Hydraulic Turbine Market

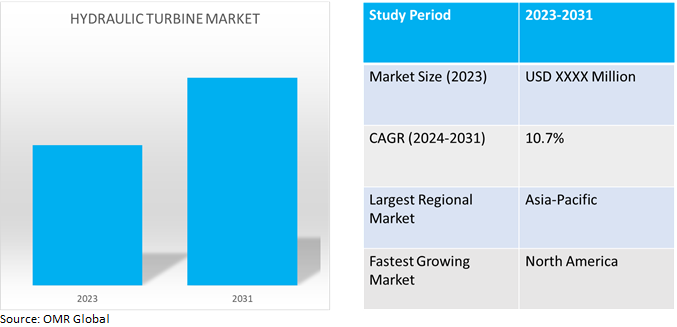

Hydraulic Turbine Market Size, Share & Trends Analysis Report by Product Type (Reaction and Impulse), by Capacity (Small (Less than 1MW), Medium (1MW to 10MW) and Large (10MW and above)), and by End-Users (Industrial, Commercial, and Residential), Forecast Period (2024-2031)

Hydraulic turbine market is anticipated to grow at a significant CAGR of 10.7% during the forecast period (2024-2031). The growth of the hydraulic turbine market is attributed to the global trend toward renewable energy sources, such as hydropower, that has fueled demand for hydraulic turbines. The hydraulic turbine sector is undergoing digital transformation. This involves the integration of sensors, data analytics, and automation to optimize turbine operation, predict maintenance needs, and enhance overall performance. According to the International Energy Agency (IEA), in June 2021, the Share of hydro in total renewable capacity was 45.0% and the Share of hydro in total generation was 17.0%.

Market Dynamics

Enhancing the Efficiency of Hydraulic Turbines

Optimizing elements like guide vane openness, duct profile, and blade thickness to increase the efficiency of hydraulic turbines. Transmission efficiency can be increased and energy loss can be minimized by switching from a mechanical to a hydraulic transmission through configuration device optimization. The development and utilization rate of hydropower is determined by the performance of hydraulic turbines, which are the primary mechanical equipment used in the process. The development of hydraulic turbine technology has advanced significantly, propelled by advances in contemporary science and technology. The increasing need for fuel-efficient and lightweight applications is driving up demand for strong and lightweight hydraulic components. In the production of hydraulic components, new materials such as composites and high-strength alloysare taking the place of conventional materials.

Adoption of Smart Hydraulic Systems

The growing use of smart hydraulic turbine systems that make use of sensors, networking, and sophisticated control algorithms to improve accuracy, effectiveness, and overall performance. With real-time monitoring and data analytics provided by smart hydraulics, predictive maintenance, decreased downtime, and optimal energy use are all made possible, making operations more economical and environmentally friendly. In the industry, the incorporation of electro-hydraulic technology represents a revolutionary trend. Servo valves and proportional valves are electro-hydraulic components that combine the benefits of hydraulic power with the accuracy and control provided by electronic systems. This integration is especially noticeable in high-precision applications such as industrial automation, where electro-hydraulic technologies help to increase response times and accuracy. Components that are specifically designed to fit the demands of industries including aircraft, agriculture, and construction are being produced by manufacturers.

Market Segmentation

Our in-depth analysis of the global hydraulic turbine market includes the following segments byproduct type, capacity, and end-users.

- Based on product type, the market is sub-segmented into reaction and impulse.

- Based on capacity, the market is sub-segmented into small (less than 1MW), medium (1MW to 10MW), and large (10MW and above).

- Based on end-users, the market is sub-segmented into industrial, commercial, and residential.

Large (10MW and above) is Projected to Emerge as the Largest Segment

Based on the capacity, the global hydraulic turbine market is sub-segmented into small (less than 1MW), medium (1MW to 10MW), and large (10MW and above).Among these large (10MW and above) sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include 10MW hydraulic turbines can be made with technologies, and some of the subsystems benefit from the size increase – large generators are cheaper per torque than small ones, and many control and support systems are the same as in much smaller machines, thereby reducing in cost per megawatt. Furthermore, large Hydraulic turbines are extensively employed in hydroelectric power plants to convert the energy of flowing or falling water into electrical energy, providing a reliable and renewable source of power. For instance, Renugen offers Francis Hydro turbine 10Mw suitable for hydropower stations of middle or high water head and medium-sized flow. It is suitable for hydropower stations whose water heads change large.

Industrial Sub-segment to Hold a Considerable Market Share

Based on the end-users, the global hydraulic turbine market is sub-segmented into industrial, commercial, and residential. Among these, the industrial sub-segment is expected to hold a considerable share of the market. The segmental growth is attributed to the increasing hydraulic turbine utilization to supply mechanical power for various industrial processes, such as milling, pumping, and driving machinery, enhancing efficiency and productivity. Industrial hydraulic turbines are a type of small-scale turbine with a more versatile and compact use that is widely employed in ammonia synthesis, hydrogen cracking, and water field circulation. Its rotation speed varies with the upstream flow characteristics, working stability in variable speed situations is equally essential as energy recovery efficiency.

Regional Outlook

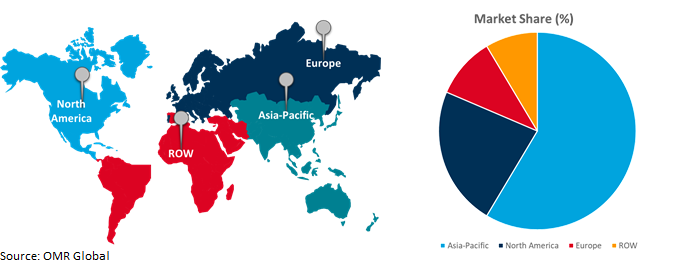

The global hydraulic turbine market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Hydraulic Turbine in North America

- According to the US Hydropower Market Report 2023, The US conventional hydropower feet includes 2,252 hydropower plants with a total generating capacity of 80.58 GW.1 The US hydropower feet produced 28.7% of electricity from renewables and 6.2% of all electricity in 2022.

- According to the US Hydropower Market Report 2021, Almost 12 GW of hydropower and PSH turbine capacity has been installed in the US. 79.0% of the 291 turbine installations went toward R&U of existing hydropower facilities and represented 96.0% of the turbine capacity installed.

Global Hydraulic Turbine Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to numerous prominent companies and hydraulic turbine providers. The growth is attributed to the increasing demand for transition to renewable energy and the pressing need for hydropower capacity expansion. According to the International Hydropower Association (IHA), 2022, with rapid urbanization and industrialization, the East Asia and Pacific region has been on a trajectory of rapidly rising energy demand. China has an exploitable hydropower capacity ranging between 400-700 GW, largely attributed to its conducive geographical features, especially in the southwestern regions. Harnessing hydropower in the Asia-Pacific region can significantly decrease regional fossil fuel reliance, contributing to carbon emission reduction, and fostering sustainable economic growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global hydraulic turbine market include Mitsubishi Heavy Industries, Ltd., Siemens AG, Toshiba Corp., Voith GmbH & Co. KGaA, and WEG S.A., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2021, Atlas Copco Gas and Process (Atlas Copco) and Vericor Power Systems (Vericor) partnered to use Vericor's gas-driven turbines to power Atlas Copco's integrally geared centrifugal compressors. Vericor's gas-driven turbines offer consistent and cost-effective power with extended maintenance intervals, making them the perfect choice to power these compressors.

Recent Development

- In July 2023, Shizen Energy Inc.(Shizen Energy) and GUGLER Water Turbines GmbH (GUGLER), an Austrian company that develops, designs, and manufactures water turbines for small and medium-sized hydroelectric power plants, installed a 2.2 MW Pelton turbine and synchronous generator to the Kuroda Hydroelectric Power Plant (Toyota City, Aichi Prefecture) of Chubu Electric Power Co., Inc. (Chubu Electric Power).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydraulic turbine market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Siemens AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Toshiba Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. WEG S.A.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hydraulic Turbine Market by Product Type

4.1.1. Reaction

4.1.2. Impulse

4.2. Global Hydraulic Turbine Market by Capacity

4.2.1. Small (Less than 1MW)

4.2.2. Medium (1MW to 10MW)

4.2.3. Large (10MW and above)

4.3. Global Hydraulic Turbine Market by End-User

4.3.1. Industrial

4.3.2. Commercial

4.3.3. Residential

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Andritz AG

6.2. Bharat Heavy Electricals Ltd. (BHEL)

6.3. Canadian Hydro Components Ltd.

6.4. Canyon Hydro

6.5. CINK Hydro-Energy s.r.o.

6.6. Dongfang Electric Corp.

6.7. FLOVEL Energy Pvt. Ltd.

6.8. General Electric Company

6.9. Gilbert Gilkes & Gordon Ltd.

6.10. Harbin Electric Corporation Co., Ltd.

6.11. IREM S.p.A

6.12. Kirloskar Brothers Ltd.

6.13. LITOSTROJ POWER

6.14. MITSUBISHI HEAVY INDUSTRIES, LTD.

6.15. Norcan Hydraulic Turbine Inc.

6.16. NTN Corp.

6.17. Voith GmbH & Co. KGaA

6.18. Wärtsilä Corp

1. GLOBAL HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL REACTION HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL IMPULSE HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2023-2031 ($ MILLION)

5. GLOBAL SMALL (LESS THAN 1MW) HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL MEDIUM (1MW TO 10MW) HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LARGE (10MW AND ABOVE) HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL HYDRAULIC TURBINE FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL HYDRAULIC TURBINE FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL HYDRAULIC TURBINE FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

17. EUROPEAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2023-2031 ($ MILLION)

20. EUROPEAN HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

25. REST OF THE WORLD HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2023-2031 ($ MILLION)

28. REST OF THE WORLD HYDRAULIC TURBINE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL HYDRAULIC TURBINE MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL REACTION HYDRAULIC TURBINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL IMPULSE HYDRAULIC TURBINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HYDRAULIC TURBINE MARKET SHARE BY CAPACITY, 2023 VS 2031 (%)

5. GLOBAL SMALL (LESS THAN 1MW) HYDRAULIC TURBINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL MEDIUM (1MW TO 10MW) HYDRAULIC TURBINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LARGE (10MW AND ABOVE) HYDRAULIC TURBINE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL HYDRAULIC TURBINE MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL HYDRAULIC TURBINE FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL HYDRAULIC TURBINE FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL HYDRAULIC TURBINE FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA HYDRAULIC TURBINE MARKET SIZE, 2023-2031 ($ MILLION)