High Bandwidth Memory Market

Global High Bandwidth Memory Market Size, Share & Trends Analysis Report by Type (Graphics Processing Unit, Central Processing Unit, Accelerated Processing Unit, and Others), By Application (Servers, Networking, High-performance Computing, Data Centres, and Others) Forecast Period 2022-2028 Update Available - Forecast 2025-2035

The global market for high bandwidth memory is projected to have a considerable CAGR of around 25.1% during the forecast period. High-bandwidth memory (HBM) is the fastest DRAM on the planet, designed for applications that demand the maximum possible bandwidth between memory and processing. The growth of the market is also being aided by the increasing popularity of portable computing devices such as laptops. The market is also greatly influenced by the increase in demand for animation-based games such as FIFA and the Need for Speed, as well as the increased adoption of virtual reality headsets. Furthermore, the rising advancements in the development of advanced memory solutions are also expected to contribute to the market growth during the forecast period. For instance, Lancaster University recently developed a non-volatile RAM, known as the ULTRARAM. Apart from that, the rise in demand for faster, more efficient, and cost-effective memory solutions, fuelled by advancements in computing technology, as well as the global surge in cryptocurrency mining, are likely to create significant market growth opportunities.

Segmental Outlook

The global high bandwidth memory market is segmented based on types, and applications. Based on the type, the market is further classified into the graphics processing unit, central processing unit, and accelerated processing unit, and others. Further, based on the application the market is classified into servers, networking, high-performance computing, data centers, and others.

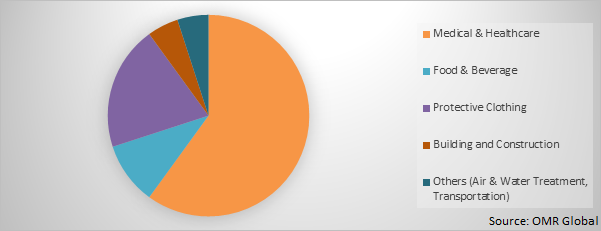

Global High Bandwidth Memory Market Share by Application, 2021(%)

The Medical & Healthcare is Considered as the Dominating Segment in the Global High Bandwidth Memory Market.

Among applications, the accelerated processing unit segment is expected to dominate the market during the forecast period. An accelerated processing unit (APU) is a microprocessor that combines the central processing unit (CPU) with the graphics processing unit (GPU) on a single computer chip. An Accelerated Processing Unit improves the data transfer rate between a CPU and a GPU, allowing a computer to complete tasks while consuming less power than if the components worked separately. The increase in its applications that need videos to run smoother, with improved software performance and faster data rates are driving the growth of accelerated processing units. Moreover, increasing investment in semiconductors and computing technologies and demand for high-end computing systems along coupled with growing digitization is anticipated to boost the segment growth.

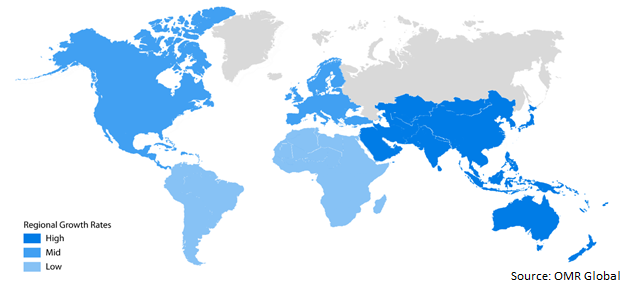

Regional Outlook

Geographically, the global high bandwidth memory market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia-Pacific is projected to have a significant share in the high bandwidth memory market. The growth is attributed to the emergence of big data in the region has increased the demand for systems that can handle a more data-intensive workload. Emerging economies such as China, India, and Japan in the region dominate the high bandwidth memory market due to the high investments for introducing advanced technologies and increasing its application by the various industries.

Global High Bandwidth Memory Market Growth, by region 2022-2028

North America Holds the Largest Share in the Global High Bandwidth Memory Market.

Geographically, North America is projected to hold the largest share in the global high bandwidth memory market attributing to the growing high-performance computing (HPC) applications in the region that require high-bandwidth memory solutions for fast data processing. Furthermore, various memory manufacturing companies in North America are looking for ways to expand their business. For instance, in September 2021, Intel has started its new fabrication plant in Arizona to manufacture next-generation memory and storage solutions. The organization invested USD 1 billion in this project as the first part of a USD 7 billion investment phase-out. These kinds of investments will enable the high bandwidth memory market to flourish in the region.

Market Players Outlook

The key players in the high bandwidth memory market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Micron Technology, Inc., Samsung Electronics Co. Ltd., SK Hynix Inc., IBM Corp, Intel Corp among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In April 2020, AMD announced the launch of new AMD Radeon Pro 5000 series GPUs for the updated 27-inch iMac. The new AMD Radeon Pro 5000 series GPUs are built on industry-leading 7nm process technology and advanced AMD RDNA graphics architecture. They feature up to 40 compute units and up to 16GB of high-speed GDDR6 memory and deliver up to 7.6 teraflops of single-precision (FP32) computational performance.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global High Bandwidth Memory market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global High Bandwidth Memory Industry

• Recovery Scenario of Global High Bandwidth Memory Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global High Bandwidth Memory Market by Type

5.1.1. Graphics Processing Unit

5.1.2. Central Processing Unit

5.1.3. Accelerated Processing Unit

5.1.4. Others

5.2. Global High Bandwidth Memory Market by Application

5.2.1. Servers

5.2.2. Networking

5.2.3. High-performance Computing

5.2.4. Data Centers

5.2.5. Others (Graphics, Automotive))

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Micro Devices Inc

7.2. Cadence Design Systems, Inc

7.3. Fujitsu Limited

7.4. IBM Corp

7.5. Intel Corporation

7.6. Marvell Technology, Inc.

7.7. Micron Technology, Inc.

7.8. Nvidia Corporation

7.9. Samsung Electronics Co., Ltd

7.10. Open-Silicon, Inc

7.11. Qualcomm Inc

7.12. SK hynix Inc

7.13. STMicroelectronics N.V.

7.14. Toshiba Corp

7.15. Xilinx Inc

7.16. Fujitsu Ltd

1. GLOBAL HIGH BANDWIDTH MEMORY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL HIGH BANDWIDTH MEMORY FOR GRAPHICS PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL HIGH BANDWIDTH MEMORY FOR CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HIGH BANDWIDTH MEMORY FOR ACCELERATED PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL HIGH BANDWIDTH MEMORY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL HIGH BANDWIDTH MEMORY FOR SERVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL HIGH BANDWIDTH MEMORY FOR NETWORKING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL HIGH BANDWIDTH MEMORY FOR HIGH-PERFORMANCE COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL HIGH BANDWIDTH MEMORY FOR DATA CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL HIGH BANDWIDTH MEMORY FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. EUROPEAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. EUROPEAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. REST OF THE WORLD CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD CENTRAL PROCESSING UNIT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HIGH BANDWIDTH MEMORY MARKET, 2021-2028 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HIGH BANDWIDTH MEMORY MARKET BY SEGMENT, 2021-2028 (% MILLION)

3. RECOVERY OF GLOBAL HIGH BANDWIDTH MEMORY MARKET, 2021-2028 (%)

4. GLOBAL HIGH BANDWIDTH MEMORY MARKET SHARE BY TYPES, 2021 VS 2028 (%)

5. GLOBAL HIGH BANDWIDTH MEMORY MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

6. GLOBAL HIGH BANDWIDTH MEMORY MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL HIGH BANDWIDTH MEMORY FOR GRAPHICS PROCESSING UNIT MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL HIGH BANDWIDTH MEMORY FOR CENTRAL PROCESSING UNIT MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL HIGH BANDWIDTH MEMORY FOR ACCELERATED PROCESSING UNIT MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL HIGH BANDWIDTH MEMORY FOR SERVERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL HIGH BANDWIDTH MEMORY FOR NETWORKING MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL HIGH BANDWIDTH MEMORY FOR HIGH-PERFORMANCE COMPUTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL HIGH BANDWIDTH MEMORY FOR DATA CENTERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL HIGH BANDWIDTH MEMORY FOR OTHER APPLICATION MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

17. UK HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

22. ROE HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

26. ASEAN HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD HIGH BANDWIDTH MEMORY MARKET SIZE, 2021-2028 ($ MILLION)