Healthcare Interoperability Solutions Market

Healthcare Interoperability Solutions Market by Type (EHR Interoperability Solutions, Healthcare Information Exchange Interoperability Solutions, Enterprise Interoperability Solutions, Imaging System Interoperability Solutions, and Others), by Interoperability Solutions (Foundational, Structural, and Semantic), and by End-User – Industry Size, Share, Global Trends, Competitive Analysis and Forecast, 2019 to 2025 Update Available - Forecast 2025-2035

The growing healthcare market is experiencing an enormous revolution, as technology is widely being used to engage patients, caregivers, consumers and provide real-time information and support with better use of data and analytics. Besides, the healthcare industry is focusing on the improvement of the quality of healthcare facilities and operational effectiveness, which includes diminishing medical errors occurring while conducting medical procedures and reducing the cost of medical procedures. To maintain a good clinical workflow, the hospitals and clinics should have the right information about the patient, which informs about the diagnosis, treatment and ongoing care. This, in turn, is considered as a crucial factor fueling the growth of the global healthcare interoperability solutions market. Moreover, the diagnostic and multiple EHR are complex procedures and sometimes can be time-consuming; therefore, the interoperability solutions in healthcare offers certain benefits over conventional procedures, such as speed, accuracy, consistency, and quality. Furthermore, the lack of integration and interoperability among healthcare payers and providers and other stakeholders weakens the unified healthcare range. The patient’s health records are captured in different formats such as papers, free text, multiple hospital information systems, structured electronic health care records, and payer application. This creates instability in combining data and makes it difficult for security and safeguarding of patient’s confidential clinical health data.

Increasing focus on healthcare interoperability solutions by healthcare authorities, funding for improving healthcare facilities and emerging focus on patient-centric care delivery have enhanced several features in medical practices in recent years. These solutions are broadly employed in healthcare facilities, leading to rapid developments and advancements in healthcare interoperability solutions market across the globe. Escalating demand for cutting down the healthcare costs, several initiatives for enhancing patient’s safety and care are the primary growth factors affecting the global market. Moreover, the rising healthcare infrastructure across the emerging economies of the region, such as China and India, is expected to offer significant growth opportunities for the players in the global healthcare interoperability solutions market. However, the lack of skilled healthcare professional and data privacy concerns are some of the prominent factors that hinder the market growth in the forecast period.

Segmental Outlook

The healthcare interoperability solutions market is segmented into type, interoperability solutions, and end-user. On the basis of type, the market is segmented into EHR interoperability solutions, healthcare information exchange interoperability solutions, enterprise interoperability solutions, imaging system interoperability solutions, and others. Based on the interoperability solutions, the market is fragmented into foundational, structural, and semantic. On the basis of end-user, the market is segmented into patients, healthcare providers, healthcare payers, and research organizations.

Healthcare provider segment is anticipated to showcase lucrative growth in the market

The healthcare providers contribute a significant share in the healthcare interoperability solutions market, as they adopt these solutions for various services such as scheduling and confirming appointments for patients, providing reminders, and following up with providing appointments for medical diagnosis with physicians, among others. Moreover, the healthcare payers are increasingly deploying healthcare interoperability solutions in their healthcare facilities, in order to track patient’s records, including wellness assessments, enrollment guidance, billing, and collections, among others.

Regional Outlook

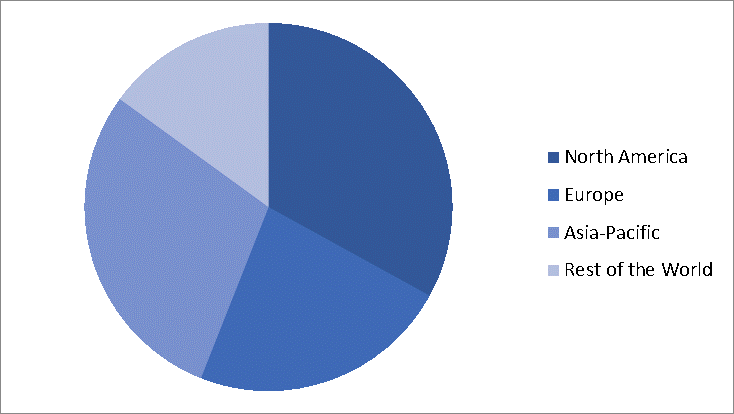

On the basis of geographical viewpoint, the global healthcare interoperability solutions market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global market, owing to the increasing demand for quality healthcare facilities along with a rising focus on reducing healthcare spending. Implementation of several initiatives and regulations to improve the overall efficiency of healthcare organizations in North America has been propelling the market growth from several years. Moreover, Asia-Pacific is projected to witness considerable growth in the global healthcare interoperability solutions market during the forecast period. This is majorly owing to the rising awareness programs for the clinicians to provide effective treatment by implementing healthcare interoperability services in healthcare administrative facilities of the organization.

Global Healthcare Interoperability Solutions Market by Region, 2018 (%)

Market Players Outlook

The prominent players functioning in the global healthcare interoperability solutions market include Cerner Corp., InterSystems Corp., Nextgen Healthcare Inc., IBM Corp., ViSolve Inc., Orion Health Group Ltd., AM Healthcare Technology, and Jitterbit, Inc. These market players are contributing to the market by adopting various market approaches including product launch and approvals, merger and acquisition, partnerships and collaborations, and others for gaining a strong position in the market. The companies are increasingly investing in product development and innovation to gain a competitive share.

Recent Developments

In January 2018, Epic System Corp. launched “One Virtual System Worldwide” and enhanced its “Care Everywhere Solutions” for the clinicians across all organizations. These new solutions facilitate clinicians with the exchange of more data and interaction on the same platform.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare interoperability solutions market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. InterSystems Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cerner Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Nextgen Healthcare Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Jitterbit, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. IBM Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Healthcare Interoperability Solutions Market by Type

5.1.1. EHR Interoperability Solutions

5.1.2. Healthcare Information Exchange Interoperability Solutions

5.1.3. Enterprise Interoperability Solutions

5.1.4. Imaging System Interoperability Solutions

5.1.5. Others (Lab System Interoperability Solution)

5.2. Global Healthcare Interoperability Solutions Market by Interoperability Solutions

5.2.1. Foundational

5.2.2. Structural

5.2.3. Semantic

5.3. Global Healthcare Interoperability Solutions Market by End-User

5.3.1. Patients

5.3.2. Healthcare Providers

5.3.3. Healthcare Payers

5.3.4. Research Organizations

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AM Healthcare Technology

7.2. Cerner Corp.

7.3. Deevita LLC

7.4. EData Platform

7.5. Epic Systems Corp.

7.6. General Electric Co.

7.7. IBM Corp.

7.8. Infor Inc.

7.9. iNTERFACEWARE Inc.

7.10. InterSystems Corp.

7.11. Jitterbit, Inc.

7.12. Koninklijke Philips N.V.

7.13. Nextgen Healthcare Inc.

7.14. Orion Health Group Ltd.

7.15. OSP Labs

7.16. ViSolve, Inc.

1. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL EHR INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL HEALTHCARE INFORMATION EXCHANGE INTEROPERABILITY SOLUTIONS

MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ENTERPRISE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL IMAGING SYSTEM INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND

ANALYSIS BY INTEROPERABILITY SOLUTIONS, 2018-2025 ($ MILLION)

8. GLOBAL FOUNDATIONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL STRUCTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL SEMANTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

12. GLOBAL PATIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL HEALTHCARE PROVIDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL HEALTHCARE PAYERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL RESEARCH ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET

RESEARCH AND ANALYSIS BY INTEROPERABILITY SOLUTIONS, 2018-2025 ($

MILLION)

20. NORTH AMERICAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

21. EUROPEAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. EUROPEAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND

ANALYSIS BY INTEROPERABILITY SOLUTIONS, 2018-2025 ($ MILLION)

24. EUROPEAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

25. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH

AND ANALYSIS BY INTEROPERABILITY SOLUTIONS, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

29. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

30. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET

RESEARCH AND ANALYSIS BY INTEROPERABILITY SOLUTIONS, 2018-2025 ($

MILLION)

31. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET RESEARCH AND ANALYSIS BY END-USER, 2018-2025 ($ MILLION)

1. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY INTEROPERABILITY SOLUTIONS, 2018 VS 2025 (%)

3. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY END-USER, 2018 VS 2025 (%)

4. GLOBAL HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD HEALTHCARE INTEROPERABILITY SOLUTIONS MARKET SIZE, 2018-2025 ($ MILLION)