Hyperscale Computing Market

Hyperscale Computing Market Size, Share & Trends Analysis Report by Type (Solution and Service), by Enterprise Size (Large Enterprises, and Small and Medium Enterprises), by Application (Cloud Computing, Big Data, and IoT), by end-user (BFSI, IT and Telecom, Media and Entertainment, Retail and E-Commerce, and Healthcare) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Hyperscale computing market is anticipated to grow at a CAGR of 21.4% during the forecast period. The rising focus on high-performance computing is a key factor to drive the hyperscale computing market over the forecast period. Hyperscale computing is referred to as a distributed architecture that can accommodate increasing demand from back-end computing and internet-facing resources and does not require additional electric or cooling power and physical space. Hyperscale architecture ensures an optimum level of throughput performance and incremental redundancy for providing fault tolerance and continuous availability. Hyperscale architecture can easily reconfigure hardware or software according to an organization’s needs and allows for upgrading components in an organized manner, thereby providing IT professionals with a cost-effective approach to scale resources on demand. For instance, in February 2020, Dell Technologies introduced the EMC PowerEdge XE2420 server. The new short-depth, compact, high-performance server is developed to operate in challenging and space-constrained environments. Additionally, the server is equipped with a two-socket system, four accelerators to manage evolving business demands, and the option to add up to 92TB of storage per server. The rising popularity and deployment of Artificial Intelligence (AI), Machine Learning (ML), Industrial 4.0, Internet of Things (IoT), autonomous cars, big data, and cloud computing are expected to drive revenue growth of the global hyperscale computing market to a significant extent over the forecast period.

Segmental Outlook

The global hyperscale computing market is segmented based on type, enterprise size, application, and by end-user. Based on type, the market is bifurcated into solution and service. By enterprise size, the market is bifurcated into large enterprises and short and medium enterprises. By application, the market is sub-segmented into cloud computing, big data, and IoT. Further, by end-user, the market is sub-segmented into BFSI, IT and Telecom, media and entertainment, retail and e-commerce, and healthcare. Among these, the cloud computing sub-segment accounted for the dominant share of the market during the forecast period. This can be attributed to the rising adoption of cloud-based solutions and the increased need for hyperscale to build distributed infrastructure systems to meet the growing cloud computing and big data requirements of modern organizations.

IT and Telecom Sub-Segment is Anticipated to Hold Prominent Share in the Global Hyperscale Computing Market

The IT & telecom segment is expected to account for the largest revenue share owing to increasing technological innovations to gain a competitive edge over other players in the market and increasing adoption of technologically advanced hybrid solutions. In addition, increasing advancements in communication technologies such as social media, the internet, 4G, and 5G are increasing the need to build these networks with efficient processing ability, increased flexibility, and bandwidth density. With the growing demand several IT and Telecom companies investing in hyperscale computing will further drive the market. For instance, in October 2022, US-based multinational technology services and telecom equipment provider, Cisco, announced to invest in dedicated data center capacity for WebEx, its remote conferencing, file sharing, and contact center operation services suite, in India. The undisclosed investment amount will be used to set up a domestic data center and acquire regulatory licenses for WebEx in India.

Regional Outlook

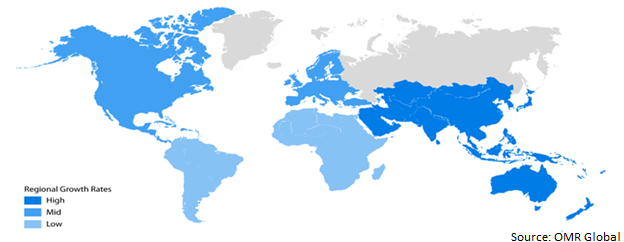

The global hyperscale computing market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). Among these, the Asia-Pacific region is projected to expand at a significant CAGR during the forecast period, due to rapid growth in Internet of Things (IoT) applications, ongoing shift towards digitalization, rising demand for cloud services, and adoption of 5G wireless networks which are driving demand for small sites hosting edge computing infrastructure. In addition, a steady shift towards the adoption of hybrid cloud solutions coupled with a rise in the number of hyperscale data centers in the region is expected to continue to drive the market over the forecast period.

Global Hyperscale Computing Market Growth, by Region 2023-2030

The North American Region is Anticipated to Hold a Significant Share of the Global Hyperscale Computing Market

North America is expected to continue to account for a larger revenue share among other regional markets during the forecast period due to the increasing adoption of advanced cloud computing technology, the rising implementation of high-performance computing solutions, and the increasing number of hyperscale data centers in the region. According to comsoc.org, as of March 2022, the US currently accounts for almost 40.0% of operational hyperscale data centers, which was half of all worldwide capacity. The US has the most data centers in the future pipeline, with a current known pipeline of 314 future new hyperscale data centers, the installed base of operational data centers will pass the 1,000 mark in three years and continue growing rapidly thereafter.

The increasing penetration of digital services across various sectors, such as healthcare, finance, retail, and more, has further bolstered the demand for hyperscale computing solutions. For instance, Netflix, a company that relies heavily on data centers for streaming content to millions of users worldwide, utilizes AWS's EC2 hyperscale facilities to handle peak loads and ensure a seamless user experience. Additionally, the robust presence of various small and large vendors providing hyperscale computing services is opening up significantly large revenue opportunities for players and supporting the growth of the North American hyperscale computing market.

Market Players Outlook

The major companies serving the global hyperscale computing market include Amazon Web Services, Inc., Dell Technologies, Inc, Intel Corp., and Server Technology, Inc. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, funding, collaborations, and new product launches to stay competitive in the market. For instance, in February 2023, Amazon Web Services teamed up with Rebura, a UK-based provider of AWS consulting services. The collaboration involves jointly working to broaden their service offerings. In October 2021, Google Cloud signed an agreement with Thales, a leader in advanced technologies. The agreement includes jointly developing hyperscale cloud offerings for France. The new hyperscale offering benefits the public sector and French companies. Further, the company aims to provide innovative and advanced solutions to organizations in France.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global hyperscale computing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dell Technologies, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hewlett Packard Enterprise Development LP

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Intel Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Server Technology, Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hyperscale Computing Market by Component

4.1.1. Solution

4.1.2. Service

4.2. Global Hyperscale Computing Market by Enterprise Size

4.2.1. Large Enterprises

4.2.2. Small and Medium Enterprises

4.3. Global Hyperscale Computing Market by Application

4.3.1. Cloud Computing

4.3.2. Big Data

4.3.3. IoT

4.4. Global Hyperscale Computing Market by End-User

4.4.1. BFSI

4.4.2. IT and Telecom

4.4.3. Media and Entertainment

4.4.4. Retail and E-commerce

4.4.5. Healthcare

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Apple Inc.

6.2. Arista Networks, Inc.

6.3. Celestica Inc.

6.4. Century Link

6.5. Cisco Systems Inc.

6.6. Ericsson

6.7. Google Inc.

6.8. IBM Corp

6.9. Microsoft Corp

6.10. Oracle Corp

6.11. Pure Storage, Inc.

6.12. Quanta Cloud Technology USA LLC

6.13. Super Micro Computer, Inc.

6.14. Viavi Solutions, Inc.

6.15. Yahoo Inc

1. GLOBAL HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL SOLUTION HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL SERVICE HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

5. GLOBAL HYPERSCALE COMPUTING MARKET FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL HYPERSCALE COMPUTING MARKET FOR SMALL AND MEDIUM ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

8. GLOBAL HYPERSCALE COMPUTING MARKET IN CLOUD COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL HYPERSCALE COMPUTING MARKET IN BIG DATA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL HYPERSCALE COMPUTING MARKET IN IOT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

12. GLOBAL HYPERSCALE COMPUTING MARKET FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL HYPERSCALE COMPUTING MARKET FOR IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL HYPERSCALE COMPUTING MARKET FOR MEDIA AND ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL HYPERSCALE COMPUTING MARKET FOR RETAIL AND E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL HYPERSCALE COMPUTING MARKET FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

20. NORTH AMERICAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

21. NORTH AMERICAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. NORTH AMERICAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

23. EUROPEAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. EUROPEAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

25. EUROPEAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

26. EUROPEAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

27. EUROPEAN HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. ASIA-PACIFIC HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. ASIA-PACIFIC HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

33. REST OF THE WORLD HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

34. REST OF THE WORLD HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

35. REST OF THE WORLD HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2022-2030 ($ MILLION)

36. REST OF THE WORLD HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

37. REST OF THE WORLD HYPERSCALE COMPUTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL HYPERSCALE COMPUTING MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

2. GLOBAL SOLUTION HYPERSCALE COMPUTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL SERVICE HYPERSCALE COMPUTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL HYPERSCALE COMPUTING MARKET SHARE BY ENTERPRISE SIZE, 2022 VS 2030 (%)

5. GLOBAL HYPERSCALE COMPUTING MARKET FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL HYPERSCALE COMPUTING MARKET FOR SMALL AND MEDIUM ENTERPRISES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL HYPERSCALE COMPUTING MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

8. GLOBAL HYPERSCALE COMPUTING MARKET IN CLOUD COMPUTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL HYPERSCALE COMPUTING MARKET IN BIG DATA MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL HYPERSCALE COMPUTING MARKET IN IOT MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL HYPERSCALE COMPUTING MARKET SHARE BY END-USER, 2022 VS 2030 (%)

12. GLOBAL HYPERSCALE COMPUTING MARKET FOR BFSI MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL HYPERSCALE COMPUTING MARKET FOR IT AND TELECOM MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL HYPERSCALE COMPUTING MARKET FOR MEDIA AND ENTERTAINMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL HYPERSCALE COMPUTING MARKET FOR RETAIL AND E-COMMERCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL HYPERSCALE COMPUTING MARKET FOR HEALTHCARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL HYPERSCALE COMPUTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. US HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

19. CANADA HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

20. UK HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

21. FRANCE HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

22. GERMANY HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

23. ITALY HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

24. SPAIN HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF EUROPE HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

26. INDIA HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

27. CHINA HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

28. JAPAN HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

29. SOUTH KOREA HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF ASIA-PACIFIC HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD HYPERSCALE COMPUTING MARKET SIZE, 2022-2030 ($ MILLION)