In-Building Wireless Market

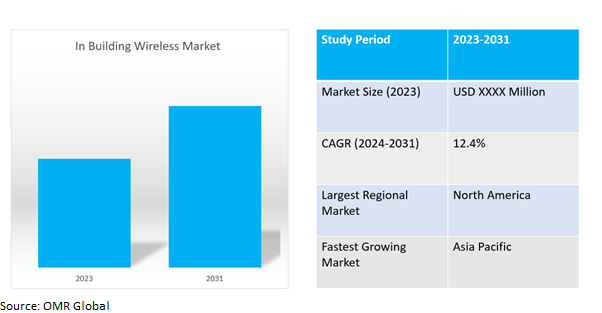

In-Building Wireless Market Size, Share & Trends Analysis Report by Type (Antenna Distributed Antenna Systems (DAS) , Cables , Repeaters, Small Cells), by Application (Commercial, Residential, Industrial) Forecast Period (2024-2031)

In-building wireless market is anticipated to grow at a significant CAGR of 12.4% during the forecast period (2024-2031). In-building wireless is a system that enhances and distributes cellular signals inside buildings. It amplifies existing signals to provide reliable cell service throughout a building, similar to how Wi-Fi works for internet access. The market growth is driven by rising demand of uninterrupted wireless connectivity. Additionally, traditional wireless systems struggle to penetrate building materials, causing issues like dropped calls and slow data speeds, which is also driving market growth.

Market Dynamics

Emergence of 5G Technology

The rollout of 5G promises ultra-fast data speeds and low latency, enabling new applications like remote surgery and connected vehicles. However, 5G signals have a shorter range and struggle to penetrate buildings effectively. In-building wireless systems are crucial for delivering the full potential of 5G technology indoors. For instance, in April 2024 Kenya is introducing the XR Workforce concept, allowing its human capital to be available to European and North-American markets via remote, immersive digital environments. Three Kenyan universities, Kenyatta University, University of Nairobi, and Technical University of Kenya, are set to roll out 5GMokki Tech Spaces, a modular high-tech unit for the development of software applications.

Increasing Focus on Smart and Sustainable Buildings

Modern buildings are incorporating automation and smart features to improve energy efficiency, safety, and occupant comfort. In-building wireless systems play a vital role in facilitating communication between various building systems and sensors. For instance, in October 2022The US company Corning announced that it is carefully considering the prospect of producing its wireless equipment, such as small cells and distributed antenna systems, in India using the government's incentive program. The Gurugram wireless research center expands the company's US facility.

Market Segmentation

Our in-depth analysis of the global in-building wireless market includes the following segments by type, product, and technology,

- Based on type, the market is segmented into antenna, Distributed Antenna Systems (DAS) , cables , repeaters, small cells

- Based on application, the market is segmented into commercial, residential, industrial.

Distributed Antenna Systems (DAS)is Projected to Emerge as the Largest Segment

Among these Distributed Antenna Systems (DAS) segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes high demand for reliable, high-capacity connectivity, improved user experience, compatibility with multiple frequency bands, efficient data management, and improved network security. DAS addresses the need for strong, consistent cellular signals, ensuring seamless coverage, compatibility with existing and future technologies, and ensuring sufficient bandwidth for all users.

Residential Sub-segment to Hold a Considerable Market Share

The US Census Bureau reported a surge in building permits for new residential construction in early 2020, reaching a peak of 169,000 units. Despite COVID-19, residential construction increased in Europe, with significant projects like ZAC Campus Grand Prac, Milanosesto, Camden Goods Yard, Viaduct, and Sackville Road. China's construction industry primarily consists of residential structures, with housing accounting for over 67.0% of completed floorspace. India invested $2.4 billion in real estate assets in the last year, a 52.0% increase from 2000 to September. The in-building wireless market, a specialty of VeriDAS Technologies, is expected to grow if real estate prices rise.

Regional Outlook

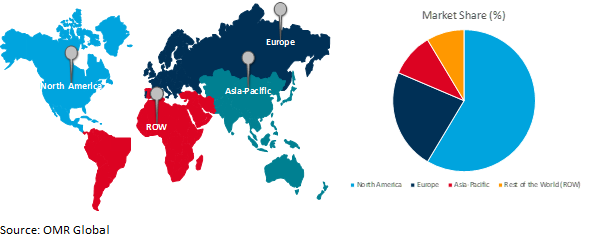

The global in building wireless market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Global In Building Wireless Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of rising demand for electricity. Total end-use power consumption in the US was around 3.0% in 2022.Retail electricity sales to the residential sector were around 4.0%, while retail power sales to the commercial sector were approximately 3.0% in 2022.

Apart from this, there is an increase in the number of biorefineries in North America which is further propelling the regional market growth. According to the VERBIO North America, there are 199 operating ethanol biorefineries in North America as of 2022. Furthermore, the region also consumes a high amount of biofuels, according to the Environmental Impact Assessment (EIA), in 2021, about 17.5 billion gallons of biofuels were produced in the US and about 16.8 billion gallons were consumed. The US was a net exporter of about 0.8 billion gallons of biofuels in 2021, with fuel ethanol accounting for the largest share of gross and net exports of biofuels.

Market Players Outlook

The major companies serving the global in-building wireless market include Pierson Wireless Corp, AT&T, Inc., CommScope, Inc., Corning Incorporated, ExteNet Systems,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in October2022, HFCL, a domestic telecom equipment manufacturer, partnered with Qualcomm Technologies to design and develop 5G outdoor small-cell products. In line with its 5G strategy, HFCL's investment in 5G outdoor small cell products will speed up the deployment of 5G networks, improve the 5G user experience, and make the most of the 5G spectrum.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global in building wireless market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AT&T, Inc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cobham Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. CommScope

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global IN BUILDING Wireless Market by Type

4.1.1. Antennas

4.1.2. Distributed Antenna Systems

4.1.3. Repeaters

4.1.4. Small cells

4.1.5. Cables

4.2. Global IN BUILDING Wireless Market by Application

4.2.1. Commercial

4.2.2. Residential

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Anixter Inc.

6.2. Betacom Inc.

6.3. Dali Wireless, Inc.

6.4. Corning Incorporated.

6.5. Telefonaktiebolaget LM Ericsson

6.6. Pierson Wireless Corp.

6.7. TE Connectivity Ltd.

6.8. Verizon

1. GLOBAL IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY Type, 2023-2031 ($ MILLION)

2. GLOBAL ANTENNA IN-BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DISTRIBUTED ANTENNA SYSTEMS (DAS) IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CABLES IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL REPEATERS IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SMALL CELLS IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY By END-USER INDUSTRY 2023-2031 ($ MILLION)

8. GLOBAL IN BUILDING WIRELESS FOR COMMERCIAL RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBALIN BUILDING WIRELESSFOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL IN BUILDING WIRELESS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION

17. EUROPEAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. EUROPEAN IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFICIN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD IN BUILDING WIRELESS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL IN BUILDING WIRELESS MARKETSHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ANTENNA IN BUILDING WIRELESS MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DISTRIBUTED ANTENNA SYSTEMS (DAS) IN BUILDING WIRELESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CABLES IN BUILDING WIRELESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL REPEATERS IN BUILDING WIRELESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SMALL CELLS IN-BUILDINGWIRELESS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL IN BUILDING WIRELESS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL IN BUILDING WIRELESS FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL IN BUILDING WIRELESS FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL IN BUILDING WIRELESS FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL IN BUILDING WIRELESS MARKETSHARE BY REGION, 2023 VS 2031 (%)

12. US IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

14. UK IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE IN BUILDING WIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA IN BUILDING WIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA IN BUILDING WIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN IN BUILDING WIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA IN BUILDING WIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA IN-BUILDINGWIRELESS MARKET SIZE, 2023-2031 ($ MILLION)