Image Sensors Market

Global Image Sensors Market Size, Share & Trends Analysis Report by Technology (CMOS and CCD), By End-User Industry (Automotive, Consumer Electronics, Industrial, Security & Surveillance, Healthcare and Others), and Forecast, 2019-2025 Update Available - Forecast 2025-2031

Global image sensor market is expected to grow with a CAGR of 8.2% during the forecast period of 2019-2025. Image sensor is a photosensitive device that changes light signals into digital signals. It detects and conveys the information that creates an image. It does so by converting the variable attenuation of light waves into signals, small burst of current that conveys the information. It is majorly used in smartphones, digital cameras, security and surveillance cameras, aerospace and other imaging devices. Global image sensors market is mainly driven due to growing number of smartphone users across the globe. Smartphone manufacturers nowadays uses three image sensors in a single smartphone. One sensor at front of the mobile and 2 at the back of the smartphone. The image sensors used to improve the quality of the picture. As a smartphone replaces stand-alone cameras, the bar has been raised for imaging technologies. Increasing use of smartphones for taking pictures and video shooting enhances the demand for high quality cameras in smartphones that further propels the market.

Segmental Outlook

The global Image sensors market is segmented on the basis of technology and end-user industry. Based on the technology the market is further classified into Complementary Metal-Oxide-Semiconductor (CMOS) and Charge-Coupled Device (CCD). On the basis of end-user industry, the market is segregated into automotive, consumer electronics, industrial, security & surveillance, healthcare and others (aerospace & defense).

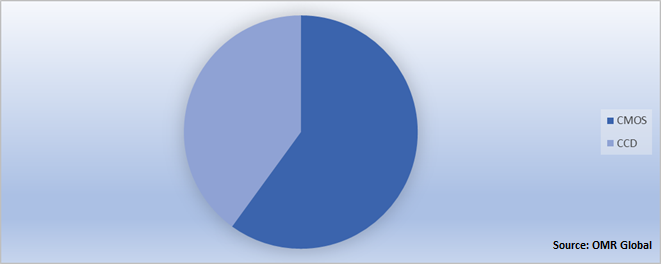

Global Image sensors Market Share by Technology, 2018 (%)

Global Image sensors market to be driven by CMOS image sensors

CMOS image sensors segment is projected to have a significant market share during the forecast period. The market is growing due to the increasing application of CMOS image sensors in consumer electronics such as smartphone, laptop and others. These types of electronic devices require high quality of images with lower power consumption. CMOS image sensor consumes less power as compared to CCD and is more cost effective, therefore it is a priority of the imaging products manufacturers. Apart from that CMOS technology provides digital output and can be controlled at pixel level. This provides significant advantages in specialized imaging where one might want particular control process to only a segment of the sensor. This capability is useful for control of cameras in different imaging modes for multi spectral imaging.

Regional Outlook

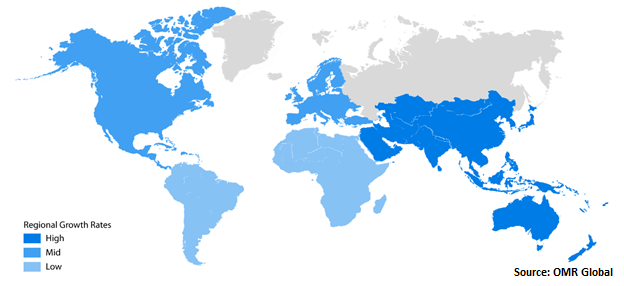

Moreover, the global image sensors market further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World. North American market is growing due to technological development of medical imaging technologies such as MRI, ultrasound and others in healthcare industry and high penetration of smartphone users in the region.

Global Image sensors Market Growth, by Region 2019-2025

Asia-Pacific a force to reckon with in the global image sensors market

Geographically, Asia-Pacific is estimated to have a significant market share in the global Image sensors market during the forecast period. The major economies such as China, Japan, South Korea, India, and are significantly contributing to the growth of the market during the forecast period. Further, in these regions, there is high adoption consumer electronics products that raises the demand image sensors. Moreover, growing trend of dual, triple, quad and penta camera smartphone, increases the demand image sensors. Additionally, automobile industry contributing in the growth of the market as growing application of image sensing equipment in driverless cars. China is the significant contributor in the growth of the market in the region due to increasing technological development and presence of consumer electronics manufacturers in the country.

Market Players Outlook

The major players that contribute to the growth of the global Image sensors market include Canon Inc., Nikon Corp., OmniVision Technologies, Inc., Carl Zeiss, Panasonic Corp., Samsung Electronics Co., Ltd., SK Hynix Inc., Sony Corp., STMicroelectronics International N.V., and many others. The players operating in the market adopt various strategies such as technology developent, product launch, merger and acquitions for gaining the sustainable position in the market that further propels the growth of the market. For instance, in June 2019, Sony corp. announced the launch of two new models of CMOS image sensors: the IMX415 type 1/2.8 4K-resolution stacked CMOS image sensor; and the IMX485 type 1/1.2 4K-resolution back-illuminated CMOS image sensor, which provide low-light performance approximately 3.3 times that of conventional. With thease launch the company increased their image sensors portfolio that further will grow their revenue in the sensor market.

Recent Developments

- In August 2019, Samsung Electronics Co., Ltd., launched the 108 megapixel (Mp) Samsung ISOCELL Bright HMX image sensor for smartphones. With the latest addition, the company will expand its 0.8?m image sensor offerings from its recently announced ultra-high 64Mp to 108Mp.

- In July 2018, Sony corp. announced the launch of of the IMX586 stacked CMOS image sensor that enhanced imaging on smartphone cameras.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global image sensors market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Canon Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. OmniVision Technologies, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Samsung Electronics Co., Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Sony Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. STMicroelectronics International N.V.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Image sensors Market by Technology

5.1.1. Complementary Metal-Oxide-Semiconductor (CMOS)

5.1.2. Charge-Coupled Device (CCD)

5.2. Global Image sensors Market by End-User Industry

5.2.1. Automotive

5.2.2. Consumer Electronics

5.2.3. Industrial

5.2.4. Security and Surveillance

5.2.5. Healthcare

5.2.6. Others (Aerospace & Defense)

6. Regional Analysis

6.1. North America

6.1.1. The US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Airy3D

7.2. Ambarella Inc.

7.3. ams AG

7.4. Canon Inc.

7.5. Carl Zeiss AG

7.6. CMOS Sensor Inc.

7.7. Fastree 3D SA

7.8. HAMAMATSU Group

7.9. Himax Technologies, Inc.

7.10. Nikon Corp.

7.11. OmniVision Technologies, Inc.

7.12. Panasonic Corp.

7.13. PixArt Imaging Inc.

7.14. PIXELPLUS

7.15. Samsung Electronics Co., Ltd.

7.16. Semiconductor Components Industries, LLC

7.17. Sharp Corp.

7.18. SK Hynix Inc.

7.19. Sony Corp.

7.20. STMicroelectronics International N.V.

7.21. Teledyne Judson Technologies.

1. GLOBAL IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

2. GLOBAL CMOS IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CCD IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

5. GLOBAL IMAGE SENSORS IN AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL IMAGE SENSORS IN CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL IMAGE SENSORS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL IMAGE SENSORS IN SECURITY AND SURVEILLANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL IMAGE SENSORS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL IMAGE SENSORS IN OTHER END-USER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

15. EUROPEAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

17. EUROPEAN IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

21. REST OF THE WORLD IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

22. REST OF THE WORLD IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL IMAGE SENSORS MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

2. GLOBAL IMAGE SENSORS MARKET SHARE BY END-USER INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL IMAGE SENSORS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. The US IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD IMAGE SENSORS MARKET SIZE, 2018-2025 ($ MILLION)