, bedding, and surgical drapes. In addition, the nanotechnology, tissue bioengineering, and biomaterials fields are creating new horizons for non-woven textiles owing to their few controllable properties, including porosity, cost-effectiveness, fabric weight, and thickness. It can be produced using natural, eco-friendly fibers and normally use cotton that contains several potential applications/properties for the medical environment, including hypoallergenic and naturally absorbent products.

Global Healthcare Fabrics Market Share by Fabric Type, 2018 (%)

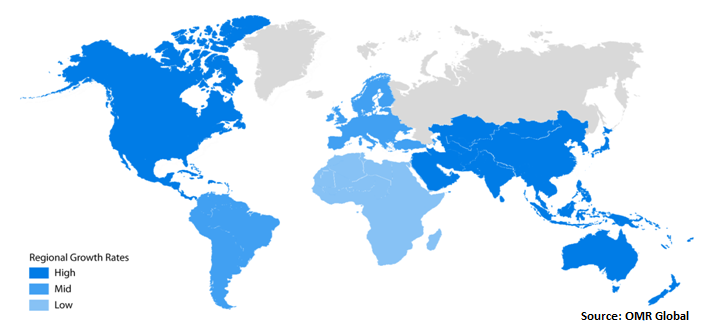

Regional Outlook

Geographically, the global healthcare fabrics market is segmented into four major regions, such as North America, Europe, Asia-Pacific, and RoW. North America has witnessed significant growth in the market owing to the well-developed healthcare infrastructure and high focus on the prevention and control of healthcare-acquired infections. Emerging demand for smart textiles in the healthcare industry is further expected to positively influence the market growth in the region. However, Asia-Pacific is estimated to attract substantial share in the market during the forecast period owing to the rising number of multi-specialty hospitals and growth in medical tourism in the region.

IBEF estimated that the medical tourism market in India was valued $3 billion in 2017. During the period, 2018-2019, Indian medical tourism market is expected to double owing to the relaxation in norms for the approvals of medical visa. The value of medical tourism is forecast to reach $9 billion by 2020. In addition, the number of Foreign Tourist Arrivals (FTAs) in India on medical visa increased 15.9% year-on-year to an estimated 495,056 in 2017 from 427,014 in 2016. India competes mainly with Thailand and Singapore for medical tourism in Asia. This growth in medical tourism is enforcing hospitals to use medical textiles that can reduce microbe sustainability and useful for hygiene applications. This, in turn, leads the demand for healthcare fabrics with antimicrobial properties in the region.

Global Healthcare Fabrics Market Growth by Region, 2019-2025

Market Players Outlook

Major players in the global healthcare fabrics market include Honeywell International, Inc., Carnegie Fabrics, LLC, Design Tex Group, Inc., Knoll, Inc., and Dupont de Nemours, Inc. The advent of smart clothing is witnessing as a technique revolutionizing the practice of healthcare to monitor the health and keep track of chronic conditions. Smart textiles are designed to feel comfortable on the skin and contain conventional fabric woven with conductive fibers and electronic elements, including fiber optics, biomedical sensors, microcontrollers, and wearable antennas, including Mouser's line of Internet of Things system-on-modules. Smart textiles are gaining the attention of several players involved in healthcare fabrics, which in turn, is offering an opportunity for market growth.

One of its major instances is DuPont Intexar smart clothing technology. It transforms ordinary fabrics into connected, active and intelligent garments that offer critical biometric data, such as muscle tension, breathing rate, and heart rate. Further, companies are working to explore the use of advanced medical fabrics in medical devices. For instance, in February 2019, Honeywell launched Spectra Medical Grade (MG) fiber applicable in medical devices for use in minimally invasive procedures.

It is an ultra-high-strength and ultra-lightweight fiber, provides the manufacturers of medical devices with superior flexibility to design and shape smaller, stronger and lighter devices. By using Spectra Medical Grade fiber, doctors can carry out minimally invasive procedures, such as suture applications where the fiber is utilized for repairing bone breaks, in force transmission in surgical robots and in catheters where the fiber works as a pulling mechanism. High resistance to chemicals, low friction, abrasion and fatigue allows easier movement which makes it a feasible alternative to other fibers that facilitate particles to detach with the time, thereby potentially entering a patient’s bloodstream, which causes pain and infection.

As compared to traditional polyethylene fiber, it features an ultra-high molecular weight, crystallinity and degree of orientation, that results in better wear resistance to surface damage and higher fiber strength. In a volume basis, it is three times stronger as compared to polyester and is highly resistant to water, chemicals, and ultraviolet light. Owing to the increasing preference of minimally invasive surgical procedures, the demand for the minimally invasive devicesare growing significantly, which in turn, will act as a major growth factor for medical fabrics.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare fabrics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Healthcare Fabrics Market by Material

5.1.1. Polyester

5.1.2. Polypropylene

5.1.3. Cotton

5.1.4. Polyethylene

5.1.5. Others (Polyamide and Viscose)

5.2. Global Healthcare Fabrics Market by Fabric Type

5.2.1. Woven

5.2.2. Non-Woven

5.2.3. Knitted

5.3. Global Healthcare Fabrics Market by Application

5.3.1. Hygiene Products

5.3.2. Clothing Products

5.3.3. Privacy Curtains

5.3.4. Dressing Products

5.3.5. Blanket &Bedding

5.3.6. Others (Upholstery and Wearables)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Fabrics (SAAF)

7.2. Arc-Com

7.3. Architex International

7.4. Arville Textiles Ltd.

7.5. Associates NonWovens

7.6. ATEX Technologies Inc.

7.7. Avgol Ltd.

7.8. Baltex UK

7.9. Brentano, Inc.

7.10. Carnegie Fabrics, LLC.

7.11. Carriff Corp.

7.12. Design Tex Group Inc.

7.13. DuPont de Nemours, Inc.

7.14. Eximius Inc.

7.15. Herculite, Inc.

7.16. Honeywell International, Inc.

7.17. Johnson & Johnson Services, Inc.

7.18. Kimberly-Clark Corp.

7.19. Knoll, Inc.

7.20. Koninklijke Ten Cate bv

7.21. Maharam Fabric Corp. (Herman Miller, Inc.)

7.22. Marlen Textiles

7.23. Paramount Tech Fab Industries

7.24. Schoeller Textil AG

7.25. Sensoria Inc.

7.26. Standard Textile Co., Inc.

7.27. WPT Nonwovens Corp.

1. GLOBAL HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

2. GLOBAL POLYESTER HEALTHCARE FABRICSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL POLYPROPYLENEHEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL COTTON HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL POLYETHYLENEHEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHERHEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY FABRIC TYPE, 2018-2025 ($ MILLION)

8. GLOBAL WOVENHEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL NON-WOVENHEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL KNITTED HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

12. GLOBAL HEALTHCARE FABRICS IN HYGIENE PRODUCTSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL HEALTHCARE FABRICS IN CLOTHING PRODUCTSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL HEALTHCARE FABRICS IN PRIVACY CURTAINS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL HEALTHCARE FABRICS IN DRESSING PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL HEALTHCARE FABRICS IN BLANKET & BEDDING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL HEALTHCARE FABRICS IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL HEALTHCARE FABRICSMARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. NORTH AMERICAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

21. NORTH AMERICAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY FABRIC TYPE, 2018-2025 ($ MILLION)

22. NORTH AMERICAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. EUROPEAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. EUROPEAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

25. EUROPEAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY FABRIC TYPE, 2018-2025 ($ MILLION)

26. EUROPEAN HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY FABRIC TYPE, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

31. REST OF THE WORLD HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

32. REST OF THE WORLD HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY FABRIC TYPE, 2018-2025 ($ MILLION)

33. REST OF THE WORLD HEALTHCARE FABRICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL HEALTHCARE FABRICS MARKET SHARE BY MATERIAL, 2018 VS 2025 (%)

2. GLOBAL HEALTHCARE FABRICS MARKET SHARE BY FABRIC TYPE, 2018 VS 2025 (%)

3. GLOBAL HEALTHCARE FABRICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL HEALTHCARE FABRICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY HEALTHCARE FABRICSMARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD HEALTHCARE FABRICS MARKET SIZE, 2018-2025 ($ MILLION)