HVDC Cables Market

HVDC Cables Market Size, Share & Trends Analysis Report, By Voltage (High {35 kV to 475 kV}, Extra High {> 475 kV to 600 kV}, and Ultra-High {> 600 kV}), By Installation (Overhead, Submarine, and Underground), By Application (Intra-Regional and Cross Border), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

HVDC cables market is anticipated to grow at a CAGR of 7.0% during the forecast period. The expansion of smart grid infrastructure coupled with the up-gradation and modernization of existing infrastructure is resulting in increasing demand for HVDC cables. A high-voltage, direct current (HVDC) electric power transmission system uses direct current (DC) for the transmission of electrical power, in contrast with the more common alternating current (AC) systems. High voltage DC cables are used owing to their lightweight, high-power transmission capacity, low maintenance, and minimum handling cost. According to the Observatory of Economic Complexity (OEC), in 2020 the top importers of Parts of electrical transformers and inductors were the US ($1.4 billion), Hong Kong ($952 million), China ($833 million), Germany ($776 million), and India ($382 million). These factors will strongly propel the demand for HVDC cables during the forecast period.

Segmental Outlook

The global HVDC cables market is segmented based on voltage, installation, and application. Based on the voltage, the market is segmented into high {35 kV to 475 kV}, extra high {> 475 kV to 600 kV}, and ultra-high {> 600 kV}. Based on the installation, the market is segmented into overhead, submarine, and underground. Based on application the market is segmented into Intra-regional and cross-border. Based on the voltage, the extra-high HVDC cables are anticipated to grow at the fastest rate during the forecast period owing to the ongoing installation of the long route transmission lines to meet the rising electricity demand. In addition, the ongoing advancements to deploy energy-efficient power lines will drive the product demand. The above-mentioned segments can be customized as per the requirements. According to the World Green Building Council, around 4.3 billion people live in the Asia-Pacific region, out of which 2 billion lives in urban areas, and it is also anticipated that this will increase to 3.3 billion by 2050. This shows the need for increasing electricity demand and for energy-efficient power lines which will boost the demand for extra-high HVDC cables during the forecast period. Additionally, according to International Energy Agency (IEA), after falling by about 1% in 2020 due to the impacts of the COVID-19 pandemic, the global electricity demand increased close to 5% in 2021 and will increase around 4% in 2022.

Regional Outlook

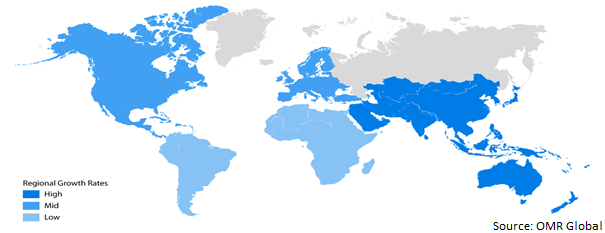

The global HVDC cables market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Europe is anticipated to grow at the fastest rate during the forecast period. For instance, Hecate Independent Power (HIP) is to build a nearly $238 million submarine cable factory in the UK to support its $30 billion offshore wind power project.

Global HVDC Cables Market Growth, by Region 2022-2028

Asia-Pacific Region to Hold Considerable Share in the Global HVDC Cables Market During the Forecast Period.

The Asia-Pacific region is anticipated to hold a considerable share in the global HVDC cables market during the forecast period. The rapid urbanization and increasing construction activities across emerging countries such as India and China have led to the demand for HVDC cables. Growing demand for reliable and continuous power along with ongoing grid connections across remote locations will further spur the global Asia-Pacific HVDC cables market. Emerging countries which include China and India have increased investment towards up-gradation and expansion of power capacities and infrastructure. Additionally, the power consumption pattern is changing in these developing countries which is boosting the sales of HVDC cables. According to Asian Development Bank (ADB), by 2030, more than 55% of the population of Asia will be urban, cities will merge to create urban settlements on a large scale which will require proper electricity supply, further boosting the demand for HVDC cables. Moreover, According to The National Bureau of Asia Research (NBR), the latest data Southeast Asia has been among the regions with the fastest-growing energy demand, rising 6% annually over the last two decades. This, in turn, is driving the growth of the market in the region.

Market Players Outlook

The major companies serving the global HVDC cables market include Siemens AG, Hitachi, Ltd., Toshiba Corp., Mitsubishi Electric Corp., and General Electric Co. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in march 2021 Siemens AG commissioned India’s first high-voltage direct current (HVDC) link featuring voltage-sourced converter (VSC) technology. It consists of 2,000 megawatts (MW) electricity transmission system, consisting of two links between Pugalur in the state of Tamil Nadu and Thrissur in Kerala, which supports Power Grid Corporation of India Ltd. (PGCIL) to counter the power deficit in India’s southern region and improve the grid stability. The ±320 kilovolt (kV) HVDC system was realized by Siemens Ltd. in association with a consortium of Siemens Energy (Germany) and Sumitomo Electric Industries Ltd., Japan, and features for the first time the integration of High Voltage Direct Current XLPE Cable with overhead lines in India.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global HVDC cables market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global HVDC Cables Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Siemens AG

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Hitachi, Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Toshiba Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Mitsubishi Electric Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. General Electric Co.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global HVDC Cables Market by Voltage

4.1.1. High {35 kV to 475 kV}

4.1.2. Extra High {> 475 kV to 600 kV}

4.1.3. Ultra-High {> 600 kV}

4.2. Global HVDC Cables Market by Installation

4.2.1. Overhead

4.2.2. Submarine

4.2.3. Underground

4.3. Global HVDC Cables Market by Application

4.3.1. Intra-Regional

4.3.2. Cross Border

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ABB Ltd

6.2. alfanar Group

6.3. Gupta Power Infrastructure Ltd.

6.4. ILJIN co., ltd.

6.5. J-POWER/Electric Power Development Co.,Ltd.

6.6. LS Cable & System Ltd.

6.7. LS Corp.

6.8. Nexans

6.9. NKT A/S

6.10. Prysmian S.p.A.

6.11. Sumitomo Electric Industries, Ltd.

6.12. Taihan Cable & Solution Co., Ltd.

6.13. ZMS Cable Co., Ltd.

6.14. ZTT

1. GLOBAL HVDC CABLES MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2021-2028 ($ MILLION)

2. GLOBAL HIGH HVDC CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL EXTRA HIGH HVDC CABLES EXTRA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ULTRA-HIGH HVDC CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL HVDC CABLES MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

6. GLOBAL OVERHEAD HVDC CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL SUBMARINE HVDC CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL UNDERGROUND HVDC CABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL HVDC CABLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

10. GLOBAL HVDC CABLES FOR INTRA-REGIONAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL HVDC CABLES FOR CROSS BORDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL HVDC CABLES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

17. EUROPEAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2021-2028 ($ MILLION)

19. EUROPEAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

20. EUROPEAN HVDC CABLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC HVDC CABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC HVDC CABLES MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC HVDC CABLES MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC HVDC CABLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. REST OF THE WORLD HVDC CABLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD HVDC CABLES MARKET RESEARCH AND ANALYSIS BY VOLTAGE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD HVDC CABLES MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

28. REST OF THE WORLD HVDC CABLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL HVDC CABLES MARKET SHARE BY VOLTAGE, 2021 VS 2028 (%)

2. GLOBAL HIGH HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL EXTRA HIGH HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL ULTRA-HIGH HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL HVDC CABLES MARKET SHARE BY INSTALLATION, 2021 VS 2028 (%)

6. GLOBALOVERHEAD HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL SUBMARINE HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL UNDERGROUND HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL HVDC CABLES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL HVDC CABLES FOR INTER-REGIONAL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL HVDC CABLES FOR CROSS BORDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL HVDC CABLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. US HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

15. UK HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD HVDC CABLES MARKET SIZE, 2021-2028 ($ MILLION)