Hot Rolled Steel Market

Hot Rolled Steel Market Size, Share & Trends Analysis Report by End-User Industries (Construction, Automotive, Aviation & Marine, and Yellow Goods and Mining Equipment) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Hot rolled steel market is anticipated to grow at a considerable CAGR of 3.4% during the forecast period. Hot rolled steel is steel that has undergone the rolling process at a temperature above its recrystallization temperature (usually 1700° F or greater). The global market for hot rolled steel is driven by rising industrialization and rising infrastructure spending. The growing automobile industry in developing economies such as India, China, Japan, and South Korea has further contributed to market growth. The high presence of auto manufacturing facilities, low-cost labor and the increasing urbanization are further driving the market gro. Hot rolled steel is highly required by end-user industries owing to its exceptional qualities, including great formidability, weldability, castability, strong residual strain during baking, and high adhesion capacity.

However, due to years of excess steel production capacity and low profitability, the industry is constantly under pressure. The cost of upgrading steelmaking facilities is rising, which has increased the global competition. In the near future, rising automation across a number of industries is anticipated to drive the global market for hot rolled steel.

Segmental Outlook

The global hot rolled steel market is segmented based on end-user industries which includes construction, automotive, aviation & marine, and yellow goods and mining equipment. Among these, the automotive sub-segment held a considerable share of global hot rolled steel market. In recent years, Big River Steel has made plans to increase the amount of flat steel it produces and recycles in Arkansas. The development would triple the company’s ability to produce hot rolled steel annually. The expansion would also increase the business’s ability to produce even higher grades of electric steel, which is anticipated to see an increase in demand soon as the world’s attention turns increasingly to energy efficiency and sales of electric vehicles (EVs) and hybrid electric vehicles (HEVs) rise. According to data collated by Steelmint, Indian mills have agreed to a reduction of ?4,900/tonne in hot rolled coils (HRCs) and ?4,200/tonne in cold rolled coils (CRCs) prices in Q3 FY23 auto contracts. Auto segment accounts for 9-10 per cent of India’s steel consumption.

Regional Outlooks

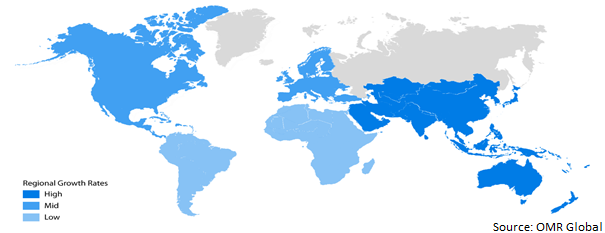

The global hot rolled steel market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific market held considerable share in the hot rolled sheet market in 2022. Increasing automation in various prominent industries of the region is anticipated to drive the growth of the regional hot rolled steel market. Rising disposable income among the middle-class families in India is increasing the expenditure capacity of consumers thereby fueling the growth of automotive industry, in which the hot rolled steel is widely used, ultimately accelerating the rise of hot rolled steel market. Surge in demand for infrastructural activities along with rising industrialization is increasing the demand for hot rolled steel market. Tata is one of the major players of hot rolled steel in India. In July 2022, a 24,000-tonne cargo shipment of Russian-origin hot rolled steel coil arrived in Mumbai on the Akson Serin bulk carrier. Several Indian steelmakers increased their hot rolled steel prices in order to exploit the resulting gap left by the disruption in CIS supply after Russia invaded Ukraine.

Global Hot Rolled Steel Market Growth, by Region 2023-2030

The North America Region is Anticipated to Exhibit Considerable Growth in the Global Hot Rolled Steel Market

North America is anticipated to exhibit considerable Growth in the global hot rolled steel market. The regional market has been driven by the high demand for hot rolled steel from automotive industry. Looking towards the higher demand for the product, in February 2023, Cleveland-Cliffs and Nucor Sheet Mill Group raised prices for hot-rolled products by $50 per ton. The hike sets a new floor for HRC at $900 per ton.

Market Players Outlook

The major market player of the hot rolled steel market includes Tata Steel Ltd., Wuhan Iron and Steel Group Corp., Jiangsu Sha gang Group Co., Ltd., Hebei Iron and Steel Group Co. Ltd., and Baosteel Group Corp. among others. These players are actively adopting growth strategies such as mergers and acquisitions, partnerships, collaboration and agreements to improve their dominance among competitors. Technological innovation is the core strength of key market players in the hot rolled steel market.

For instance, in December 2022, JSW Steel Ltd. Has received BIS all India first License under product certification scheme for “Hot-Rolled Mild Steel Sheet and Strip in Coil Form for Cold-Reduced Tinplate and Cold-Reduced Blackplate” This standard covers the requirements of Hot rolled mild steel sheets and Strips in coil form for production of Cold Reduced tinplate and cold reduced black plate. This hot rolled coil is further cold rolled and electrolytically coated with tin. It is primarily used in food industries for packaging.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hot rolled steel market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baosteel Group Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hebei Iron and Steel Group Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Jiangsu Shagang Group Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wuhan Iron and Steel Group Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Tata Steel Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hot Rolled Steel Market by End-User Industries

4.1.1. Construction

4.1.2. Automotive

4.1.3. Aviation & Marine

4.1.4. Yellow Goods & Mining Equipment

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. A G Universal Ltd.

6.2. ArcelorMittal S.A

6.3. Baosteel Group Corp.

6.4. Hebei Iron and Steel Group Co. Ltd.

6.5. Hyundai Steel Co., Ltd

6.6. JFE Steel Corp.

6.7. JSW Group

6.8. Jiangsu Shagang Group Co., Ltd

6.9. Nippon Steel Corp.

6.10. Pohang Iron and Steel Co. (POSCO)

6.11. Raunaq Steels Trading Pvt. Ltd.

6.12. Shree Ji Steel Corp.

6.13. Steel Authority of India Limited (SAIL)

6.14. Tata Steel Ltd.

6.15. Wuhan Iron and Steel Group Corp.

1. GLOBAL HOT ROLLED STEEL MARKET BY END-USER INDUSTRIES, 2022-2030 ($ MILLION)

2. GLOBAL HOT ROLLED STEEL FOR CONSTRUCTION MARKET BY REGION,2022-2030 ($ MILLION)

3. GLOBAL HOT ROLLED STEEL FOR AUTOMOTIVE MARKET BY REGION,2022-2030 ($ MILLION)

4. GLOBAL HOT ROLLED STEEL FOR AVIATION & MARINE MARKET BY REGION,2022-2030 ($ MILLION)

5. GLOBAL HOT ROLLED STEEL FOR YELLOW GOODS & MINING EQUIPMENT MARKET BY REGION,2022-2030 ($ MILLION)

6. GLOBAL HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. NORTH AMERICAN HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

8. NORTH AMERICAN HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRIES, 2022-2030 ($ MILLION)

9. EUROPEAN HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. EUROPEAN HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRIES, 2022-2030 ($ MILLION)

11. ASIA-PACIFIC HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. ASIA-PACIFIC HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRIES, 2022-2030 ($ MILLION)

13. REST OF THE WORLD HOT ROLLED STEEL MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRIES, 2022-2030 ($ MILLION)

1. GLOBAL HOT ROLLED STEEL MARKET SHARE BY END-USER INDUSTRIES, 2022 VS 2030 (%)

2. GLOBAL HOT ROLLED STEEL FOR CONSTRUCTION MARKET BY REGION, 2022 VS 2030 (%)

3. GLOBAL HOT ROLLED STEEL FOR AUTOMOTIVE MARKET BY REGION, 2022 VS 2030 (%)

4. GLOBAL HOT ROLLED STEEL FOR AVIATION & MARINE MARKET BY REGION, 2022 VS 2030 (%)

5. GLOBAL HOT ROLLED STEEL FOR YELLOW GOODS & MINING EQUIPMENT MARKET BY REGION, 2022 VS 2030 (%)

6. GLOBAL HOT ROLLED STEEL MARKET BY REGION, 2022 VS 2030 (%)

7. US HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

8. CANADA MARKET HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

9. UK HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

10. GERMANY HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

11. SPAIN HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

14. REST OF EUROPE HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

15. INDIA HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

16. CHINA HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

17. JAPAN HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OFASIA-PACIFIC HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)

19. REST OF WORLD HOT ROLLED STEEL MARKET SIZE, 2022-2030 ($ MILLION)