Humic Acid Market

Global Humic Acid Market Size, Share & Trends Analysis Report by From (Powdered, Granular, and Liquid)By Application (Agriculture & Horticulture, Animal Feed, Pharmaceuticals, Dietary Supplements, and Others) Forecast Period (2021-2027) Update Available - Forecast 2025-2031

The global humic acid market is anticipated to grow at a considerable CAGR of 11.4% during the forecast period. The major factor boosting the market growth is high demand for diatery supplements, and demand for humic acid in making animal feed. Humic acid is majorly used in dietary supplements in the form of vitamin, mineral, herbal products, and other ingestible products which used to strengthen the immune system. Moreover, taking humic acid in dietary supplements helps in the supply of oxygen level to red blood cells in the body, speeds up the metabolism rate, strengthens natural skin protection against UV rays. Humic acid in dietary supplements is available in the form of pills, liquid, and powder. The regulation of dietary supplements varies according to the country. In the US, supplement food was regulated under the Dietary Supplement Health and Education Act (DSHEA). Under the regulation of DSHEA, the US Food and Drug Administration(FDA), treated dietary supplements as foods, not as drugs. Owing to their useful benefits the humic acid in dietary supplements is expected to grow during the forecast period.

The rising mergers and acquisition among players is further likely to accelerate the market growth. For instance, in April 2021, Nestle Health Science, has acquired Bountiful Company. The acquisition of the company provides a broader range of dairy supplements and healthy food products, which enhances the health of customers across the globe.

Impact of COVID-19 Pandemic on Global Humic Acid Market

COVID-19 pandemic has distressed the economy of country across the globe. Emergence of COVID-19 variants continue to spread and has impacted industrial, manufacturing, and other services units. Closing down of various production and service sector has slower the growth of economy of the country. Strict lockdown caused disruptions in transportation,logistics, businesses, operations, and agriculture, fisheries and, dairty sector. Moreover, restriction in the movement of labour, raw material , caused a loss of employment and financial crises.

Moreover, COVID-19 pandemic also brought positive change in the life style of people, as they are more concern about their health and people preferred to eat healthy and nourishment food which strengthen their immune system. Humic acid helps to soften the blood vessels, circulate the blood to other parts of the body, maintain the metabolism of liver and man more. After COVID-19 the demand of humic acid has grown rapidly as people are become more conscious about their physical and mental health.

Segmental Outlook

The global humic acid market is segmented based on the form and application. Based on the form, the market is sub-segmented into powdered, granular, and liquid. Based on the application, the market is sub-segmented into the agriculture & horticulture, animal feed, pharmaceuticals, dietary supplements, and others.

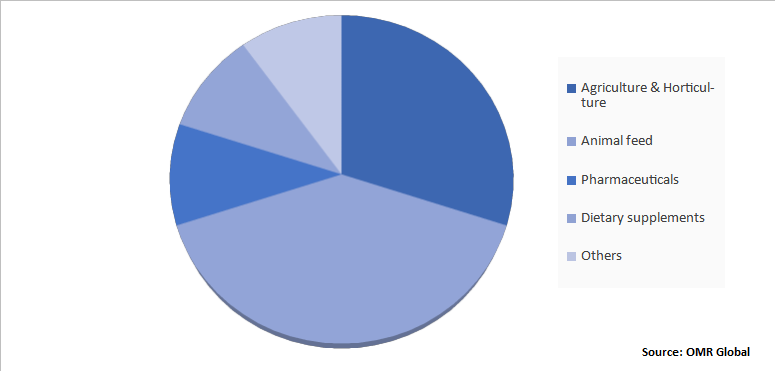

Global Humic Acid Market Share by Application, 2020 (%)

The Agriculture& Horticulture Segment Holds the Major Share in the Global Humic Acid Market

The agriculture & horticulture market is expected to hold the major share in the market. Humic acid performs a major role in binding the insoluble ions and prevents the leaching of nitrogen. Humic acid is essential for crops and plants, to provide deep root nourishment, prevent soil erosion, and help to provide essential vital nutrients to plants . Humic acid can be used in the form of liquid, powder, granular so that a sufficient amount of acid is spread to the plants. Owing to such factors the market is anticipated to grow at the forecast period. The increasing global population, urbanization, and industrialization has surged the food demand across the globe, which in turn has boosted the utilization of humic acid in agriculture sector. With further development in agriculture sector owing to growing population, the demand for humic acid to increase nutritive value of the land due to presence of organic elements needed to improve soil fertility, is projected to increase more, that will help the segment to grow during the forecast period.

Regional Outlooks

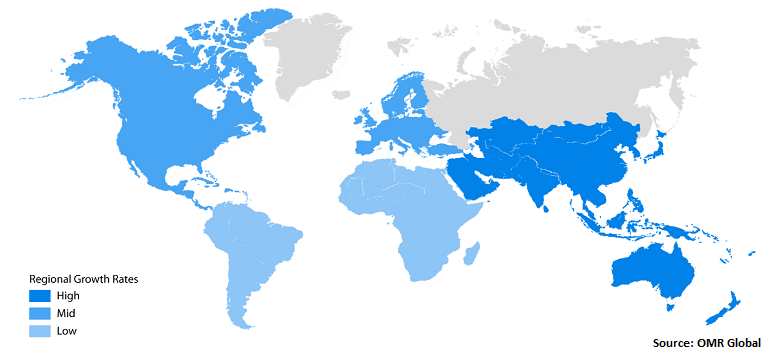

The global humic acid market is further segmented based on geography including North America (the US, and Canada), Europe (UK,Italy, Spain, Germany, France, and rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and rest of Asia-Pacific), and the Rest of the World (the Middle East &Africa, and Latin America). Among these, Asia-Pacific is projected to be the fastest growing region during the forecast period.

Global Humic Acid Market Growth, by Region 2021-2027

The North-America Region Holds the Major Share in the Global Humic Acid Market

Geographically, North-America is a major contributor in the growth of humic acid market. The increase in utilization of organic food products, concern about health and fitness among young generation, growing use of humic acid in agriculture and pharmaceutical industry are the major drivers for market growth in North-America region. In North America, agriculture is the major source of income for people, increasing need for organic products and natural fertilizers, rise in exports and imports of agriculture products, are the major factor which contributes in the development of humic acid market. Moreover, to strengh then the immune system, the need for humic acid is become essential ingredients in food products. Such factor will stimulate the regional market growth of humic acid market.

Market Players Outlook

The major companies serving the global humic acid market include Agbest Technology Co. ltd., Arihant Chemical Industries, BIOAG., Balck Earth Humic LP., Aglukon, Andersons Inc., Biolchim SPA., Desarrollo Agricola Y Minero S.A,and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2020, Black Earth Humic acquired Canadina Humalite International. The newly entity named as Black Earth Products Inc. This acquisitions aid company to brings a wider array of high-quality humic acid and fertilizers designed for agriculture and industrial use.

The Report Covers

• Market value data analysis of 2020 and forecast to 2027.

• Annualized market revenues ($ million) for each market segment.

• Country-wise analysis of major geographical regions.

• Key companies operating in the global humic acid market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

• Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

• Analysis of market-entry and market expansion strategies.

• Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Humic Acid Market

• Recovery Scenario of Global Humic Acid Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Humic Acid Market by Form

4.1.1. Powdered

4.1.2. Granular

4.1.3. Liquid

4.2. Global Humic Acid Market by Application

4.2.1. Agriculture & Horticulture

4.2.2. Animal Feed

4.2.3. Pharmaceuticals

4.2.4. Dietary Supplements

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aglukon

6.2. Andersons Inc.

6.3. Biolchim SPA.

6.4. Cifo SRL

6.5. Desarrollo Agrícola Y Minero, S.A.

6.6. Grow More Inc.

6.7. Humintech GmbH

6.8. Humic Growth Solutions, Inc.

6.9. Jiloca Industrial S.A.

6.10. Koppert Biological systems

6.11. Land O’Lakes Inc.

6.12. Minerals Technologies Inc.

6.13. Nature’s Lawn and Garden Inc.

6.14. Nutri-Tech Solutions Pvt. Ltd.

6.15. Omnia Specialities Pvt.

6.16. Pingxiang Jiangxi Annwa Biotechnology Co., Ltd

6.17. Saint Humic Acid

6.18. Shandong Chuangxin Humic Acid Technology Co. Ltd.

6.19. Sikko Industries Ltd.

6.20. VALAGRO S.P.A,

6.21. Wilbur-Ellis Holdings, Inc.

1. GLOBAL HUMIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2020-2027 ($ MILLION)

2. GLOBAL POWDERED HUMIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL GRANULAR HUMIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL LIQUID HUMIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL HUMIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

6. GLOBAL HUMIC ACID IN AGRICULTURE & HORTICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL HUMIC ACID IN ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL HUMIC ACID IN PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL HUMIC ACID DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OTHER HUMIC ACID MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL HUMIC ACID MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2020-2027 ($ MILLION)

14. NORTH AMERICAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

15. EUROPEAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2020-2027 ($ MILLION)

17. EUROPEAN HUMIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC HUMIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC HUMIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC HUMIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. REST OF THE WORLD HUMIC ACID MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. REST OF THE WORLD HUMIC ACID MARKET RESEARCH AND ANALYSIS BY FORM, 2020-2027 ($ MILLION)

23. REST OF THE WORLD HUMIC ACID MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HUMIC ACID MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HUMIC ACID MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL HUMIC ACID MARKET, 2021-2027 (%)

4. GLOBAL HUMIC ACID MARKET SHARE BY FORM, 2020 VS 2027 (%)

5. GLOBAL POWDERED HUMIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL GRANULAR HUMIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL LIQUID HUMIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL HUMIC ACID MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

9. GLOBAL HUMIC ACID IN AGRICULTURE & HORTICULTURE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL HUMIC ACID IN ANIMAL FEED MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL HUMIC ACID IN PHARMACEUTICALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL HUMIC ACID IN DIETARY SUPPLEMENTS MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL HUMIC ACID IN OTHER MARKET REGION BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL HUMIC ACID MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

17. UK HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD HUMIC ACID MARKET SIZE, 2020-2027 ($ MILLION)