Home Gym Equipment Market

Global Home Gym Equipment Market Size, Share & Trends Analysis Report by Product Type (Cardio Equipment (Ellipticals, Treadmills, Exercise Bikes, and Others) and Strength Training Equipment (Free Weights, Barbells & Ladders, Extension, and Others)) and by Distribution Channel (Online and Offline) Forecast Period (2020-2026) Update Available - Forecast 2025-2035

The global home gym equipment market is growing at a CAGR of 3.2% during the forecast period. The home gym equipment market is one of the fastest-growing industries at present owing to the COVID-19 outbreak, as many gyms and health clubs were under lockdown since Q1 2020. Hence, the consumer’s shift toward home gym was a positive driving factor for the home gym equipment industry. Home gym equipment is also driven by an increase in health awareness, the prevalence of obesity, and a rise in health consciousness. Home gym equipment is classified based on product type and sales channel in the market. The global home gym equipment market is vast, with multiple players delivering a diverse range of equipment.

Although online sales have increased in 2020 owing to lockdown measures, the delivery of gym equipment was heavily impacted due to restrictions on the movement of cargo in certain places. Post the relaxation of lockdown measures, both online and offline mediums witnessed a spike in traction. Because of this, vendors, through their offline stores, increased their local sales strategies, particularly in those areas where an online connection doesn’t come easy, and other lesser-known areas to reach the customer better.

Segmental Outlook

The global home gym equipment market is segmented based on product type, and distribution channel. Based on product type, the home gym equipment market is fragmented into cardio equipment, which is further sub-segmented into ellipticals, treadmills, exercise bikes, and others; and strength training equipment, which is further sub-segmented into free weights, barbells & ladders, extensions, and others. Based on the distribution channel, the market is classified into online and offline. Market demand will remain high until 2026, and more due to the availability of online multichannel platforms as vendors increase their virtual presence through e-commerce platforms (own or third party). Offline channels too are expected to grow at a steady rate during the forecast period.

Growth in E-Commerce Fitness Equipment Market

Growth in the home gym equipment market has given a boost to the e-commerce market for home gym equipment, such as Decathlon, Flipkart, Amazon, Snapdeal, and others. These market players saw a surge in sales during the COVID-19 lockdown. Therefore, the home gym equipment market edged over online stores, with the majority of equipment sold being dumbbells, weights, bars, treadmills, and exercise bikes.

Regional Outlook

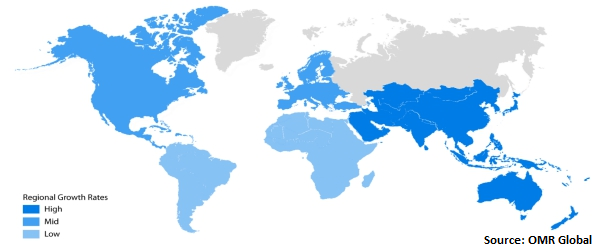

The global home gym equipment market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. The global home gym equipment market saw tremendous success owing to the COVID-19 pandemic outbreak. 2020’s first quarter ended with a contraction in sales, while the second quarter onward, the market saw a surge in sales in various countries such as the UK, Germany, India, and the US. In Europe, the performance was impacted by a weakness in the UK due to Brexit issues; however, a positive trend took effect in France and Germany. In Asia-Pacific, China and India are the top two countries seeing a higher demand in the market. Pricing depends on three factors – material, transportation, and labor costs. It also varies from region to region. For instance, North America has higher labor costs but comparatively low material and transportation costs. On the other hand, Asia-Pacific sees lower labor costs but higher material and transportation costs. Hence, pricing of the product varies considerably, which affects the overall cost of the product across territories, thereby influencing demand in the market.

Global Home Gym Equipment Market Growth, by Region 2020-2026

Market Players Outlook

The market for home gym equipment consists of international as well as local vendors, which has brought a fair amount of competition to the sector. Technogym, Johnson Health, Dyaco, and Nautilus are a few prominent players. Vendors operating in the market are offering products with advanced capabilities to make them more attractive to consumers. Technogym, for example, launched Apple GymKit in March 2018, providing its customers with digital support. The company’s cardio equipment is compatible with the ‘Apple Watch’ through Apple GymKit. The industry is likely to face intensified competition from similar product suppliers in markets where patent protection due to the expiry of the patent is restricted or diminished. The principal competitive factors affecting businesses are quality, brand recognition, innovation, and pricing. The use of online platforms and websites for product sales by traditional retailers has grown, with competitors largely opting for direct and retail sales channels.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global home gym equipment market. Based on the availability of data, information related to the products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Adidas AG

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Dyaco International

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. ICON Health & Fitness

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Nautilus, Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. TECHNOGYM S.p.A.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Home Gym Equipment Market by Product Type

5.1.1. Cardio Equipment

5.1.1.1. Ellipticals

5.1.1.2. Treadmills

5.1.1.3. Exercise Bikes

5.1.1.4. Others

5.1.2. Strength Training Equipment

5.1.2.1. Free Weights

5.1.2.2. Barbells & Ladders

5.1.2.3. Extension

5.1.2.4. Others

5.2. Global Home Gym Equipment Market by Distribution Channel

5.2.1. Online

5.2.2. Offline

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adidas AG

7.2. Amer Sports Corp.

7.3. Cybex International, Inc.

7.4. Dyaco International

7.5. Echelon Fitness Multimedia LLC

7.6. Fitness World

7.7. Health in Motion, LLC

7.8. ICON Health & Fitness

7.9. Implus LLC

7.10. Johnson Health Tech. Co., Ltd.

7.11. Nautilus, Inc.

7.12. Nelco (India) Pvt. Ltd.

7.13. Origin Fitness, Ltd.

7.14. SportsArt, Inc.

7.15. TECHNOGYM S.p.A.

7.16. Torque Fitness USA.

7.17. TRUE Fitness

7.18. Tunturi New Fitness B.V.

1. GLOBAL HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

2. GLOBAL CARDIO EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL STRENGTH TRAINING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

5. GLOBAL ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OFFLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. NORTH AMERICAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

9. NORTH AMERICAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

10. EUROPEAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. EUROPEAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

12. EUROPEAN HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

13. ASIA-PACIFIC HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. REST OF THE WORLD HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD HOME GYM EQUIPMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL HOME GYM EQUIPMENT MARKET SHARE BY PRODUCT TYPE, 2019 VS 2026 (%)

2. GLOBAL HOME GYM EQUIPMENT MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL HOME GYM EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. THE US HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

6. UK HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD HOME GYM EQUIPMENT MARKET SIZE, 2019-2026 ($ MILLION)