HFC Refrigerants Market

Global HFC Refrigerants Market Size, Share & Trends Analysis Report by Refrigerant Type (HFC-134a, HFC-125, HFC-143a, HFC-32, HFC-152a, and Others), By Application (Air Conditioner, Automotive Air Conditioner, Refrigerators, and Others), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global HFC refrigerants market is anticipated to exhibit a CAGR of 3.7% during the forecast period (2021-2027). The considerable rise in urbanization has created high demand for air conditioners for offices, buses, homes, and many more places and thereby has created the demand for different refrigerants. Furthermore, the rising demand for chilled and frozen food and beverage products has increased the demand for the cold chain market which is further creating the demand for different refrigerants. HFCs offers several benefits as a refrigerant; as it contributes less to depleting of the ozone layer as it does not contain chlorine and does not deplete the stratosphere layer of the ozone layer. It is also used for replacements for older CFCs and HCFCs that are more hazardous to the environment.

However, the rising adoption of refrigeration gases as the best available alternative over HFCs by key manufacturers of AC and refrigerators is likely to make a negative impact on the growth of the HFC refrigerant market across the globe. Moreover, stringent government regulations prohibiting the use of the HFCs, CFCs, and HCFCs are estimated to restrain and challenge the growth of the HFC refrigerant market share during the forecast period. For instance, in September 2020, New York State announced to ban the use of HFC refrigerants to reduce the emissions that lead to greenhouse gases. Moreover, according to the report published by NASA (National Aeronautics and Space Administration), excessive use of HFCs is expected to contribute most to global warming in 2050 if not now, by speeding up the chemical reaction destroying the ozone layer.

Segmental Outlook

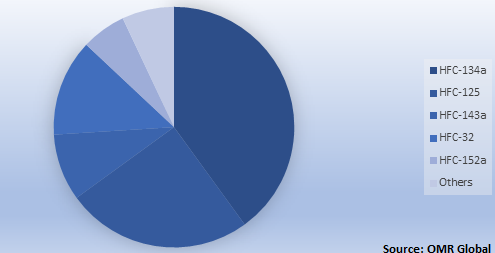

The market is segmented based on type and applications. Based on type, the market is segmented into HFC-134a, HFC-125, HFC-143a, HFC-32, HFC-152a, and others. Based on the application segment, the market is bifurcated into the air conditioner, automotive air conditioner, refrigerators, and others.

Global HFC Refrigerant Market Share by Type, 2020 (%)

R134a segment holds a significant market share in 2020. The market growth is driven by its uses in air conditioners, automotive air conditioners, and medium temperature refrigeration across the globe. It was generally developed to replace R12 in car AC systems and coolers. The R134a is the most abundant HFC in the atmosphere and is the most common refrigerant used in MVAC systems since the 1990s. The companies involved in the manufacturing of R134a HFC refrigerators include Harp International Ltd., Daikin Industries, Ltd., Linde AG, and Mexichem S.A.B. de C.V.

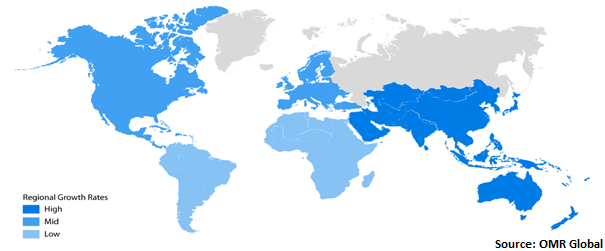

Regional Outlooks

The global HFC refrigerant market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is bifurcated into North America, Europe, Asia Pacific, and the Rest of the World. The Asia Pacific is estimated to be the fastest-growing region during the forecast period due to emerging economies like Japan, China, and India leading to high growth of urbanization in this region. North America is estimated to have a decline in the HFC refrigerant market owing to strict government policies and regulations. In September 2016, the United States Environmental Protection Agency announced that specific refrigerants including R134a and R410A can no longer be used in new chillers.

Global HFC Refrigerants Market Growth, by Region 2021-2027

Market Players Outlook

Key players of the global HFC refrigerant market are Linde AG, Arkema Group, Daikin Industries, Ltd., Honeywell International Inc., The Chemours Company FC, LLC, and Zhejiang Yonghe Refrigerant Co., Ltd. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global HFC refrigerants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global HFC Refrigerant Market by Refrigerant Type

5.1.1. HFC-134a

5.1.2. HFC-125

5.1.3. HFC-143a

5.1.4. HFC-32

5.1.5. HFC-152a

5.1.6. Others

5.2. Global HFC Refrigerant Market by Application

5.2.1. Air Conditioner

5.2.2. Automotive Air Conditioner

5.2.3. Refrigerator

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arkema Group.

7.2. Daikin Industries, Ltd.

7.3. Dongyue Group

7.4. Foam Supplies, Inc.

7.5. Harp International Ltd.

7.6. Honeywell International Inc.

7.7. Linde AG

7.8. Mexichem S.A.B. de C.V

7.9. National Refrigerants, Inc.

7.10. ZheJiangYonghe Refrigerant Co., Ltd.

7.11. Xiamen Juda Chemical & Equipment Co., Ltd.

7.12. SOL Hellas A.E.

7.13. Shandong Yuean New Material Co., Ltd.

7.14. The Chemours Company FC, LLC.

1. GLOBAL HFC REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REFRIGERANT TYPE 2020-2027($ MILLION)

2. GLOBAL HFC-134A REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL HFC-125 REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL HFC-143A REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL HFC-32 REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL HFC-152A REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL OTHERS REFRIGERANT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL HFC REFRIGERANT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

9. GLOBAL REFRIGERATION MARKET RESEARCH AND ANALYSIS, 2020-2027 ($MILLION)

10. GLOBAL AIR CONDITIONER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($MILLION)

11. GLOBAL AUTOMOTIVE AIR CONDITIONER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($MILLION)

12. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($MILLION)

13. GLOBAL HFC REFRIGERANT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027($ MILLION)

14. NORTH AMERICAN HFC MARKET RESEARCH AND ANALYSIS BY REFRIGERANT TYPE, 2020-2027 ($MILLION)

15. NORTH AMERICAN HFC MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

16. NORTH AMERICAN HFC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

17. EUROPEAN HFC MARKET RESEARCH AND ANALYSIS BY REFRIGERANT TYPE, 2020-2027 ($MILLION)

18. EUROPEAN HFC MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

19. EUROPEAN HFC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

20. ASIA-PACIFIC HFC MARKET RESEARCH AND ANALYSIS BY REFRIGERANT TYPE, 2020-2027 ($MILLION)

21. ASIA-PACIFIC HFC MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

22. ASIA-PACIFIC HFC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

23. REST OF THE WORLD HFC MARKET RESEARCH AND ANALYSIS BY REFRIGERANT TYPE, 2020-2027 ($MILLION)

24. REST OF THE WORLD HFC MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

1. GLOBAL HFC REFRIGERANT MARKET SHARE ANALYSIS BY REFRIGERANT TYPE, 2020 VS 2027 (%)

2. GLOBAL HFC REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

3. GLOBAL HFC REFRIGERANT MARKET SHARE ANALYSIS BY GEOGRAPHY 2020 VS 2027 (%)

4. GLOBAL HFC-134A REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

5. GLOBAL HFC-125 REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

6. GLOBAL HFC-143A REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

7. GLOBAL HFC-32 REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

8. GLOBAL HFC-152A REFRIGERANT MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

9. GLOBAL OTHER REFRIGERANT HFC MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

10. GLOBAL REFRIGERATION MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

11. GLOBAL AIR CONDITIONER MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

12. GLOBAL AUTOMOTIVE AIR CONDITIONER MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

13. GLOBAL OTHERS MARKET SHARE ANALYSIS BY APPLICATION, 2020 VS 2027 (%)

14. US HFC MARKET SIZE, 2020-2027 ($MILLION)

15. CANADA HFC MARKET SIZE, 2020-2027 ($MILLION)

16. UK HFC MARKET SIZE, 2020-2027 ($MILLION)

17. FRANCE HFC MARKET SIZE, 2020-2027 ($MILLION)

18. GERMANY HFC MARKET SIZE, 2020-2027 ($MILLION)

19. ITALY HFC MARKET SIZE, 2020-2027 ($MILLION)

20. SPAIN HFC MARKET SIZE, 2020-2027 ($MILLION)

21. REST OF EUROPE HFC MARKET SIZE, 2020-2027 ($MILLION)

22. INDIA HFC MARKET SIZE, 2020-2027 ($MILLION)

23. CHINA HFC MARKET SIZE, 2020-2027 ($MILLION)

24. JAPAN HFC MARKET SIZE, 2020-2027 ($MILLION)

25. REST OF ASIA-PACIFIC HFC MARKET SIZE, 2020-2027 ($MILLION)

26. REST OF THE WORLD HFC MARKET SIZE, 2020-2027 ($MILLION)