Identity Theft Insurance Market

Identity Theft Insurance Market Size, Share & Trends Analysis Report by Type (Financial Identity Theft, Tax and Employment Identity Theft, Medical Identity Theft, and Others), and by Application (Individual and Business) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Identity theft insurance market is anticipated to grow at a considerable CAGR of 13.6% during the forecast period. The government and public organizations are highly dependent on computer networks, and electronic data to conduct their daily operations, a mass amount of financial and personal information is being transferred and stored online, which may get corrupted or stolen by thefts. Increasing identity theft attacks on government agencies, non-profit organizations, and other institutes are the major factor that drives market growth. According to the Federal Trade Commission (FTC), a total of 5.7 million total fraud and identity theft were reported in 2021, of which 1.4 million were consumer identity theft cases, $2.8 billion of losses were from imposter scams, and $392 million were from consumer online shopping. Furthermore, fraud cases are up 70% in 2021 compared to 2020. Losses from identity theft cost $5.8 billion in 2021 in America.

Segmental Outlook

The global identity theft insurance market is segmented based on type, and application. Based on type the market is sub-segmented into financial identity theft, tax and employment identity theft, medical identity theft, and others. Based on application, the market is bifurcated into individuals and businesses. Among the application, the business sub-segment is expected to grow at a significant rate during the forecast period. The growth is mainly augmented owing to the increasing credit card fraud by hackers and the rising online shopping accounts by various business enterprises boosting the segment growth. Meanwhile, the individual segment accounted for a significant market share, owing to an increase in the number of social media accounts, and the rising use of digital payment services drives the individual segment growth in the global identity theft insurance market.

Among the type, the financial identity theft sub-segment is expected to grow at a favorable rate in the global identity theft insurance market. The segmental growth is attributed due to the increasing number of online payment systems, rising credit card frauds globally, along with growing e-commerce sector have made security and privacy more vulnerable which further drives the growth of the segment. About 70% of identity theft victims suffered financial losses, which totaled $15.1 billion in 2018, with average losses of $640 per person, according to the US Department of Justice, and nearly 25,000 New Yorkers reported their information had been misused on an existing credit card account or to open a new account.

Regional Outlooks

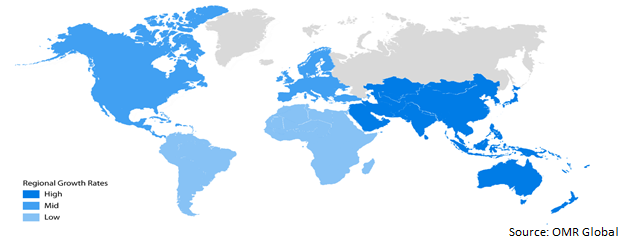

The global identity theft insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the European region is anticipated to grow at a considerable rate, owing to a rise in the number of opening bank accounts, social media, and shopping accounts, which have increased the need for theft protection. Meanwhile, the North American region holds a prominent market share, during the forecast period. The presence of major key insurance companies such as Discover Financial Services, and Kroll, that protects against identity theft drives the market growth in the region.

Global Identity Theft Insurance Market Growth by Region, 2022-2028

North America is Expected to Hold a Prominent Share of the Global Identity Theft Insurance Market

The major factor driving the market growth is increasing cases of identity theft in major economies such as the US, and Canada. Moreover, the rise in the number of social media accounts, and the increasing trend of digitalization, resulted in higher growth of the market. The US Federal Trade Commission (FTC) received more than 5.88 million fraud reports in 2021, a 19% increase from 2020. Reports of associated financial losses topped $6.1 billion, an increase of more than 77% compared with 2020, in the US. Moreover, the number of consumer identity theft complaints in the US rose 3.3%, to over 1.43 million from about 1.39 million in 2020.

Market Players Outlook

The major companies serving the global identity theft insurance market include American International Group (AIG), Nationwide Mutual Insurance Co., Experian, Geico, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in September 2022, Aura announced new proactive capabilities that have been added to its platform to protect people from online theft and ensure threats are prevented before they can have an impact on finances, identities, or accounts. These features work together to secure potentially at-risk online accounts, protect online privacy while browsing, and prevent spam emails that clutter inboxes.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global identity theft insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segmentation

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendation

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. The Allstate Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Development

3.3. American International Group (AIG)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Development

3.4. Nationwide Mutual Insurance Co.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Development

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Identity Theft Insurance Market by Type

4.1.1. Financial Identity Theft

4.1.2. Tax or Employment Identity Theft

4.1.3. Medical Identity Theft

4.1.4. Others (Estate Identity Theft, Synthetic Identity Theft)

4.2. Global Identity Theft Insurance Market by Application

4.2.1. Individual

4.2.2. Business

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alliance Insurance Group

6.2. Aura Sub, LLC

6.3. Chubb Group of Insurance Co.

6.4. Equifax Inc.

6.5. Experian Information Solutions, Inc.

6.6. Geico Corp.

6.7. Liberty Mutual Group

6.8. McAfee Corp.

6.9. MetLife, Inc.

6.10. NortonLifeLock Inc.

6.11. Prepaid Legal Services, Inc.

6.12. Sontiq, Inc.

6.13. The Hanover Insurance Group

6.14. The Travelers Companies, Inc.

6.15. Zander Insurance Group

1. GLOBAL IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL FINANCIAL IDENTITY THEFT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL TAX AND EMPLOYMENT IDENTITY THEFT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MEDICAL IDENTITY THEFT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL OTHERS IDENTITY THEFT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL IDENTITY THEFT INSURANCE FOR INDIVIDUAL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL IDENTITY THEFT INSURANCE FOR BUSINESS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. NORTH AMERICAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

12. NORTH AMERICAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

15. EUROPEAN IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. REST OF THE WORLD IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

21. REST OF THE WORLD IDENTITY THEFT INSURANCE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL IDENTITY THEFT INSURANCES MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL FINANCIAL IDENTITY THEFT MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL TAX AND EMPLOYMENT IDENTITY THEFT MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL MEDICAL IDENTITY THEFT MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL OTHERS IDENTITY THEFT MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL IDENTITY THEFT INSURANCE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

7. GLOBAL IDENTITY THEFT FOR INDIVIDUAL INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL IDENTITY THEFT FOR BUSINESS INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL IDENTITY THEFT INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. US IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

11. CANADA IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

12. UK IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

13. FRANCE IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

14. GERMANY IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

15. ITALY IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

16. SPAIN IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. REST OF EUROPE IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. INDIA IDENTITY THEFT INSURANCES MARKET SIZE, 2021-2028 ($ MILLION)

19. CHINA IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. JAPAN IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. SOUTH KOREA IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF ASIA-PACIFIC IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. LATIN AMERICA IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. MIDDLE EAST AND AFRICA IDENTITY THEFT INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)