Healthcare Payer Services Market

Healthcare Payer Services Market Size, Share & Trends Analysis Report by Services (Business Process Outsourcing (BPO) Services, Knowledge Process Outsourcing (KPO) Services, and Information Technology Outsourcing (ITO) Services), and by End-Use (Private Payers and Public Payers), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Healthcare payer services market is anticipated to grow at a CAGR of 7.8% during the forecast period (2023-2030). The growth of this market is attributed to the rising need for cost-effective operations and the growth in demand for advanced supply chain management (SCM) practices, minimizing the overall cost of healthcare supply chain BPO services is likely to boost market growth during the forecast period. Moreover, health insurance enrollments triggered by PPACA, rising federal healthcare mandates, rising incidences of chronic diseases, and growing cases of healthcare fraud are factors driving market growth. In June 2023, the Centers for Medicare & Medicaid Services (CMS) released the latest enrollment figures for Medicare. As of March 2023, there were 65,748,297 people are enrolled in Medicare, an increase of almost 100,000 since the last report in September. Of those, 33,948,778 were enrolled in Original Medicare. There were 31,799,519 are enrolled in Medicare Advantage or other health plans. This includes enrollment in Medicare Advantage plans with and without prescription drug coverage. There were 51,591,776 are enrolled in Medicare Part D. This includes enrollment in stand-alone prescription drug plans as well as Medicare Advantage plans that offer prescription drug coverage. In addition, the rising chronic diseases further bolster way for health insurance, leading to the adoption of healthcare payer services and fueling the market growth. According to the International Diabetic Federation 2021, around 537 million persons aged 20 to 79 affected by diabetes. Diabetes was responsible for over 6.7 million deaths. By 2030, the overall number of diabetics is expected to reach 643 million, and by 2045, it will reach 783 million. Additionally, according to Globocan 2020, estimated 19.3 million new cases, and 10 million cancer deaths. Such a huge burden of chronic diseases will lead to increased adoption of ethical medication, driving the market growth significantly.

Segmental Outlook

The global healthcare payer services market is segmented based on technology, and end-use. Based on the technology, the market is sub-segmented into BPO services, KPO services, and ITO services. Further, based on end-use, the market is sub-segmented into private payers, and public payers. Among the end-use, the private payers sub-segment is anticipated to hold a largest market share during the forecast period. The large share of this segment is credited to the lower costs, higher efficiency, and ability to focus on essential business operations provided by BPO services. This greatly attributes to the fact that BPO services offer administration in important administrative domains.

The Private Payers Sub-Segment is Anticipated to Hold a Considerable Share of the Global Healthcare Payer Services Market

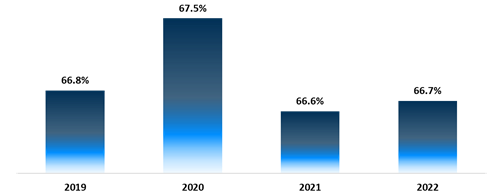

Among the end-use, private payers sub-segments expected to grow over the forecast period. The segment is driven by the owing to the increasing private investment in the healthcare payer vertical and growing government support to promote private investment in the healthcare industry. According to the National Health (NIH) Interview Survey 2022, among adults aged 18–64 years, 12.2% were uninsured, 22.0% had public coverage, and 67.8% had private health insurance coverage. Adults aged 18–64 were the most likely to have private coverage (67.8%), followed by children aged 0–17 years (54.3%) and adults aged 65 and over (45.7%).

US Adults aged 18–64 years with private coverage, 2019–2022 (%)

Source: National Health Interview Survey 2022

Regional Outlook

The global healthcare payer services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the Asia-Pacific region is anticipated to grow over the forecast period, owing to the growing demand for healthcare payer services, increasing geriatric population, rising adoption of health insurance, the rising healthcare frauds, and the rising healthcare expenditure.

Global Healthcare Payer Services Market Growth, by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Healthcare Payer Services Market

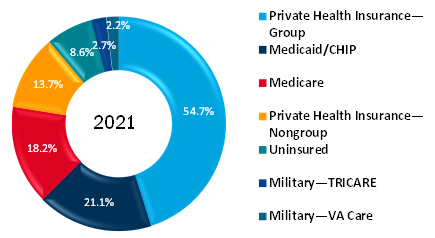

North America is expected to hold a prominent share in the market, owing to the rising adoption of healthcare policies along with the presence of sophisticated healthcare system in the region. According to the article published by the Congressional Research Service, titled 'The US Health Care Coverage and Spending,' updated in February 2023, most people had private health insurance or were covered by a government program such as Medicare or Medicaid in 2021. The US had an estimated population of 327 million individuals. Most of those individuals had private health insurance or were covered under a federal program such as medicare or medicaid. However, about 8.6% of the total US population was still uninsured. Individuals including those who were uninsured, health insurers, and federal and state governments spent approximately $4.0 trillion on various types of health consumption expenditures (HCE) in 2021, which accounted for 17.4% of the nation’s gross domestic product (GDP). Such a huge investment in healthcare consumption in this region led to driving the growth of this market in this region owing to the adoption of healthcare payer services to claim insurance.

Health Insurance Coverage as a Percentage of Total US Population, 2021

Source: US Health Care Coverage and Spending

Market Players Outlook

The major companies serving the global healthcare payer services market include Accenture plc, Dell Inc., Oracle Corp., Xerox Holdings Corp., HCL Technologies Ltd., Hewlett-Packard, IBM Corp., Infosys Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2023, Elevance Health acquired the Blue Cross and Blue Shield of Louisiana (BCBSLA), with the payers aiming to improve care access, quality, and affordability for Louisiana members.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global healthcare payer services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Accenture plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dell Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Oracle Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Xerox Holdings Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Healthcare Payer Services Market by Services

4.1.1. Business Process Outsourcing (BPO) Services

4.1.2. Knowledge Process Outsourcing (KPO) Services

4.1.3. Information Technology Outsourcing (ITO) Services

4.2. Global Healthcare Payer Services Market by End-Use

4.2.1. Private Payers

4.2.2. Public Payers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allscripts Healthcare, LLC

6.2. Cognizant Technology Solutions Corp.

6.3. Concentric Corp.

6.4. Conduent Inc.

6.5. Conifer Health Solutions, LLC

6.6. EXL Service Holdings, Inc.

6.7. Firstsource Solutions Ltd.

6.8. Genpact

6.9. HCL Technologies Ltd.

6.10. Hewlett-Packard

6.11. Hinduja Global Solution Ltd.

6.12. IBM Corp.

6.13. Infosys Ltd.

6.14. Inovalon

6.15. IQVIA Inc.

6.16. Mphasis Corp.

6.17. NTT DATA GROUP Corp.

6.18. OMH HealthEdge Holdings, LLC

6.19. Parexel International Corp.

6.20. R1 RCM, Inc.

6.21. SAS Institute Inc.

6.22. Tata consultancy services Ltd.

6.23. UnitedHealth Group, Inc.

6.24. Wipro Ltd.

6.25. WNS (Holdings) Ltd.

1. GLOBAL HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

2. GLOBAL HEALTHCARE BPO SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL HEALTHCARE KPO SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HEALTHCARE ITO SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

6. GLOBAL HEALTHCARE PAYER SERVICES FOR PRIVATE PAYERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL HEALTHCARE PAYER SERVICES FOR PUBLIC PAYERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

11. NORTH AMERICAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

12. EUROPEAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. EUROPEAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

14. EUROPEAN HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

18. REST OF THE WORLD HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. REST OF THE WORLD HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY SERVICES, 2022-2030 ($ MILLION)

20. REST OF THE WORLD HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022-2030 ($ MILLION)

1. GLOBAL HEALTHCARE PAYER SERVICES MARKET SHARE BY SERVICES, 2022 VS 2030 (%)

2. GLOBAL HEALTHCARE BPO SERVICES MARKET SHARE BY MATERIAL, 2022 VS 2030 (%)

3. GLOBAL HEALTHCARE KPO SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL HEALTHCARE ITO SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL HEALTHCARE PAYER SERVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2022 VS 2030 (%)

6. GLOBAL HEALTHCARE PAYER SERVICES FOR PRIVATE PAYERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL HEALTHCARE PAYER SERVICES FOR PUBLIC PAYERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL HEALTHCARE PAYER SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. US HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

10. CANADA HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

11. UK HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

13. GERMANY HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. ITALY HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. REST OF EUROPE HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. INDIA HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. CHINA HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. JAPAN HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

20. SOUTH KOREA HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD HEALTHCARE PAYER SERVICES MARKET SIZE, 2022-2030 ($ MILLION)