Hyperspectral Imaging Market

Hyperspectral Imaging Market Size, Share & Trends Analysis Report by End-User (Medical Industry, Military and Defense Industry, Agriculture and Forestry Industry, Food & Beverages Industry, Mining Industry, and Other Industries), and by Components (Cameras, and Other Accessories) Forecast Period (2024-2031)

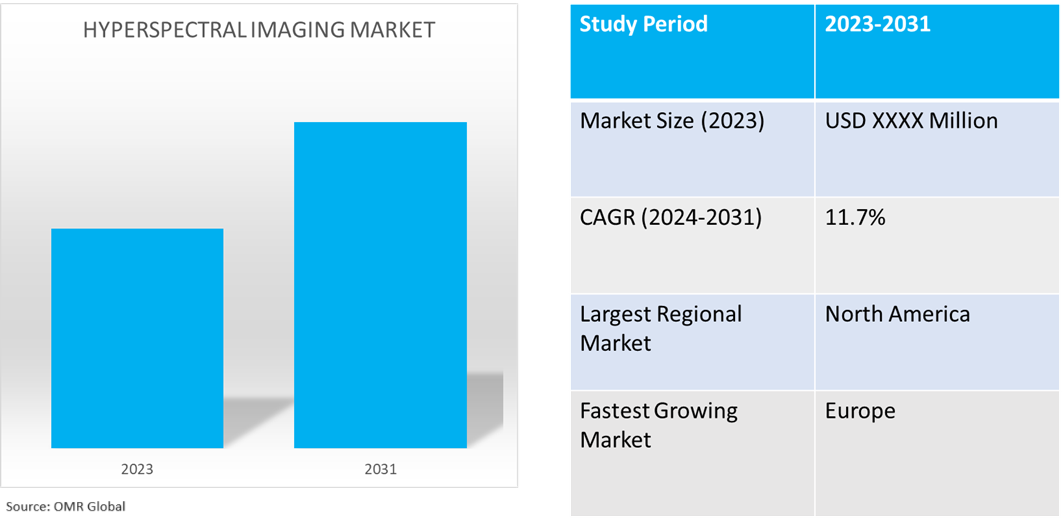

Hyperspectral imaging market is anticipated to grow at a significant CAGR of 11.7% during the forecast period (2024-2031). The market growth is attributed to the growing use of hyperspectral photography systems in several industries, including healthcare, defense, food, and mining industries for enhanced night vision and remote sensing. The ongoing technological developments are expected to increase product uptake, including improvements in sensor design, high spectral and spatial resolution, and compact and lightweight devices driving the growth of the market. According to the World Economic Forum, in May 2024, the market for hyperspectral imaging is predicted to be worth $47.3 billion by 2032.

Market Dynamics

Increasing Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Hyperspectral data processing is becoming increasingly accurate and automated owing to the growing integration of AI and ML for data analysis and interpretation. Using machine learning to integrate AI capabilities into hyperspectral imaging systems is emerging as a new avenue for the development of innovative smart sensing instruments and devices. The branch of AI &ML consists of algorithms that can extract meaningful information from data and use that information to self-learn to produce accurate classifications or predictions. Machine learning grew as a subdomain of AI that comprises algorithms capable of deriving useful information from data and utilizing that information in self-learning for making good classification or prediction.

Growing Adoption of Hyperspectral Imaging in Defense and Surveillance

Hyperspectral imaging is being used by the military and defense industries for reconnaissance, target identification, and surveillance. Hyperspectral imaging sensors obtain widespread use in government and defense applications. These include medium-altitude commercial aircraft, tiny satellites, and high-altitude reconnaissance aircraft. Numerous medium- and low-altitude UAVs also employ them. These compact, lightweight, customizable Commercial Off-The-Shelf (COTS) sensors can also be utilized for spectrum tagging, border control, checkpoint inspections, and other purposes both on the ground and in cars. The huge potential of hyperspectral imaging to provide high-resolution spectral and spatial data that specifically targets the evidence of metal corrosion has made aircraft and naval vessel corrosion detection a growing hyperspectral imaging military use.

Market Segmentation

- Based on the components, the market is segmented into cameras and other accessories.

- Based on the end-user, the market is segmented into the medical industry, military and defense industry, agriculture and forestry industry, food & beverages industry, mining industry, and other industries.

Cameras is Projected to Hold the Largest Segment

The primary factors supporting the growth include the development of novel signal-processing techniques in sensor development, high-speed and low-cost circuits, and sophisticated manufacturing processes have all contributed to the expansion of this market. It is projected that factors such as technical product quality, economic viability, and dependability will fuel the hyperspectral camera market's expansion. Light intensity for a broad variety of spectral bands is acquired by a hyperspectral camera. This feature gives each pixel in the picture a continuous spectrum, which can be utilized to precisely and thoroughly identify things. Furthermore, it is anticipated that the proliferation of low-cost cameras and increasing processing power will accelerate the uptake of these goods. For instance, in June 2024, Specim introduced the next-generation NIR hyperspectral camera Specim GX17 for industrial machine vision. The new Specim GX17 complements Specim’s highly successful FX camera series, the first hyperspectral camera designed specifically for industrial use.

Military and Defense Industry to Hold a Considerable Market Share

The factors supporting segment growth include improvements in component production methods and data management. Numerous military applications, such as tracking and identifying soldiers or other objects, make use of hyperspectral imaging. Additionally, growing superior precision and consistency when compared to other traditional imaging techniques. Market players work together to make hyperspectral imagery more accessible by annotating and labeling the pictures, which can then be used to train AI and machine learning models. For instance, in May 2024, Pixxel and Enabled Intelligence announced a partnership under which the data labeling startup annotates the space company’s hyperspectral imagery. Through the partnership, customers in critical national security missions at the Pentagon and Intelligence Community will have access to custom annotated hyperspectral images with greater precision, speed, and scale.

Regional Outlook

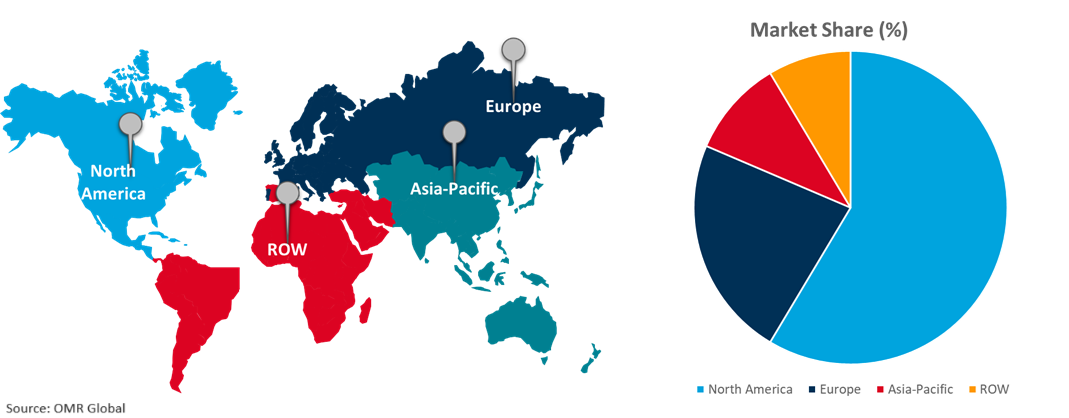

The global hyperspectral imaging market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Hyperspectral Imaging in Europe

- The regional growth is attributed to the growing use of hyperspectral imaging in a variety of industries, including the chemical, pharmaceutical, medical diagnostic, culinary, agricultural, aerospace, and defense sectors. It is expected that technological developments such as sensor design advances, high spectral and spatial resolutions, compactness, smooth software integration, and the creation of lightweight devices drive regional market expansion.

Global Hyperspectral Imaging Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to the presence of hyperspectral imaging offering companies such as Corning Inc., Raytheon Technologies Corp., Teledyne Digital Imaging Inc., and others. The market growth is attributed to the increasing defense spending and a broad range of applications for hyperspectral imaging systems. Additionally, the increasing deployment of hyperspectral imaging systems technology to compressed sensing technology in medical care and space exploration drives the industry's growth. The next-generation instrument helps to identify patterns that may have been missed in prior missions owing to the timing of image collection or image fidelity, helping agencies respond to natural disasters, human migration, and environmental disasters. For instance, in June 2024, Raytheon was awarded a $506 million contract from NASA to design and build the Landsat Next Instrument Suite (LandIS), which includes three next-generation space instruments, with an option for an additional instrument. Through multispectral imaging technology, LandIS collects images of the Earth's surface every six days, detecting natural and human-induced changes.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the hyperspectral imaging market include Corning Inc., HORIBA, Ltd., InnoSpec GmbH, Raytheon Technologies Corp., and Teledyne Digital Imaging Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In April 2024, KP Labs announced the successful capture of the first hyperspectral images by the Intuition-1 satellite, which provides detailed observations of the equatorial region. This development and on-board data processing supported by AI highlights a significant advancement in Earth observation capabilities, enhancing data analysis for various scientific and commercial applications.

- In January 2024, Headwall Photonics, in spectral imaging solutions for remote sensing and industrial machine vision, announced its acquisition of inno-spec GmbH of Nuremberg, Germany, a prominent manufacturer of industrial hyperspectral imaging systems used in high-volume recycling, industrial sorting, and quality testing. Headwall Photonics is a portfolio company of Arsenal Capital Partners.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the hyperspectral imaging market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Corning, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. HORIBA, Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. InnoSpec GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Raytheon Technologies Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Teledyne Digital Imaging Inc.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Hyperspectral Imaging Market by Component

4.1.1. Cameras

4.1.2. Other Accessories (Imaging Spectrometer)

4.2. Global Hyperspectral Imaging Market by End-Users

4.2.1. Medical Industry

4.2.2. Military and Defense Industry

4.2.3. Agriculture and Forestry Industry

4.2.4. Food & Beverages Industry

4.2.5. Mining Industry

4.2.6. Other Industries (Forensics)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Headwall Photonics, Inc.

6.2. Resonon, Inc.

6.3. Specim, Spectral Imaging Ltd.

6.4. Applied Spectral Imaging

6.5. Norsk Elektro Optikk AS

6.6. Telops Inc.

6.7. BaySpec, Inc.

6.8. Surface Optics Corp.

6.9. Cubert GmbH

6.10. IMEC Inc.

6.11. Photonfocus AG

6.12. XIMEA GmbH

6.13. Hyspex

6.14. ZEISS Group (SensoLogic)

6.15. Gooch & Housego PLC

6.16. EVK DI Kerschhaggl GmbH

6.17. Galileo Group, Inc.

6.18. Prediktera AB

6.19. Spectral Devices Inc.

6.20. Stemmer Imaging AG