Hi-Fi System Market

Global Hi-Fi System Market Size, Share & Trends Analysis Report by System Type (Devices and Components), By Connectivity (Wired and Wireless), By Application (Residential and Commercial) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global Hi-Fi system market is growing significantly, at a CAGR of around 5.4% during the forecast period (2019-2025). The hi-fi (high fidelity) system is referred to as the high-quality reproduction of sound with the use of high-quality amplifiers, receivers, cables, DAC, and other components in the sound system. The system produces modern audio compression techniques with increased bandwidth. The pivotal factor that drives market growth includes the rising adoption of wireless/portable devices and continuous innovations in the efficiency of audio technology in the electronics industry. The replacement of a portable computing system such as personal desktop with laptops and tablets has been acting as a catalyst to the growth of the market. Rising disposable income has increased the adoption of advanced entertainment products in emerging economies, such as India. Continuous growth and innovations in headphones, speakers, and soundbars will offer growth opportunities to the hi-fi system market during the forecast period. However, there are certain factors that restraints market growth include government policies and health concerns.

Segmental Outlook

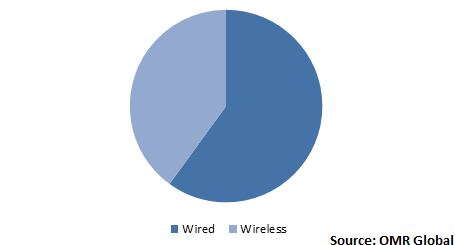

The Hi-Fi system market is classified on the basis of system type, connectivity, and application. Based on the system type, the market is bifurcated into deices and components. The devices segment is further segmented into headphones and earphones, speakers and soundbars, CD players, network media players, others; whereas, the components segment is further classified into amplifiers, cables, receivers, and others. Based on connectivity, the market is segregated into wired and wireless. Based on the application, the market is segmented into residential and commercial. Among the connectivity, the wireless hi-fi system segment is estimated to project a considerable CAGR during the forecast period. This growth is attributed to the growing trend for wireless technologies as they are portable and lightweight.

Global Hi-Fi System Market Share by Connectivity, 2018 (%)

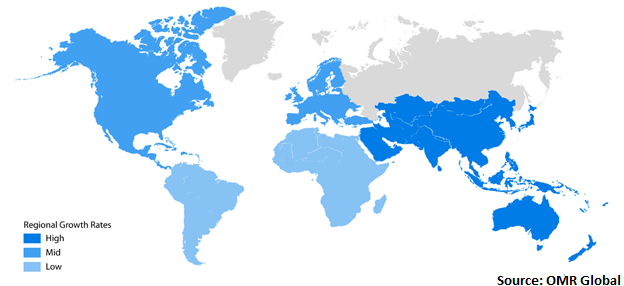

Regional Outlook

The global hi-fi system market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and the Rest of the World. North America and Europe are estimated to share significantly in the global hi-fi system market. Major economies that will contribute to the North American hi-fi system market are the US and Canada, whereas, the major economies in the European hi-fi system market include UK, Germany, France, Spain, and Italy. The increasing expenditure in the electronics and automotive, with the presence of some of the luxury car manufacturers, such as Ferrari, have been offering growth to the European hi-fi system market.

Global Hi-Fi System Market Growth, by Region 2019-2025

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is expected to project a considerable CAGR in the global Hi-Fi system market during the forecast period. This growth can be attributed to the rising adoption of consumer electronics, rising urbanization, and large manufacturing units of automobiles in the major emerging economies of India and China. India is one of the prominent exporters of automobiles across the globe. According to the IBEF, automobile exports grew by 14.5% during the fiscal year 2019. The annual production has also increased substantially in the past few years. According to Invest India, India’s annual production of automobiles reached around 29.1 million in 2018 from 25.3 million in 2017, registering a growth of 14.8%. In addition, China is considered as the leader of the electronics industry; owing to which, there is a significant market for hi-fi systems in Asia-Pacific.

Market Players Outlook

The key players in the hi-fi system market are contributing significantly by providing advanced technology-based products and expanding their geographical presence across the globe. The key players operating in the global hi-fi system market include Samsung Electronics Co., Ltd., Bose Corp., KEF International, Sonos Inc., Amazon.com, Inc., and Sennheiser electronic GmbH & Co. KG. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In November 2019, Amazon.com, Inc. launched Amazon Echo Studio, a smart hi-fi speaker with immersive 3D audio. Through such launches, the company is moving in towards the consumer electronics sector and has experienced a successful response from its speakers segment in the recent past few years.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hi-fi system market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Samsung Electronics Co., Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bose Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. KEF International (GP Acoustics International Ltd.)

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Sonos Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Sennheiser electronic GmbH & Co. KG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Hi-Fi System Market by System Type

5.1.1. Devices

5.1.1.1. Headphones and Earphones

5.1.1.2. Speakers and Sound Bars

5.1.1.3. CD Players

5.1.1.4. Network Media Players

5.1.1.5. Others (DVD Player and Blu-Ray Player)

5.1.2. Components

5.1.2.1. Amplifiers

5.1.2.2. Cables

5.1.2.3. Receivers

5.1.2.4. Others (Digital-to-Analog Converter (DAC))

5.2. Global Hi-Fi System Market by Connectivity

5.2.1. Wired

5.2.2. Wireless

5.3. Global Hi-Fi System Market by Application

5.3.1. Residential

5.3.2. Commercial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Apple Inc.

7.2. Amazon.com, Inc.

7.3. Audioengine LLC

7.4. B & W Group Ltd.

7.5. Bose Corp.

7.6. Edifier International Ltd.

7.7. ELAC Electroacustic GmbH

7.8. GESSI SPA

7.9. HiBy Music

7.10. High Fidelity Cables

7.11. highend-electronics, inc.

7.12. KEF International (GP Acoustics International Ltd.)

7.13. Koninklijke Philips N.V.

7.14. LG Electronics Inc.

7.15. Linn Products Ltd.

7.16. MARSHALLHEADPHONES (Zound Industries International AB)

7.17. Onkyo (Aqipa GmbH)

7.18. Panasonic Corp.

7.19. Samsung Electronics Co., Ltd.

7.20. Sennheiser electronic GmbH & Co. KG

7.21. Sonos Inc.

7.22. Sony Corp.

7.23. Tannoy (Music Tribe Global Brands Ltd.)

7.24. Yamaha Corp.

1. GLOBAL HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2018-2025 ($ MILLION)

2. GLOBAL HI-FI DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL HI-FI COMPONENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2018-2025 ($ MILLION)

5. GLOBAL WIRED HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL WIRELESS HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

8. GLOBAL HI-FI SYSTEM FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL HI-FI SYSTEM FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. EUROPEAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2018-2025 ($ MILLION)

18. EUROPEAN HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

23. REST OF THE WORLD HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY SYSTEM TYPE, 2018-2025 ($ MILLION)

24. REST OF THE WORLD HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY CONNECTIVITY, 2018-2025 ($ MILLION)

25. REST OF THE WORLD HI-FI SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL HI-FI SYSTEM MARKET SHARE BY SYSTEM TYPE, 2018 VS 2025 (%)

2. GLOBAL HI-FI SYSTEM MARKET SHARE BY CONNECTIVITY, 2018 VS 2025 (%)

3. GLOBAL HI-FI SYSTEM MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL HI-FI SYSTEM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

7. UK HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD HI-FI SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)