Hydroxychloroquine Market

Global Hydroxychloroquine Market Size, Share & Trends Analysis Report, By Application (COVID-19, Malaria, Rheumatoid Arthritis, Lupus Erythematosus, and Others), By Dosage Type (100 mg, 200 mg, 400 mg, 600 mg, and 800 mg) and Forecast, 2019-2025 Update Available - Forecast 2025-2035

The global hydroxychloroquine market is estimated to grow at a CAGR of XX% during the forecast period. Hydroxychloroquine is a class of drugs which is used for the treatment of malaria, lupus erythematosus, rheumatoid arthritis, and Q fever. The significant prevalence of malaria and the rising incidences of COVID-19 are the major factors contributing to market growth. Currently, emerging demand for hydroxychloroquine has been reported across the globe for the treatment of COVID-19 patients. There is a considerable rise in the incidences of COVID-19 patients recorded across the globe. As per the World Health Organization (WHO), on 7th April 2020, the number of confirmed COVID-19 cases reported was 68,766 with 5,020 mortalities, which is increasing day by day.

On 8th April 2020, the confirmed cases were 73,639 with 6,695 mortalities. Due to the emerging cases of COVID-19, the government is seeking for effective alternatives for the patients’ treatment. As no drugs are approved for COVID-19, the countries are looking for options that are readily available for the treatment of COVID-19. Therefore, most of the countries, including the US, Brazil, Spain, Bahrain, Germany, Nepal, Bhutan, Bangladesh have shifted their focus towards hydroxychloroquine owing to its demonstrated antiviral activity which may be useful to stimulate the immune system. This, in turn, is contributing to the rising adoption of hydroxychloroquine drugs.

Market Segmentation

The global hydroxychloroquine market is segmented into application and dosage type. Based on application, the market is classified into COVID-19, malaria, rheumatoid arthritis, lupus erythematosus, and others. Based on dosage type, the market is classified into 100 mg, 200 mg, 400 mg, 600 mg, and 800 mg. 200 mg and 400 mg are being significantly recommended for the treatment of COVID-19 patients in addition to the standard treatment for nearly five consecutive days. Although, 400 mg is a high dosage form for some patients which may increase the risk of cardiac arrhythmia. Hence, 200 mg dose is also preferred over 400 mg for some COVID-19 patients. The dosage type relies on the age and the effect of the first dose on the patients.

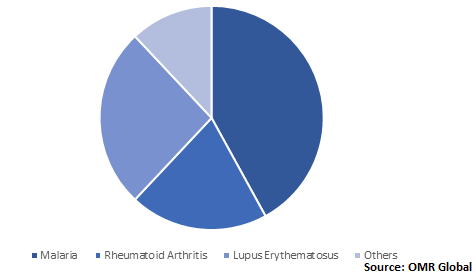

Hydroxychloroquine were anticipated to have major share in malaria treatment in 2018

Hydroxychloroquine was anticipated to have significant application in malaria treatment in 2018. As per the WHO, in 2018, there were nearly 228 million malaria cases reported across the globe and the number of mortalities due to malaria stood at 405,000 in 2018. Children under the age group of 5 years are highly susceptible group affected by malaria; in 2018 as they accounted for 67% (272,000) of overall mortalities reported due to malaria globally. The rising incidences of malaria have led to the adoption of hydroxychloroquine to prevent and treat acute attacks of malaria. Hydroxychloroquine has shown effectiveness against the malarial parasites, including Plasmodium ovale (P. ovale), P. malariae, P. vivax, and vulnerable strains of P. falciparum.

Global Hydroxychloroquine Market Share by Application, 2018 (%)

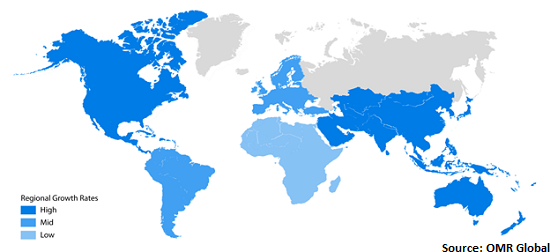

Regional Outlook

The global hydroxychloroquine market is classified into North America, Europe, Asia-Pacific, and Rest of the World (RoW). North America is estimated to hold a significant share in the market during the forecast period owing to the rising prevalence of lupus erythematosus in the region. Currently, the US is among the major consumers of hydroxychloroquine to treat COVID-19 patients. The US had asked for 48 lakh hydroxychloroquine tablets. However, India has allowed 35.82 lakhs hydroxychloroquine tablets along with 9 metric tonne (MT) active pharmaceutical ingredient (API). These factors are contributing to the increasing demand for hydroxychloroquine in the region.

Global Hydroxychloroquine Market Growth, by Region 2019-2025

Market Players Outlook

Some crucial players operating in the market include Cipla Ltd., Sanofi S.A., Ipca Laboratories Ltd., Novartis International AG, and Teva Pharmaceutical Industries Ltd. Owing to the emerging demand for hydroxychloroquine for the treatment of COVID-19, the manufacturers have increased their production of hydroxychloroquine to meet the demand for global supply. For instance, on 20th March 2020, Novartis International AG declared to donate up to 130 million 200 mg doses of generic hydroxychloroquine by the end of May in response to the global COVID-19 epidemic. Hydroxychloroquine and associated drug, chloroquine, is under clinical trials evaluation to treat COVID-19. The company is supporting ongoing clinical trial efforts and will assess the demand for additional clinical trials. Novartis is also further exploring to accelerate capacity to enhance the supply and is committed to working with manufacturers globally to meet global demand.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hydroxychloroquine market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cipla Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Sanofi S.A.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Ipca Laboratories Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Novartis International AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Teva Pharmaceutical Industries Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Hydroxychloroquine Market by Application

5.1.1. COVID-19

5.1.2. Malaria

5.1.3. Rheumatoid Arthritis

5.1.4. Lupus Erythematosus

5.1.5. Others (Porphyria cutanea tarda (PCT) and Q Fever)

5.2. Global Hydroxychloroquine Market by Dosage Type

5.2.1. 100 mg

5.2.2. 200 mg

5.2.3. 400 mg

5.2.4. 600 mg

5.2.5. 800 mg

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ADVANZ PHARMA Corp.

7.2. Amneal Pharmaceuticals, Inc.

7.3. Apotex Inc.

7.4. Bayer AG

7.5. Bristol Laboratories Ltd.

7.6. Cadila Healthcare Ltd. (CHL)

7.7. Cardinal Health, Inc.

7.8. Cipla Ltd.

7.9. Covis Pharmaceuticals, Inc.

7.10. Dr. Reddy's Laboratories Ltd.

7.11. Intas Pharmaceuticals Ltd.

7.12. Ipca Laboratories Ltd.

7.13. Laurus Labs Ltd.

7.14. Mangalam Drugs and Organics Ltd.

7.15. Mylan N.V.

7.16. Novartis International AG

7.17. Sanofi S.A.

7.18. Shenhua Pharmaceutical Co., Ltd.

7.19. Sun Pharmaceutical Industries Ltd.

7.20. Teva Pharmaceutical Industries Ltd.

7.21. Torrent Pharmaceuticals Ltd.

7.22. Wallace Pharmaceuticals Ltd.

1. GLOBAL HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL HYDROXYCHLOROQUINE IN COVID-19 MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL HYDROXYCHLOROQUINE IN MALARIA MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL HYDROXYCHLOROQUINE IN RHEUMATOID ARTHRITIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL HYDROXYCHLOROQUINE IN LUPUS ERYTHEMATOSUS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL HYDROXYCHLOROQUINE IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY DOSAGE TYPE, 2018-2025 ($ MILLION)

8. GLOBAL 100 MG HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL 200 MG HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL 400 MG HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL 600 MG HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL 800 MG HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. NORTH AMERICAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. NORTH AMERICAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY DOSAGE TYPE, 2018-2025 ($ MILLION)

17. EUROPEAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. EUROPEAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY DOSAGE TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY DOSAGE TYPE, 2018-2025 ($ MILLION)

23. REST OF THE WORLD HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. REST OF THE WORLD HYDROXYCHLOROQUINE MARKET RESEARCH AND ANALYSIS BY DOSAGE TYPE, 2018-2025 ($ MILLION)

1. GLOBAL HYDROXYCHLOROQUINE MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL HYDROXYCHLOROQUINE MARKET SHARE BY DOSAGE TYPE, 2018 VS 2025 (%)

3. GLOBAL HYDROXYCHLOROQUINE MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

6. UK HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD HYDROXYCHLOROQUINE MARKET SIZE, 2018-2025 ($ MILLION)