Image-guided Therapy Systems Market

Image-guided Therapy Systems Market Size, Share & Trends Analysis Report by Product (Endoscopes, Ultrasound Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI), Positron Emission Tomography (PET), and Others), by Application (Neurosurgery, Cardiac Surgery, Urology, Orthopedic Surgery, Oncology Surgery, and Others), and by End-User (Hospitals, Ambulatory Surgery Centers, and Specialty Clinics) and Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Image-guided therapy systems market is anticipated to grow at a significant CAGR of 5.4% during the forecast period. The increasing use of radiotherapy to treat patients with cancer and the increasing several initiatives that are undertaken to promote cancer radiotherapy are factors that are contributing to the positive growth of the image-guided therapy systems market. Moreover, companies in the market are developing remote solutions, such as cloud-based training on virtual machines that are further boosting the market growth. For instance, in February 2022, Philips collaborated with Cydar to plan and guide surgery in real-time and added cloud-based AI, and 3D mapping into its Mobile C-arm System Series Zenition. This integration of Cydar EV Maps software into the Philips Zenition platform has now added new features that include extended procedure planning and real-time 3D guidance capabilities.

Segmental Outlook

The global image-guided therapy systems market is segmented based on the product, application, and end-user. Based on the product, the market is segmented into endoscopes, ultrasound systems, computed tomography (CT) scanners, magnetic resonance imaging (MRI), positron emission tomography (PET), and others. Based on the application, the market is sub-divided into neurosurgery, cardiac surgery, urology, orthopaedic surgery, oncology surgery, and others. Based on the end-user, the market is segmented into hospitals, ambulatory surgery centers, and speciality clinics. Among the end-user segment, ambulatory surgery centers (ASCs) are anticipated to witness the fastest growth in the market owing to various advantages offered by these healthcare settings such as reduced waiting time and increased cost savings. Moreover, the increasing trend of same-day surgery in developed economies due to optimum care delivery and reduced hospital stays are factors driving market growth further.

The endoscopes segment is expected to hold a prominent share in the market owing to the growing adoption of robot-assisted endoscopic surgeries and high procedures of endoscope-guided surgeries for various interventions. Other factors contributing to the segment's growth include the rising incidence of cancer and gastrointestinal diseases which in turn increases the demand for endoscopic systems. In addition, the increasing technological advancement, new product developments, and launches by key market players are key factors contributing to the segmental growth of the market. For instance, in May 2021, EndoFresh company received the US Food and Drug Administration (FDA) approval 510(k) clearance for EndoFresh's Disposable Digestive Endoscopy System for gastrointestinal purposes which is designed to alleviate the cross-contamination problems caused by devices. This device can also be used with the medical display and other peripheral devices and consists of a camera system.

Regional Outlooks

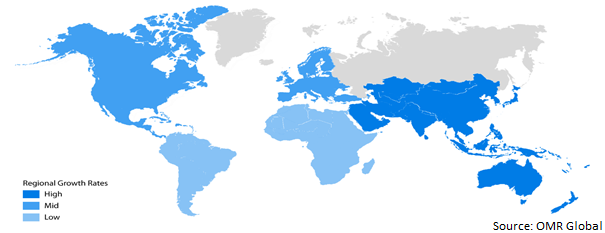

The global image-guided therapy systems market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America is predicted to hold a major share in the market owing to the well-established healthcare infrastructure and the presence of prominent players.

Global Image-guided Therapy Systems Market Growth, by Region 2022-2028

The Asia-Pacific Region is Fastest Growing in the Global Image-guided Therapy Systems Market

The regional growth is attributed majorly owing to the high medical tourism, an increasing geriatric population, and spurring cases of target diseases. Additionally, improving healthcare infrastructure along with the growing number of research centres in countries, such as India and China, and the presence of prominent players are some other primary factors bolstering the growth of the market. These prominent market players are continuously focusing on new products and device development. For instance, in May 2022, Royal Philips launched an EchoNavigator 4.0 advanced image-guided therapy solution for the treatment of structural heart disease. These new devices give greater control of live fusion-imaging on the company's Image Guided Therapy System - Azurion - platform. These devices assist in efficient fusion-imaging workflow for minimally-invasive treatment.

Market Players Outlook

The major companies serving the global image-guided therapy systems market include Abbott, Canon Medical Systems Corp., General Electric Co., Koninklijke Philips N.V., Medtronic Plc, Stryker, and Zeta Surgical Inc., and among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, geographical expansions, partnerships, product launches, and collaborations, to stay competitive in the market. For instance, in April 2021, Siemens Healthineers acquired Varian Medical Systems to create the most comprehensive cancer care portfolio in the industry. The company with the acquisition called EnVision has set out to establish a digital, diagnostic, and therapeutic ecosystem that includes treatment management. Both the companies under the partnership are using AI-assisted analytics to advance their data-driven precision care.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global image-guided therapy systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Image-Guided Therapy Systems Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abbott

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Koninklijke Philips N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Medtronic Plc

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Stryker Corp.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Image-Guided Therapy Systems Market by Products

4.1.1. Endoscopes

4.1.2. Ultrasound Systems

4.1.3. Computed Tomography (CT) Scanners

4.1.4. Magnetic Resonance Imaging (MRI)

4.1.5. Positron Emission Tomography (PET)

4.1.6. Others (X-ray Fluoroscopy)

4.2. Global Image-Guided Therapy Systems Market by Application

4.2.1. Neurosurgery

4.2.2. Cardiac Surgery

4.2.3. Urology

4.2.4. Orthopaedic Surgery

4.2.5. Oncology Surgery

4.2.6. Others (Gastroenterology)

4.3. Global Image-Guided Therapy Systems Market by End-User

4.3.1. Hospitals

4.3.2. Ambulatory Surgery Centers

4.3.3. Speciality Clinics

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acoustic MedSystems, Inc.

6.2. Brainlab AG

6.3. Canon Medical Systems Corp.

6.4. C-Rad AB

6.5. Elekta AB

6.6. EnVision Endoscopy

6.7. ESAOTE SPA

6.8. HistoSonics, Inc.

6.9. Hitachi, Ltd.

6.10. Image Guided Therapy

6.11. Lumicell

6.12. Maxer Endoscopy GmbH

6.13. Mevion Medical Systems

6.14. OncoNano Medicine Inc.

6.15. OnLume Inc.

6.16. PROCEPT BioRobotics Corp

6.17. Photolitec, LLC

6.18. Siemens Healthcare GmbH

6.19. Xoran Technologies

6.20. Zeta Surgical Inc.

1. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL ENDOSCOPES IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ULTRASOUND SYSTEMS IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL MAGNETIC RESONANCE IMAGING (MRI) IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL POSITRON EMISSION TOMOGRAPHY (PET) IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL OTHERS SYSTEMS IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

9. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN NEUROSURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN CARDIAC SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN UROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN ORTHOPEDIC SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN ONCOLOGY SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN OTHERS SURGERY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

16. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR AMBULATORY SURGERY CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

20. NORTH AMERICAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. NORTH AMERICAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

22. NORTH AMERICAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. NORTH AMERICAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

24. EUROPEAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. EUROPEAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

26. EUROPEAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. EUROPEAN IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY END -USER, 2021-2028 ($ MILLION)

32. REST OF THE WORLD IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

33. REST OF THE WORLD IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

34. REST OF THE WORLD IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

35. REST OF THE WORLD IMAGE-GUIDED THERAPY SYSTEMS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL ENDOSCOPES IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL ULTRASOUND SYSTEMS IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL COMPUTED TOMOGRAPHY (CT) SCANNERS IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL MAGNETIC RESONANCE IMAGING (MRI) IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL POSITRON EMISSION TOMOGRAPHY (PET) IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL OTHERS SYSTEMS IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

9. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN NEUROSURGERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN CARDIAC SURGERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN UROLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN ORTHOPEDIC SURGERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN ONCOLOGY SURGERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS IN OTHERS SURGERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

16. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR HOSPITALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR AMBULATORY SURGERY CENTERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS FOR SPECIALTY CLINICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL IMAGE-GUIDED THERAPY SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. US IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

21. CANADA IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

22. UK IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

23. FRANCE IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

24. GERMANY IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

25. ITALY IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

26. SPAIN IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF EUROPE IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

28. INDIA IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

29. CHINA IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

30. JAPAN IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

31. SOUTH KOREA IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

32. REST OF ASIA-PACIFIC IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF THE WORLD IMAGE-GUIDED THERAPY SYSTEMS MARKET SIZE, 2021-2028 ($ MILLION)