Hyperlipidemia Drug Market

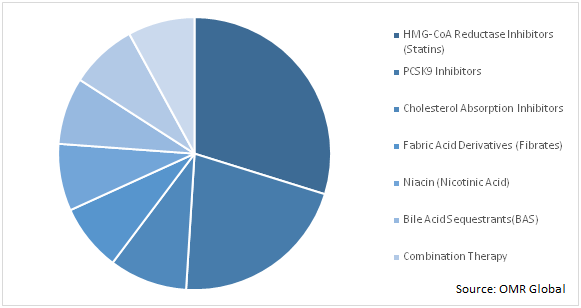

Global Hyperlipidemia Drug Market Size, Share & Trends Analysis Report, By Drug Class (HMG-CoA Reductase Inhibitors (Statins), PCSK9 Inhibitors, Cholesterol Absorption Inhibitors, Fabric Acid Derivatives (Fibrates), Niacin (Nicotinic Acid), Bile Acid Sequestrants(BAS), Combination Therapy, and Others) and Forecast Period 2019-2025 Update Available - Forecast 2025-2035

The global hyperlipidemia drug market is estimated to grow at a CAGR of around 2% during the forecast period. Growing sedentary lifestyle and high fat and dairy food consumption is contributing to the demand for hyperlipidemia drug. In addition, growing obesity and growing number of patients with heart disease or diabetes are also propelling the growth of the global hyperlipidemia drug market. Side effects of hyperlipidemia drugs are restraining the growth of the global hyperlipidemia drug market. Hyperlipidemia is a medical term for abnormally high levels of fats (lipids) in the blood.

The two major types of lipids found in the blood are triglycerides and cholesterol. Triglycerides are made when the body stores the extra calories it doesn’t need for energy. They also come directly from the diet in foods such as red meat and whole-fat dairy. A diet high in refined sugar, fructose, and alcohol raise triglycerides. Cholesterol is produced naturally in the liver. Similar to triglycerides, cholesterol is also found in fatty foods like eggs, red meat, and cheese. Hyperlipidemia is more commonly known as high cholesterol. Although high cholesterol can be inherited, it’s more often the result of unhealthy lifestyle choices.

Segmentation

The global hyperlipidemia drug market is segmented based on the drug class. Based on the drug class the market is segmented into HMG-CoA reductase inhibitors (statins), PCSK9 inhibitors, cholesterol absorption inhibitors, fabric acid derivatives (fibrates), niacin (nicotinic acid), bile acid sequestrants (BAS), combination therapy and others.

HMG-CoA reductase inhibitors (statins) held a significant share in the drug class segment

HMG-CoA reductase inhibitors (Statins)account for a significant market share. Statins are recommended for most patients. Statins are the only cholesterol-lowering drug class that has been directly associated with a reduction in the risk of heart attack or stroke. Statins are the first line of lipid-lowering drugs, while others, discussed subsequently, are added to increase the efficiency of statins or in cases of statin intolerance or cases of severe hypertriglyceridemia. Statins can lower low-density lipoprotein (LDL), and triglyceride concentrations (at higher doses) while increasing high-density lipoprotein (HDL) concentrations.

Global Hyperlipidemia Drug Market by Drug Class, 2018 (%)

Regional Outlook

Geographically, the global hyperlipidemia drug market is segmented based on the region including North America, Europe, Asia-Pacific, and the Rest of the world (RoW).North America is expected to have a significant market share in the global market. Key factors that are driving the North American hyperlipidemia drug market are the availability of proper healthcare infrastructures and the presence of the major players offering hyperlipidemia drugs in the market. Moreover, the market in Asia-Pacific region is growing considerably owing to large numbers of the patient, the presence of established generic drug market, and increasing health awareness. Moreover, the government-sponsored awareness program about generic medicine in the Asia-Pacific region is one of the major drivers for hyperlipidemia drug market growth. For instance, in 2016, the Government of India’s Department of Pharmaceuticals launched ‘Pradhan Mantri Bhartiya Janaushadhi Pariyojana’ (PMBJP) campaign to provide quality medicines at an affordable price. For that, the government set up stores to provide quality generic medicines, also government made a public-private partnership.

Global Hyperlipidemia Drug Market Growth, by Region 2019-2025

Competitive Landscape

The major manufactures of the hyperlipidemia drug include Amgen Inc., Bristol-Myers Squibb Co., Daiichi Sankyo Co., Ltd., Ionis Pharmaceuticals, Inc., Mylan N.V, GlaxoSmithKline PLC Pfizer, Inc., Sanofi-Aventis S.A., Merck & Co., Inc., Dr. Reddy's Laboratories, Ltd. and others. The range of products provided by these players is Crestor, Zetia, Vytorin, Welchol, and others.These companies are continuously making efforts to provide innovative products in the market. For instance, in February 2020, the US FDA approved Esperion’s NEXLIZET, a bempedoic acid. It is taken orally and used to lower the cholesterol level. It is the first non-statin pill. Further, in December 2017, The US FDA also approved Amgen’s Repatha, which is used as an adjunct to diet, alone or in combination with other lipid-lowering therapies, such as statins, for the treatment of adults with primary hyperlipidemia to reduce low-density lipoprotein cholesterol.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hyperlipidemia drug market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. AstraZeneca PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Novartis AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Mylan N.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Pfizer, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Sanofi-Aventis S.A.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Hyperlipidemia Drug Market by Drug Class

5.1.1. HMG-CoA Reductase Inhibitors (Statins)

5.1.2. PCSK9 Inhibitors

5.1.3. Cholesterol Absorption Inhibitors

5.1.4. Fabric Acid Derivatives (Fibrates)

5.1.5. Niacin (Nicotinic Acid)

5.1.6. Bile Acid Sequestrants(BAS)

5.1.7. Combination Therapy

5.1.8. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Amgen, Inc.

7.3. AstraZeneca PLC

7.4. Bristol-Myers Squibb Co.

7.5. Daiichi Sankyo Co., Ltd.

7.6. Dr.Reddy's Laboratories, Ltd.

7.7. GlaxoSmithKline PLC

7.8. Ionis Pharmaceuticals, Inc.

7.9. Merck & Co., Inc.

7.10. Mylan N.V.

7.11. Novartis AG

7.12. Pfizer, Inc.

7.13. Sanofi-Aventis S.A.

7.14. Sun Pharmaceutical Industries, Ltd.

7.15. Teva Pharmaceutical Industries, Ltd.

1. GLOBAL HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

2. GLOBAL HMG-COA REDUCTASE INHIBITORS (STATINS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

3. GLOBAL PCSK9 INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

4. GLOBAL CHOLESTEROL ABSORPTION INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

5. GLOBAL FABRIC ACID DERIVATIVES (FIBRATES) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

6. GLOBAL NIACIN (NICOTINIC ACID)MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

7. GLOBAL BILE ACID SEQUESTRANTS (BAS) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

8. GLOBAL COMBINATION THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

9. GLOBAL OTHERS HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($, MILLION)

10. GLOBAL HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

14. EUROPEAN HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

18. REST OF THE WORLD HYPERLIPIDEMIA DRUG MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2018-2025 ($ MILLION)

1. GLOBAL HYPERLIPIDEMIA DRUG MARKET SHARE BY DRUG CLASS, 2018 VS 2025 (%)

2. GLOBAL HYPERLIPIDEMIA DRUG MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

5. UK HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD HYPERLIPIDEMIA DRUG MARKET SIZE, 2018-2025 ($ MILLION)