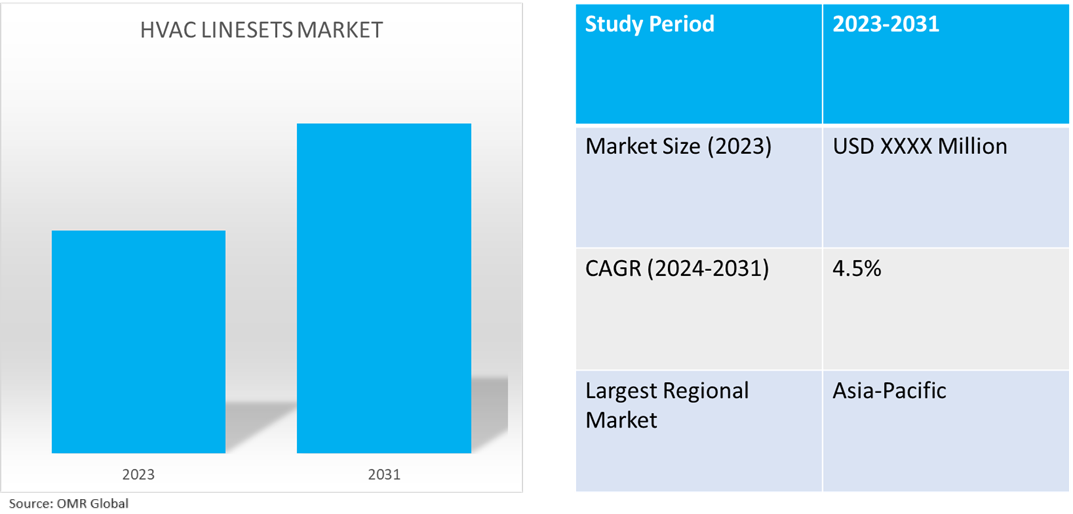

HVAC Linesets Market

HVAC Linesets Market Size, Share & Trends Analysis Report by Material Type (Copper, Low Carbon, and Others), by End-User (Residential, Commercial, and Industrial), and by Implementation (New Construction, and Retrofit) Forecast Period (2024-2031)

HVAC linesets market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). HVAC linesets comprise a pair of tubes that connect outdoor air conditioners with indoor evaporator coils providing features such as refringent transfer, heat transfer, and pressure regulation, among others. The key growth-driving factors for the market include increasing demand for energy-efficient HVAC systems, the growing rate of urbanization, and advancement in HVAC systems and relative technology.

Market Dynamics

Rising Global Temperature and Environmental Concerns

Global environmental dynamics strongly influence the growth of the HVAC lineset market. In recent decades, global temperatures have risen exponentially, which has created demand for air conditioning and other HVAC systems across sectors and end-user requirements. Further, manufacturers are optimizing HVAC technology, such as eco-friendly refrigerators, to reduce environmental impacts and emissions. However, throughout advancements and changes in HVAC systems, linesets remain an integral component to support the functioning of current and novel HVAC systems, providing energy efficiency and optimum refrigeration and power transfer features. For instance, the 2023 Global Climate Report from the NOAA National Centers for Environmental Information states that each month of 2023 was among the top 7 warmest for that month, and the months from June to December were the hottest on record. Specifically, global temperatures in July, August, and September surpassed 1.0°C (1.8°F) above the long-term average, marking the first instance in NOAA's record of any month exceeding that threshold. Additionally, NOAA's 2023 Annual Climate Report indicates that the combined land and ocean temperature has risen at an average rate of 0.11° Fahrenheit (0.06° Celsius) per decade since 1850, totaling about 2° F. The pace of warming since 1982 has been more than three times faster, reaching 0.36°F (0.20°C) per decade.

Urbanization & Infrastructure Development

The other factor influencing the demand for HVAC lighting is rapid urbanization and infrastructure development, particularly in emerging countries. The rise in urban population has created an increased demand for HVAC products such as AC and refrigerators owing to the residential lifestyle culture in urban areas, which has resulted in a derived demand for linesets. For instance, as per the World Bank, over 50.0% of the population lives in urban areas today, and by 2045, the world's urban population will increase by 1.5 times to 6 billion. The rising urban population with an increase in global per capita is contributing to the rise.

Segmental Outlook

- Based on material type, the market is segmented into copper, low carbon, and others (aluminum, and polyethylene).

- Based on end-users, the market is segmented into residential, commercial, and industrial.

- Based on implementation, the market is segmented into new construction, and retrofit.

Copper is the Most Prominent HVAC Linesets Material Type

Copper is the most prominent material type in HVAC linesets due to its high heat resistance, longer life duration, comparatively higher durability as compared to other materials, better output, and high consumer preference in residential settings, among others.

Commercial Holds Major Share Based on End-Users

The commercial sector is projected to remain the biggest end-user of HVAC linsets owing to increasing demand for HVAC systems in commercial settings such as offices, hospitals, malls, and supermarkets, among others, and the requirement for multiple systems in a single structure.

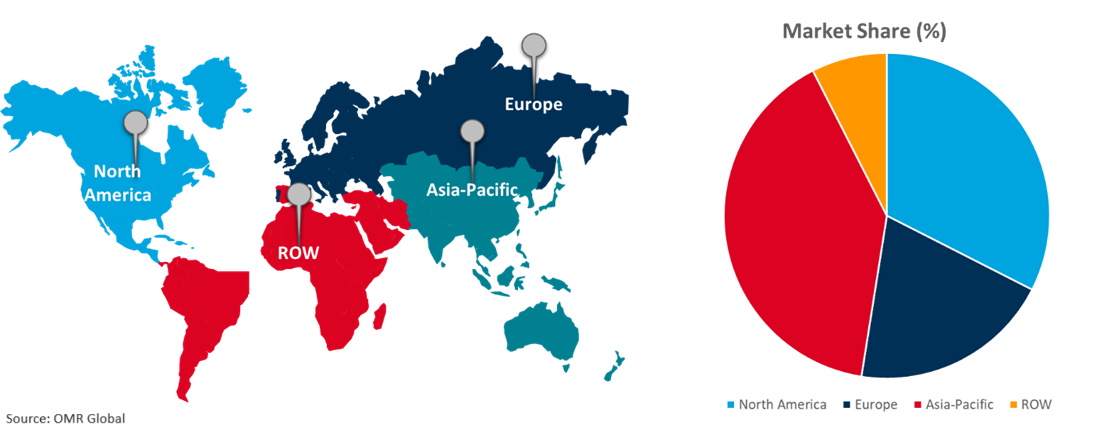

Regional Outlook

The global HVAC linesets market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global HVAC Linesets Market Growth by Region 2024-2031

Asia-Pacific is Estimated to Demonstrate Significant Market Growth

Asia-Pacific is predicted to demonstrate the highest growth rate during the forecast period, attributed to the ongoing increase in demand for HVAC systems in the region, and growing investment in the development of infrastructure. The rising disposable income in major emerging nations from Asia-Pacific such as India, Myanmar, Thailand, and others, the rapidly growing commercial and industrial sector in the region, and the presence of major HVAC systems and lineset manufacturers such as LG and Daikin, among others, are other contributors to the regional market growth. For instance, as per IBEF India, the capital investment allocation for infrastructure has been increased by 11.1% in the Interim Budget 2024–25 to Rs. 11.11 lakh crore ($133.86 billion), or 3.4% of GDP. The Railways have been allocated a capital outlay of Rs. 2.55 lakh crore ($ 30.72 billion) under the Interim Budget 2023–24, which represents a 5.8% increase over the previous year.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global HVAC linesets market include Daikin Industries, Ltd., Johnson Controls International plc, and LG Electronics Inc. among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in September 2022, the YORK brand of Johnson Controls, the global leader for smart and sustainable buildings, is driving greater efficiencies in residential and light commercial markets with its launch of the next generation of YORK Residential Package Equipment. The comprehensive AC and heat pump range is offered in both 14 SEER and ENERGY STAR-certified 16 SEER efficiencies with electric or gas heating, providing affordable performance and reduced energy use compared to older models.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global HVAC linesets market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Implementation Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global HVAC Linesets Market by Material Type

4.1.1. Copper

4.1.2. Low Carbon

4.1.3. Others (Aluminum and Polyethylene)

4.2. Global HVAC Linesets Market by End-User

4.2.1. Residential

4.2.2. Commercial

4.2.3. Industrial

4.3. Global HVAC Linesets Market by Implementation

4.3.1. New Construction

4.3.2. Retrofit

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Alt-Line

6.2. CSW Industrials, Inc.

6.3. Cambridge-Lee Industries LLC

6.4. Daikin Industries, Ltd.

6.5. Dial Manufacturing, Inc.

6.6. DiversiTech Corp.

6.7. Elvalhalcor Hellenic Copper and Aluminium Industry S.A (Halcor)

6.8. Good Brand Co.

6.9. JMF Co.

6.10. Johnson Controls International plc

6.11. Klimaire Products Inc.

6.12. Lennox International, Inc.

6.13. Linesets Inc.

6.14. LG Electronics Corp.

6.15. McChesney Heating and Air Conditioning, Inc.

6.16. Mueller Streamline Co.

6.17. Norsk Hydro ASA

6.18. Python (Flex-Tek)

6.19. Thermo Manufacturing

6.20. York (Johnson Controls)

1. Global HVAC Linesets Market Research and Analysis by Material Type, 2023-2031 ($ Million)

2. Global Copper-Based HVAC Linesets Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Low Carbon-Based HVAC Linesets Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Other Materials Based HVAC Linesets Market Research and Analysis by Region, 2023-2031 ($ Million)

5. Global HVAC Linesets Market Research and Analysis by End-User, 2023-2031 ($ Million)

6. Global HVAC Linesets for Residential Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global HVAC Linesets for Commercial Market Research and Analysis by Region, 2023-2031 ($ Million)

8. Global HVAC Linesets for Industrial Market Research and Analysis by Region, 2023-2031 ($ Million)

9. Global HVAC Linesets Market Research and Analysis by Implementation, 2023-2031 ($ Million)

10. Global HVAC Linesets in New Construction Market Research and Analysis by Region, 2023-2031 ($ Million)

11. Global HVAC Linesets in Retrofit Market Research and Analysis by Region, 2023-2031 ($ Million)

12. Global HVAC Linesets Analysis Market Research and Analysis by Region, 2023-2031 ($ Million)

13. North American HVAC Linesets Market Research and Analysis by Country, 2023-2031 ($ Million)

14. North American HVAC Linesets Market Research and Analysis by Material Type, 2023-2031 ($ Million)

15. North American HVAC Linesets Market Research and Analysis by End-User, 2023-2031 ($ Million)

16. North American HVAC Linesets Market Research and Analysis by Implementation, 2023-2031 ($ Million)

17. European HVAC Linesets Market Research and Analysis by Country, 2023-2031 ($ Million)

18. European HVAC Linesets Market Research and Analysis by Material Type, 2023-2031 ($ Million)

19. European HVAC Linesets Market Research and Analysis by End-User, 2023-2031 ($ Million)

20. European HVAC Linesets Market Research and Analysis by Implementation, 2023-2031 ($ Million)

21. Asia-Pacific HVAC Linesets Market Research and Analysis by Country, 2023-2031 ($ Million)

22. Asia-Pacific HVAC Linesets Market Research and Analysis by Material Type, 2023-2031 ($ Million)

23. Asia-Pacific HVAC Linesets Market Research and Analysis by End-User, 2023-2031 ($ Million)

24. Asia-Pacific HVAC Linesets Market Research and Analysis by Implementation, 2023-2031 ($ Million)

25. Rest of the World HVAC Linesets Market Research and Analysis by Region, 2023-2031 ($ Million)

26. Rest of the World HVAC Linesets Market Research and Analysis by Material Type, 2023-2031 ($ Million)

27. Rest of the World HVAC Linesets Market Research and Analysis by End-User, 2023-2031 ($ Million)

28. Rest of the World HVAC Linesets Market Research and Analysis by Implementation, 2023-2031 ($ Million)

1. Global HVAC Linesets Market Share by Material Type, 2023 Vs 2031 (%)

2. Global Copper Based HVAC Linesets Market Share by Region, 2023 Vs 2031 (%)

3. Global Low-Carbon Based HVAC Linesets Market Share by Region, 2023 Vs 2031 (%)

4. Global Other Materials Based HVAC Linesets Market Share by Region, 2023 Vs 2031 (%)

5. Global HVAC Linesets Market Share by End-User, 2023 Vs 2031 (%)

6. Global HVAC Linesets for Residential Market Share by Region, 2023 Vs 2031 (%)

7. Global HVAC Linesets for Commercial Market Share by Region, 2023 Vs 2031 (%)

8. Global HVAC Linesets for Industrial Market Share by Region, 2023 Vs 2031 (%)

9. Global HVAC Linesets Market Share by Implementation, 2023 Vs 2031 (%)

10. Global HVAC Linesets in New Construction Market Share by Region, 2023 Vs 2031 (%)

11. Global HVAC Linesets in Retrofit Market Share by Region, 2023 Vs 2031 (%)

12. Global HVAC Linesets Market Share by Region, 2023 Vs 2031 (%)

13. US HVAC Linesets Market Size, 2023-2031 ($ Million)

14. Canada HVAC Linesets Market Size, 2023-2031 ($ Million)

15. UK HVAC Linesets Market Size, 2023-2031 ($ Million)

16. France HVAC Linesets Market Size, 2023-2031 ($ Million)

17. Germany HVAC Linesets Market Size, 2023-2031 ($ Million)

18. Italy HVAC Linesets Market Size, 2023-2031 ($ Million)

19. Spain HVAC Linesets Market Size, 2023-2031 ($ Million)

20. Rest Of Europe HVAC Linesets Market Size, 2023-2031 ($ Million)

21. India HVAC Linesets Market Size, 2023-2031 ($ Million)

22. China HVAC Linesets Market Size, 2023-2031 ($ Million)

23. Japan HVAC Linesets Market Size, 2023-2031 ($ Million)

24. South Korea HVAC Linesets Market Size, 2023-2031 ($ Million)

25. Rest Of Asia-Pacific HVAC Linesets Market Size, 2023-2031 ($ Million)

26. Latin America HVAC Linesets Market Size, 2023-2031 ($ Million)

27. Middle East and Africa HVAC Linesets Market Size, 2023-2031 ($ Million)