Hydrogen Fueling Station Market

Hydrogen Fueling Station Market Size, Share & Trends Analysis Report by Station Type (Fixed Hydrogen Station and Mobile Hydrogen Station), by Supply Type (Off-Site and On-Site), and by Solution (Engineering, Procurement and Construction (EPC) and Components) Forecast Period (2024-2031)

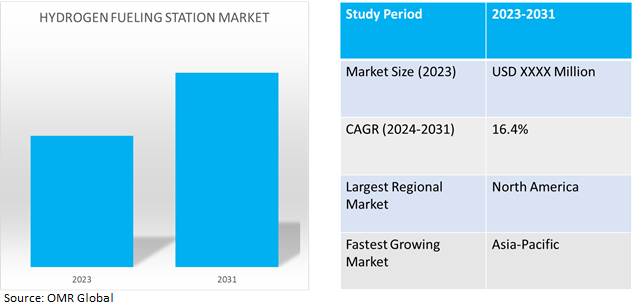

Hydrogen fueling station market is anticipated to grow at a significant CAGR of 16.4% during the forecast period (2024-2031).The growing adoption of hydrogen-powered vehicles, advancements in fuel cell technology, and the development of hydrogen infrastructure with improving green hydrogen production are the key factors supporting the market growth globally. Major automakers are increasingly investing in hydrogen-powered vehicle development owing increase in demand for hydrogen fuel. The expansion of fuel cell vehicle fleets necessitates the availability of a robust hydrogen fueling infrastructure to support the growth of the market. According to the International Energy Agency (IEA), in July 2023, global hydrogen use reached 95 Mt in 2022, a nearly 3.0% increase year-on-year, with strong growth in all major consuming regions except Europe, which suffered a hit to industrial activity owing to the sharp increase in natural gas prices.

Market Dynamics

Growing adoption of hydrogen fueling in the automotive industry

Increasing demand for hydrogen-fueled vehicles owing to factors such as environmental degradation, easy refueling, abundant fuel availability, government subsidies and tax incentives for zero-emission vehicles, and rising demand for low-emission commuting. Manufacturers of several vehicle types have produced or developed hydrogen-powered cars, such as FCEVs, H2-ICEVs, and FCHEVs. Manufacturers of hydrogen-fueled cars, including Hyundai, Toyota, and Riversimple, have begun to create new business strategies.

Increasing government initiatives to accelerate hydrogen fuelling station deployment

To accelerate the hydrogen economy, governments set clear targets and a prioritized roadmap for hydrogen deployment, and associated renewable energy to enable net-zero emissions (such as Carbon Capture And Storage (CCS) or nature-based solutions). For instance, in March 2022, the Australian Government, through the Australian Renewable Energy Agency (ARENA), provided $22.8 million for Viva Energy to build the hydrogen cell refueling station.

Market Segmentation

Our in-depth analysis of the global hydrogen fueling station market includes the following segments station type,supply type, and solution.

- Based on station type, the market is sub-segmented into fixed hydrogen stations and mobile hydrogen stations.

- Based on supply type, the market is sub-segmented into off-site and on-site.

- Based on the solution, the market is sub-segmented into engineering, procurement, construction (EPC), and components.

Fixed Hydrogen Station is Projected to Emerge as the Largest Segment

Based on the station type, the global hydrogen fueling station market is sub-segmented into fixed hydrogen stations and mobile hydrogen stations. Among these, the fixed hydrogen station sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing deployment of hydrogen fueling stations to reduce the growing concerns of climate change, air pollution, and energy security. All these factors are eventually driving the hydrogen fueling station market.

On-Site Sub-segment to Hold a Considerable Market Share

The on-site sub-segment holds a considerable sub-segment of the hydrogen fueling station market. In an on-site hydrogen fueling station (HFS), hydrogen is generated at the HFS site. The on-site HFS has an energy source, such as fossil fuels or Renewable Energy (RE) systems like LPG, solar, wind, biomass, and others that may be utilized to produce hydrogen. The method most commonly employed at on-site HRS to create hydrogen is water electrolysis.

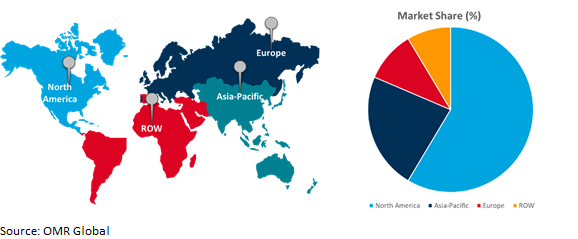

Regional Outlook

The global hydrogen fueling station market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

An increasing number of hydrogen fuel companies and governments' investment

- Rising foreign investments in the hydrogen infrastructure, government targets to reduce carbon emissions from the mobility sector, and the implementation of national hydrogen strategies by the governments are major factors driving the growth of the hydrogen fueling station market in the Asia Pacific region.

- The region's increasing adoption of renewable energy sources and their expansion bring down the cost of producing hydrogen and supporting its use.

Global Hydrogen Fueling Station Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of an enormous number of providers offering hydrogen fueling stations.Several companies are offering hydrogen fueling station systems for the automotive and transportation sectors. The availability of stations providing reasonably priced hydrogen in places where vehicles will be deployed remains a key challenge to the adoption of this technology. To address this challenge, the U.S. Department of Energy (DOE) launched H2USA a public-private collaboration with federal agencies, automakers, hydrogen providers, fuel cell developers, national laboratories, and additional stakeholders. H2USA is focused on advancing hydrogen infrastructure to support more transportation energy options for the US consumers. According to the US Department of Energy, in 2023,there are59 retail hydrogen stations in the US with 50 stations in various stages of planning or construction. Most of the existing and planned stations are in California, with one in Hawaii and 5 planned for the northeastern states. As the market expands, hydrogen fueling stations will be matched with vehicle rollout as both grow together.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global hydrogen fueling station market include Air Liquide S.A., Hexagon Composites ASA, Linde plc, Siemens AG, and Toyota Industries Corp.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, inMarch 2022, ENEOS, Toyota, and Woven Planet collaborated to facilitate CO2-free hydrogen production and usage for Woven City and beyond. ENEOS and Toyota have decided to commence the construction and operation of a hydrogen refueling station near Woven City to produce and supply CO2-free hydrogen to Woven City and Fuel Cell Electric Vehicles (FCEVs).

Recent Development

- In February 2023, Hexagon Purus, through its wholly owned subsidiary Wystrach GmbH (‘Wystrach’), a hydrogen systems supplier, received an order for mobile hydrogen refueling stations and stationary storage from Deutsche Bahn, a provider of mobility and logistics services and the number one railway operator in Europe.The value of the order is approximately EUR 2.5 million ($2.706 million).

- In January 2023, Ballard Power Systems partnered with Adani Group to develop a hydrogen fuel cell truck for mining & transportation. This collaboration marks Asia’s first planned hydrogen-powered mining truck.The Adani Group announced it plans to invest more than $50.0 billion over the next ten years in green hydrogen and associated ecosystems.

- In August 2022, OneH2, Inc. partnered with Douglas County PUD in the development of a hydrogen terminal & fueling station. North Carolina-based OneH2, Inc. contract for supplying hydrogen fueling equipment in a $2.9 million deal negotiated with Douglas County Public Utility District in East Wenatchee, Wash. for the development of a production terminal and a retail fueling station.

- In December 2021, ITM Power launched the first public access hydrogen refueling station. At the Advanced Manufacturing Park, just off the M1, Junction 33 in South Yorkshire, funded by InnovateUK.The launch is being supported by Hyundai, Toyota, and Honda displaying their fuel cell electric vehicles (FCEV).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydrogen fueling station market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Air Liquide

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Air Products and Chemicals, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Linde plc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hydrogen Fueling Station Market by Station Type

4.1.1. Fixed Hydrogen Station

4.1.2. Mobile Hydrogen Station

4.2. Global Hydrogen Fueling Station Market by Supply Type

4.2.1. Off-Site

4.2.2. On-Site

4.3. Global Hydrogen Fueling Station Market by Solution

4.3.1. Engineering, Procurement and Construction (EPC)

4.3.2. Components

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Air Products and Chemicals, Inc.

6.2. Ballard Power Systems Inc.

6.3. Chart Industries, Inc.

6.4. Cummins Inc.

6.5. FirstElement Fuel Inc.

6.6. FuelCell Energy, Inc.

6.7. Green Hydrogen Systems

6.8. Haskel International, Inc. (Ingersoll Rand Inc.)

6.9. Hexagon Composites ASA

6.10. HyGear

6.11. ITM Power PLC

6.12. McPhy Energy S.A.

6.13. Nel ASA.

6.14. Nikola Corp.

6.15. Nuberg EPC

6.16. Nuvera Fuel Cells, LLC

6.17. Plug Power Inc.

6.18. PowerTap Hydrogen Capital Corp.

6.19. Shell plc

6.20. Siemens AG

6.21. Toyota Industries Corp.

6.22. TrueZero

1. GLOBAL HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2023-2031 ($ MILLION)

2. GLOBAL HYDROGEN FUELING FIXED STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL HYDROGEN FUELING MOBILE STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SUPPLY TYPE, 2023-2031 ($ MILLION)

5. GLOBAL OFF-SITE HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ON-SITE HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

8. GLOBAL ENGINEERING, PROCUREMENT AND CONSTRUCTION (EPC) FOR HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COMPONENTS FOR HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2023-2031 ($ MILLION)

13. NORTH AMERICAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SUPPLY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

15. EUROPEAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SUPPLY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SUPPLY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY STATION TYPE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SUPPLY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD HYDROGEN FUELING STATION MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

1. GLOBAL HYDROGEN FUELING STATION MARKET SHARE BY STATION TYPE, 2023 VS 2031 (%)

2. GLOBAL HYDROGEN FUELING FIXED STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL HYDROGEN FUELING MOBILE STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HYDROGEN FUELING STATION MARKET SHARE BY SUPPLY TYPE, 2023 VS 2031 (%)

5. GLOBAL OFF-SITE HYDROGEN FUELING STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ON-SITE HYDROGEN FUELING STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL HYDROGEN FUELING STATION MARKET SHARE BY SOLUTION, 2023 VS 2031 (%)

8. GLOBAL ENGINEERING, PROCUREMENT AND CONSTRUCTION (EPC) FOR HYDROGEN FUELING STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL COMPONENTS FOR HYDROGEN FUELING STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL HYDROGEN FUELING STATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

13. UK HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA HYDROGEN FUELING STATION MARKET SIZE, 2023-2031 ($ MILLION)