Home Medical Equipment Market

Home Medical Equipment Market Size, Share & Trends Analysis Report, by Monitoring Devices (Blood Pressure Monitors, Glucose Monitoring Devices, and Others), by Therapeutic Devices (Dialysis Equipment, Respiratory Equipment, and Others), and by Mobility Care Devices (Wheelchair, Mobility Scooters, Walkers, Canes, and Crutches, Medical Furniture, and Others) Forecast Period (2024-2031)

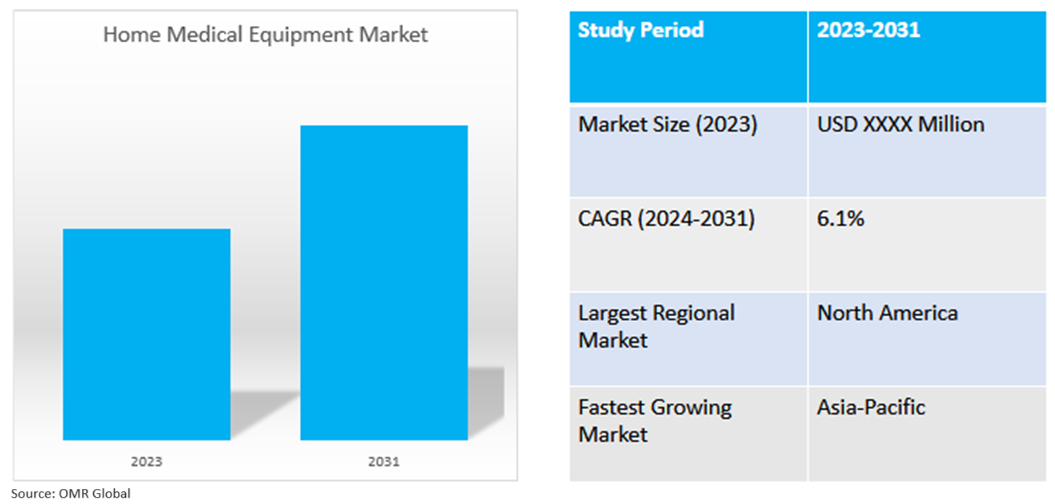

Home medical equipment market is anticipated to grow at a significant CAGR of 6.1% during the forecast period (2024-2031). The industry growth is attributed to the advancements in medical technology that have made medical care of patients easy in the comfort of home. Innovations in medical device technology have led to the development of more compact, user-friendly, and efficient home medical equipment including wearable devices, and smart healthcare apps that enable patients to monitor their health parameters in real-time and share data with healthcare providers seamlessly. For instance, in March 2021, Vanderbilt University Medical Center (VUMC) launched a new medical equipment company Carefluent Connect that integrates advanced technologies to enhance patient care and streamline operations. One key technology implemented is a system that allows for seamless documentation of patient education directly into the electronic health record (EHR). This integration ensures that clinicians are informed when patients receive prescribed equipment and supplies, along with documented education, which helps improve continuity of care.

Market Dynamics

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, and respiratory disorders demands the continuous monitoring and operation of home medical devices. According to the National Center for Chronic Disease Prevention and Health Promotion, in February 2024, it estimated that 129 million individuals in the US have at least 1 major chronic disease, such as heart disease, cancer, diabetes, obesity, or hypertension, The US Department of Health reports that five of the top 10 leading causes of mortalities are preventable and treatable chronic diseases, with 42.0% of Americans having multiple conditions, impacting the healthcare system's $4.1 trillion annual expenditure.

Advancements in Medical Technology

Advancements in medical technology have positively influenced home medical equipment by introducing innovative capabilities, including wearable health devices, telehealth integration, and remote monitoring, which drive market growth. For instance, in June 2024, Sky Medical Supplies introduced a new range of affordable medical equipment, including wheelchairs, mobility scooters, hospital beds, oxygen concentrators, and lift chairs. Further, in April 2024, the Indian Institute of Technology (IIT) Madras launched India's first mobile medical device calibration facility, aiming to boost health and well-being and ensure quality healthcare across the country, including remote villages, by testing and maintaining medical devices.

Market Segmentation

- Based on the monitoring device, the market is segmented into blood pressure monitors, glucose monitoring devices, and others (pregnancy and ovulation kits).

- Based on therapeutic devices, the market is segmented into therapeutic devices, dialysis equipment, respiratory equipment, and others (sleep apnea therapeutic devices).

- Based on mobility care devices, the market is segmented into wheelchairs, mobility scooters, walkers, canes, crutches, medical furniture, and others (rollators).

Mobility Scooters Sub-Segment to Hold a Considerable Market Share

The advancements in mobility scooters enhance their usability and comfort a contributor to the growth of this market segment. For instance, in April 2024, Permobil's introduction of the Power Platform represents a significant advancement in power wheelchair electronics, catering specifically to the evolving needs of individuals with mobility impairments. This new platform integrates cutting-edge technology, such as the QuickConfig app for customizable settings and enhanced connectivity via the MyPermobil app. By addressing user feedback and leveraging technological advancements, Permobil aims to maximize user independence and accessibility, setting new standards in complex rehab technology.

Regional Outlook

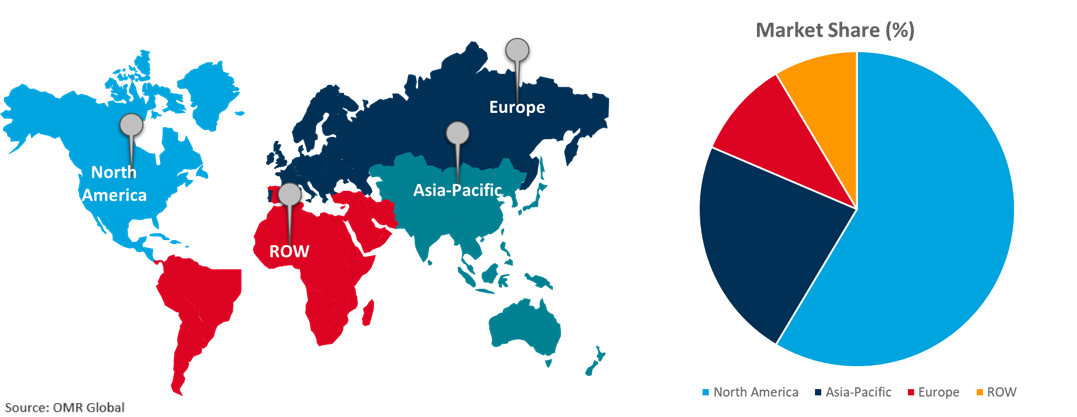

The global home medical equipment market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increase in the Aging Population in Asia-Pacific

The rapidly aging population across the emerging economies of Asia-Pacific such as India is driving the demand for home-based medical equipment to manage health conditions associated with aging. According to the United Nations Population Fund (UNPF), in 2023 India is experiencing an increase in its aging population. In 2022, there are 149 million individuals aged 60 years and above, representing approximately 10.5 percent of the total population. By 2050, this proportion is projected to rise to 20.8 percent, with an estimated 347 million older individuals.

Global Home Medical Equipment Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share of the global home medical equipment market owing to the rising prevalence of diabetes. According to the US Centers for Disease Control and Prevention, in May 2023, approximately 38 million adults lived with diabetes in the US, with one in five unaware of their condition. Type 2 diabetes accounts for 90% to 95% of diagnosed cases, while type 1 diabetes makes up the remaining 5% to 10%. Over the past two decades, the number of diagnosed adults with diabetes has more than doubled, highlighting its growing public health burden. The economic toll is substantial, with medical costs and lost productivity due to diabetes exceeding $413 billion annually. Additionally, the market growth is attributed to supportive government policies and reimbursement. Policies that support home healthcare and reimbursement mechanisms that cover the cost of home medical equipment play a crucial role in expanding the market by making these devices more accessible and affordable for patients. For instance, in January 2022, the Biden Administration launched a major initiative to provide 1 billion at-home, rapid COVID-19 tests to Americans for free. Individuals can order up to four tests per residential address through COVIDTests.gov, with delivery typically within 7-12 days. Additionally, the administration has expanded free testing options through over 20,000 sites globally and mandated private insurers to cover at-home tests, underscoring a comprehensive approach to increasing testing capacity and equitable access across communities.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the home medical equipment market include Abbott Laboratories Inc., Becton, Dickinson and Co., F. Hoffmann-La Roche Ltd, General Electric Co., and Bayer AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In April 2024, Philips and smartQare partnered to automate and simplify continuous patient monitoring in and out of the hospital. It helps to ease the complexity of continuous monitoring by making data and decision support accessible via easy-to-use platforms, regardless of whether the patient is still hospitalized or recovering at home.

- In August 2023, Fresenius Medical Care introduced Innovative Versi®HD with GuideMe Software for Home Hemodialysis. VersiHD with GuideMe Software provides graphical walk-through guidance that aims to enhance ease of use and confidence for both patients and nurses. It is designed to improve patient training time, ease the transition to home, and make the training experience easier for new users.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the home medical equipment market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott Laboratories

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Becton, Dickinson, and Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. F. Hoffmann-La Roche Ltd

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. General Electric Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Bayer AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Home Medical Equipment Market by Monitoring Devices

4.1.1. Blood Pressure Monitors

4.1.2. Glucose Monitoring Devices

4.1.3. Others (Pregnancy and Ovulation Kits)

4.2. Global Home Medical Equipment Market by Therapeutic Devices

4.2.1. Dialysis Equipment

4.2.2. Respiratory Equipment

4.2.3. Others (Sleep Apnea Therapeutic Devices)

4.3. Global Home Medical Equipment Market by Mobility Care Devices

4.3.1. Wheelchair

4.3.2. Mobility Scooters

4.3.3. Walkers, Canes, and Crutches

4.3.4. Medical Furniture

4.3.5. Others (Rollators)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. B. Braun Melsungen AG

6.2. Cardinal Health

6.3. CESCO Bio Products

6.4. Fresenius Medical Care AG & Co. KGaA

6.5. GF Health Products, Inc.

6.6. Hill-Rom Holdings, Inc.

6.7. Invacare Corp.

6.8. Koninklijke Philips N.V.

6.9. McKesson Corp.

6.10. Medtronic PLC

6.11. OMRON Healthcare, Inc.

6.12. Rotech Healthcare Inc.

6.13. Siemens Healthcare GmbH

6.14. Stryker Corp.

6.15. Sunrise Medical (US) LLC