High Potency Active Pharmaceutical Ingredients (HPAPI) Market

Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market Size, Share and Trends Analysis Report, By Type (Innovative HPAPI and Generic HPAPI), By Type of Synthesis (Synthetic HPAPI and Biotech HPAPI), By Application (Oncology, Glaucoma, Hormonal Disorder, and Others), Forecast (2022-2028) Update Available - Forecast 2025-2035

The global high potency active pharmaceutical ingredient (HPAPI) Market is expected to grow at a significant CAGR during the forecast period. High potent active pharmaceutical ingredients (HPAPIs) are pharmacologically active substances. They exhibit biological activity at extremely low concentrations such as a daily therapeutic dose of <10 mg or an occupational exposure limit (OEL) of < 10 ?g/m3 at an eight-hour time-weighted average. The major factor driving the demand for the global high potency active pharmaceutical ingredients (HPAPI) market during the forecast period is the increasing cases of cancer globally. Furthermore, funding in development and research for new drug substances by the governments, high investment funds needed for manufacturing and production facilities are providing the use of contract product manufacturing which is driving the global HPAPI market during the forecast period. Moreover, the increasing demand for antibody-drug conjugate and drugs for oncology, approving government regulation for the production and manufacture of the novel drug is expected to boost the global HPAPI market.

Impact of COVID-19 Pandemic on the Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market

The COVID-19 pandemic has impacted the global economy due to a slowdown, as a result of nationwide lockdowns. The COVID-19 pandemic has caused enormous challenges in healthcare and pharmaceuticals globally. Furthermore, the COVID-19 pandemic has impacted practically every phase and also the global high potency active pharmaceutical ingredient (HPAPI) market due to impact on trade segment, manufacturing and closing the industry due to lockdown. However, as the COVID-19 situation normalizes, the global glycosylated peptide market started recovery as industrial operations were normalized after the recovery.

Segmental Outlook

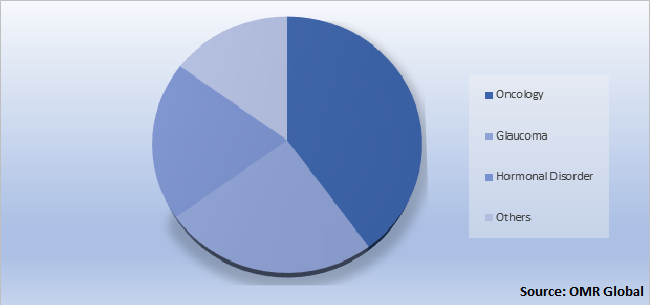

The global high potency active pharmaceutical ingredient (HPAPI) market is segmented based on type, type of synthesis, and application. Based on type, the market is sub-segmented into innovative HPAPI and generic HPAPI. Based on the type of synthesis, the market is sub-segmented into synthetic HPAPI and biotech HPAPI. Based on the application, the market is sub-segmented into oncology, glaucoma, hormonal disorder, and others. Among these, Oncology is going to lead the global high potency active pharmaceutical ingredient (HPAPI) market in the application segment. Furthermore, synthetic HPAPI is going to lead the global high potency active pharmaceutical ingredient (HPAPI) market in the type of synthesis segment. Moreover, innovative HPAPI is going to lead the market in the type segment.

Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market Share by Application, 2021 (%)

The Oncology segments hold a Prominent Share in the Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market

Oncology holds the largest share in the market due to the growing incidence and prevalence of cancer across the globe and the launch of new target therapies. Furthermore, technological advancements in the oncology HPAPI-antibody conjugate technology are driving the market during the forecast period.

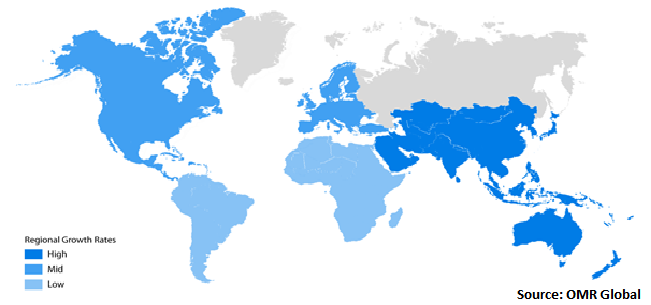

Regional Outlooks

The global high potency active pharmaceutical ingredient (HPAPI) market is further segmented on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). The North American region dominates the market, followed by Europe the second largest market for high potency active pharmaceutical ingredients (HPAPI). In addition, the Asia Pacific is also expected to grow during the forecast year.

Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market Growth, by region 2022-2028

North America region is estimated to Hold a Prominent Share in the Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market

North America is anticipated to hold a prominent share in the market due to its well-established research and development infrastructure for innovative drug development. Furthermore, the existence of prominent manufacturers and modern technical infrastructure, as well as the region’s growing demand for HPAPIs. Moreover, increasing cases of chronic diseases, associated low prices as compared to patented drugs, a growing number of pharmaceutical manufacturers, patients, and increasing government initiatives are driving the North America high potency active pharmaceutical ingredient market during the forecast period.

Market Players Outlook

The major companies serving the global high potency active pharmaceutical ingredient (HPAPI) market include BASF SE, Corden Pharma International GmbH, Cambrex Corp., CARBOGEN AMCIS AG, Dr. Reddy’s Laboratories Ltd., and Others. The growth of the market is considerably contributed by the market player by the adoption of various strategies including mergers and acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2019, Cambrex Corp. completed the construction of a $24 million high potency active pharmaceutical ingredient manufacturing facility at its site in Charles City, IA.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global High Potency Active Pharmaceutical Ingredient (HPAPI) Market. Based on the availability of data, information related to the market, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on The Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market

- Recovery Scenario of Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. BASF SE

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Corden Pharma International GmbH

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cambrex Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. CARBOGEN AMCIS AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Dr. Reddy’s Laboratories Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market by Type

4.1.1. Innovative HPAPI

4.1.2. Generic HPAPI

4.2. Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market by Type of Synthesis

4.2.1. Synthetic HPAPI

4.2.2. Biotech HPAPI

4.3. Global High Potency Active Pharmaceutical Ingredient (HPAPI) Market by Application

4.3.1. Oncology

4.3.2. Glaucoma

4.3.3. Hormonal Disorder

4.3.4. Others (Respiratory Disorders, CVD, Diabetes, Cosmetology, and Erectile Dysfunction)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ajinomoto Bio-Pharma Services

6.2. Boehringer Ingelheim International GmbH

6.3. Bristol Myers Squibb

6.4. Curia Global, Inc.

6.5. Cipla Ltd.

6.6. Eli Lilly and Company

6.7. F. Hoffmann-La Roche Ltd.

6.8. GlaxoSmithKline plc

6.9. Merck & co. Inc.

6.10. Mylan Laboratories Ltd.

6.11. Novartis AG

6.12. Pfizer, Inc.

6.13. SANOFI SA

6.14. Sun Pharmaceutical Industries, Ltd.

6.15. Teva Pharmaceutical Industries Ltd.

1. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL INNOVATIVE HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL GENERIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE OF SYNTHESIS, 2021-2028 ($ MILLION)

5. GLOBAL SYNTHETIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL BIOTECH HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR ONCOLOGY RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR GLAUCOMA RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR HORMONAL DISORDER RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR OTHERS RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE OF SYNTHESIS, 2021-2028 ($ MILLION)

15. NORTH AMERICAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. EUROPEAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

17. EUROPEAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE OF SYNTHESIS, 2021-2028 ($ MILLION)

18. EUROPEAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE OF SYNTHESIS, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. REST OF THE WORLD HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

23. REST OF THE WORLD HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY TYPE OF SYNTHESIS, 2021-2028 ($ MILLION)

24. REST OF THE WORLD HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET, 2022-2028 (%)

4. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL INNOVATIVE HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL GENERIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY TYPE OF SYNTHESIS, 2021 VS 2028 (%)

8. GLOBAL SYNTHETIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL BIOTECH HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR ONCOLOGY, SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR GLAUCOMA, SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR HORMONAL DISORDER, SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET FOR OTHERS, SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

18. UK HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD HIGH POTENCY ACTIVE PHARMACEUTICAL INGREDIENT (HPAPI) MARKET SIZE, 2021-2028 ($ MILLION)