Hunter Syndrome Treatment Market

Global Hunter Syndrome Treatment Market Size, Share & Trends Analysis Report, by Treatment (Enzyme Replacement Therapy (ERT), Hematopoietic Stem Cell Transplant (HSCT), Others) and Forecast Period 2019-2025 Update Available - Forecast 2025-2035

The global hunter syndrome treatment market is estimated to grow at a CAGR of around 5% during the forecast period. Hunter syndrome is also known as Mucopolysaccharidosis type II or MSP II. It is a very rare genetic disorder caused by the malfunction of the enzyme. Hunter syndrome happens due to the deficiency of the enzyme. The enzyme breaks down certain complex sugar molecules, when enzyme deficits in the body these sugar molecules grow up in harmful amounts. By breaking down,this kind of sugar molecule helps to build bones, skins, tendons, and other tissues. When these sugar molecules grow up it damages parts of bodies including the brain.

Hunter syndrome is mainly seen in boys. According to the National MPS Society, 1 in 1,00,000 to 1 in 1,70,000 every male are affected by the hunter syndrome. When a mother is a carrier of MSP II, there is a 50% chance that her baby boy will have the hunter syndrome. Although rare hunter syndrome has been diagnosed in girls too. Girls have less chance of having hunter syndrome as they have two X chromosomes if any of the X chromosomes is defective, then the other normal X chromosome can provide a functional gene. Where a male has only one X chromosome, if it is defective then the male suffers hunter syndrome.

Innovative novel therapies in clinical trials and increasing R&D activities by major market players for the development of hunter syndrome treatment are the major two driving factors of the global hunter syndrome treatment market. For instance, in June 2019, Denali Therapeutics Inc. got approval from the FDA for DNL310, it is used to improve overall clinical manifestations of Hunter syndrome, including both peripheral and neurological symptoms, which are not adequately addressed by currently approved therapies. The high cost involved in the treatment of hunter syndrome is restraining the growth of the global hunter syndrome treatment market. For instance, the current treatment cost for hunter syndrome costs an amount of $250,000 to $500,000 per year per patient.

Segmentation

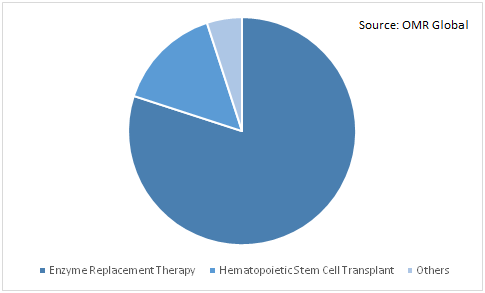

The global hunter syndrome treatment market is segmented based on treatment into Enzyme Replacement Therapy (ERT), Hematopoietic Stem Cell Transplant (HSCT), and others (Gene Therapy, Bone Marrow Transplant, and Tonsillectomy). There is no cure, however,treatments such as enzyme replacement therapies can help make the disease more manageable. Enzyme replacement therapy (ERT) is an FDA approved medical procedure. This drug is given through an intravenous line oncea week. If enzyme replacement therapy is given at the early stage of hunter syndrome, it may delay or prevent some of the symptoms of Hunter syndrome. Although, in enzyme replacement therapy there are some side effects, such as allergic reactions, headache, fever and skin reactions. Some of the enzyme replacement therapy drugs are Elaprase (idursulfase) by Shire Plc, Hunterase (idursulfase) by GC Pharma, and others.

Global Hunter Syndrome Treatment Market Share by Treatment, 2018 (%)

Regional outlook

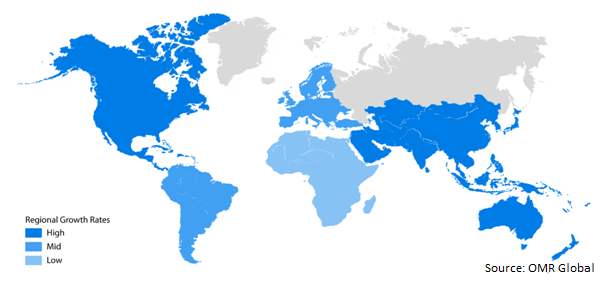

North America is expected to have a significant market share in the global hunter syndrome treatment market. Key factors that are driving the market in the region include growing awareness among the public, availability of proper healthcare infrastructures, and the presence of the major players offering innovative drugs for hunter syndrome treatment in the market. Moreover, awareness campaigns about the benefits of hunter syndrome treatment conducted by some NGOs are also driving the market in North America. For instance, in May 2018, Shire Plc., National MPS Society, and International MPS Network collaboratively launched a digital campaign to create awareness about hunter syndrome treatment among the public, named #FlyforMPS. Also, 15th May is International MPS awareness day.

The market in the Asia-Pacific region is the fastest-growing owing to the rise of large numbers of the patient, growing economy, and increasing health awareness in the Asia-pacific region is driving the hunter syndrome treatment market. Due to these factors, key players are focused on gaining approval for hunter syndrome treatment drug therapies mainly in China, India, and Japan market. For instance, in July 2019, CAN Bridge Pharmaceuticals Inc. filled application to get approval for Hunterase from National Medical Products Administration (NMPA), China. Hunterase is used for the treatment of Hunter syndrome and it is a patented therapy of GC Pharma.

Global Hunter Syndrome Treatment Market Growth, by Region 2019-2025

Competitive Landscape

The major players providing drugs of hunter syndrome treatment include Shire Plc. (Takeda Pharmaceutical Company), GC Pharma, JCR Pharmaceuticals Co Ltd., RegenxBio Inc., Sangamo Therapeutics, Inc., ArmaGen Inc., Inventiva S.A., Denali Therapeutics Inc., and others. The range of products provided by these companies includes One Path, Hunterase, Elaprase, RGX-121, and others. Mergers and acquisitions and product launches are considered as crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance,in December 2019, Regenxbio’s R&D on gene therapy RGX-121 showed a positive action in the hunter syndrome treatment study. In this study, the company found this gene therapy can decline high levels of heparan sulfate which are associated with neurocognitive by 33% from baseline to week 8. Also, this study found that those patients who progressed beyond week 24 showed stable neurocognitive development. The estimated completion date of this R&D study is December 2022.

Few more recent developments-

- In August 2018, ArmaGen received the US Orphan Drug Designation for AGT-184. It is an investigational enzyme replacement therapy (ERT) for the treatment of hunter syndrome treatment.

- In February 2018, Inventive announced it shows a positive outcome of biomarker study measuring intracellular GAGs in leukocytes from MPS VI patients. This R&D is intended to reduce leuko GAGs enzymes using MPS VI and limited ERT.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hunter syndrome treatment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Takeda Pharmaceutical Company

3.3.1.1. Overview

3.3.1.2. SWOT Analysis

3.3.1.3. Recent Developments

3.3.2. Clinigen Group PLC

3.3.2.1. Overview

3.3.2.2. SWOT Analysis

3.3.2.3. Recent Developments

3.3.3. JCR Pharmaceuticals Co Ltd.

3.3.3.1. Overview

3.3.3.2. SWOT Analysis

3.3.3.3. Recent Developments

3.3.4. RegenxBio Inc.

3.3.4.1. Overview

3.3.4.2. SWOT Analysis

3.3.4.3. Recent Developments

3.3.5. ArmaGen, Inc.

3.3.5.1. Overview

3.3.5.2. SWOT Analysis

3.3.5.3. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Hunter Syndrome Treatment Market by Treatment

5.1.1. Enzyme Replacement Therapy (ERT)

5.1.2. Hematopoietic Stem Cell Transplant (HSCT)

5.1.3. Others ( Gene Therapy, Bone Marrow Transplant, Tonsillectomy)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ArmaGen, Inc.

7.2. Bioasis Technologies, Inc.

7.3. Clinigen Group PLC

7.4. Denali Therapeutics, Inc.

7.5. Esteve Pharmaceuticals, S.A.

7.6. GC Pharma Corp.

7.7. Inventiva S.A.

7.8. JCR Pharmaceuticals Co., Ltd.

7.9. REGENXBIO, Inc.

7.10. Sangamo Therapeutics, Inc.

7.11. Shire Plc. (Takeda Pharmaceutical Company)

1. GLOBAL HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

2. GLOBAL ENZYME REPLACEMENT THERAPY (ERT) TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

3. GLOBAL HEMATOPOIETIC STEM CELL TRANSPLANT (HSCT) TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

4. GLOBAL OTHERS TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

5. GLOBAL HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

6. NORTH AMERICAN HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

7. NORTH AMERICAN HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

8. EUROPEAN HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

9. EUROPEAN HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

10. ASIA-PACIFIC HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. ASIA-PACIFIC HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

12. REST OF THE WORLD GLOBAL HUNTER SYNDROME TREATMENT MARKET RESEARCH AND ANALYSIS BY TREATMENT, 2018-2025 ($ MILLION)

1. GLOBAL HUNTER SYNDROME TREATMENT MARKET SHARE BY TREATMENT, 2018 VS 2025 (%)

2. GLOBAL HUNTER SYNDROME TREATMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. UK HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD HUNTER SYNDROME TREATMENT MARKET SIZE, 2018-2025 ($ MILLION)