Implantable Collamer Lens Market

Implantable Collamer Lens Market Size, Share & Trends Analysis Report by Indication (Myopia, Hyperopia and Astigmatism), and by End-user (Hospitals, Ophthalmic Clinics and Other) Forecast Period (2024-2031)

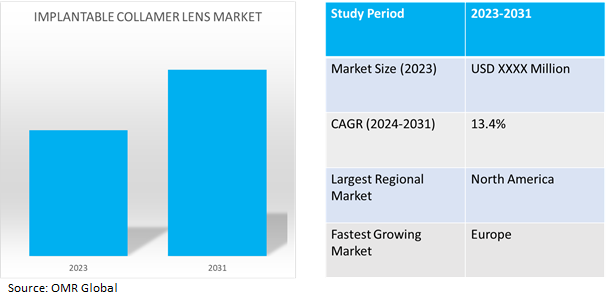

Implantable collamer lens market is anticipated to grow at a significant CAGR of 13.4% during the forecast period (2024-2031). Implantable collamer lens (ICL) is a kind of posterior chamber phakic intraocular lens (pIOL). When corneal refractive surgery is not recommended or for severe degrees of refractive error, pIOLs are typically employed. Benefits over corneal refractive surgery include reversibility and a speedier recovery. Since they are positioned farther away from the cornea and are less visible from the outside, posterior chamber photoiolenses (pIOLs) offer a more aesthetically pleasing option than anterior chamber (AC) pIOLs. They also pose a lower risk of endothelial cell loss (ECL).

Market Dynamics

Growing awareness and accessibility for ICL

With improved awareness and accessibility to ICL surgery, this alternative for vision correction is expected to gain popularity. As more individuals learn about the benefits of ICLs, including those who are not candidates for conventional laser vision correction an operation, their popularity is expected to grow.

A rising number of populations that are preferring ICL

Growth in the market for these lenses is anticipated as long as ICL technology progresses and regulatory approvals are sustained. It is projected that new manufacturers will enter the market and that new models and indication ICL devices will be certified in the future. People are choosing to improve their quality of life with vision correction procedures like ICLs due to lifestyle conveniences and aesthetics. The main benefit of ICLs over glasses or contact lenses is clear vision as they go away with the hassle of everyday wear.

Market Segmentation

Our in-depth analysis of the global implantable collamer lens market includes the following segments by indication, and end-user:

- Based on indication, the market is sub-segmented into myopia, hyperopia and astigmatism.

- Based on end-user, the market is bifurcated into hospitals, ophthalmic clinics and other (ambulatory surgical centers and eye research institutes).

Astigmatismis Projected to Emerge as the Largest Segment

Astigmatism is growing more common in a variety of age groups, which is propelling the demand for ICLs. ICLs have grown in popularity in recent years while contacts and glasses have declined in popularity. Innovations in material, design, and production processes are constantly enhancing the comfort, safety, and functionality of ICLs. Innovative technologies that enable people to find answers for a variety of health issues include bioengineered materials and personalized designs.

Eye Research Institutes Sub-segment to Exhibit Considerable Growth

The market for eye research institutes is anticipated to exhibit considerable growth during the forecast period. The government finances for research on vision correction procedures and ophthalmic technologies. The market for ICLs is expanding due to rising knowledge of sophisticated vision correction solutions and the growing popularity of surgical treatments. Testimonials and positive experiences can encourage patients to use new technologies.

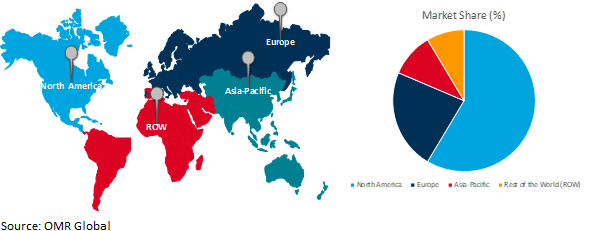

Regional Outlook

The global implantable collamer lens market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (Middle East & Africa, and Latin America).

Global Implantable Collamer Lens Market Growth by Region 2024-2031

North America Holds Major Market Share

In the US, implantable collamer lenses, or ICLs, are quickly rising to the top of the list of vision correction choices. The ongoing technological advancements in field of collamer lenses along with high preference of citizens in adopting less invasive surgical techniques is a key contributor to the regional market growth. ICLs are becoming more and more common in the US as more patients look for long-term vision correction options.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global implantable collamer lens market include Carl Zeiss Meditec, Johnson & Johnson, Bausch +Lomb, Alcon and STAAR Surgical among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global implantable collamer lens market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bausch +Lomb GmbH

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Carl Zeiss Meditec AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Johnson & Johnson

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Implantable Collamer Lens Market by Indication

4.1.1. Myopia

4.1.2. Hyperopia

4.1.3. Astigmatism

4.2. Global Implantable Collamer Lens Market by End-User

4.2.1. Hospitals

4.2.2. Ophthalmic Clinics

4.2.3. Other (Ambulatory Surgical Centers and Eye Research Institutes)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Aier Eye Hospital Group

6.2. Alcon plc

6.3. Bascom Palmer Eye Institute

6.4. Beijing Tongren Hospital

6.5. C-Mer Eye Care Holdings Ltd.

6.6. EuroEyes

6.7. Eye-Q Super-Speciality Eye Hospitals

6.8. Huaxia Eye Hospital Group

6.9. Juntendo University Hospital

6.10. STAAR Surgical

6.11. Teikyo University Hospital

6.12. Thomas Jefferson University Hospitals

6.13. Wills Eye Hospital

1. GLOBAL IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

2. GLOBAL IMPLANTABLE COLLAMER LENS FOR MYOPIA CORRECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL IMPLANTABLE COLLAMER LENS FOR HYPEROPIA CORRECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL IMPLANTABLE COLLAMER LENS FOR ASTIGMATISM CORRECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

6. GLOBAL IMPLANTABLE COLLAMER LENS FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL IMPLANTABLE COLLAMER LENS FOR OPHTHALMIC CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL IMPLANTABLE COLLAMER LENS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

13. EUROPEAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

15. EUROPEAN IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFICIMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFICIMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. REST OF THE WORLD IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD IMPLANTABLE COLLAMER LENS MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL IMPLANTABLE COLLAMER LENS MARKET SHARE BY INDICATION, 2023 VS 2031 (%)

2. GLOBAL IMPLANTABLE COLLAMER LENS FOR MYOPIA CORRECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL IMPLANTABLE COLLAMER LENS FOR HYPEROPIA CORRECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL IMPLANTABLE COLLAMER LENS FOR ASTIGMATISM CORRECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL IMPLANTABLE COLLAMER LENS MARKET SHAREBY END-USER, 2023 VS 2031 (%)

6. GLOBAL IMPLANTABLE COLLAMER LENS FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL IMPLANTABLE COLLAMER LENS FOR OPHTHALMIC CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL IMPLANTABLE COLLAMER LENS FOR OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL IMPLANTABLE COLLAMER LENS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

12. UK IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC IMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICAIMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICAIMPLANTABLE COLLAMER LENS MARKET SIZE, 2023-2031 ($ MILLION)