High Electron Mobility Transistor (HEMTs) Market

High Electron Mobility Transistor (HEMTs) Market Size, Share & Trends Analysis Report by Type (Gallium Nitride (GaN), Silicon Carbide (SiC), Gallium Arsenide (GaAs)) and Other (Indium Phosphide) and by End-User (Aerospace and Defense, Automotive, Consumer Electronics, Industrial, and Others (Medical)) Forecast Period (2024-2031)

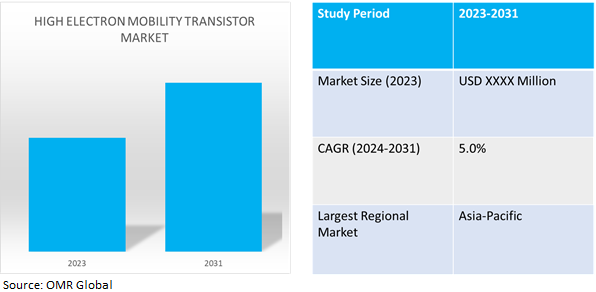

High electron mobility transistor market is anticipated to grow at a CAGR of 5.0% during the forecast period (2024-2031). The market growth is driven by the increasing demand for high-performance and high-frequency electronic devices across various industries such as telecommunications, aerospace, and defense. HEMTs are known for their ability to operate at high frequencies and power levels, making them essential components in modern communication systems such as 5G networks, satellite communications, and radar systems. The growth of the wireless communication industry and the ongoing transition to 5G technology are fueling the demand for HEMTs, as they enable faster data transmission and improved network efficiency. Additionally, advancements in materials such as gallium nitride (GaN) and indium phosphide (InP) have further enhanced the performance and reliability of HEMTs, driving their adoption in a variety of applications.

Market Dynamics

Demand in the Development of Wireless Technology

The development of wireless technology is essential to the high electron mobility transistor industry's growth. These high-frequency components provide large power efficiency, low noise levels, and wireless communication systems, among other benefits. The constant advancement of wireless communication technology to higher frequencies and bandwidths is driving greater demand for HEMTs. Newer wireless protocols, Internet of Things (IoT) devices, and 5G networks have fueled the development of HEMTs with improved features like reduced P.C. and a higher cutoff frequency. For instance, in March 2024, Fujitsu’s R&D teams achieved an important new milestone, creating the world’s highest output X-band power amplifier for long-range wireless communication and radar. Improved insulating protective film quality in high electron mobility transistors (HEMTs) based on gallium nitride (GaN) material has resulted in a world-leading power density of 31 W/mm, the highest value for solid-state electron devices including GaN materials in nearly 20 years.

Advancements in IoT Technologies to boost the market

Globally, the development of loT has greatly accelerated the high electron mobility transistor market. In these applications, HEMTs are essential parts of wireless communication systems that require low-noise, rapid amplifiers to satisfy various loT requirements for connected cars, wearables, smart homes, and industrial sensors, among other uses. Because loT connects more devices via networks, more data transmission rates are needed to support them all, which has also raised demand for HEMTs. It's also important to remember that HEMT is a crucial component of many businesses, including smart manufacturing and e-healthcare, which rely heavily on it for dependable and quick data processing amongst interconnected device networks in these kinds of cities.

Market Segmentation

Our in-depth analysis of the global high electron mobility transistor market includes the following segments by type and end-user:

- Based on type, the market is sub-segmented into gallium nitride, silicon carbide, gallium arsenide, and other (indium phosphide).

- Based on technology, the market is augmented into aerospace and defense, automotive, consumer electronics, industrial, and others.

Gallium Nitride (GaN) is Projected to Emerge as the Largest Segment

The gallium nitride sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include the exceptional performance characteristics and the ability of GaN HEMTs to address the evolving needs of high-frequency and high-power applications. GaN HEMTs offer enhanced electron mobility and breakdown voltage, making them suitable for applications in power amplifiers, radar systems, satellite communication, and 5G infrastructure.

Consumer Electronics Sub-segment to Hold a Considerable Market Share

Consumer electronics manufacturers strive to create smaller, more efficient devices without compromising performance. HEMTs exceptional performance qualities such as fast speed, low noise, and low power consumption make it a great choice for a range of headphone electronics applications. HEMTs improve the entire user experience in smartphones, tablets, and wearable technology by enabling faster data processing, longer battery life, and better signal reception. It contributes to superior audio quality, efficient signal processing, and enhanced user experiences. They are efficient for applications like power management, wireless communication, and signal amplification because of their capacity to handle high frequencies and power levels.

Regional Outlook

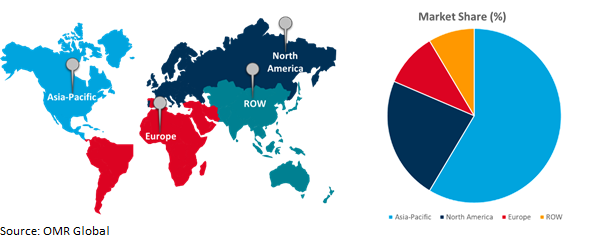

The global high electron mobility transistor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America’s countries to invest in the high electron mobility transistor market

- Expansion of 5G networks in Canada to fuel the market demand for high electron mobility transistor-based products.

- The aerospace and defense industries in the U.S. are aided by the growing requirement for cutting-edge radar and electronic warfare systems to propel the market growth.

Global High Electron Mobility Transistor Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of increasing demand for high-frequency communication technologies, including the widespread deployment of 5G networks in countries, such as China and South Korea. China, Japan, South Korea, and Taiwan are among the Asia-Pacific region's top producers of semiconductors and technical advancements. This region's robust infrastructure and skilled labor force enable faster production and adoption of HEMTs. The Asia-Pacific region's growing need for consumer electronics, telecommunications equipment, and automotive electronics is driving up demand for high-performance semiconductors like HEMTs.

The demand is further increased by the proliferation of smartphones, tablets, loT technologies, and 5G infrastructure. Government programs that encourage the semiconductor industry's expansion, as well as higher spending in R&D, boost innovation in HEMTS since governments back the sector's expansion. Alliances between local enterprises and multinational semiconductor makers also contribute to market expansion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global high electron mobility transistor market include NXP Semiconductors B.V., Sumitomo Electric Group, STMicroelectronics, Toshiba Infrastructure, Mitsubishi Electric Corp, Innoscience, Rohm Co. Ltd., and Texas Instruments, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2022, Mitsubishi Electric Corporation announced two new 12.75-13.25 GHz (Low-Ku band) 70W (48.3dBm) gallium-nitride high-electron-mobility transistors (GaN HEMTs) that will be added to the company's GaN HEMT lineup for Satellite-Communication (SATCOM) earth stations. Even in the Low-Ku band, the two GaN HEMT products, one for multi-carrier1 communications and the other for single-carrier2 communications support smaller ground stations and higher data transmission capacities

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global high electron mobility transistor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. STMicroelectronics N.V.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Toshiba Infrastructure Systems & Solutions Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sumitomo Electric Industries, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Mitsubishi Electric Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global High Electron Mobility Transistor Market by Type

4.1.1. Gallium Nitride (GaN)

4.1.2. Silicon Carbide (SiC)

4.1.3. Gallium Arsenide (GaAs)

4.1.4. Other (Indium Phosphide (InP))

4.2. Global High Electron Mobility Transistor Market by End-User

4.2.1. Aerospace and Defense

4.2.2. Automotive

4.2.3. Consumer Electronics

4.2.4. Industrial

4.2.5. Others (Medical)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Ampleon Netherlands B.V.

6.2. Analog Devices, Inc.

6.3. Fujitsu Ltd.

6.4. Infineon Group

6.5. Innoscience

6.6. MACOM Technology Solutions, Inc.

6.7. Microchip Technology, Inc.

6.8. NXP Semiconductor B.V.

6.9. OKI Electric Industry Co., Ltd.

6.10. Qorvo Inc.

6.11. RFHIC Corp.

6.12. Renesas Electronics Corp.

6.13. Rohm Co. Ltd.

6.14. Teledyne Technologies Inc

6.15. Texas Instruments, Inc.

6.16. Wolfspeed, Inc.

1. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL GALLIUM NITRIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SILICON CARBIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GALLIUM ARSENIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR AEROSPACE AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. REST OF THE WORLD HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD HIGH ELECTRON MOBILITY TRANSISTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL GALLIUM NITRIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SILICON CARBIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GALLIUM ARSENIDE HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHER HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR AEROSPACE & DEFENSE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL HIGH ELECTRON MOBILITY TRANSISTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

15. UK HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA HIGH ELECTRON MOBILITY TRANSISTOR MARKET SIZE, 2023-2031 ($ MILLION)