Hearing Aids Market

Global Hearing Aids Market Size, Share & Trends Analysis Report by Type (Behind-the-ear (BTE), In-the-Ear (INE), and In-the-Canal (ITC)), and Function (Analog and Digital), Forecast 2019-2025 Update Available - Forecast 2025-2035

The global hearing aids market is estimated to grow at a lucrative CAGR of over 6.5% during the forecast period. The primary factors that drive the growth of the market increasing geriatric population coupled with increased prevalence of hearing impairment and technological advancement in the field of hearing aid industry. According to the United Nations, the number of people aged 60 years and more in 2017 was 962 million. This number is expected to get doubled by 2050 and tripled by 2100. The global population with age 60 and more is growing faster as compared to the population of younger age groups. Moreover, it is inferred from the data available from the United Nations that population (962 million) with age 60 and more accounts for 13% of the global population and this aging population is growing with a rate of around 3% per year.

With the growing age, the cases of hearing loss increases. According to the National Institute of Health in 2018, around one in three people in the US between the ages of 65 and 74 has hearing loss, and nearly half of those older than 75 have difficulty hearing.Most older people who experience hearing loss have a combination of both age-related hearing loss and noise-induced hearing loss.There are a number of devices and aids that assist these people in hearing properly. With the increasing geriatric population and hence the increasing hearing loss problem, the demand for hearing aids will significantly increase.

Segmental Outlook

The global hearing aids market is segmented on the basis of type and function.On the basis of function, the market is bifurcated into analog hearing aids and digital hearing aids. Among these, the digital hearing aids market is estimated to generate a considerable value in 2018 and is estimated to expand at a remarkable growth during the forecast period.

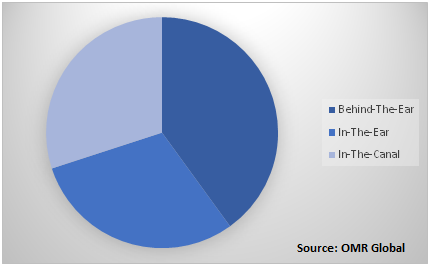

Global Hearing Aids Market by Type, 2018 (%)

Based on the type, the market is segmented into BTE, ITE, ITC, and other hearing aid devices. Among these, the BTE hearing aids segment is estimated to hold a significant share in 2018 as these are easy to handle devices. In addition, it is generally used by young children as it can fit various earmold types. Moreover, they can be easily cleaned and handled. In addition, these devices offer better connectivity as compared to other devices. Moreover, ITC hearing aids is estimated to register a remarkable growth during the forecast period.

Regional Outlook

The global hearing aids marketis geographically segmented intoNorth America, Europe, Asia-Pacific, and the Rest of the World.Europe is expected to hold a significant share in the global hearing aidsmarket. The growth is attributed to the presence of the key manufacturersof hearing aids and devicessuch as Demant A/S, AmplifonSpA, Sonova Holding AG, GN hearing A/S, and others.In addition, increasing prevalence of hearing losses in the region coupled with the rising awareness among people regarding the same is considered to be driving factors for the regional growth of the market.

Moreover, Asia-Pacific is anticipated to exhibit remarkable growth during the forecast period. Major economies contributing to the growth of the market in the Asia-Pacific region include China, India, and Japan. Besides, rising geriatric population pool coupled with the increasing prevalence of hearing losses in the region and improving healthcare infrastructure further give a boost to the regional growth of the market.

Market Players Outlook

The study of the global hearing aids market report covers the analysis of various players operating in the market. Some of the players include Cochlear Ltd., Demant A/S, AmplifonSpA, Sonova Holding AG, GN hearing A/S, and others.The hearing aidsmanufacturers are adopting various strategies such as new product launches and approvals, merger and acquisition, partnerships and collaborations, and many others in order to sustainin a competitive environment.

For instance, in August 2019, Oticon, Inc. introduced Oticon Xceed and Oticon Xceed Play hearing aids to its portfolio of advanced hearing solutions. These are designed for adults and children with severe-to-profound hearing loss, respectively, giving wearers more access to speech with less listening effort. For individuals with single-sided deafness (SSD), the company has also unveiled Oticon CROS, a powerful new wireless solution that opens up a wearer to sounds from all directions.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hearing aids market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Demant A/S

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cochlear Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. AmplifonSpA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Sonova Holding AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. GN Hearing A/S

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Hearing Aids Market by Type

5.1.1. Behind-the-Ear (BTE)

5.1.2. In-the-Ear (ITE)

5.1.3. In-the-Canal (ITC)

5.2. Global Hearing Aids Market by Function

5.2.1. Analog

5.2.2. Digital

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AmplifonSpA

7.2. Audina Hearing Instruments Inc.

7.3. Beurer GmbH

7.4. Cochlear Ltd.

7.5. Demant A/S

7.6. Medtronic, PLC

7.7. Merry Healthcare Co. Ltd.

7.8. GN Hearing A/S

7.9. Oticon, Inc.

7.10. Sivantos Group

7.11. Sonova Holding AG

7.12. Starkey Hearing Technologies

7.13. Widex A/S

1. GLOBAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BTEHEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ITEHEARING AIDSMARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ITCHEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

6. GLOBAL ANALOGHEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DIGITAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

11. NORTH AMERICAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

12. EUROPEAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

14. EUROPEAN HEARING AIDS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC HEARING AIDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC HEARING AIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC HEARING AIDS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

18. REST OF THE WORLD HEARING AIDS MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. REST OF THE WORLD HEARING AIDS MARKET RESEARCH AND ANALYSIS BY FUNCTION, 2018-2025 ($ MILLION)

1. GLOBAL HEARING AIDS MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL HEARING AIDS MARKET SHARE BY FUNCTION, 2018 VS 2025 (%)

3. GLOBAL HEARING AIDS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD HEARING AIDS MARKET SIZE, 2018-2025 ($ MILLION)