Hemodialysis Blood Tubing Sets Market

Global Hemodialysis Blood Tubing Sets Market Size, Share and Trends Analysis Report by Clinical Application (Detoxification, Mineral Balance, Others), and by End-User (Hospitals and Clinics, Ambulatory Surgical Centers, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global hemodialysis blood tubing sets market is anticipated to grow at a significant CAGR during the forecast period. Arterial and venous lines are included in hemodialysis/AV blood tubing systems. The arterial tubing transports blood from the patient to the hemodialysis machine, while the venous tubing returns blood to the patient from the hemodialysis machine. The color-coded tubing allows for quick and easy identification. Medication ports and needle-stick injury precautions may be included in AV blood tubing sets. Hemodialysis is a blood-filtering procedure that removes wastes and excess water. This medication enables to manage blood pressure by regulating minerals in the blood such as potassium, sodium, and calcium. The prevalence of end-stage renal disease (ESRD) is increasing, that is driving the market growth. In addition, the increased prevalence of acid-base and electrolyte imbalance in patients with chronic kidney disease and chronic diseases such as cancer, heart disease, stroke, among others around the world is propelling the market growth. Rising demand for RAPClot serum tubes can restrain the market growth.

Impact of COVID-19 on Global Hemodialysis Blood Tubing Sets Market.

The COVID-19 had a negative impact on the global hemodialysis blood tubing sets market, as it has surged the demand for management in dialysis units. Mismatches in resource availability and demand across the globe are a major source of concern. As a result of the increased number of workers who are unwell or furloughed to enable with social distancing, supply production falls. The lack of dialysis equipment and supplies that is harming hospitals during the COVID-19 has been addressed by Fresenius Medical Care North America and Baxter International Inc. Fresenius is focused on the rising demand for dialysis machines among COVID-19 patients who have acquired acute renal damage, according to a press statement.

Segmental Outlook

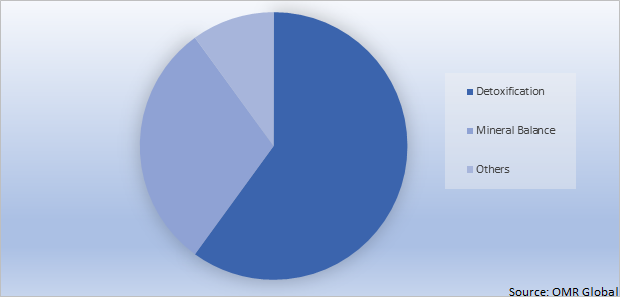

The global hemodialysis blood tubing sets market is segmented based on clinical application and end-user. Based on clinical application, the market is segmented into detoxification, mineral balance, others. Based on end-user the market is segmented into hospitals and clinics, ambulatory surgical centers, others. The above-mentioned segments can be customized as per the requirements.

Hemodialysis Blood Tubing Sets Market Share by Clinical Application, 2021(%)

The Detoxification Segment is Expected to Grow at a Considerable CAGR in the Global Hemodialysis Blood Tubing Sets Market

Among the clinical application segment, the detoxification sub-segment is anticipated to cater significant CAGR over the forecast period. Detoxification is the simple process of withdrawing a person from a specific psychoactive substance in a safe and effective manner. The clinical application sector for hemodialysis blood tubing sets market is anticipated led by detoxification, as rise in consumption of alcohol by young population which is the major cause of kidney failure or renal diseases. The purpose of detox is to safely manage withdrawal symptoms when someone stops taking drugs or alcohol. According to the World Health Organization (WHO), around 2 million patients were diagnosed with end-stage renal disease (ESRD) in 2020.

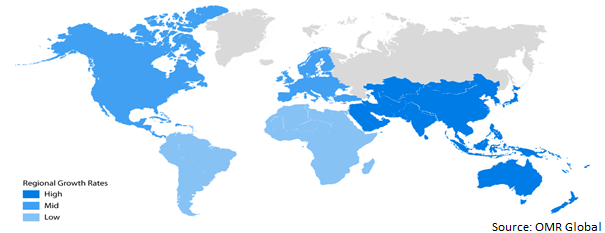

Regional Outlooks

The global hemodialysis blood tubing sets market is further segmented based on geography Including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

Global Hemodialysis Blood Tubing Sets Market Growth, by Region 2022-2028

The North America is Expected to Dominate the Global Hemodialysis Blood Tubing Sets market

The North America region is expected to hold a prominent share in the hemodialysis blood tubing sets market during the forecast period. The primary factor contributing in the growth includes the increasing number of patients suffering from end-stage renal disease. According to the studies published by the National Institute of Health (NIH), in 2021, approximately 750,000 patients in the US are diagnosed with the end-stage renal disease every year. Hemodialysis is specifically prescribed to the people which are end stage of renal diseases or end-stage renal failure. It is the final, permanent stage of chronic kidney disease, where kidneys can no longer function on their own. Furthermore, the USFDA's favorable regulatory environment for the sale and distribution of hemodialysis blood tubing sets propels the market forward in the area.

Market Players Outlook

The major companies serving the global hemodialysis blood tubing sets market include Baxter International Inc., Asahi Kasei Medical Co., Ltd., Fresenius SE & Co. KGaA, Nipro Corp., Weigao Holding Co. Ltd., others. To enhance their market share, industry participants are employing a number of critical techniques. For instance, in 2021, Nipro Corp., a Japanese medical equipment maker, received a grant to invest an extra $270 million in its HCMC factory and establish Vietnam's first dialyzer production line. Therapeutic dialysis is performed using dialysis machines. Nipro further plans to begin renovating its factory and producing dialyzers by 2023, initially producing six million units in the first year before ramping up to 48 million per year.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hemodialysis blood tubing sets market. Based on the availability of data, information related to new product launches, and relevant news is additionally available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Hemodialysis Blood Tubing Sets Market

• Recovery Scenario of Global Hemodialysis Blood Tubing Sets Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Baxter International Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Asahi Kasei Medical Co., Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Fresenius SE & Co. KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. Swot Analysis

3.3.4. Recent Developments

3.4. Nipro Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Weigao Holding Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Hemodialysis Blood Tubing Sets Market by Clinical Application

4.1.1. Detoxification

4.1.2. Mineral Balance

4.1.3. Others

4.2. Global Hemodialysis Blood Tubing Sets Market by End-User

4.2.1. Hospitals and Clinics

4.2.2. Ambulatory Surgical Centers

4.2.3. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advin Health Care

6.2. Angiplast Pvt. Ltd.

6.3. Guangdong Biolight Meditech Co., Ltd.

6.4. Blue Sail Medical Co., Ltd.

6.5. DaVita Inc.

6.6. Finetech Research and Innovation Corp.

6.7. Hemant surgical industries ltd.

6.8. Lifeline Systems Pvt. Ltd.

6.9. Medtech Devices

6.10. Nanotech Inc.

6.11. P. K. Scientific & Chemicals

6.12. Rajsun Innovations Llp

6.13. Rizhao Bigway Medical Device Co., Ltd.

6.14. Renax Biomedical Technology Co., Ltd.

6.15. Shree Ambica Surgical Pvt. Ltd.

6.16. Shree Umiya Surgical Pvt. Ltd.

6.17. Techmed Manufacturing and Enterprises

6.18. Vivan Meditech

6.19. Varni Corp.

1. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY CLINICAL APPLICATION, 2021-2028 ($ MILLION)

2. GLOBAL DETOXIFICATION IN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL MINERAL BALANCE IN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL OTHER APPLICATIOS IN HEMODIALYSIS BLOOD TUBING SETS IN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

6. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

7. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

8. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

9. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028($ MILLION)

10. NORTH AMERICAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY CLINICAL APPLICATION, 2021-2028 ($ MILLION)

12. NORTH AMERICAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

13. EUROPEAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY CLINICAL APPLICATION, 2021-2028($ MILLION)

15. EUROPEAN HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY CLINICAL APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

19. REST OF THE WORLD HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY CLINICAL APPLICATION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD HEMODIALYSIS BLOOD TUBING SETS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET, 2022-2028 (%)

4. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY CLINICAL APPLICATION, 2021 VS 2028 (%)

5. GLOBAL DETOXIFICATION IN HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL MINERAL BALANCE IN HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL OTHERS IN HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

9. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN HOSPITALS AND CLINICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN AMBULATORY SURGICAL CENTERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL HEMODIALYSIS BLOOD TUBING SETS IN OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL HEMODIALYSIS BLOOD TUBING SETS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

15. UK HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD HEMODIALYSIS BLOOD TUBING SETS MARKET SIZE, 2021-2028 ($ MILLION)