In-Flight Catering Market

In-Flight Catering Market Size, Share, and Trends Analysis Report by Aircraft Class (Economy Class, Business Class, and First Class), by Flight Type (Full Service, and Low Cost), by Food Type (Meals, Bakery & Confectionary, Beverages, and Others), and Forecast Period (2023–2030) Update Available - Forecast 2025-2035

In-flight catering market size was valued at $17.5 billion in 2022, and is projected to reach $26.2 billion by 2030, registering a CAGR of 5.9% during the forecast period (2023-2030). In recent years, an exponential increase in the number of people traveling by air has been predicted to be the key driver of the in-flight food service industry's expansion. Despite weaker economic development in certain nations, the number of domestic and international air passengers has grown, increasing market growth. For instance, according to the International Civil Aviation Organization, the aviation industry is rapidly expanding and will continue to expand. As per the same source, in 2017, over 4.1 billion passengers traveled by airplanes globally, and every day, about 10 million people travel by air. This results in an increasing demand for in-flight catering services.

Segmental Outlook

The global in-flight catering market is segmented by aircraft class, flight type, and food type. Based on aircraft class, the market is sub-segmented into economy class, business class, and first class. Based on flight type, the market is sub-segmented into full service and low cost. Based on food type, the market is sub-segmented into meals, bakery & confectionary, beverages, and others. Among food types, the meals segment is expected to generate the largest market share, owing to the increased number of passengers and long-distance air travel. Furthermore, several catering firms have created various types of meals, such as mini-meals for customers traveling for a short period of time, fueling the expansion of the segment.

The Full Service Sub-Segment Holds a Prominent Share in the Global In-Flight Catering Market

Based on flight type, the market is sub-segmented into full service and low cost. Among these, the full-service sector is expected to hold the largest market share. Full-service carrier flights are popular because they offer a wide range of amenities and services to their passengers, which makes flying more comfortable and convenient. These amenities may include comfortable seating, in-flight entertainment, complimentary meals and beverages, extra luggage allowances, and other perks that make the overall travel experience more enjoyable. Additionally, full-service carriers often have a larger network of destinations and more frequent flights, which can provide passengers with more options for travel. All of these factors contribute to the popularity of full-service carrier flights and make them a preferred choice for many travelers.

Regional Outlook

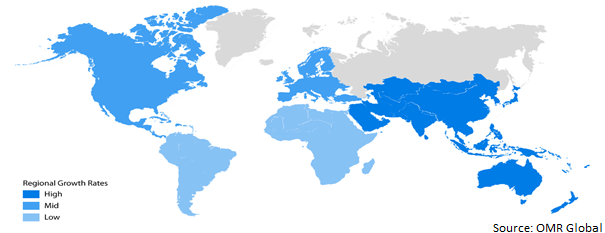

The global in-flight catering market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the North American region is expected to generate the highest market share, followed by the Asia-Pacific market. The region's growing number of airline carriers is likely to generate considerable development potential for in-flight catering suppliers. The area is expected to grow at the quickest rate, owing to significant growth in both international air travel and tourism in developing nations such as China, India, and Vietnam.

Global In-Flight Catering Market Growth, by Region (2023-2030)

The North American Region is Expected to Dominate the Global In-Flight Catering Market

North America is expected to hold the largest market share due to an increase in the number of passengers traveling for business and vacations in the region. According to data from the Bureau of Transportation Statistics, airlines in the US transported 674 million passengers in 2021, up from 369 million in 2020. The number of passengers transported by airlines in the US increased by 82.5% over 2020. Another factor attributed to the market’s growth is the economic growth of the countries in the region. With high economic growth, people have more money to spend on luxury living, such as air travel, resulting in the market’s growth. According to the International Monetary Fund’s data, the GDP of North America was $23,730 in 2020 and reached $30,110 in 2023, whereas the GDP per capita was $50,610 in 2020 and reached $62,540 in 2023.

Market Players Outlook

The major companies serving the global in-flight catering market include DO & CO., Flying Food Group LLC, Gate Gourmet Switzerland GmbH, Journey Group Plc, and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and the launch of new in-flight catering services to stay competitive in the market. For instance, in March 2022, Newrest stated that it will begin delivering hot meal services on Air Transat two-class flights in European countries including Belgium, France, the Netherlands, England, Portugal, and Spain. Additionally, Gate Gourmet Switzerland GmbH signed a partnership renewal deal with LATAM Airlines in July 2021 to supply in-flight food services for another five years. The deal states that Gate Gourmet Switzerland GmbH will serve LATAM Airlines at 16 locations, including two new important domestic facilities in Bogotá, Colombia, and Santiago, Chile.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global in-flight catering market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global In-Flight Catering Market by Aircraft Class

4.1.1. Economy Class

4.1.2. Business Class

4.1.3. First Class

4.2. Global In-Flight Catering Market by Flight Type

4.2.1. Full Service

4.2.2. Low Cost

4.3. Global In-Flight Catering Market by Food Type

4.3.1. Meals

4.3.2. Bakery & Confectionary

4.3.3. Beverages

4.3.4. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abby’s Catering

6.2. ANA Catering Services Co., Ltd.

6.3. Brahim’s Holdings Berhad

6.4. Cathay Pacific Airways Ltd.

6.5. DO & CO Aktiengesellschaft

6.6. Flying Food Group LLC

6.7. Gate Gourmet Switzerland GmbH

6.8. Journey Group Plc

6.9. KLM Catering Services Schiphol bv

6.10. LSG Lufthansa Service Holdings AG

6.11. Newrest Group International S.A.S

6.12. SATS Ltd.

6.13. Servair SA

6.14. The Emirates Group

1. GLOBAL IN-FLIGHT CATERING MARKET SHARE BY AIRCRAFT CLASS, 2022 VS 2030 (%)

2. GLOBAL ECONOMY CLASS IN-FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

3. GLOBAL BUSINESS CLASS IN-FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

4. GLOBAL FIRST CLASS IN-FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

5. GLOBAL IN-FLIGHT CATERING MARKET SHARE BY FLIGHT TYPE, 2022 VS 2030 (%)

6. GLOBAL FULL SERVICE FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

7. GLOBAL LOW COST FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

8. GLOBAL IN-FLIGHT CATERING MARKET SHARE BY FOOD TYPE, 2022 VS 2030 (%)

9. GLOBAL IN-FLIGHT MEALS MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

10. GLOBAL IN-FLIGHT BAKERY & CONFECTIONARY MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

11. GLOBAL IN-FLIGHT BEVERAGES MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

12. GLOBAL IN-FLIGHT CATERING BY OTHER FOOD TYPE MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

13. GLOBAL IN-FLIGHT CATERING MARKET SHARE BY GEOGRAPHY, 2022 VS 2030 (%)

14. US IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

16. UK IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD IN-FLIGHT CATERING MARKET SIZE, 2022-2030 ($ MILLION)