Helicopter Market

Global Helicopter Market Size, Share & Trends Analysis Report, by End-User (Military, Government & Homeland Security, Commercial), By Application (Security, Surveillance, Transportation, Emergency Medical Services, Other), By Type (Light Weight, Medium Weight, Heavy Weight) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The helicopter market will witness a modest growth rate during the forecast period. Continuous procurements of the helicopter by the military are providing a modest growth and strength to the helicopter market. Moreover, increasing commercial usage of the helicopter such as for emergency medical services, taxi services, personal usage is providing a significant growth to the market. It is due to the increasing need for faster solutions in urban transportation. Traffic congestion is one of the biggest mobility issues in recent times primarily at certain peak hours due to heavy traffic congestions. According to the World Economic Forum, in 2018, in the US the total productivity loss due to traffic congestion was around $87 billion. Moreover, India loses around $21.3 billion annually due to traffic congestion. Due to this, the millionaires and billionaires are using air taxi service for transportation. Thus, augmenting the demand of the helicopters all across the globe.

In October 2019, Uber Inc. has taken a big step in urban air mobility and introduced helicopter taxi service, The Uber Copter in New York, the US. It transports passengers from lower Manhattan to John F. Kennedy (JFK) International Airport within eight-minutes. The price of each trip is around $200-$250 as per the demand. In addition, the increased investments by private and public organizations for the development of advanced transportation systems and the rising number of urban mobility projects augmenting the helicopter market.

Market Segmentation

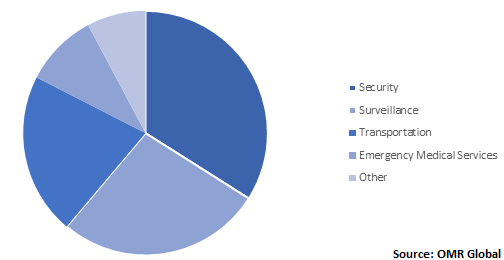

The global helicopter market is segmented based on end-user, applications, and types. By end-user, the market is further segmented into military, government & homeland security, commercial. Commercial sector is expected to showcase the fastest growth rate during the forecast period. By application, the market is further divided into security, surveillance, transportation, emergency medical services, and others. In the security helicopter segment, add-on defense equipments are not taken into consideration during evaluating the market. Transportation is expected to witness a lucrative growth rate whereas security and surveillance sector will hold a major market share during the forecast period. By type, the helicopter market is segmented into lightweight, medium weight, and heavyweight. Light-weight helicopter for civil and commercial activities is expected to witness substantial growth all across the globe.

Global Helicopter Market Share by End-User, 2019 (%)

Regional Outlook

The global helicopter market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). The US holds a major market share all across the globe. The country has the largest defense budget globally and a considerable amount is dedicated to helicopters for defense purposes. Moreover, there is high use of helicopters by homeland security, EMS as well as for private transportation. Expansion plans by taxi services such as Uber Inc. are also expected to provide considerable market growth to the country. A similar trend is expected in European countries. Germany, France, UK, Italy, Spain are expected to have a major market share during the forecast period in Europe.

Asia-Pacific is expected to exhibit substantial market growth during the forecast period. High military expenditure by China, India, Japan, South Korea, Australia, and Pakistan in the region are providing significant opportunities to the helicopter industry. Moreover, rising usage of helicopters for tourism and transportation, further development of private medical infrastructure and so EMS helicopter industry is also propelling the market growth in the region.

Global Helicopter Market Growth, by Region 2020-2026

Market Players Outlook

The helicopter market is the highly consolidated market and very few OEMs are working in the market due to high investment associated with it however various small companies are collaborating with these OEMs to provide different hardware and innovative technologies. Some of the major players operating in the market include Airbus SE, BAE Systems plc, Bell Textron Inc., Kawasaki Heavy Industries, Ltd., Leonardo S.p.A, Lockheed Martin Corp., Russian Helicopters, JSC, Thales Group, The Boeing Co. These companies are adopting growth strategies including mergers & acquisitions, new product & technology launches, expansions, partnerships & collaborations to gain a competitive edge in the market. For instance, in May 2020 Lockheed Martin Corp., subsidiary Sikorsky has signed an agreement to provide 24 MH-60R helicopters to the Indian Navy for anti-submarine warfare duties by the spring of 2021. The deal cost around $905 million.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Helicopter market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Airbus SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Leonardo S.p.A

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Bell Textron Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Lockheed Martin Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. The Boeing Co.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Helicopter Market by End-User

5.1.1. Military

5.1.2. Government & Homeland Security

5.1.3. Commercial

5.2. Global Helicopter Market by Application

5.2.1. Security

5.2.2. Surveillance

5.2.3. Transportation

5.2.4. Emergency Medical Services (EMS)

5.2.5. Other

5.3. Global Helicopter Market by Type

5.3.1. Light Weight

5.3.2. Medium Weight

5.3.3. Heavy Weight

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Spain

6.2.5. Italy

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airbus SE

7.2. BAE Systems plc

7.3. Bell Textron Inc.

7.4. Hindustan Aeronautics Ltd.(HAL)

7.5. Kawasaki Heavy Industries, Ltd.

7.6. Korea Aerospace Industries, Ltd.

7.7. Leonardo S.p.A

7.8. Lockheed Martin Corp.

7.9. MD Helicopters, Inc.

7.10. Russian Helicopters, JSC

7.11. Thales Group

7.12. The Boeing Co.

7.13. The Robinson Helicopter Co.

7.14. Cicaré S.A

7.15. Kaman Corp.

1. GLOBAL HELICOPTER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

2. MILITARY HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

3. GOVERNMENT & HOMELAND SECURITY HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

4. COMMERCIAL HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

5. GLOBAL HELICOPTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. SECURITY HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

7. SURVEILLANCE HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

8. TRANSPORTATION HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

9. EMERGENCY MEDICAL SERVICES HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

10. OTHER HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

11. GLOBAL HELICOPTER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

12. LIGHT WEIGHT HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

13. MEDIUM WEIGHT HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

14. HEAVY WEIGHT HELICOPTER MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

15. NORTH AMERICAN HELICOPTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN HELICOPTER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. NORTH AMERICAN HELICOPTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. NORTH AMERICAN HELICOPTER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. EUROPE HELICOPTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. EUROPE HELICOPTER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

21. EUROPE HELICOPTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

22. EUROPE HELICOPTER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

23. ASIA PACIFIC HELICOPTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

24. ASIA PACIFIC HELICOPTER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

25. ASIA PACIFIC HELICOPTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

26. ASIA PACIFIC HELICOPTER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD HELICOPTER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

28. REST OF THE WORLD HELICOPTER MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

29. REST OF THE WORLD HELICOPTER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

30. REST OF THE WORLD HELICOPTER MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

1. GLOBAL HELICOPTER MARKET SHARE BY End-User, 2019 VS 2026 (%)

2. GLOBAL HELICOPTER MARKET SHARE BY PROPULSION Application, 2019 VS 2026 (%)

3. GLOBAL HELICOPTER MARKET SHARE BY PROPULSION Type, 2019 VS 2026 (%)

4. GLOBAL HELICOPTER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

6. Canada HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

10. Spain HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

11. Italy HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

12. REST OF EUROPE HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF WORLD HELICOPTER MARKET SIZE, 2019-2026 ($ MILLION)