High-Throughput Screening Market

High-Throughput Screening Market Size, Share & Trends Analysis Report by Product and Services (Consumables, Instruments, Services, and Software), by Technology (Cell-Based Assays, Lab-on-a-Chip Technology, and Label-Free Technology), and by Application (Drug Discovery, Biochemical Screening, Life Sciences Research, and Other) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

High-throughput screening market is anticipated to grow at a significant CAGR of 7.7% during the forecast period. The key factors contributing to the market growth include a rise in the use of high-throughput screening for drug development, as it reduces the time taken to develop a drug. Additionally, the surge in healthcare expenditure, high disposable income, and growth in awareness among the people positively affect the high throughput screening market. Healthcare spending in the US increased by 9.7% in 2020 to 4.3% in 2019, and spending was 19.7% of GDP in 2020 compared with 17.6% of GDP in 2019. Meanwhile, technological advancements and the increasing application of high throughput screening for plant protection are other factors that contribute to the market growth. For instance, in April 2022, Berkeley Lights, Inc. and Vestaron Corp., announced a strategic partnership to advance the development of pesticidal peptides as Active Ingredients (AIs) to improve the safety and efficacy of crop protection solutions for the global food supply. In this partnership, Vestaron uses Berkeley Lights’ propriety high-throughput, functional screening service to optimize the development of novel AIs with pesticidal properties that target proven receptors.

Segmental Outlook

The global high-throughput screening market is segmented based on the product and services, technology and application. Based on products and services, the market is segmented into consumables, instruments, services, and software. Based on the technology, the market is segmented into cell-based assays, lab-on-a-chip technology, and label-free technology. Based on the application, the market is subdivided into drug discovery, biochemical screening, life sciences research, and others. Based on technology, the lab-on-chip technology segment is expected to grow at a considerable rate, owing to the rise in the incidence of various health disorders, and the increase in the number of research in the biotechnology field propels the segment growth. However, the label-free technology segment has witnessed favourable growth in the global high-throughput screening market. The growth is mainly augmented owing to the increase awareness among end-users concerning the benefits of using label-free technology.

Based on application, the biochemical screening segment is expected to grow at a favorable rate. The major factors that are driving the segment growth are rapidly growing pharmaceutical and biotechnology industries, along with increasing investments, and rising production of new biologics due to the high disease burden. For instance, in March 2020, Regeneron and Sanofi initiated the development of their biologic Kevzara for the treatment of patients with COVID-19, which inhibits the IL-6 pathway. Thus, with the development of new treatments for COVID-19, the demand for biological screening has also increased.

Regional Outlooks

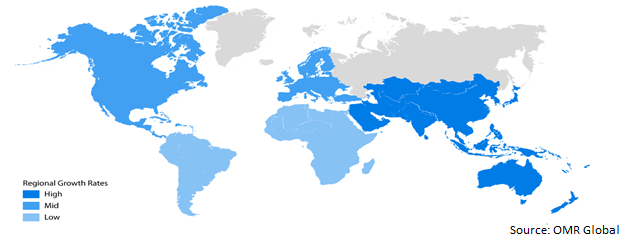

The global high-throughput screening market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is estimated to hold a prominent share owing to the established healthcare infrastructure and continuous product development. However, the Asia-Pacific is expected to be the fastest-growing region over the projected period. The growth is mainly augmented owing to the rising life science and research activities, and government support for the pharmaceutical industry.

Global High-Throughput Screening Market Growth, by Region 2022-2028

North America is Anticipated to Dominate the Global High-Throughput Screening Market

Among all regions, North America is expected to contribute majorly to the growth of the market. The regional growth of the market is attributed to factors such as the emerging requirement of validation of drugs and devices process of manufacturing. According to the US Food & Drug Administration (FDA) report, in 2021, the US reported around 4,814 manufacturing sites for drugs. Additionally, the advanced healthcare infrastructure and rising R&D spending are expected to increase the revenue size further. According to the data of Pharmaceutical Research and Manufacturers of America (PhRMA), in the US, about $83 billion were spent by the pharmaceutical industry on R&D in 2021. Thus, expected to further boost the market growth over the forecast period.

Market Players Outlook

The major companies serving the global high-throughput screening market include Agilent Technologies, Inc., Charles River Laboratories International Inc, Corning Inc., Danaher Corp., Lonza Group Ltd., Merck KGaA, PerkinElmer Inc., Thermo Fisher Scientific, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in September 2022, Molecular Devices and HeartBeat.bio collaborated to automate and scale cardiac organoids for high-throughput screening in drug discovery. Together, the companies committed to developing and commercializing the end-to-end high-throughput human cardiac organoid screening platform.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global high-throughput screening market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

1.1. Key Company Analysis

3.1. Corning, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Danaher Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PerkinElmer, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Thermo Fisher Scientific, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global High-Throughput Screening Market By Product and Service

4.1.1. Consumables

4.1.1.1. Reagents & Assay Kits

4.1.1.2. Laboratory Equipment

4.1.2. Instruments

4.1.2.1. Liquid Handling Systems

4.1.2.2. Detection Systems

4.1.2.3. Other Instruments

4.1.3. Software

4.1.4. Services

4.2. Global High-Throughput Screening Market By Technology

1.1.1. Cell-Based Assays

1.1.1.1. 2D Cell Culture

1.1.1.2. 3D Cell Culture

1.1.1.3. Perfusion Cell Culture

1.1.1.4. Reporter-Based Assay

1.1.2. Lab-on-a-Chip Technology

1.1.3. Label-Free Technology

4.3. Global High-Throughput Screening Market By Application

4.3.1. Drug Discovery

4.3.2. Biochemical Screening

4.3.3. Life Sciences Research

4.3.4. Other (Toxicology Assessment)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agilent Technologies Inc.

6.2. Axxam S.p.A.

6.3. Aurora Biomed Inc.

6.4. AZoM Ltd.

6.5. Bio-Rad Laboratories Inc.

6.6. Biomat Srl

6.7. Bmg Labtech Gmbh

6.8. Carna Biosciences

6.9. Celldom

6.10. Charles River Laboratories International, Inc.

6.11. Creative Biolabs

6.12. Diana Biotechnologies S.R.O.

6.13. Lonza Group Ltd.

6.14. NanoTemper Technologies

6.15. Plexium, Inc.

6.16. Promega Corp

6.17. Reprocell Inc.

6.18. SelectScience Ltd.

6.19. Tecan Group Ltd.

6.20. Solvias AG

6.21. Visikol, Inc.

1. GLOBAL HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCT AND SERVICE, 2021-2028 ($ MILLION)

2. GLOBAL HIGH-THROUGHPUT SCREENING CONSUMABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL HIGH-THROUGHPUT SCREENING INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL HIGH-THROUGHPUT SCREENING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL HIGH-THROUGHPUT SCREENING SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

7. GLOBAL CELL-BASED ASSAYS IN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL LAB-ON-A-CHIP TECHNOLOGY IN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL LABEL-FREE TECHNOLOGY IN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

11. GLOBAL HIGH-THROUGHPUT SCREENING IN DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL HIGH-THROUGHPUT SCREENING IN BIOCHEMICAL SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL HIGH-THROUGHPUT SCREENING IN LIFE SCIENCES RESEARCH MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL OWNED HIGH-THROUGHPUT SCREENING IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCT AND SERVICE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

20. EUROPEAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCT AND SERVICE, 2021-2028 ($ MILLION)

22. EUROPEAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

23. EUROPEAN HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCT AND SERVICE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. REST OF THE WORLD HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCT AND SERVICE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)REST OF THE WORLD HIGH-THROUGHPUT SCREENING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL HIGH-THROUGHPUT SCREENING MARKET SHARE BY PRODUCT AND SERVICE, 2021 VS 2028 (%)

2. GLOBAL HIGH-THROUGHPUT SCREENING CONSUMABLES MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL HIGH-THROUGHPUT SCREENING INSTRUMENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL HIGH-THROUGHPUT SCREENING SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL HIGH-THROUGHPUT SCREENING SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL HIGH-THROUGHPUT SCREENING MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

7. GLOBAL CELL-BASED ASSAYS IN HIGH-THROUGHPUT SCREENING MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL LAB-ON-A-CHIP TECHNOLOGY IN HIGH-THROUGHPUT SCREENING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL LABEL-FREE TECHNOLOGY IN HIGH-THROUGHPUT SCREENING MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL HIGH-THROUGHPUT SCREENING MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL HIGH-THROUGHPUT SCREENING IN DRUG DISCOVERY MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL HIGH-THROUGHPUT SCREENING IN BIOCHEMICAL SCREENING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL HIGH-THROUGHPUT SCREENING IN LIFE SCIENCES RESEARCH MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL HIGH-THROUGHPUT SCREENING IN OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL HIGH-THROUGHPUT SCREENING MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

18. UK HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD HIGH-THROUGHPUT SCREENING MARKET SIZE, 2021-2028 ($ MILLION)