Hypertensive Heart Disease Market

Global Hypertensive Heart Diseases Market Size, Share & Trends Analysis Report By Diagnosis (Electrocardiogram, Echocardiogram, Coronary Angiography, Others) By Therapeutic (Drugs, and Surgery) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global hypertensive heart diseases market is anticipated to grow at a CAGR of around 3.5% during the forecast period (2021-2027). Hypertensive heart diseases refer to heart failure, CAD (coronary artery disease), and thickening of heart muscles, due to high blood pressure. Other diseases caused by high blood pressure include stroke, ischemic heart disease, peripheral artery disease, aneurysms, and other kidney diseases. The rising prevalence of hypertensive heart diseases & awareness program by government organizations, and high global healthcare expenditure is boosting the growth of hypertensive heart disease market. According to the American College of Cardiology, Cardiovascular disease (CVD) are the leading cause of death in the US, around 840,768 deaths (635,260 cardiac) in 2016 were due to CVDs. Whereas, according to the same source, every 40 seconds on an average, an American will have a stroke. About 795,000 Americans have a new or recurrent stroke annually. The high healthcare expenditure by the government is also playing an important role in the market growth. For instance, in 2018, $3.8 trillion were invested by the US government in healthcare, under which $194 billion or 5% of the healthcare spending has been invested in medical and R&D expenditure. The federal government contributed around 22.2% to Medical and Health R&D expenditures.

Additionally, rising medical tourism in emerging economies such as China, Thailand, and India, are some factors driving the market growth. The global hypertensive heart disease market is segmented into diagnosis and therapeutics. Moreover, the high cost of diagnostics and therapeutics technologies, side effects of hypertensive drugs, and strict government policies are restraining the global hypertensive heart disease market. The introduction of pipeline products for the treatment of hypertensive disorders is one of the major opportunities anticipated to propel market growth in the near future.

Segmental Outlook

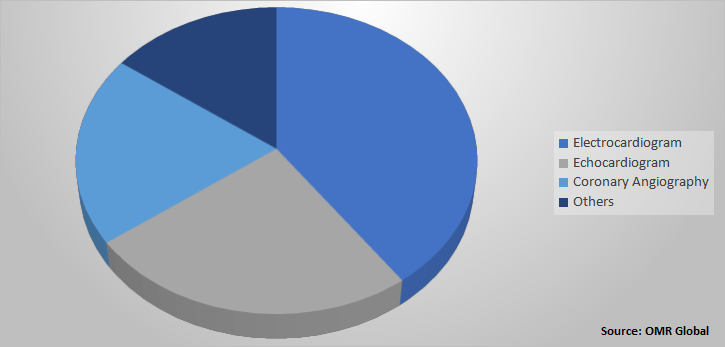

The global Hypertensive heart diseases market is segmented based on diagnosis and therapeutics. Based on the diagnosis, the market is sub-segmented into electrocardiogram, echocardiogram, coronary angiography, and others (chest x-ray). Based on therapeutics, the global hypertensive heart diseases market is classified into drugs and surgery. The drug segment is further categorized into thiazide diuretics beta-blockers, angiotensin-converting enzyme (ACE) inhibitors, angiotensin II receptor blockers (ARB), calcium channel blockers, and others (renin inhibitors). Similarly, the surgery segment is further classified into coronary artery bypass surgery, transmyocardial laser revascularization, and heart transplant. Among the therapeutic segment, the surgery sub-segment is projected to grow at faster CAGR during the forecast period owing to the increasing surgical transplant procedure due to the rising prevalence of heart failures.

Global Hypertensive Heart Diseases Market Share by Manufacturing Technology, 2020 (%)

The Electrocardiogram Segment is Projected to Hold Significant Share in Global Hypertensive Heart Diseases Market

Among Diagnosis, the electrocardiogram segment dominated the market in 2020, and it is estimated that it will hold a significant share in the global hypertensive heart diseases market during the forecast period. Electrocardiogram or ECG is a non-invasive medical test that records the electrical activity of the heart through electrodes attached to the skin. Due to the increasing geriatric population and growing incidence of heart diseases, the adoption of ECG machines is gaining popularity, which in turn, drives the market. Among all the ECG products, the Holter ECG monitors are the universally used and most common type of ambulatory monitoring of ECG. The advancement in Holter ECG monitors such as wireless Holter monitors is attributed to generating significant market share. Furthermore, the growing healthcare sectors coupled with advanced ECG devices for the diagnosis of heart diseases is further expected to drive the market growth and demand for these devices during the forecast period.

Regional Outlook

Geographically, the global hypertensive heart diseases market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Among these, Asia-Pacific is projected to exhibit the fastest growth rate in the global hypertensive heart disease market during the forecast period. The growth in the Asia-Pacific hypertensive heart disease market is backed by the growing awareness regarding the diagnosis and treatment options for heart diseases within the countries. Along with it, the regular efforts made by government organizations with expenditure on R&D and funding programs is fueling the growth of the market in the region.

Global Hypertensive Heart Diseases Market Growth, By Region 2021-2027

North America Dominates the Global Hypertensive Heart Diseases Market

Geographically, North America dominated the market by accounting largest share in the market in 2020, and it is further projected to maintain its dominance during the forecast period. The high prevalence of hypertensive heart diseases in the US is the major factor driving the growth of the region. As per the CDC report, heart diseases are the leading cause of death among the population in the US, and one person dies every 36 seconds from CDC. In addition, nearly 655,000 Americans die from heart disease each year that is 1 in every 4 deaths. High blood pressure is the major cause of hypertensive heart diseases in Americans. According to the CDC, high blood pressure costs around $131 billion every year in the US. The rising expenditure on healthcare in the US is also propelling the adoption of advanced technologies and products for hypertensive heart disease treatments and procedures. According to the Centers for Medicine & Medicaid Services, in 2019, healthcare spending grew 4.6% in 2019. The total national health expenditures in 2018 were around $3.6 trillion. Due to all these factors, the market in the region is projected to grow during the forecast period.

Market Players Outlook

The key players in the hypertensive heart disease market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Abbott Laboratories, AstraZeneca PLC, Bayer AG, Boehringer Ingelheim International GmbH, Johnson & Johnson Ltd., Merck KGaA, Novartis AG, Pfizer Inc., and Sanofi SA, among others. These market players are adopting several market strategies including product launch and approvals, merger and acquisition, partnership collaboration, business, and capacity expansion, and others. For instance, in March 2020, AstraZeneca PLC has completed the divested agreement with Atnahs Pharma for the global commercial rights to a total of five hypertension drugs which include Inderal, Tenormin, Tenoretic, Zestril, and Zestoretic. The agreement was closed with $350 million from Atnahs.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Hypertensive heart diseases market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Hypertensive Heart Disease Industry

• Recovery Scenario of Global Hypertensive Heart Disease Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Hypertensive Heart Disease Market, By Diagnosis

5.1.1. Electrocardiogram

5.1.2. Echocardiogram

5.1.3. Coronary Angiography

5.1.4. Others (Chest X-Ray)

5.2. Global Hypertensive Heart Disease Market, By Therapeutics

5.2.1. Drugs

5.2.1.1. Thiazide Diuretics

5.2.1.2. Beta-Blockers

5.2.1.3. Angiotensin-Converting Enzyme (ACE) Inhibitors

5.2.1.4. Angiotensin II Receptor Blockers (ARB)

5.2.1.5. Calcium Channel Blockers

5.2.1.6. Others (Renin Inhibitors)

5.2.2. Surgery

5.2.2.1. Coronary Artery Bypass Surgery

5.2.2.2. Transmyocardial Laser Revascularization

5.2.2.3. Heart Transplant

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East & Africa

7. Company Profiles

7.1. Abbott Laboratories

7.2. AstraZeneca PLC

7.3. Actelion Pharmaceuticals Ltd.

7.4. Boehringer Ingelheim International GmbH

7.5. Bayer AG

7.6. Eiger Biopharmaceuticals, Inc.,

7.7. Daiichi Sankyo Co., Ltd.

7.8. Gilead Sciences, Inc.

7.9. GlaxoSmithKline PLC

7.10. F. Hoffmann-La Roche Ltd.

7.11. Johnson & Johnson Services, Inc.

7.12. Lupin Pharmaceuticals, Inc.

7.13. Merck KGaA

7.14. Novartis AG

7.15. Pfizer Inc.

7.16. Sanofi SA

7.17. Sun Pharmaceutical Industries Ltd.

7.18. Takeda Pharmaceutical Co. Ltd.

7.19. United Therapeutics Corp.

7.20. Northern Therapeutics Inc.

1. GLOBAL HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS, 2020-2027 ($ MILLION)

2. GLOBAL ELECTROCARDIOGRAM FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL ECHOCARDIOGRAM FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CORONARY ANGIOGRAPHY FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHERS (CHEST X-RAY)FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2020-2027 ($ MILLION)

7. GLOBAL DRUGS FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL DRUGS FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

9. GLOBAL SURGERY FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL SURGERY FOR HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

11. NORTH AMERICAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS,2020-2027 ($ MILLION)

13. NORTH AMERICAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2020-2027 ($ MILLION)

14. EUROPEAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. EUROPEAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS, 2020-2027 ($ MILLION)

16. EUROPEAN HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2020-2027 ($ MILLION)

17. ASIA-PACIFIC HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2020-2027 ($ MILLION)

20. REST OF THE WORLD HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. REST OF THE WORLD HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY DIAGNOSIS, 2020-2027 ($ MILLION)

22. REST OF THE WORLD HYPERTENSIVE HEART DISEASE MARKET RESEARCH AND ANALYSIS BY THERAPEUTICS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL HYPERTENSIVE HEART DISEASE MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL HYPERTENSIVE HEART DISEASE MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL HYPERTENSIVE HEART DISEASE MARKET, 2020-2027 (%)

4. GLOBAL HYPERTENSIVE HEART DISEASE MARKET SHARE BY DIAGNOSIS,2020 VS 2027 (%)

5. GLOBAL HYPERTENSIVE HEART DISEASE MARKET SHARE BY THERAPEUTICS, 2020 VS 2027 (%)

6. GLOBAL HYPERTENSIVE HEART DISEASE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ELECTROCARDIOGRAM MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL ECHOCARDIOGRAM MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL CORONARY ANGIOGRAPHY MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL OTHERS (CHEST X-RAY) MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL DRUGS FOR HYPERTENSIVE HEART DISEASE MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL DRUGS FOR HYPERTENSIVE HEART DISEASE MARKET SHARE BY TYPE, 2020-2027 ($ MILLION)

13. GLOBAL SURGERY FOR HYPERTENSIVE HEART DISEASE SHARE BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL SURGERY FOR HYPERTENSIVE HEART DISEASE SHARE BY TYPE, 2020-2027 ($ MILLION)

15. US HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

17. UK HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC HYPERTENSIVE HEART DISEASE MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD HYPERTENSIVE HEART DISEASE MARKET SIZE, 2021-2027($ MILLION